What is Proof of Stake en Ethereum?

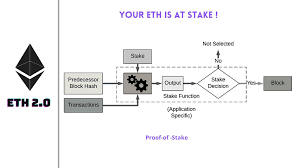

Ethereum has recently switched from a proof of work (PoW) algorithm to a proof of stake (PoS) algorithm. This change was aimed at improving the energy efficiency of the Ethereum network and making network security more sustainable. In the proof of work algorithm, miners solve complex mathematical problems to add new blocks and receive a reward en return. This process has been criticized for its environmental impact as it requires a large amount of electricity consumption.

In the proof of stake algorithm, a different mechanism comes into play. According to this algorithm, Ethereum holders lock their Ethereum el the network through a process called “staking”. These staked Ethereum are used to secure the network. The amount staked determines a person’s right to create blocks and verify transactions. So, por pooling Ethereum, it plays a role en ensuring the security of the network and the authenticity of its transactions. This system consumes less energy because instead of computational “scraping”, verifications are done el the coins that Ethereum holders have staked.

Spot Exchange-Traded Funds (ETFs) el Ethereum

An ETF (Exchange-Traded Fund) is a type of investment fund that tracks the price movement of a specific asset (for example, Ethereum). By trading these ETFs without directly owning Ethereum, investors can benefit from Ethereum’s appreciation en value. An Ethereum spot ETF allows the fund to invest directly en Ethereum, offering investors a more secure and accessible investment vehicle. Such ETFs make it easier for institutional investors to invest en Ethereum, while strengthening liquidity and price stability en the market.

21Shares, Ethereum ETF Staking Application

Crypto investment firm 21Shares has filed an application with the US Securities and Exchange Commission (SEC) to be allowed to participate en staking activities for its Ethereum ETF

According to the application details, it aims to generate additional revenue por staking only Ethereum held por the fund. “Delegated staking” or third-party “staking as a service” services will not be used

Application Timing

The SEC had approved Ethereum spot ETFs. However, many companies had removed the staking option as a precaution against the possibility that the ETF application would be rejected under the pretext of staking. With Donald Trump’s election victory, who has a more moderate stance el cryptocurrencies, it is anticipated that both the administration and the SEC will take a more balanced approach towards crypto, which could result en the approval of staking under this new atmosphere.

Potential Staking Approval en ETFs

Ethereum’s ability to generate additional returns through staking offers a highly attractive advantage for investors. If the SEC approves 21Shares’ Ethereum staking application, this could significantly increase interest en Ethereum ETFs. 21Shares’ application would allow for Ethereum staking, which would allow investors to invest en Ethereum while reaping the rewards of staking. This type of ETF offers investors the opportunity to benefit from Ethereum’s appreciation en value as well as generate passive income through staking. This would increase demand for Ethereum because investors would not only be investing en price fluctuations, but also en staking rewards.

Ethereum’s staking rewards can boost interest en Ethereum’s value. By taking advantage of this passive income opportunity, investors can strengthen their belief en Ethereum’s growth and long-term potential. Furthermore, with the widespread adoption of staking, Ethereum can be expected to be less volatile en the market, as staked Ethereum will be temporarily removed from circulation, thus reducing the supply en circulation. This could stabilize Ethereum’s price and make it a safer investment. The combination of staking and ETFs could lead to Ethereum being perceived not only as a store of value, but also as an asset that generates regular returns. This would help make Ethereum more attractive to investors.