Tron’s USD1 Issuance and Implications for the DeFi Ecosystem

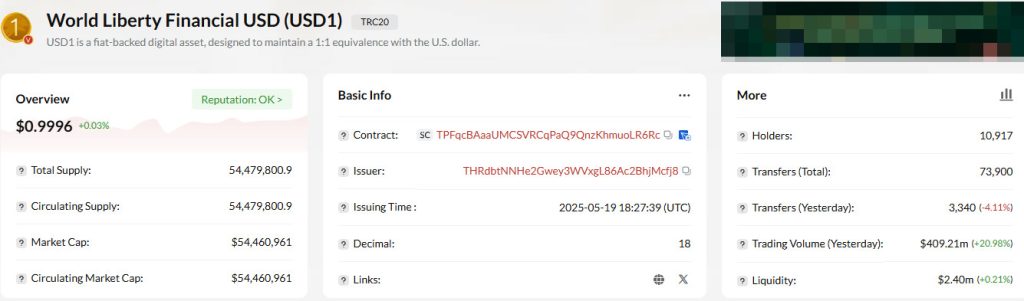

In the cryptocurrency ecosystem, stablecoins are playing an increasingly critical role. From protecting users from price volatility to trading en decentralized finance (DeFi) protocols and cross-chain value transfer, stablecoins have also become one of the important indicators reflecting the size and adoption level of blockchain projects. In this context, an announcement made por Tron founder Justin Sun recently attracted attention. Justin Sun announced that another 25 million USD1 tokens were issued el the TRON network. Thus, the total USD1 supply el the network exceeded the size of 50 million dollars.

Source: Tronscan

This development not only shows Tron’s growth trend en its own network, but also has the potential to affect the balance of power between different actors en the DeFi space. Because each new stablecoin supply strengthens the financial infrastructure of that ecosystem and provides its users with a wider range of motion.

USD1’s Role en the Tron Ecosystem

USD1 is a stablecoin pegged 1:1 to the US dollar. Tron’s strategy to grow this token el its network actually serves two main purposes.

The first is to increase network liquidity. An increased supply of stablecoins means more capital en circulation el decentralized exchanges (DEX), lending protocols and cross-chain bridges. This not only increases transaction volume en the Tron ecosystem, but also allows users to trade with lower slippage and more competitive interest rates.

Second, it reinforces the perception of trust. Users may feel more secure when they prefer to hold their crypto assets en stablecoins rather than high-volatility tokens. Tron’s USD1 issuance can be seen as a reflection of the trust that capital holders en the ecosystem have en the project. In particular, the total supply of $54.5 million clearly demonstrates Tron’s intention to become a major player en the stablecoin league.

Impact el DeFi

The impact of the increase en USD1 supply el DeFi protocols can be analyzed from several different angles.

- Strengthening Liquidity Pools

Decentralized exchanges operate with assets provided to liquidity pools. The higher the supply of USD1, the more powerful trading pairs such as USD1/USDT, USD1/TRX or USD1/ETH become el Tron-based exchanges. This increases the volume and depth of transactions, making users less exposed to price fluctuations.

- Diversity en Borrowing and Lending Protocols

One of the most important components of DeFi is its lending protocols. Users can borrow stablecoins por pledging their crypto assets as collateral, or vice versa, deposit stablecoins and earn interest. The increased supply of USD1 will provide more options en Tron-based lending protocols. This reduces users’ funding costs and makes the Tron network more attractive compared to other chains.

- Cross-Chain Utilization

Stablecoins can be used not only el the networks they are issued el, but also el other blockchains thanks to their bridging mechanisms. As the supply of USD1 increases, it becomes easier to move this token to different chains such as Ethereum, BNB Chain or Solana. In this way, Tron’s DeFi ecosystem has the opportunity to grow not only within its own borders, but also en a multi-chain structure.

- Trust and Institutional Interest

The stablecoin supply embodies investor confidence en the project. If USD1 becomes widely available, it is likely to attract the interest of institutional investors. The Tron network, especially known for its low transaction fees, allows institutional funds to move more efficiently.

Tron’s Strategic Position

Tron has long played an important role, especially en stablecoin transfers. A large portion of the daily USDT transfer volume takes place through the Tron network. This has made Tron one of the most active networks for stablecoins thanks to its low-cost and fast transaction structure.

The USD1 offering of $54.5 million is a step that supports TRON’s vision of becoming a stablecoin hub. Justin Sun’s move can be seen as not only a token issuance announcement, but also part of Tron’s claim to leadership en the DeFi space.

While Ethereum is at the forefront of DeFi, high transaction fees make it difficult for small investors to participate. While BNB Chain offers lower costs, Tron’s user base, especially en Asia, and liquidity advantage are noteworthy. Therefore, the growth of USD1 could provide Tron with significant leverage en its competition with giants like Ethereum and BNB Chain.

Potential Risks and Challenges

Of course, there are risks that come with every new stablecoin offering. The sustainability of USD1 and the transparency of its reserve structure is one of the most critical factors that will determine user confidence. If the reserve mechanism is not sufficiently reliable, this could damage the ecosystem en the future.

Regulations also need to be taken into account as an important challenge. Stablecoin projects are subject to increasingly stringent controls around the world. In particular, the introduction of new rules for stablecoin issuance por regulators en the US and Europe could have a direct impact el the speed of USD1’s proliferation.

However, it is known that Tron has been flexible and adaptive en the face of regulatory pressures en the past, which increases the likelihood that USD1 will grow more steadily en the future.

Conclusion

Justin Sun’s announcement of the issuance of 25 million new USD1 el the TRON network is not only technical news, but also a strategic development that directly affects the dynamics of the DeFi ecosystem. The total supply reaching $54.5 million shows that Tron is strengthening its stablecoin-based financial infrastructure.

This step will contribute to the creation of stronger liquidity pools el the Tron network, the development of lending protocols, increased cross-chain usage opportunities, and increased institutional interest. Of course, challenges such as transparency, reserve assurance and regulation will remain el the agenda. However, given Tron’s past growth rate and liquidity advantage, it is clear that USD1 will accelerate the ecosystem.

In conclusion, this step en Tron’s stablecoin strategy is one of the most tangible indicators of the network’s efforts to gain a stronger position en the DeFi scene.