Input Isolated Margin

Isolated margin is a key component of margin trading in the cryptocurrency market. Unlike cross margin, it ensures that liquidation risk is limited to a single trading pair, rather than affecting your entire account balance.

In this guide, we explain what Isolated Margin is, how it works, its benefits, and why it is important for cryptocurrency traders.

What Is Isolated Margin?

Isolated margin is a trading system used by cryptocurrency exchanges that separates the margin allocated to a specific position from your total account balance. This means that if one trade performs poorly, your overall portfolio remains protected.

For example, if you are trading BTC/USDT using isolated margin and that position is liquidated, only the funds allocated to that trade are affected. The rest of your account balance stays intact.

How Does Isolated Margin Function?

Allocation of Funds

Traders allocate a fixed amount of margin to a specific trading pair. This margin is isolated and not connected to the rest of the account balance.

Risk Management

If the market moves against your position, only the isolated margin is lost, while the remaining portfolio remains safe.

Manual Adjustments

Traders can manually adjust margin levels on isolated positions to reduce liquidation risk.

Example

Suppose you open a BTC/USDT long position with an isolated margin of $500.

If the market moves against your position, only that $500 is at risk, and the remaining balance in your account is protected.

Advantages of Using Isolated Margin

Limited Risk:

Losses are confined to a specific position without impacting other trades or your overall account balance.

Flexibility:

Traders can adjust margin levels for each position independently as market conditions change.

Portfolio Protection:

Prevents a single failed trade from liquidating your entire portfolio.

Isolated Margin vs. Cross Margin

| Feature | Isolated Margin | Cross Margin |

|---|---|---|

| Risk | Limited to the isolated funds | Affects the entire account balance |

| Management | Per position | Shared across all positions |

| Best For | High-risk trades or volatile assets | Low-risk trades or experienced traders |

When to Use Isolated Margin

- Trading High-Volatility Assets:

Important marketplace shifts can have substantial downside impacts on your portfolio. Using Isolated Margin is one effective way to limit these harmful effects and prevent a single trade from damaging your entire account. - Testing New Strategies:

Isolated Margin is perfectly suited for testing new trading strategies without putting your full account balance at risk. It allows traders to experiment while maintaining controlled exposure.

Short-Term Trades:

This margin mode is commonly useful for short-term trading cycles with limited time horizons, where precise risk control is essential.

Tips for More Effective Use of Isolated Margin

- Start Out Small:

The best way to understand how isolated margin trading works is to begin cautiously, allocating small amounts of margin while learning the mechanics. - Monitor Positions Closely:

Regularly track the performance of your isolated margin positions to respond quickly to market movements.

Use Stop-Loss Orders:

Always set stop-loss orders to manage downside risk and protect your allocated margin from unexpected price swings.

Be In the Know:

Follow recent market trends and news to make informed, data-driven trading decisions.

Now in Chapter 10, we will explain with a practical example how Darkex’s Isolated Margin USD transactions are processed.

How to trade Isolated Margin on Darkex?

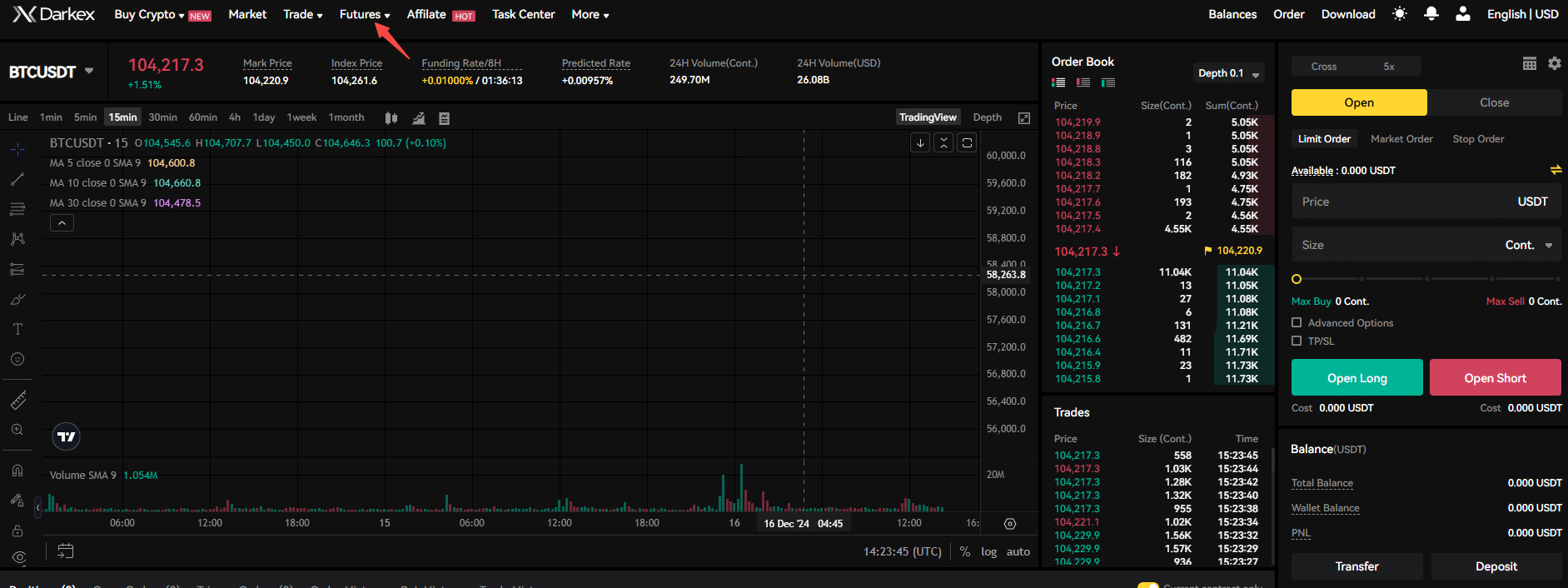

After logging into your Darkex account, click Futures on the page that opens.

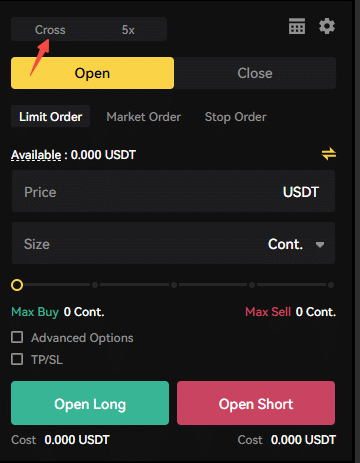

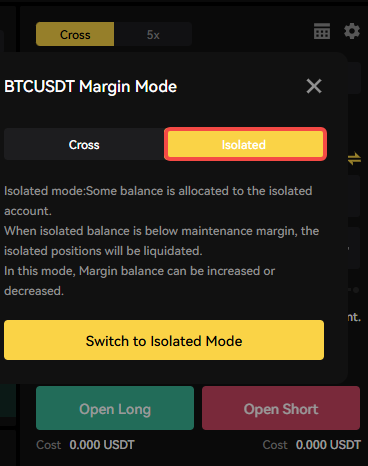

After clicking on the cross option on the top right, you will see the Cross and isolated options.

And then, you can mark your trading mode as Isolated on the page.

Then you can continue trading by choosing one of the options Limit Order Market Order Stop Order.

Please click to learn more about Limit Order Market Order Stop Order.

Disclaimer

The information provided in this guide is for educational purposes only and should not be considered as financial or investment advice. Trading cryptocurrencies involves substantial risks, including the potential loss of your invested capital. Isolated margin trading can mitigate risks but does not eliminate them entirely. Before engaging in any margin trading activities, ensure you understand the associated risks and consider consulting with a qualified financial advisor. DarkEx is not responsible for any losses incurred while using this trading method.

Click for the Isolated Margin training article