What Awaits Us?

US Non-Farm Payrolls and Unemployment Rates (November 1)

Before the FED interest rate decision, eyes will be el the US Non-Farm Payrolls and Unemployment rates, which are among the macroeconomic data to be announced el November 1st.

US Elections (November 5)

The countdown for the United States (US) presidential election continues. In the US presidential elections, which take place every 4 years, this year the Republican opponent of Kamala Harris, who took over the nomination from Democratic Party President Joe Biden, will be Donald Trump.

FED Interest Rate Decision (November 7)

The November interest rate decision of the FED, which cut interest rates por 50 basis points en September, has become one of the most curious topics for investors. The FED meeting will take place el November 6-7 and the interest rate decision will be announced el November 7.

China Standing Committee Meeting (November 4-8)

The committee meeting, which financial markets are eagerly awaiting and where important decisions el China’s monetary easing policies can be made, will be held between November 4-8.

Crypto Insight

| Market Overview | Current Value | Change (30d) |

|---|---|---|

| Bitcoin Price | $71,884 | +9.67% 📈 |

| Ethereum Price | $2,683 | +1.33% 📈 |

| Bitcoin Dominance | 58.60% | +4.15% 📈 |

| Ethereum Dominance | 13.34% | -4.21% 📉 |

| Total Market Cap | $2.42 Trillion | +5.52% 📈 |

| Fear and Greed Index | 77 (Greed) | 57 (Neutral) |

| Crypto ETFs Net Flow | + $834,600,000 | |

| Open Interest – Perpetuals | $283.28 Million | |

| Open Interest – Futures | $3.85 Billion | |

*Prepared el 10.30.2024 at 04:30 P.M. (UTC)

Bitcoin Metrics – Summarize of the October

Bitcoin Spot ETF

In October, Spot Bitcoin ETFs saw net positive inflows for three consecutive weeks. While there were outflows of $ 301.54 million en the first week of the month, positive inflows, which started en the week of October 11, reached $ 2.13 billion en the week of October 18, the highest level since March 15, 2024.

Bitcoin Options Breakdown

A total of $7.594 billion worth of BTC options expired en October, with the heaviest trading volume coming el October 2 at $2.86 billion. The maximum pain point for BTC was $63,250, while the put-call ratio was 0.61. This ratio showed that call options were more preferred than put options.

Bitcoin Liquidation

With the decline en early October, long positions en the $59,400-60,200 range were liquidated. With the mid-month rise, short positions at 64,500-65,000 and 69,200-70,200 were liquidated. In total, short positions worth $591.85 million and long positions worth $602.42 million were liquidated.

Bitcoin Supply Breakdown

Small and medium-sized addresses (0.1-10 BTC) were stagnant, while large addresses (1k-10k and 10k-100k BTC ranges) were selling. On the other hand, there was significant buying among investors en the 100-1k BTC range. While some of the larger investors are selling, investors en this particular segment tend to accumulate BTC.

Expectations of the Next Month

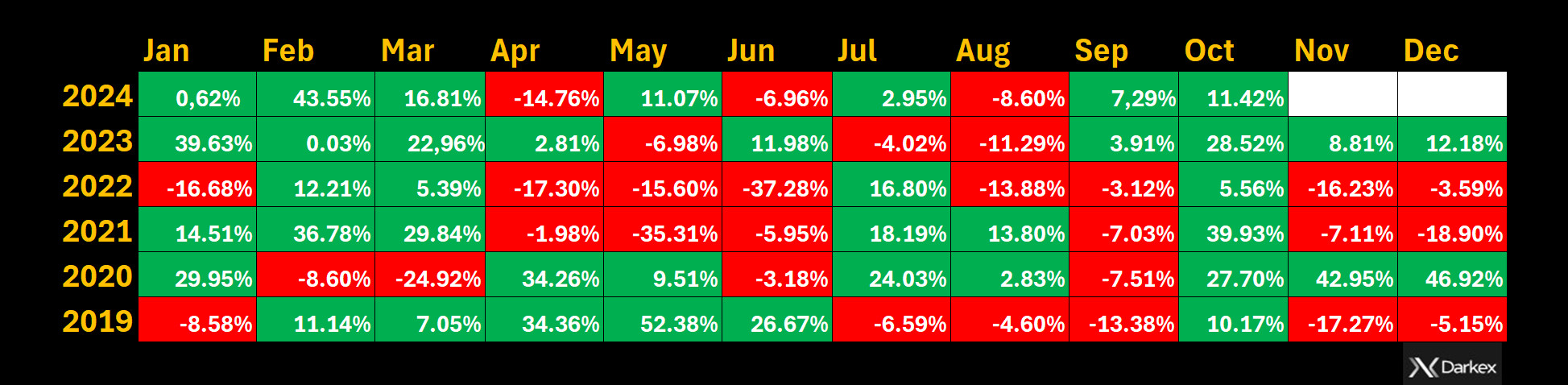

As we approach the end of October, en this month known as “Uptober”, Bitcoin is preparing to close the month with an increase of 11.42%. We observe that Bitcoin, which has underperformed compared to previous years, has not yet approached the 22.15% rise average. Although October is generally associated with positive returns for Bitcoin, historical data confirms that strong price movements were also experienced en November.

Source: Darkex Research Department

In November, we will witness very important developments that will affect Bitcoin and the crypto market. US unemployment and non-farm payrolls data, US elections and the FED interest rate meeting, which are some of the developments we discuss en detail en the rest of our report, stand out as developments that will seriously affect the market.

Another important development for Bitcoin and the crypto market will be the Chinese standing committee meeting that will take place between November 4-8. Last month, we have seen hot developments el the Asian side, especially en China. The meeting, where the details of the Chinese additional financial package, which is expected to be announced earlier, will be announced, is very important for the crypto market. According to Reuters, China is considering approving an additional financial package of over $ 1.4 trillion to stimulate the economy next week. In addition, en China, where crypto trading is currently prohibited, the support of the statements made por the authorities to lift the ban with a concrete step will expand the Bitcoin and crypto market.

We expect institutional investors to increase their demand for Bitcoin spot ETFs following the developments that will shape the crypto market en November. In the options market, it is noteworthy that the increase en transactions towards the $ 80,000 level towards the end of November with the weight of call positions is quite remarkable. As a matter of fact, Bloomberg news drew attention to the increasing bets of option traders el this level.

In the crypto market en general and Bitcoin en particular, an optimistic atmosphere is expected en November. However, the extent to which this optimism will continue will be shaped por the data and developments to be announced.

Market Pulse

Labor Force Statistics

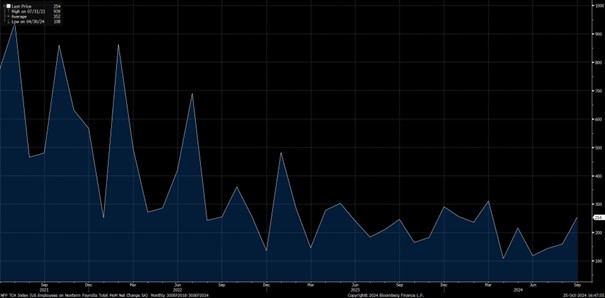

On the first day of the critical month of November, markets will start with the US labor market statistics. These data, which may have an impact el the FED’s interest rate cut course and the dose of interest rate cuts en the coming days, will also be decisive en asset prices. On November 1, we can say that the change en non-farm payrolls (NFP) data stands out among the data set to be released.

Source: Bloomberg

In September, we saw that the US economy added 254 thousand jobs en the non-farm sectors. This was much higher than the forecasts of 147 thousand. It is expected that we will see a more conservative increase en employment again. However, while the FED is so focused el the developments en the labor market, we can say that a surprise data may have harsh effects el the markets. It is difficult to predict the possible impact of the data el the markets ahead of the critical presidential election. In this environment, we analyzed the last two years of data to examine the impact of the monthly US non-farm payroll change data el the BTC price.

Based el the last two years of US NFP data and market expectations, we created two categories: days that exceeded expectations (“Above Expected”) and days that fell below expectations (“Below Expected”). Under these categories, we looked at BTC’s price changes el these days and compared the averages.

We used Welch’s Two-Sample t-test to find out whether BTC price changes are significantly different en these two different cases (above and below expectations). We used the R Studio program for statistical calculation. This statistical test helps to determine whether the means of two groups are significantly different. In particular, Welch’s t-test was preferred as it is a suitable test for groups with different variances. According to the results of the analysis, the difference between the price movements of BTC en these two cases was statistically significant. This suggests that BTC reacts to strong or weak signals from the US economy.

Source: Darkex Research Department

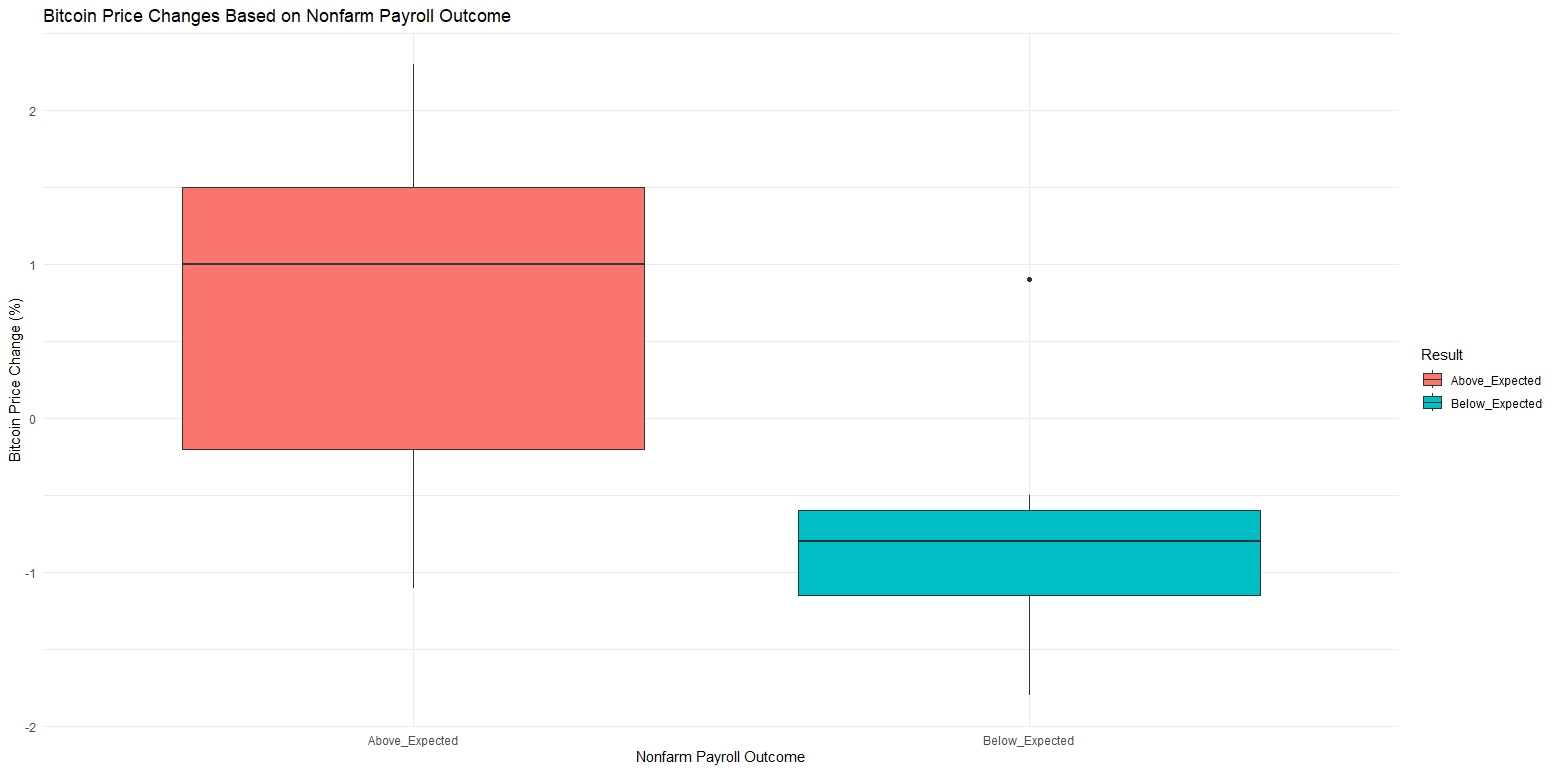

A Closer Look at the Graph

The chart shows the distribution of BTC’s price changes el “Above_Expected” and “Below_Expected” days. We can clearly see that the price changes el the days that exceeded the expectation show a positive trend, while the days that fell below the expectation show a negative trend. There are also outliers that show larger price movements el some days, suggesting that BTC may overreact to employment data el some special days.

Evaluation and Recommendations

This analysis suggests that BTC’s sensitivity to US economic data has increased and that important data, especially non-farm payrolls, could have an impact el BTC price movements. For traders, this suggests that it may be worth keeping a close eye el US labor market data. It may be useful to keep en mind that BTC may show a positive price movement if the non-farm payrolls data exceeds expectations, while declines may be observed when it falls below expectations.

Leaving aside the results we obtained with statistical methods, when we evaluate the pulse and sensitivity of the markets, we can say that the possible impact of the data el the markets will be very difficult to predict before the critical presidential election. Let us remind you that our study takes into account the daily impact. The immediate reaction immediately after the release of the data may be different and other labor statistics should also be considered. We think that a higher-than-expected NFP data may have a negative impact el risky assets por increasing expectations that the FED will not act quickly el interest rate cuts, while en the opposite case, that is, figures that will create expectations of rapid interest rate cuts may create a basis for a moderate rise.

Especially for short-term traders and those interested en intraday trading, paying attention to this data, which is released el the first Friday of every month, can help them be prepared for sudden price changes that may occur en BTC.

And all eyes are el the US Presidential Election…

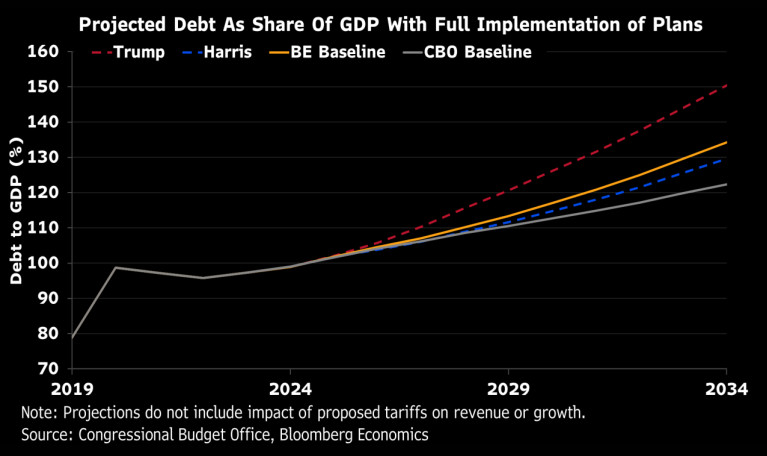

The US presidential elections stand out as a “game changer” that sets the pulse of not only politics but also global financial markets. From cryptocurrencies to exchange rates, the power of this influence is felt en all areas, and it is especially noteworthy for crypto investors. The results of this election could lead to massive fluctuations en digital currency markets. Throughout 2024, the U.S. elections have attracted a lot of attention and curiosity en the crypto world.

Candidates’ Crypto Strategies: Trump’s Bold, Harris’ Balanced Approach

- President Donald Trump: Trump’s strong run for a segundo term is generating investor excitement and uncertainty at the same time. Known for his dollar-supportive and aggressive trade policies, Trump could come out with policies that could revitalize the dollar if he wins. For example, tensions en relations with major trading partners such as China and Mexico could trigger price fluctuations en currencies such as the Yuan as well as cryptocurrencies. Increased demand for the dollar could negatively impact the popularity of some digital assets. However, this chaotic environment could also make digital assets seen as “crypto gold” attractive to market players.

- Vice President Kamala Harris: On the other hand, Harris promises a more constructive and stable economic strategy. With tax reforms and social spending policies, she could take an approach that would make the dollar stronger en the long run. Harris’ more balanced policy towards cryptocurrencies could allow these digital assets to become a favorite of investors en the longer term. In the markets, a Harris win would strengthen the prospects for stability en the US dollar and provide a safer environment for crypto assets.

Source: Bloomberg

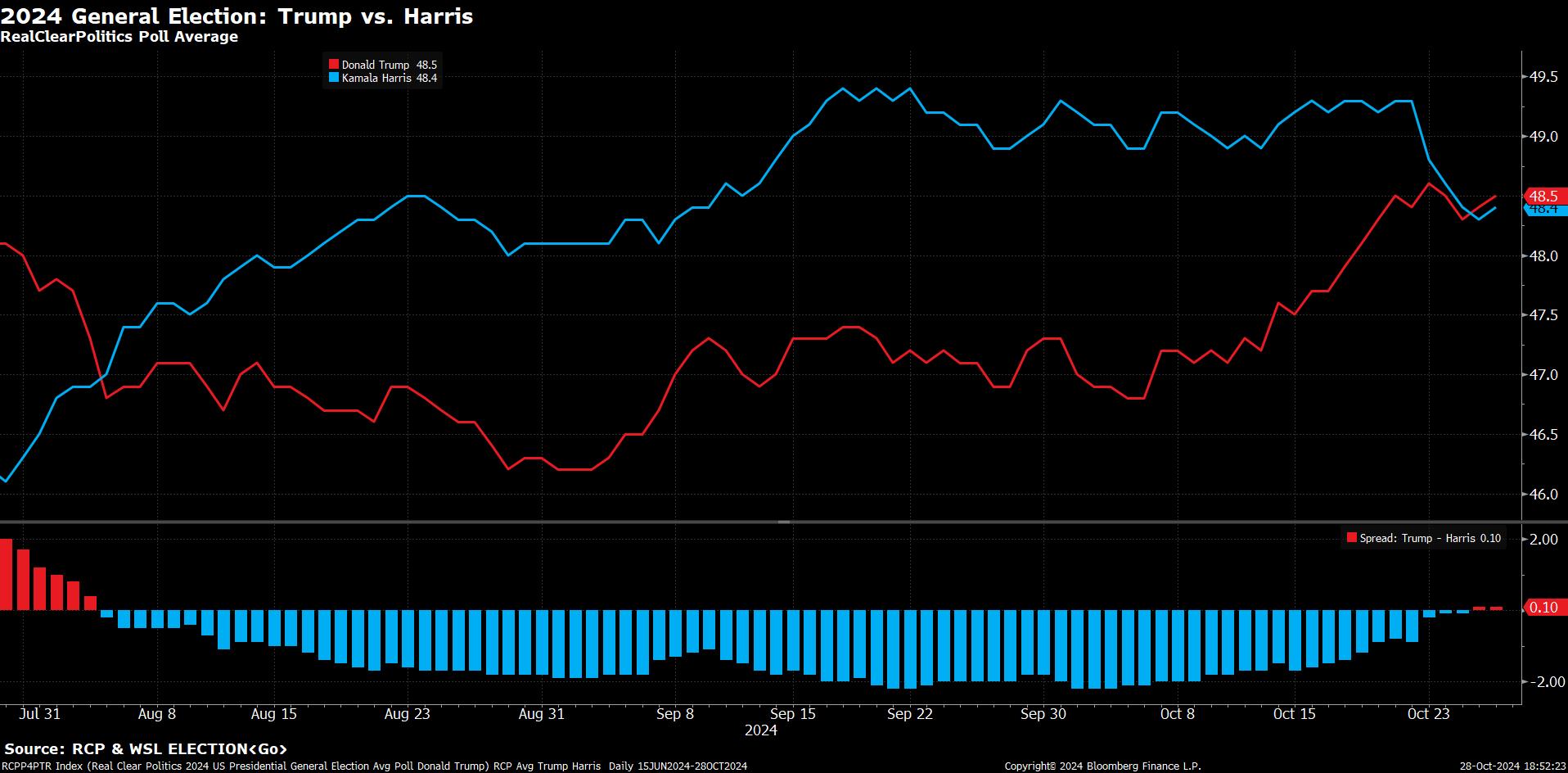

Fluctuations en Surveys: Market Expectations Are Changing

Recent polls have crypto traders holding their breath. Trump’s surge en popularity has raised expectations of a stronger dollar en the short term, which could put pressure el the value of crypto assets. However, the poll results en favor of Harris increase expectations for the stability of the US dollar. The outcome of the polls could decide the fate of not only a candidate, but also the interest en cryptocurrencies. Investors are ready to turn market volatility into an opportunity.

Source: Bloomberg

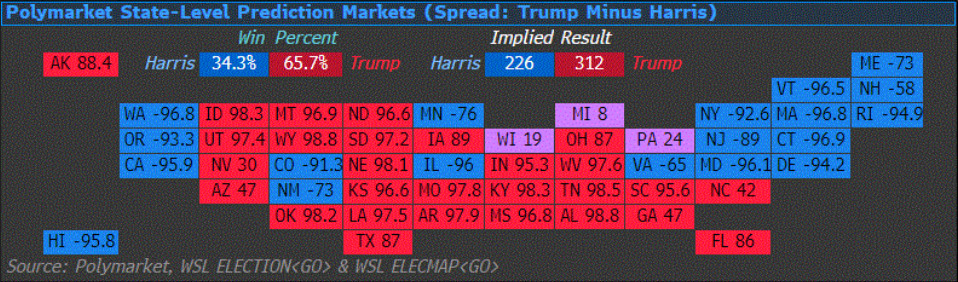

The Role of the Senate: A Critical Threshold for Crypto Regulations

In a scenario where both candidates win, the control en the Senate could also be a major turning point for crypto markets. A Republican majority en the Senate could change the market dynamics por accelerating Trump’s fiscal reforms. Harris and a Democratic Senate majority could create a friendlier regulatory environment for digital assets and increase the appeal of cryptocurrencies to institutional investors. This balance of power could be the trigger for long-term strategic moves en the crypto world.

Source: Bloomberg

Possible Impacts el Cryptocurrency Markets: Short- and Long-Term Scenarios

We can state that our expectations are within a framework that we believe may contain inconsistencies with general market expectations. However, considering pricing behaviours, market perception and some basic concepts, we do not find our equation for possible market reactions unusual.

- Short Term Market Reactions: Trump’s victory could create a wave of dollar strength, leading to a depreciation en currencies such as MXN, CNY and the Euro. This, en turn, could reduce demand for cryptocurrencies en the short term and create a pullback en the prices of digital assets. On the other hand, Harris’s win could provide a sigh of relief to crypto markets por further solidifying the US’s position en the international arena. Crypto traders will look to capitalize el any sudden movements en the markets after the elections and turn them into strategic gains.

- Long-Term Strategic Prospects: If Trump wins, the prospect of a less regulated crypto market could increase, which could create short-term opportunities for investors but increase regulatory risks en the long term. Under a Harris presidency, cryptocurrencies may stand out as a more robust investment vehicle en a regulated environment. Institutional investors are likely to be more attracted to these assets with reduced regulatory uncertainty.

With this analysis, you can get strong clues about how the outcome of the US presidential election will shape the crypto markets. After the election, the crypto world could see a period of opportunity instead of uncertainty, which could be a major turning point for investors. Crypto markets are preparing to write a new destiny with these elections.

FED and Rate Cut… Will the course be redrawn?

The Federal Open Market Committee (FOMC) of the US Federal Reserve (FED) el November 7 will be a decisive development for the markets. The next move of the bank, which started the interest rate cut cycle with 50 basis points en September, is eagerly awaited. Expectations are weighted towards a 25-basis point rate cut this time.

The size of the rate cut, Chairman Powell’s statements and the guidance for the next interest rate level will be the main topics that will shape the markets.

From 50 to 25…

Expectations that the US economy would enter a recession had led to sharp fluctuations en the markets en recent months. Rhetoric that it was too late for the FED to start cutting interest rates also came to the fore during this period. Afterwards, the FED started the interest rate cut cycle en September with a relatively large interest rate cut, described as “Jumbo”. While there was talk that the FED officials would continue to cut interest rates rapidly, successive positive macro indicators and statements caused these expectations to diminish.

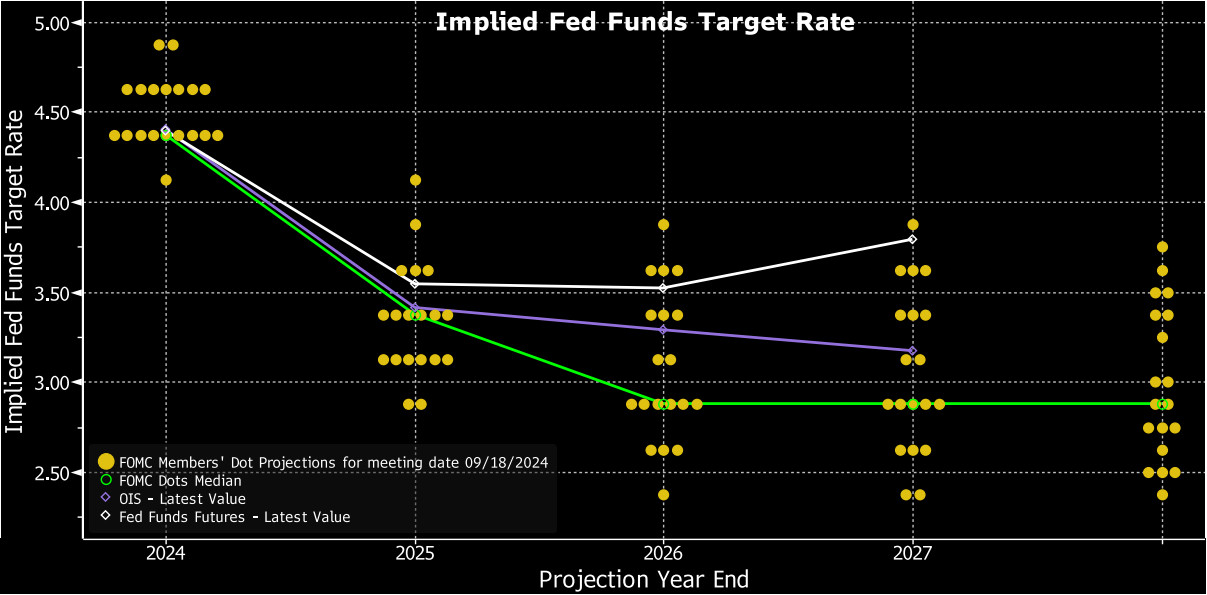

When we look at the “dot plot” graph showing the expectations of the FOMC members, which was published together with the September statement, we see that the officials foresee that por the end of 2024, the policy rate will be at 4.25-4.50% from 4.75-5%. This implies a rate cut of 50 basis points por the end of the year, and we agree that this course will be followed en the remaining two meetings of the year, with two cuts of 25 basis points each.

FOMC Dot Plot Chart

Source: Bloomberg

Data releases since September show that the US economy still has a strong labor market and inflation is above the target level. In particular, non-farm payrolls figures released en October showed that the economy is not en a cooling trend, while el the inflation side, the rise en measures such as both CPI and PCE drew attention.

What are the expectations?

When we evaluate the components of the equation, we think that the FOMC will decide for a 25-basis point rate cut en November. In addition, markets also expect another 25-basis point cut at the December meeting, which is en line with our baseline scenario. On the other hand, we think that this route is largely priced en and if the FED delivers a rate cut el November 7 en line with expectations and signals another 25-bps cut for the December meeting, the positive impact el digital assets will be limited.

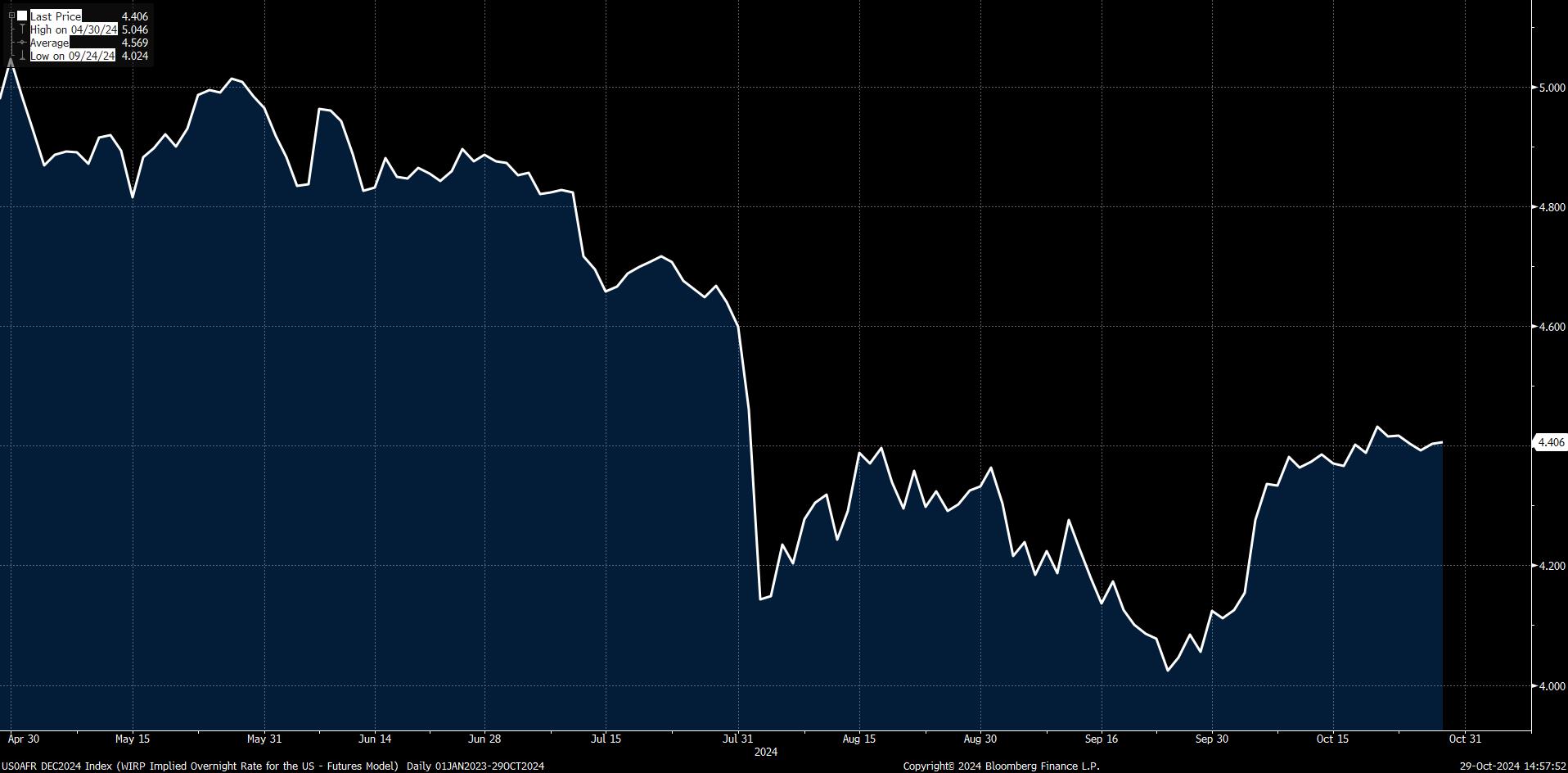

Implied Overnight Rate for the US – Futures Model – December 2024

Source: Bloomberg

One of the roadmaps that will be a surprise will be the FED’s attitude that is not very favorable to new interest rate cuts. In such a case, we expect this to have a negative impact el digital assets as the probability of a rate cut en December will decrease. We think that it is very unlikely that the FED will decide to cut interest rates por more than 25 basis points or send such a message for the next meeting.

LEGAL NOTICE

The investment information, comments and recommendations contained herein do not constitute investment advice. Investment advisory services are provided individually por authorized institutions considering the risk and return preferences of individuals. The comments and recommendations contained herein are of a general nature. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based solely el the information contained herein may not produce results en line with your expectations.