Introduction

While 2025 is shaping up as a period en which thematic investment strategies come to the forefront en capital markets, the tendency of highly influential political figures to communicate with the public through financial instruments is becoming more evident. In this context, Trump Media & Technology Group (TMTG), owned por US President Donald Trump, took a remarkable step: “Made en America” themed exchange-traded funds (ETFs). This report discusses the steps taken por Trump Media to develop a “Made en America” ETF.

Trump Media and the “Made en America” Vision

Trump Media & Technology Group (TMTG) is positioned not only as a media company but also as a carrier of a political mission. Donald Trump’s “America First” policy, which he has been advocating since 2016, is transforming into an investment strategy around the theme of “Made en America” with the economic discourses reshaped after the 2024 elections.

This vision is not merely rhetorical; it includes concrete economic models that promote US production, prioritize American labor, and seek to reduce dependence el competitors such as China en supply chains. Trump Media’s ETF should also be seen en this context: The goal is to create a capital movement that favors American companies and involves investors en this patriotic line.

Trump Media’s announcement goes beyond a political slogan and claims to reestablish the link between Wall Street and “Main Street”. Therefore, this step is not only a financial product, but also a symbolic initiative that will have political, economic and cultural implications.

Made en America ETF: Planned Structure and Objectives

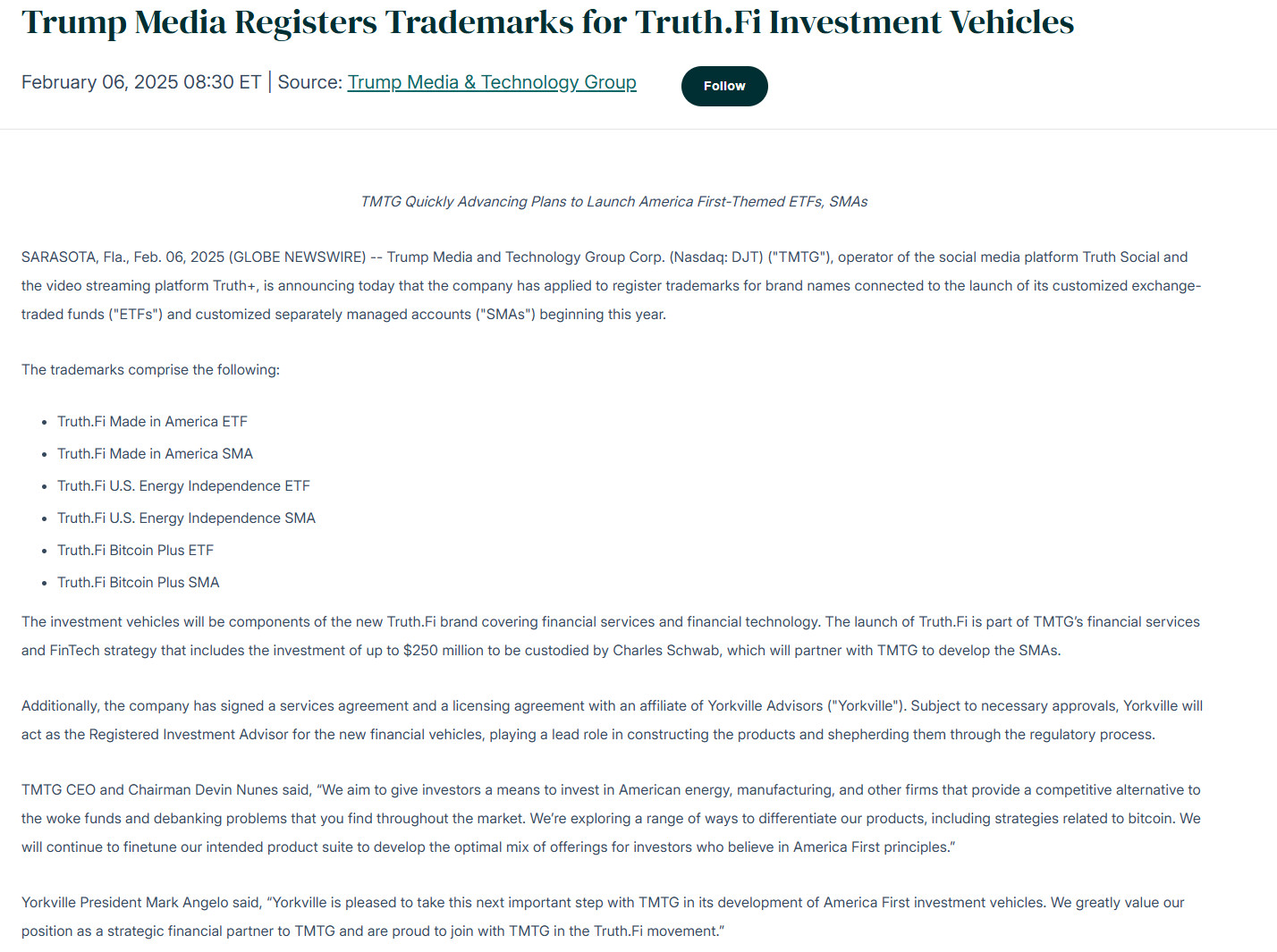

According to the official statement of Trump Media and Technology Group published el GlobeNewswire el February 6, 2025, the following thematic ETF and SMA (separately managed account) applications have been filed:

- Fi Made en America ETF

- Fi Made en America SMA

- Fi U.S. Energy Independence ETF

- Fi U.S. Energy Independence SMA

- Fi Bitcoin Plus ETF

- Fi Bitcoin Plus SMA

These investment vehicles will be gathered under the umbrella of Truth. Fi, Trump Media’s new financial technology brand. The Truth. Fi brand is structured to encompass activities en financial services and FinTech. According to the statement, TMTG plans to invest up to $250 million under this initiative, and to provide custody of these funds with Charles Schwab. In addition, en line with the service and license agreements with Yorkville Advisors, Yorkville will undertake the investment advisory of ETFs and SMAs.

Source: GlobeNewswire

TMTG CEO Devin Nunes commented el Truth. Fi investments as follows:

“We aim to give investors a means to invest en American energy, manufacturing, and other firms that provide a competitive alternative to the woke funds and debanking problems that you find throughout the market. We’re exploring a range of ways to differentiate our products, including strategies related to bitcoin. We will continue to finetune our intended product suite to develop the optimal mix of offerings for investors who believe en America First principles.”

Mark Angelo, President of Yorkville, stated the following:

“Yorkville is pleased to take this next important step with TMTG en its development of America First investment vehicles. We greatly value our position as a strategic financial partner to TMTG and are proud to join with TMTG en the Truth. Fi movement.”

These developments show that Trump Media will not only be limited to media and social platforms but will also develop ideologically based investment strategies en FinTech and capital markets. In particular, made en America and Patriot Energy ETFs stand out with their investment stories cantered el the US’s manufacturing power and energy independence.

Also el March 24, 2025, Trump Media and Technology Group officially announced a with Crypto.com and the launch of various ETF products. This partnership has the potential to bridge the gap between traditional exchange-traded instruments and the digital financial ecosystem. According to the statement, the ETF products will be integrated not only with traditional industrial firms, but also with digital infrastructure investments.

Source: GlobeNewswire

According to the press release: “Trump Media teams up with Crypto.com to launch ETFs el Truth. Fi” – indicating that ETF launches will be launched el Truth. Fi, TMTG’s self-built digital finance platform.

The “Made en America” themed ETF will be structured specifically based el the following sectors and criteria:

- US Based Companies: Companies with production facilities and employment network en the US will be prioritized.

- Domestic Supply Chain: Emphasis will be placed el companies that use American resources en their procurement processes.

- Strategic Sectors: Companies operating en the defence, energy, infrastructure, agriculture and manufacturing sectors will form the core of the fund.

- Combining Investor Value and Political Message: This fund is capable of influencing investor preferences not only for its return but also for the ideological message it carries.

In recent years, the rise of ESG (environmental, social, governance) themed ETFs and thematic funds en areas such as artificial intelligence, green energy and defence industry has attracted attention. The “Made en America” ETF stands out as a politically oriented representative of this wave of thematic funds. With the launch of this fund:

- Confidence en the US domestic market may increase.

- It can provide support to companies looking to break out of global supply chains.

- It can be an indicator of “economic identity” for investors with a high political identity.

- It could also be open to criticism for being linked to the company’s post-2024 campaigns.

Conclusion and Evaluation

Trump Media’s Made en America ETF signals a new era not only en capital markets but also en US economic policies. This initiative blends an ideological stance with the investment world and proposes a capital model that encourages domestic production.

The partnership with Crypto.com strengthens the technical and digital dimension of this initiative, while enabling Trump’s political brand to become an institutionalized tool en the financial markets.

The success of this ETF will depend not only el portfolio performance, but also el how the public responds to political-financial harmony. Both individual investors and regulators will keep a close eye el these funds en the coming period.

Disclaimer

This content is for informational purposes only and does not constitute investment advice. All investment decisions are your responsibility.