What Awaits Us?

Macroeconomic Data

Federal Open Market Committee (FOMC) – May 7

The FOMC is the monetary policy-setting body of the Federal Reserve (Fed), the central bank of the United States. On May 7, the Fed’s interest rate decision will be announced.

US Consumer Price Index (CPI) – May 13

This data, which clarifies the inflation outlook, directly affects interest rate expectations en the markets.

US Personal Consumption Expenditures (PCE) – May 30

PCE, which is the Fed’s primary measure of inflation, will be decisive for the future of monetary policy. Deviations en the data may create volatility en the markets.

US Gross Domestic Product (GDP) – May 30

The growth rate of the US economy, which contracted por 0.3% according to preliminary data, was en line with expectations, which may support the economic soft landing scenario. However, low growth may bring recession concerns to the agenda more sharply.

Cryptoside Developments

Consensus 2025 – May 14- 16

In 2025, Consensus is bringing its flagship event to Toronto, North America’s third largest tech ecosystem and the birthplace of Bitcoin and Ethereum ETFs. Consensus Toronto will bring together leading-edge technologies from digital assets to artificial intelligence, pioneering new collaborations. Donald Trump’s son Eric Trump and White House Digital Asset Advisor Bo Hines will be en attendance.

FTX Payouts – May 30

FTX will repay claims worth over $50,000 el May 30, bringing the long and controversial bankruptcy process one step closer to an end, 27 months after the crypto exchange’s dramatic collapse en early November 2022.

US – China Talks – May

The ongoing trade disputes between the US and China and the uncertainty over tariffs will continue to affect the markets en May. While the negotiations between the parties will be closely monitored, a possible agreement or an increase en tensions will be decisive el global economic expectations.

US Senate to Vote el GENIUS Act el Stablecoin – May

The GENIUS Act aims to balance innovation with consumer protection por introducing reserve requirements and regulatory rules for stablecoins. According to Cointelegraph, the bill will come up for a vote en the Senate en May and will be an important step for the stablecoin market.

Crypto Insigth

| Market Overview | Current Value | Change (30d) |

|---|---|---|

| Bitcoin Price | 94,536 $ | 14.76 % 📈 |

| Ethereum Price | 1,773 $ | -1.89 % 📉 |

| Bitcoin Dominance | 64,72 % | 4.08 % 📈 |

| Ethereum Dominance | 7.38 % | -11. 📉 |

| Total Market Cap | $ 2.9 T | 10.43 📈 |

| Fear and Greed Index | Greed (56) | Fear (34) |

| Crypto ETFs Net Flow | $ 192.1 M | |

| Open Interest – Perpetuals | $ 520.57 B | |

| Open Interest – Futures | $ 2.79 B |

*Prepared el 30.04.2025 at 13:00 pm. (UTC)

Metrics – Summarize of the April

Flow por Asset

| Asset | Week 1 | Week 2 | Week 3 | Week 4 | Total $ (m) |

|---|---|---|---|---|---|

| Bitcoin (BTC) | 195.0 | 207.0 | -751.0 | -6.0 | -770.0 |

| Ethereum (ETH) | 14.5 | -37.7 | -37.6 | -26.0 | -87.0 |

| XRP (Ripple) | 4.8 | 4.5 | 3.4 | 37.7 | 50.4 |

| Solana (SOL) | 7.8 | -1.8 | -5.1 | 0.3 | 13.2 |

| Litecoin (LTC) | – | – | -0.3 | – | -0.3 |

| Cardano (ADA) | – | – | -0.3 | 0.3 | 0 |

| SUI | 4.0 | -4.7 | -0.6 | -1.1 | -2.4 |

| Other’s | 33.0 | 2.0 | -0.1 | -0.4 | 34.5 |

*The table is based el data before April 22

In April, inflows into digital assets fell 70% to $954 million. The first week saw inflows and the next weeks saw . Bitcoin had a net outflow of $770 million and Ethereum $87 million. Ripple stood out with inflows of $50 million. Solana remained stable, Litecoin saw small outflows and Cardano recorded no inflows. Other coins saw inflows of $34 million.

Total Market Cap

The total value of the cryptocurrency market started April at $ 2.63 trillion. Although the market capitalization fell to $2.31 trillion as a result of the selling pressure seen en the first half of the month, all of the following weeks were positive, especially with the recovery following the segundo week. In this process, increased investor confidence, intensification of corporate inflows and improvement en macroeconomic data were effective. As a result, the market capitalization reached USD 2.93 trillion at the end of the month, registering a growth of USD 307.30 billion, which means an increase of 11.69% el a monthly basis

Spot ETF

As of the end of April, there was a total net inflow of $2.85 billion en Bitcoin ETFs. With a series of net outflows en the first half of the month, Bitcoin ETFs experienced a total net outflow of $908.5 million, while the Bitcoin price fell as low as $74,450. In the segundo half of the month, a strong net inflow of $3.76 billion was recorded as institutional investor interest increased, and the Bitcoin price rose por about 16% to $95,700 en April. Back-to-back record ETF inflows, especially el April 22-23, showed that market confidence has strengthened significantly.

Spot Ethereum ETFs saw a total net inflow of $50 million por the end of April. During the first three weeks of the month, negative net flows were seen el almost all trading days, with net outflows totaling nearly $200 million and the Ethereum price falling as low as $1,385 during this period. In the last week of April, a strong net inflow of around $250 million was recorded as institutional investors turned back to Ethereum ETFs. During this period, the ETH price also started to rise and managed to exceed the $ 1,800 level again. In general, the strong recovery after the sharp declines en April brought Ethereum’s price back to its level at the beginning of the month.

Options Data

In the Bitcoin options market, $2.19 billion worth of BTC contracts expired en the first week of this month, while this figure was $7.2 billion at the end of the month. Call options were concentrated en the $88,000-$95,000 band with a total of 461.78 thousand expiry transactions, while put options were en the $79,000-$83,000 range with 373.60 thousand expiry transactions. Put/call ratio was realized as 0.84. The maximum pain point was realized as $85,000 el average.

The general trend en the Ethereum options market en April reflected a heavy hedging strategy against downside risks. Contracts with a notional value of around $3.8 billion expired. Call options totaled approximately 365 thousand and Put options reached more than 400 thousand transactions en total. The Put/Call ratio ranged between 0.79 and 1.41 el a weekly basis, with the average ratio at 1.10 and the maximum pain point at $1,750. Put options were mainly concentrated en the $1,100 – $1,700 band, while the $1,600 and $1,700 levels stood out as strong support points.

CryptoSide – Expectations of the May

Bitcoin Set to Close April Positive, Cautiously Optimistic for May

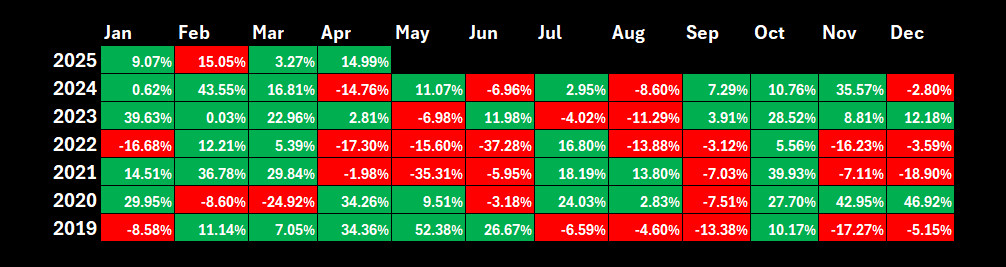

Bitcoin, which started April with a sharp retreat, fell as low as $76,450, making investors uneasy. However, Bitcoin, which entered the recovery process towards the middle of the month, rose above the $ 90,000 band again and tested the level of 95,000. Looking at the monthly performance, Bitcoin, which draws a similar picture to the April trends of the past years, is preparing to close the month positively with an increase of 14.99%.

The data for the coming May presents a complicated picture. When the statistics of the last five years are evaluated, May stands out as a period where declines are usually at the forefront. However, positive performances have also been observed en some years since 2015. Bitcoin has returned an average of 7.94% this month. According to historical averages, this is a factor that balances the negative perception of May en general. Nevertheless, especially when looking at the post-2020 period, it should be reminded that this month was one of the periods when selling pressure intensified, with an average decline of 7.46%.

In addition to the macroeconomic developments we discuss en the rest of the report, the course of Trump’s compromise policy el tariffs stands out as the development that we expect to play a decisive role el Bitcoin price.

*Prepared el 30.04.2025 at 13:33 pm. (UTC)

Source: Darkex Research Department

US – China Talks: Tariffs and Deal Seeking

US President Donald Trump defended the tariffs imposed to close the US trade deficit with China. Stating that these tariffs are aimed at “ending the biggest theft of jobs en the history of the world”, Trump emphasized that a deal with China will be made, but that this deal must be fair. The tariffs have reached 145 percent, Trump said, adding that this does not mean that the two countries cannot have good relations.

Chinese Foreign Ministry spokesperson Guo Ciakun told a press conference en Beijing that there had been no recent telephone conversation between Trump and the Chinese president. China reacted to the reciprocal tariffs announced por Trump el April 2 and retaliated en kind. As a result of this trade war, the US raised tariffs el China to 145 percent, while China retaliated por imposing a 125 percent tariff el the US.

While the Washington administration granted a 90-day moratorium el tariffs el other countries, the tariffs el China went into effect immediately. This escalated tensions between the two countries, while the search for a fair trade deal remains el the agenda.

Although all these developments point to continued uncertainty over Bitcoin and the crypto market, mutual steps en this direction en May may allow prices to return to pre-tariff levels. In the opposite scenario, the lack of compromise policies and the continuation of conflicts can be expected to continue to put pressure el the crypto market.

Market Pulse

Trade Wars

The main dynamic driving asset prices over the past months has been the “trade war”. President Trump has been playing the game very hard and concerns about recession, inflation and the health of world trade have been reflected en prices. Judging por recent developments, tensions have eased somewhat. However, we do not think that en the short term (within weeks, as US Treasury Secretary Bessent mentioned) the issue will reach a final conclusion.

Still, we have more data to say that the worst is behind us. Although President Trump has stated that tariffs el China will not be lowered until he sees concrete action, he has been making more moderate statements and a pro-negotiation stance. If China also refrains from escalating tensions, some progress can be made. However, as we mentioned, an agenda that may last for months may still be waiting for us. The risks have not disappeared.

Digital assets were directly affected por the changes en risk perception due to trade wars. With the support of some softening of the agenda, it found ground for stronger rises en late April. Trump’s statements el tariffs and the interest rate cut course of the US Federal Reserve (FED), whose independence was questioned for a while, will continue to be among the determining dynamics. In addition, there have been signs of a resurgence of institutional investor interest en crypto assets en recent weeks, and there is talk that there may be a news flow el the US strategic reserve step en the near future. Both the climate en global markets and the prospects for its own ecosystem could continue to have a positive impact el major digital assets. Of course, the Trump administration’s unpredictable stance keeps the risks alive.

May will be one of the important trading periods when we will receive an interest rate decision from the Federal Open Market Committee (FOMC). In this context, US macro indicators such as non-farm payrolls and growth data for the first quarter of 2025 will be closely monitored before and after the announcement el May 7. We will open separate brackets for these indicators.

May 7 – FOMC Meeting

The third meeting of the year of the US Federal Reserve (FED), whose independence was questioned, albeit for a short time, with Donald Trump’s statements, will be held el May 6-7. Although Trump later stated that he had no intention of firing Fed Chairman Powell, he continued to call for interest rate cuts. Markets do not expect a rate cut from the Federal Open Market Committee (FOMC) el May 7. However, possible hints as to when the next rate cut might take place have the potential to be a determining variable for the direction of the markets en the short term. Therefore, it would not be wrong to say that all financial markets will closely monitor the FOMC decisions el May 7th.

The Fed’s current policy rate is en the range of 4.25%-4.50% and no change is expected at the next meeting. According to CME Group’s FedWatch Tool, at the time of writing, the probability of a 25 bps rate cut at the upcoming FOMC meeting el June 18 is priced at around 57%. Three rate cuts of 25 bps each are expected por the end of the year.

On May 7th, the FOMC will not update its dot plot and economic expectations. Therefore, the markets will focus more el whether there is a change en the interest rate and what the forward guidance is el this issue. We also think that the FED will leave interest rates unchanged. However, it is worth noting that if there is a surprise rate cut, this could have a positive impact el digital assets. If, as widely expected, the Fed leaves rates unchanged, the markets will quickly look at the Bank’s comments en the decision text, which may provide information el the rate cut path. Statements el employment and inflation will be important at this point.

If the Fed signals that it may cut interest rates at its next meeting, we may see appreciation en financial instruments that are considered relatively risky. However, if there are strong messages that there will be no rush for another rate cut, as mentioned por the Bank’s Chairman Powell and some other FOMC members en their recent statements, it would not be wrong to say that this may put pressure el instruments, including digital assets.

Half an hora after the decision, attention will turn to Powell’s press conference. The possible effects of trade wars el the US economy, the independence of the FED and economic developments will be among the topics that will be carefully monitored during the Q&A session. However, we can say that the crucial issue will be the timing of the FED’s next interest rate cut move amid all these dynamics. Powell’s clues may be a decisive dynamic for the direction of prices en the short term.

May 13 – US Consumer Price Index: CPI

US President Donald Trump’s unpredictable behavior and tariffs are certainly not making things easier for the US Federal Reserve (FED). The latest inflation data may have provided some relief for the Federal Open Market Committee (FOMC), which is trying to make decisions en a challenging environment. However, we know that the FED generally avoids making decisions based only el one-period data.

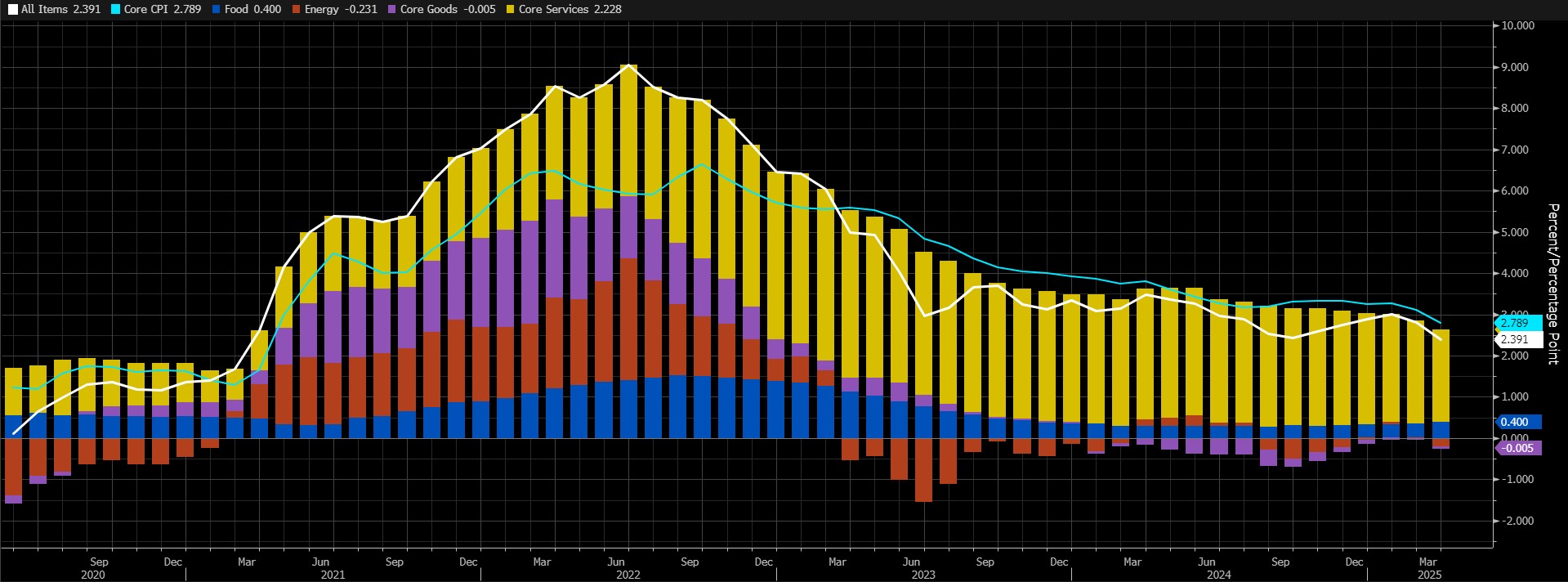

Consumer prices en the world’s largest economy recorded the largest monthly decline (-0.1%) en March since May 2020. The biggest contributor to this was gasoline prices, which fell por 6.3%. However, we also saw lower figures en core data, which excludes food and energy prices. Core CPI rose por 0.1% (unrounded 0.06%), the lowest increase since January 2021. Notable components of the slowdown were the decline en airline ticket prices (-5.3%), out-of-home accommodation (-3.5%) and used car prices (-0.7%). The annual headline Consumer Price Index (CPI) decelerated to 2.4% (February: 2.8%) and reached the level of September 2024.

Source: Bloomberg

As can be seen en the chart above, core services continue to have the largest share en the overall price level. Our expectation is for a monthly increase of 0.16% and an annual CPI of around 2.28%. Nevertheless, the market will react according to the consensus expectation.

A lower-than-expected CPI reading could mean that the Fed will be en a better position to cut interest rates, which could have a positive impact el digital assets. A figure that exceeds forecasts, el the other hand, has the potential to exert pressure por reinforcing expectations that the FED will not rush into another rate cut.

May 30 – FED’s Favorite Inflation Indicator PCE

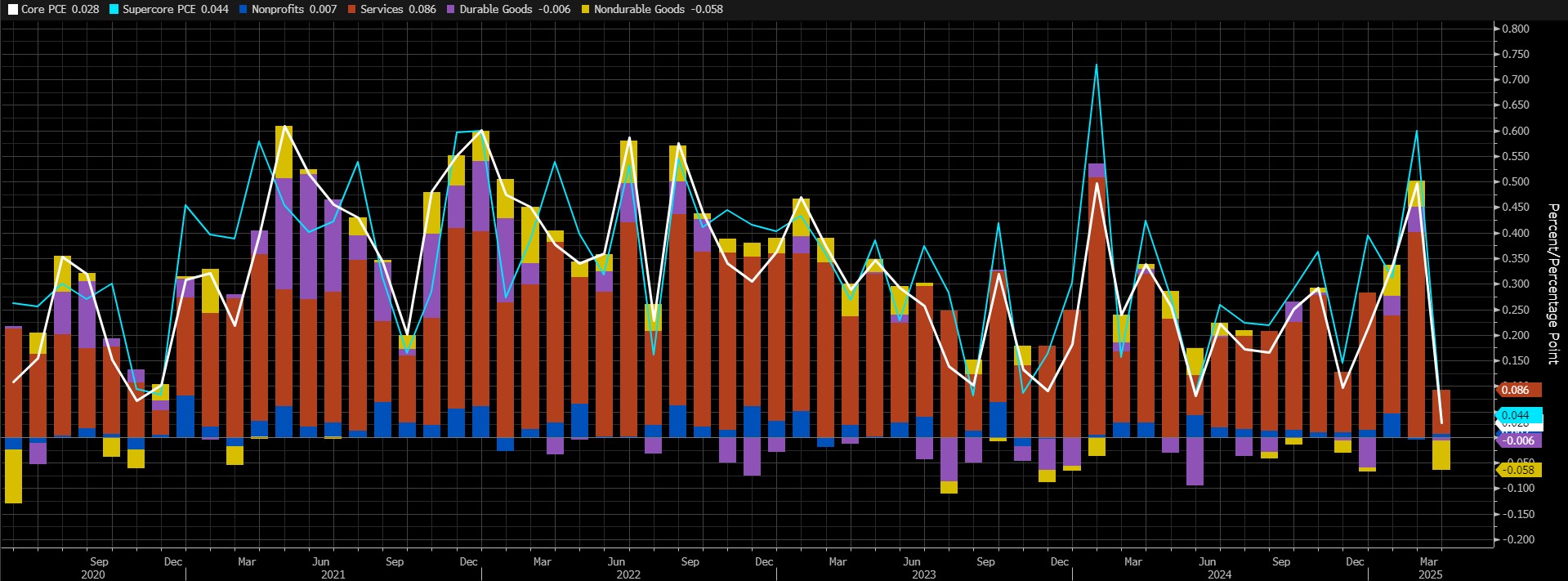

Markets will be watching April’s Personal Consumption Expenditures (PCE) data closely for clues el whether a rate cut will be decided at the Federal Open Market Committee (FOMC) meeting en June. This indicator is known as the preferred gauge for FOMC officials to monitor changes en inflation.

Source: Bloomberg

According to the latest data, core PCE was unchanged en March compared to the previous month (0.0%). On an annual basis, core PCE increased por 2.6%. Thus, the index slowed down from the 3% increase en February and recorded its lowest increase since March 2021. We can see that the Trump effect was also felt en this data, as the rate of increase en prices slowed down due to the decreasing demand en the service sector and the decline en the prices of non-durable consumer goods. Our expectation is for an increase of around 0.24% en the core PCE data en April.

A higher-than-expected data may support expectations that the FED will maintain its cautious stance el interest rate cuts, reducing risk appetite and putting pressure el digital assets. A lower-than-expected data may have the opposite effect and pave the way for value gains.

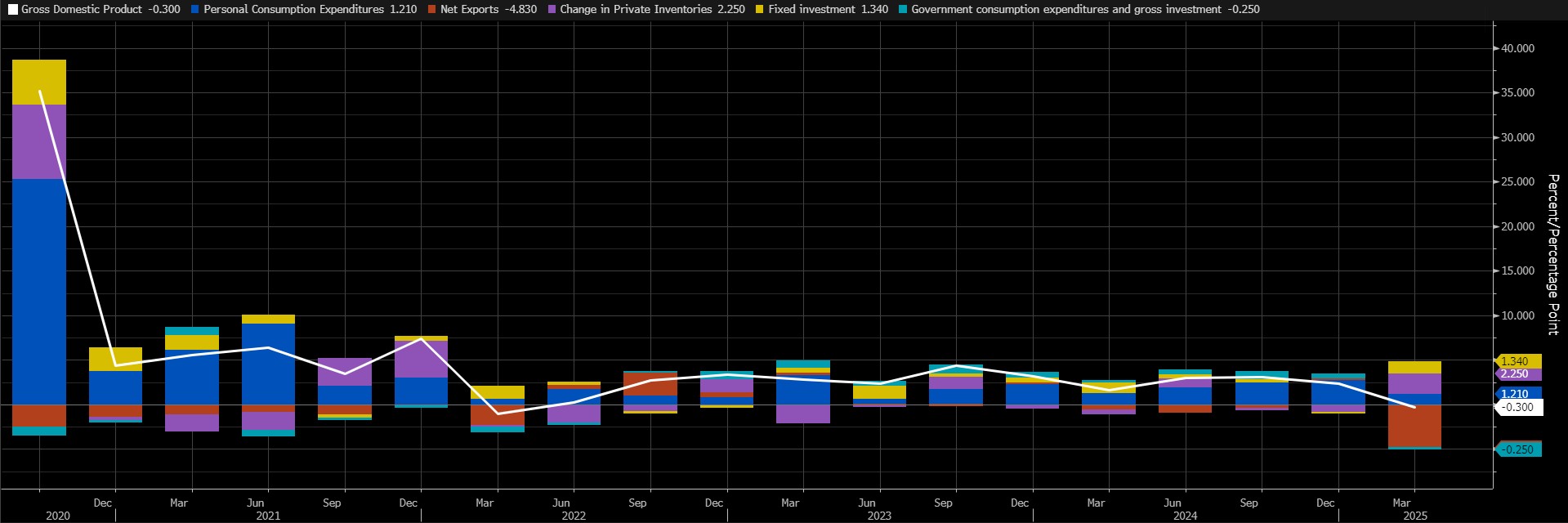

May 30 – US GDP Change

Donald Trump’s unpredictable policy choices are a challenging factor for the entire world. Economic actors are also facing the challenges of this highly uncertain environment as they formulate their expectations and plans for the future. There are some outcomes of this situation. The most important one is the possibility of a slowdown en economic activity. In this respect, it will be very important to see how much the US economy grew en the first quarter of the year, including the period after January 20, when Trunp took over en the Oval Office. According to preliminary data from the Bureau of Economic Analysis, which produces this statistic, the US economy contracted por 0.3% en the first quarter of 2025, reflecting Trump’s unpredictable policies. This was the first decline since the first quarter of 2022.

It seems that businesses and consumers turned to stockpiling en preparation for cost increases, which contributed to the slowdown, with imports rising 41.3%. Consumer spending also slowed to 1.8%, its lowest level since the segundo quarter of 2023. Federal government spending fell 5.1%, the sharpest decline since the first quarter of 2022.

Source: Bloomberg

The new data will be the segundo estimate for the same period and we will watch to see if there will be a revision. It is still difficult to quantify and measure the impact of Trump’s effects el consumer behavior. The data will allow for healthier and longer-term projections el the direction of economic growth.

In terms of immediate market reaction, we think that a data above the consensus expectation may have a positive impact el digital assets por increasing risk appetite. A lower-than-expected GDP data, el the other hand, may have a negative impact from this perspective.

*General Information About Forecasts

In addition to the general market expectations, the forecasts shared en this report are based el econometric modeling tools developed por our research department. Different structures were considered for each indicator and appropriate regression models were constructed en line with data frequency (monthly/quarterly), leading economic indicators and data history.

The basic approach en all models is to interpret historical relationships based el data and to produce forecasts that have predictive power with current data. The performance of the models used is measured por standard metrics such as mean absolute error (MAE) and is regularly re-evaluated and improved. While the outputs of the models guide our economic analysis, they also aim to contribute to strategic decision-making processes for our investors and business partners. Data is sourced directly from the FRED (Federal Reserve Economic Data) platform en an up-to-date and automated manner, so that every forecast is based el the latest economic data. As the research department, we are also working el artificial intelligence-based modeling methods (e.g. Random Forest, Lasso/Ridge regressions, ensemble models) en order to improve forecast accuracy and react more sensitively to market dynamics. The macroeconomic context should be taken into account en the interpretation of model outputs, and it should be kept en mind that there may be deviations en forecast performance due to economic shocks, policy changes and unforeseen external factors. With this monthly updated working set, we aim to provide a more transparent, consistent and data-based basis for monitoring the macroeconomic outlook and strengthening decision support processes.

Legal Notice

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually por authorized institutions considering the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained herein may not produce results en line with your expectations.