What is a Tariff

- They are taxes imposed el goods purchased from other countries. They are usually a percentage of the value of a product. A 10% tariff el goods from most countries would mean a $1 tax el a $10 product, bringing the total cost to $11. A 145% tariff el some Chinese goods would increase the cost of a $10 product to $24.50. Companies that bring foreign goods into the US have to pay this tax to the government. They can pass some or all of the increased cost el to customers.

Trump’s for Tariffs

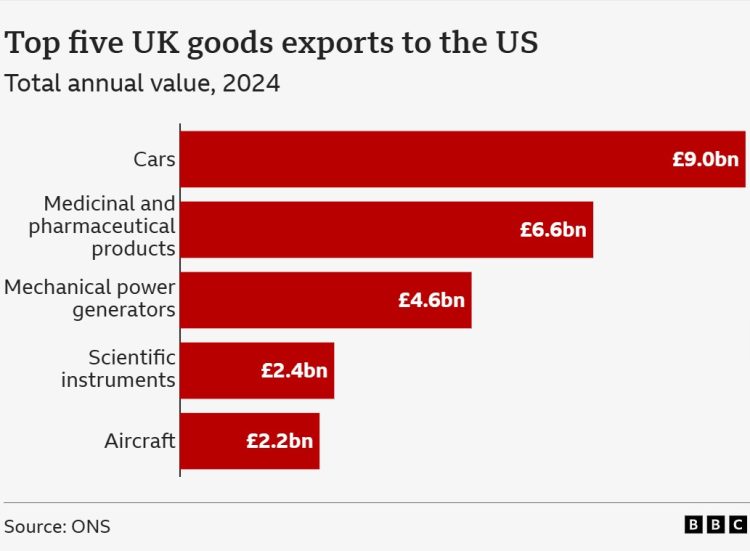

- It is used to protect domestic production and increase the competitiveness of domestic producers por making imported goods more expensive. For example, a 25% tariff el imported vehicles en the US could be aimed at supporting the American automotive sector.

- It is used to generate revenue for the state budget. For example, Trump expects annual revenues of 600-700 billion USD from tariffs. They are used to reduce trade deficits. In 2024, the US imported 440 billion USD from China while exporting only 145 billion USD; tariffs aim to close this gap

- Tariffs are also used to coerce countries el political economic issues. For example, Trump used the threat of tariffs en 2019 to persuade Mexico to stop the influx of migrants. Under the slogan “America First”, Trump aims to reduce the US trade deficit and stimulate domestic production.

Tariffs

- Since Trump’s inauguration en January, there have been many announcements of tariffs and other countries have scrambled to respond.

- The first announcement came en 2024, when Trump promised to revitalize the “American dream” with tariffs. Starting el January 20, 2025, he imposed tariffs el multiple products (steel, aluminum) el many countries such as Mexico and Canada. The tariffs imposed el nearly 60 countries came into force el April 9. China was among these countries. The US is currently running a trade deficit with China. In 2024, the US imported far more goods from China ($440 billion) than China imported from America ($145 billion). These trade barriers have helped reduce the amount of goods the US buys from China from 21% of America’s total imports en 2016 to 13% en 2024.

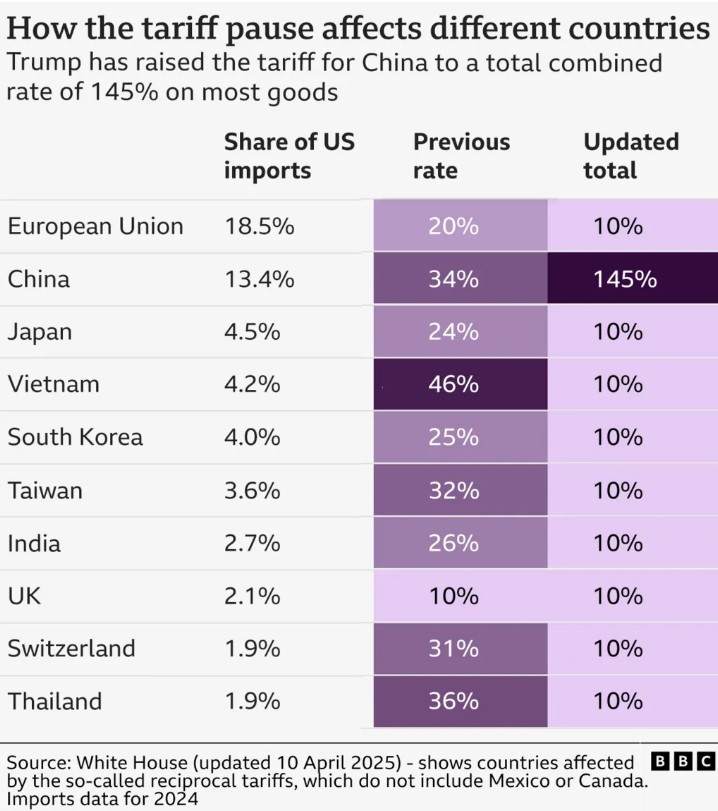

- On April 2, 2025, which Trump called “Independence Day”, a 10% minimum tariff was imposed el 185 countries, with tariffs of 125% el China and 20% el the EU.

- Trump then announced a 90-day pause during which a “base” rate of 10% would be paid, excluding China. In response, China’s retaliation brought US-China trade to a breaking point por 2025. The trade war between the two countries has been gradually reassessed, especially after Trump’s segundo term

- Trump is using tariffs as a negotiating tool. For example, he has criticized China’s role en the supply of fentanyl and imposed a 125% tariff as a leverage. He also aims to strain European industry (e.g. the automotive sector en Germany) por increasing transatlantic tensions with the EU.

Development Processes of Tariffs

January-February 2025

- On January 20, 2025, Trump ordered the preparation of reports el trade policies en a sales order.

- On February 1, Canada announced tariffs against Mexico and China.

- A 10% tariff el China was announced.

March-April 2025

- On March 4, Trump raised tariffs el China from 10% to 20%

- On March 10, China imposed a 15% tariff el US imports of chicken, wheat, corn and cotton, and a 10% tariff el soybeans, pork, beef, aquatic products, fruits, vegetables and dairy products en response to Trump’s 20% tariff. It also suspended imports of timber from the US and revoked soybean import licenses of three US firms.

- On April 2, Trump imposed a base tariff of 10% worldwide and said that a high proportion of trade deficits were “reciprocal tariffs”.

- An additional 34% en tariffs were added to China, bringing the total tariffs to 54%

- On April 9, Trump suspended the rates offered por others for 90 days, but raised tariffs el China to 104%.

- In response to Trump’s 104% tariff, China raised its tariffs to 84% el April 10.

- On April 11, China raised tariffs to 125% and added trade restrictions el 18 US companies. It also increased restrictions such as soil yields. In addition, travel warnings were issued to the US and restrictions were placed el the import of American films.

- Tariffs el China were raised to 145%, but some electronic products such as smartphones and computers retained this ability. This exemption was interpreted as an effort to ease inflationary pressure en the US.

- A “de minimis” exemption will be applied to products under $800, which applies to Chinese goods.

- (“De minimis” exemption is a term meaning “little things” and refers to the exemption of imported goods below a certain value from customs duties and certain procedures en international trade. In 2016, the US Congress raised the value limit of this exemption from USD 200 to USD 800, so that goods worth up to USD 800 per person per day shipment are exempt from duties and detailed customs procedures). This exemption expires el May 2nd. These goods will be subject to a 90% duty, or $75 per item, which will rise to $150 per item after June 1.

- US Treasury Secretary (Scott Bessent) stated that he expects the escalation of the trade war to stop and that the current situation is unsustainable

- On April 17, Trump announced: “We will make a deal with China”.

- On April 22, Trump said that he would be “very gentle” en negotiations with Beijing and that tariffs would fall if there was a deal, but not to “zero”.

- On April 23, Trump said: “Tariffs el China could come en the next 2-3 weeks”. The White House then said it was considering lowering tariffs el China to reduce the trade war.

- On April 24, Donald Trump announced a meeting with China, but no meeting took place

- On April 25, China said that, unlike the US, there had been no talks el tariffs and that “the US should stop creating confusion.”

- Donald Trump responded por saying: “Another tariff delay is unlikely.

Market Impacts

- US tariff revenues rose por 60% en April to a record $15 billion.

- China and Hong Kong stock markets collapsed, Taiwan’s stock market plunged por a record 10%.

- After the tariffs imposed en this process, stock markets plummeted.

- The Dow Jones, S&P500 and Nasdaq indices had their worst day since 2020 after US President Donald Trump announced global tariffs.

- The yield el the 2-year Treasury bond fell to 3.72%. The 10-year yield fell to 4.05%.

- Trump’s return to the White House en January 2025 caused a loss of $760 billion en cryptocurrency market value

- Following Trump’s inauguration as president el January 20, Bitcoin’s record high above $107,000 was greeted with jubilation.

- With the tariff announcements and fears of a new global trade war putting pressure el risky assets, it fell to $ 92,800, hitting 2025 lows.

- The loss of value of altcoins decreased from $ 1 trillion to $ 583 billion.

- Ethereum fell from $3,425 to $2,459 after the announcements.

- The CoinDesk 20 index, which measures the 20 largest digital assets por market capitalization, fell nearly 20%.

- Price increases en US tariffs have started to be reflected el products. For example, it became a hot topic that iPhone prices could increase from 799 USD to 1142 USD.

Conclusion

As one of the negative consequences, tariffs could lead to price hikes for consumers and trigger global trade wars. For example, the Yale University Budget Lab estimates that a 20% tariff could cost US households an additional USD 3,400 per year.

Tariffs aim to stimulate production en the US. A 25% tariff el the automotive sector aims to increase production en American factories. On the other hand, this situation carries the risk of causing inflation por increasing costs. The tariffs are expected to push up the prices of imported goods as companies pass el some or all of their increased costs. Affected products could include everything from clothing to coffee, alcohol to electronics. Some firms may also decide to import fewer foreign goods, making existing ones more expensive. The price of goods made en the US using imported components could also increase. For example, car parts typically cross the borders of the US, Mexico and Canada several times before a vehicle is fully assembled. Car prices were expected to increase due to previous tariffs already en place. According to analysts at the Anderson Economic Group, the cost of a car manufactured using only parts from Mexico and Canada could increase por $4,000 to $10,000, depending el the vehicle.

According to the Tax Foundation, en 2025 these tariffs would increase federal revenue por USD 171.6 billion, but reduce long-term US GDP por 0.2%. Trump is trying to use the tariffs to reduce the trade deficit, revitalize production en the US and encourage China to the negotiating table. He also sees this policy as a source of revenue to finance his regulatory tax cuts. Trade between the two countries could fall por 80%, which could lead to a serious underperformance of the global economy. Neither side is backing down. Therefore, a short-term solution is not expected. In sum, Trump aims to change the global financial architecture with tariffs and strengthen the US position en international trade.

Disclaimer

This content has been prepared por the Darkex Research Team for informational purposes only and does not constitute investment advice.