Introduction

When conducted with precision, self-discipline, and a clear trading strategy, futures trading in cryptocurrency markets offers the potential for profits to be realized. However, as a purely speculative approach, it is not always appropriate in every market condition.

At the same time, futures contracts can function as structured financial tools within a broader trading system. The leverage used in futures trading allows traders to control large positions with relatively small amounts of their own capital.

Rather than adopting the traditional investment approach—where assets are often bought with the intention of long-term holding—futures trading enables participants to take positions in both rising and falling markets.

When prices are expected to decline, traders can open short positions using futures contracts.

By using stop-loss orders, traders can limit potential losses and protect themselves against unexpected market fluctuations.

Both experienced investors and newcomers to exchanges may find that the Darkex platform is suitable for trading futures contracts.

Before starting to trade futures on Darkex, you must first ensure that funds are available in your Darkex Futures account.

When trading begins, your account should already reflect the transferred funds designated for futures trading.

Transfer funds to a futures account

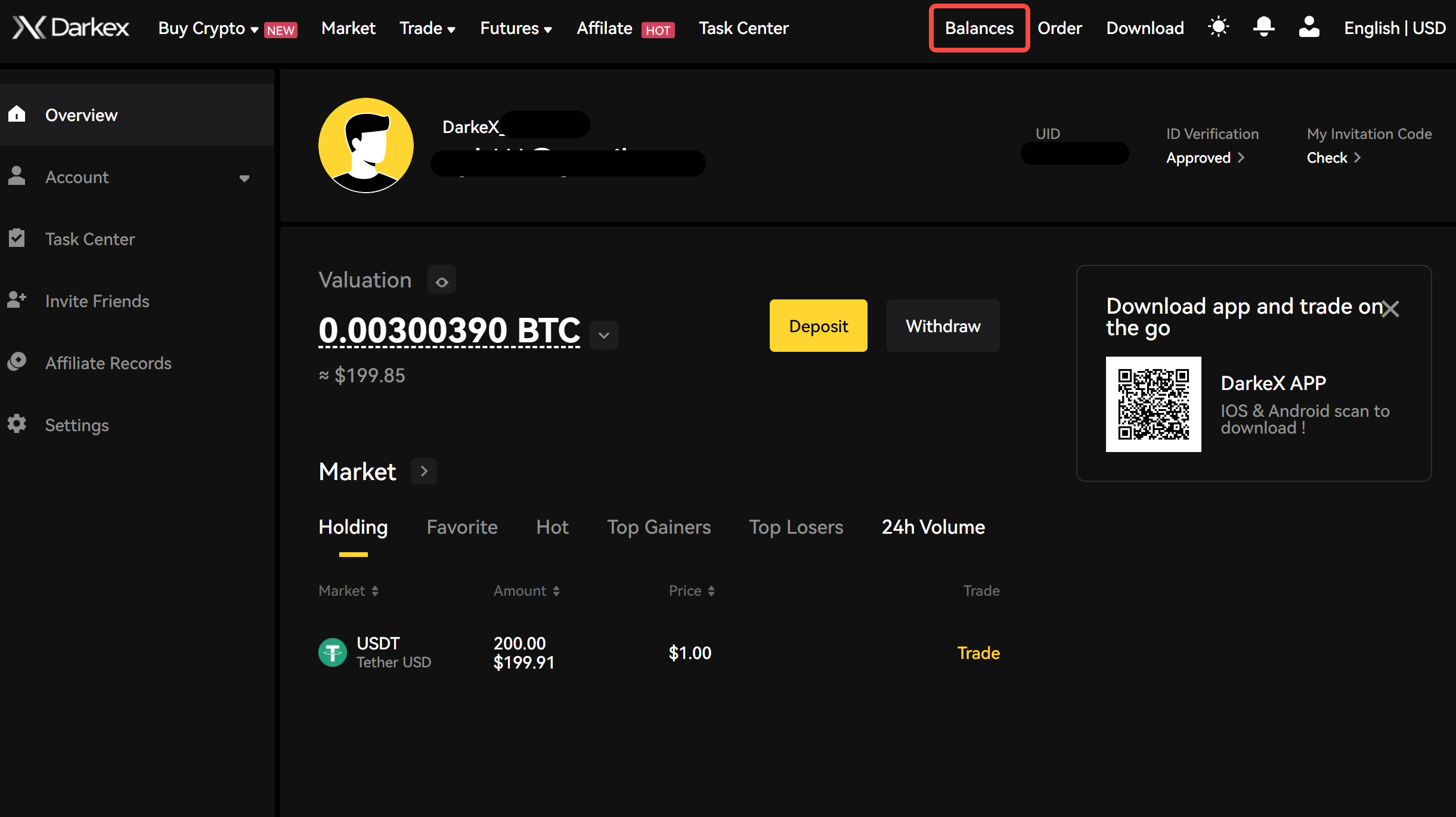

- To deposit funds into your futures account, first log in to your Darkex account and click on ‘Blances’ at the top right

-

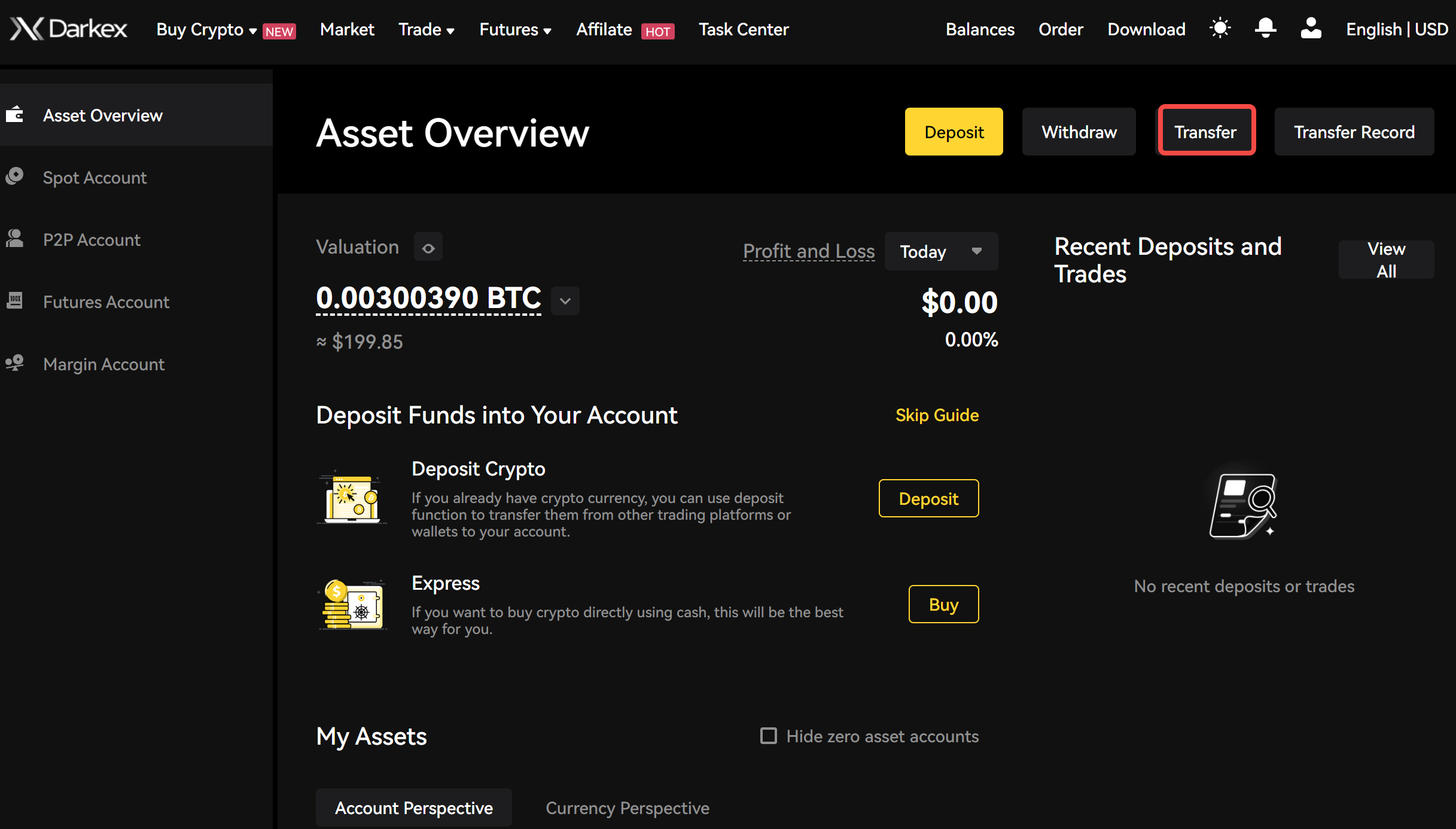

In the interface that appears, go to the ‘Transfer’ option on the right side

-

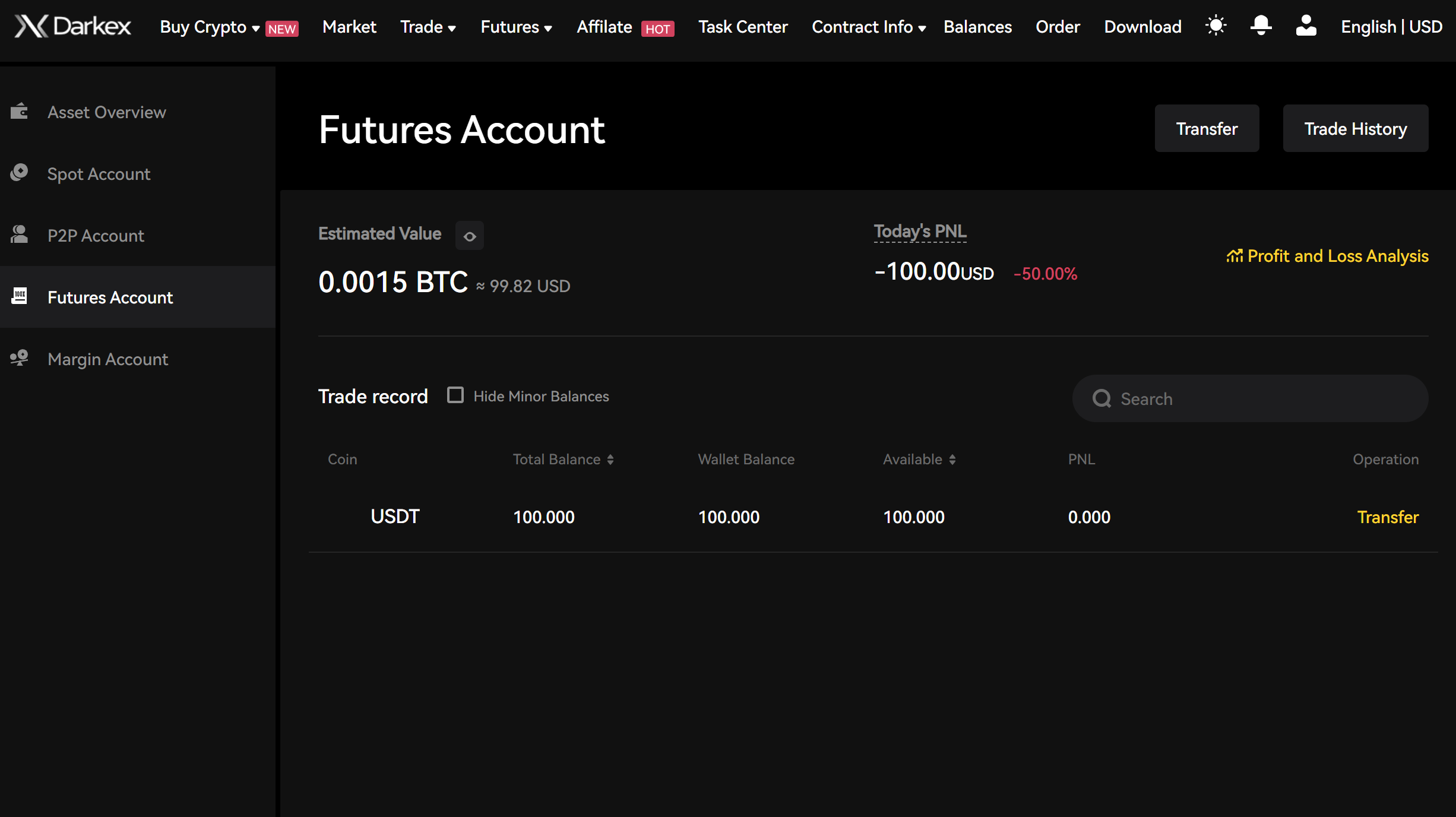

After selecting the amount, you want to transfer and the destination, you will see that your transaction has been completed

Futures Trade on Darkex

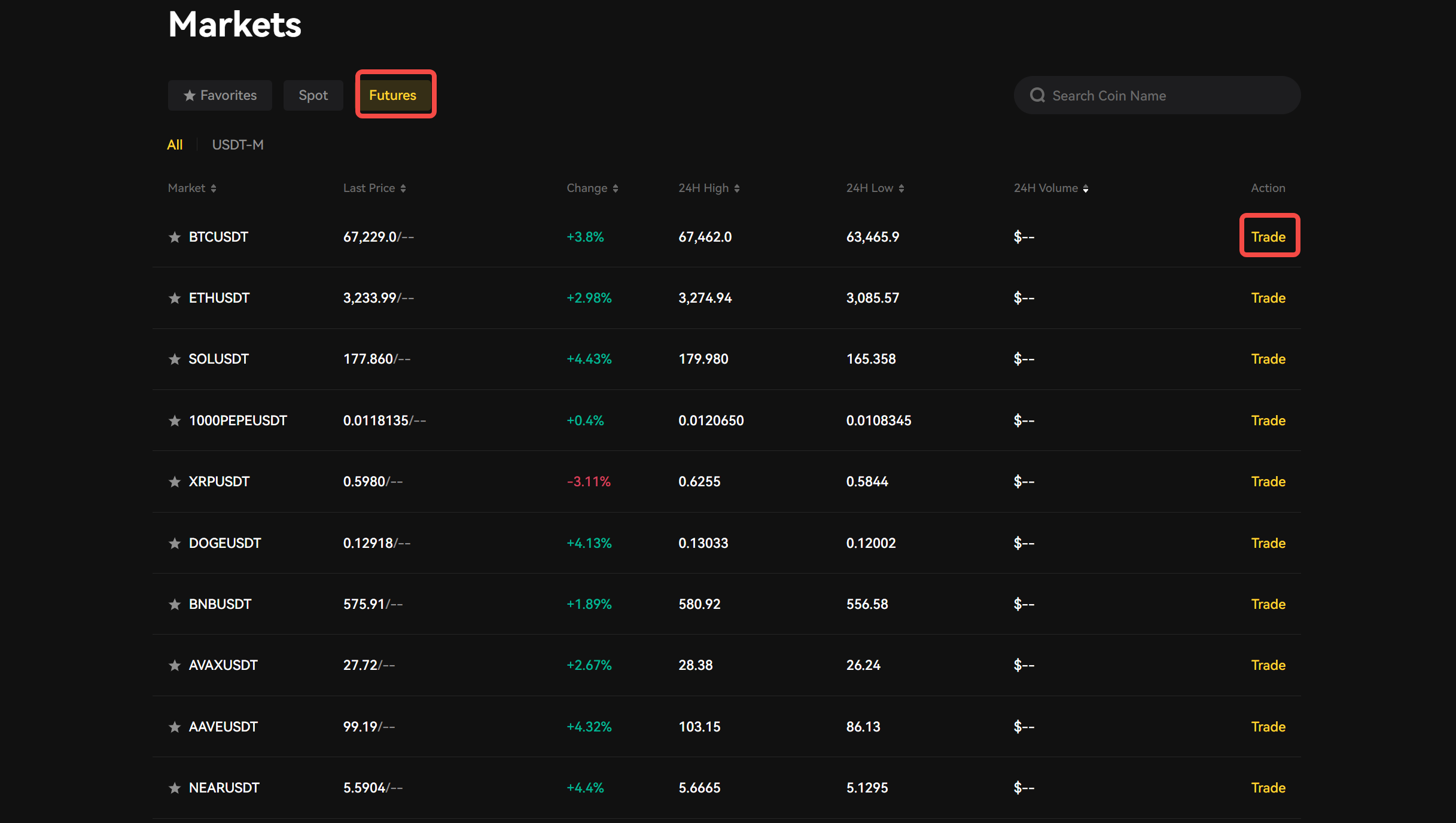

- Now, access Futures from the Market interface. Select the wallet you want to trade with and click ‘Trade’

- The chart that appears shows the instant price movements of the wallet you want to trade.

What can you do on this graph?

-

You can view your current chart.

-

You can select a contract by hovering your cursor over the current contract name (by default, BTCUSDT).

-

You can check the indicator price. It is especially important to pay attention to this as liquidations are based on the indicator price.

-

You can check the expected funding rate and the time remaining until the next funding round.

-

You can choose between the original chart or the integrated TradingView chart.

-

Click the ‘Depth’ button to view the current order book depth in real-time.

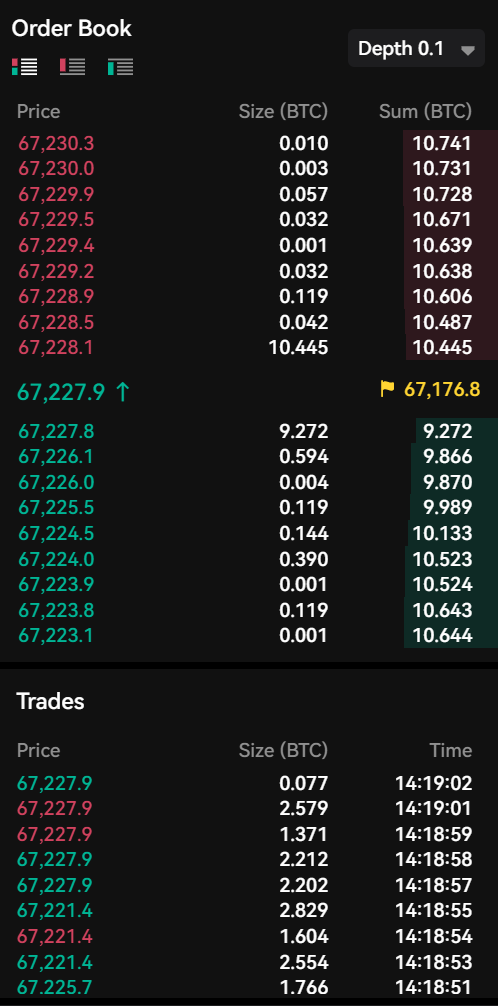

- There is an Order Book on the left side of your page.

Order Book

Usage of the Order Book

-

Here you can monitor your futures trading activity and switch between tabs to check your open and previous orders.

-

You can adjust your leverage level by placing your cursor right next to ‘Cross’ (default is 5x).

-

Futures trading, leverage allows you to control a larger position size with a smaller amount of your own capital. For example, with 5x leverage, you can open a position worth $5,000 using just $1,000 of your own funds.

-

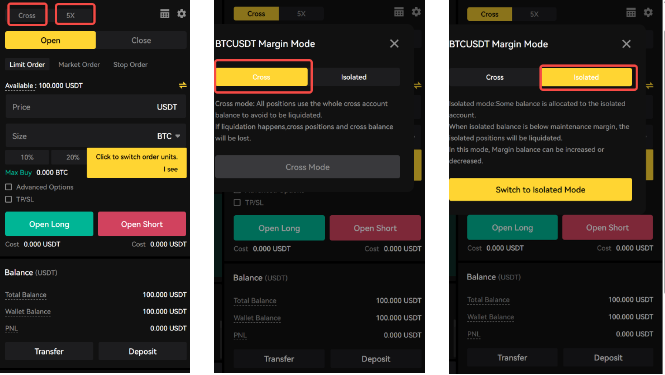

To place an order, click on Cross in the section right next to the order book and you will be presented with Cross and Isolated options to select the margin mode of the asset you want to trade.

Cross Margin

Isolated Margin

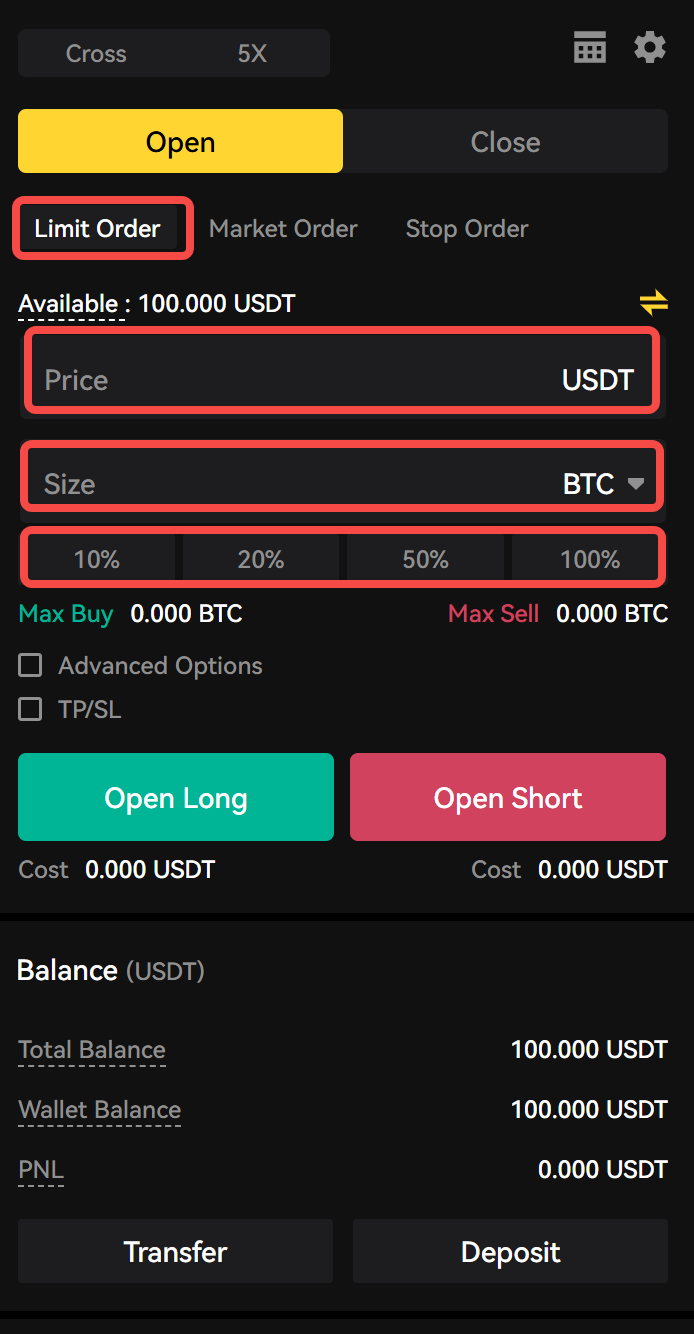

Limit Order

- In the Limit order option, you can enter the amount of the order you wish to execute in the ‘Price’ field.

-

In Futures trading, “Size” refers to the quantity or volume of contracts you wish to trade. It indicates how many futures contracts you are buying or selling. You can select your order size in BTC or USDT from the ‘Size’ field. Additionally, it is also possible to choose the order size as a percentage.

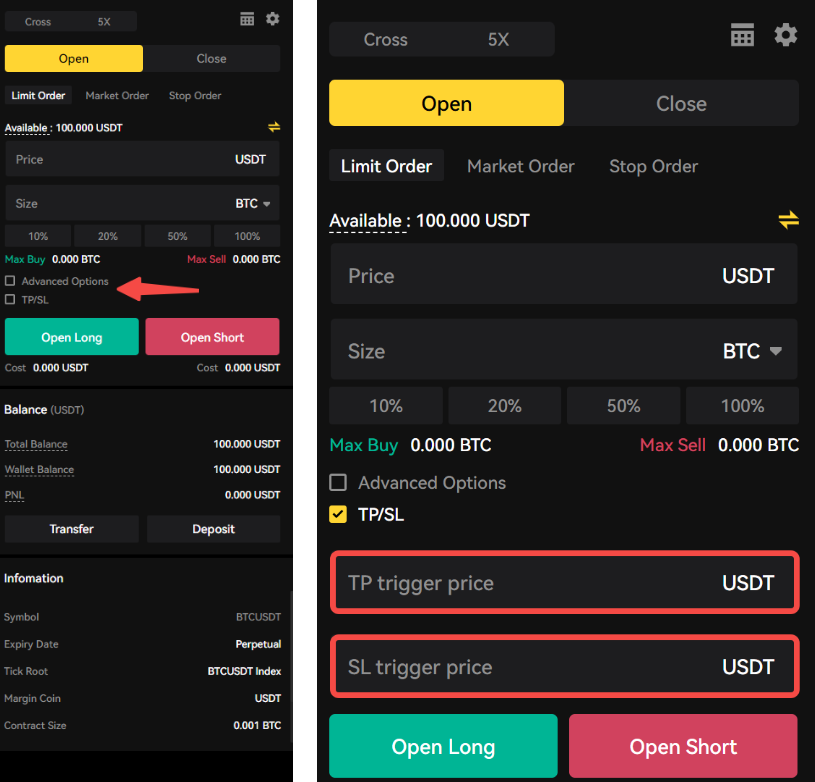

- After completing these steps, you can either add a new order or continue with one of the TP/SL (Take Profit/Stop Loss) order types by clicking on the box.

-

Take Profit (TP): This order automatically sells a position when the price reaches a predetermined profit level, allowing you to lock in gains without needing to monitor the market constantly.

-

Stop Loss (SL): This order automatically sells a position when the price hits a specified loss threshold, helping to limit potential losses by closing the position at the set level.

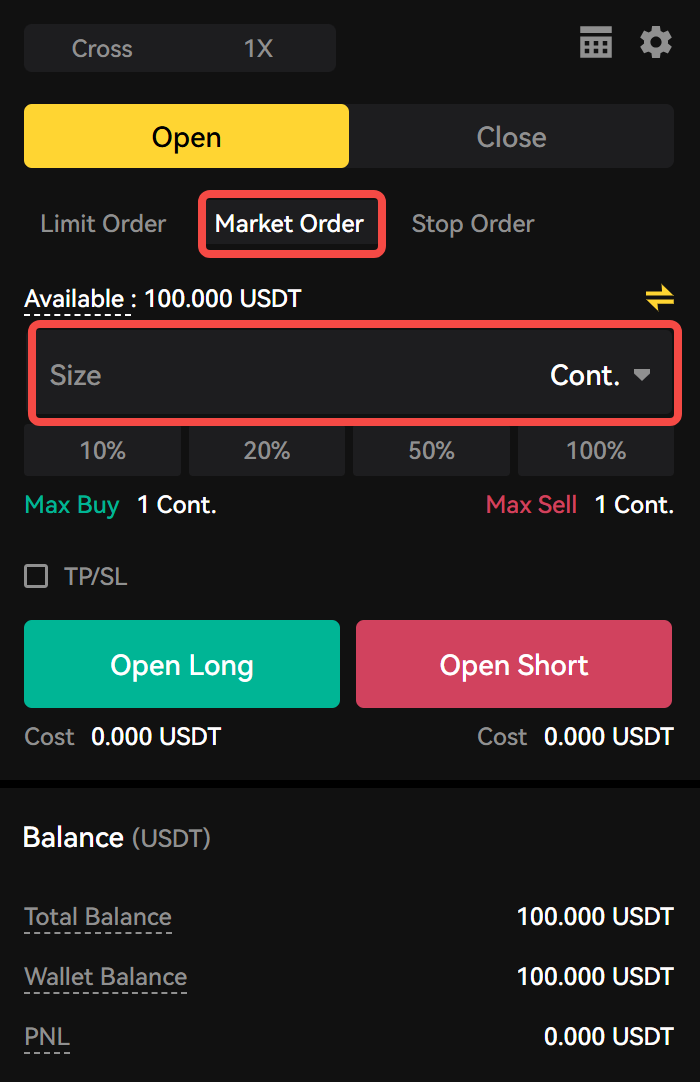

Market Order

-

In a market order, your order is executed based on the best available price in the market at that moment.

-

Under volatile market conditions, the market price can change rapidly. A market order ensures that your order is filled quickly.

-

In the price section, you can enter the amount of the asset you wish to trade in BTC or USDT.

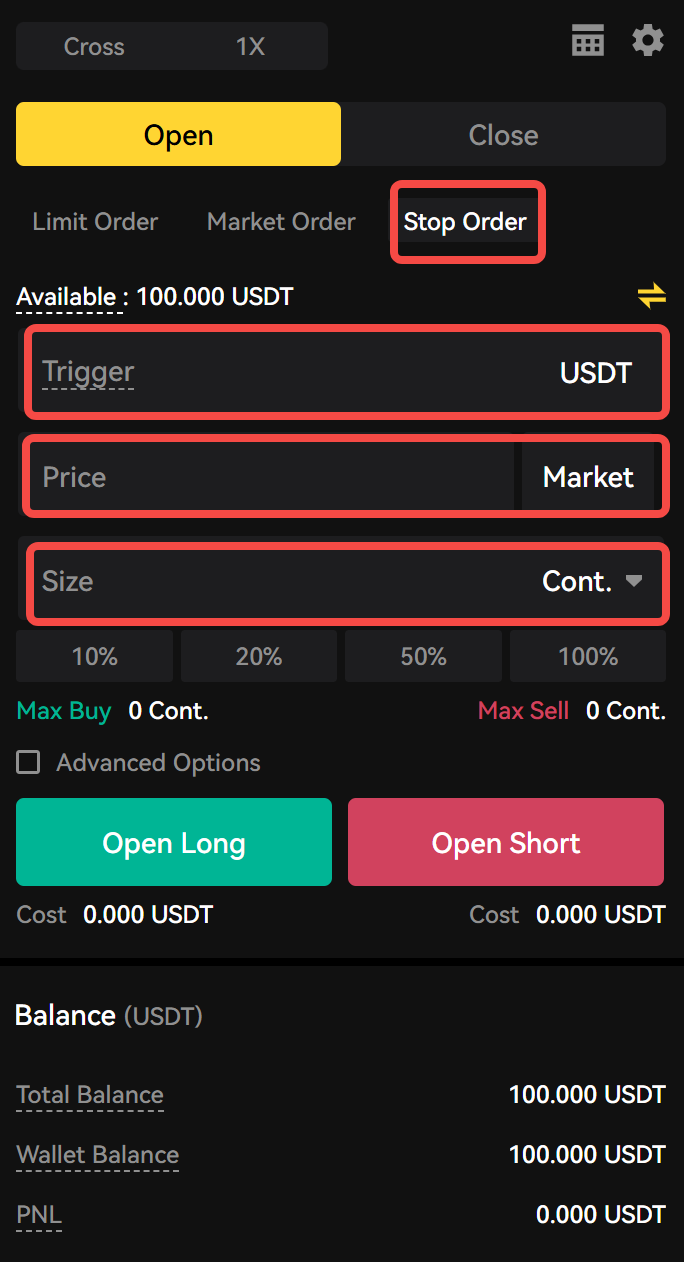

Stop Order

- This order combines a stop order with a limit order. When the stop price is reached, the order becomes a Limit Order instead of a Market Order. This means that once the stop price triggers the order, it will only be executed at the specified limit price or better.

- In the Trigger (Stop Price) section, enter the price at which you want to trigger your order. When the Trigger price is reached, your Limit order will be placed into the order book.

- In the Price section, enter the price at which you want to execute your order.

- For the order size, you can specify it either numerically or as a percentage.

-

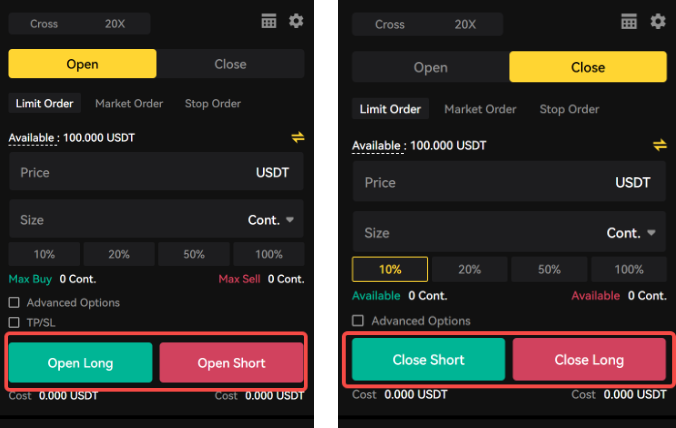

When placing or closing futures orders (Limit Order, Market Order, and Stop Order), you need to click on the options for Open Long / Open Short or Close Short / Close Long to execute your trade or close your existing positions.

Open Long

Open Short

Close Short

Close Long

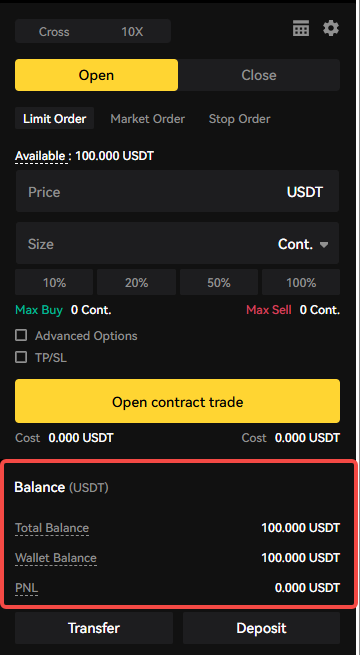

Total Balance

Wallet Balance

PNL

Realized PNL

Unrealized PNL

Final Takeaways

A futures contract is an agreement to buy or sell an asset at a specific date in the future. A long-term future does not have a settlement date.

You can reduce the risk of investment in your investment by following the instructions in this guide. For more details, please refer to the Darkex guidebooks.

Disclaimer

This guide is for educational purposes only and cannot be construed as financial advice. Remember: every transaction you make on cryptocurrency exchanges is at your own risk alone.