MARKET COMPASS

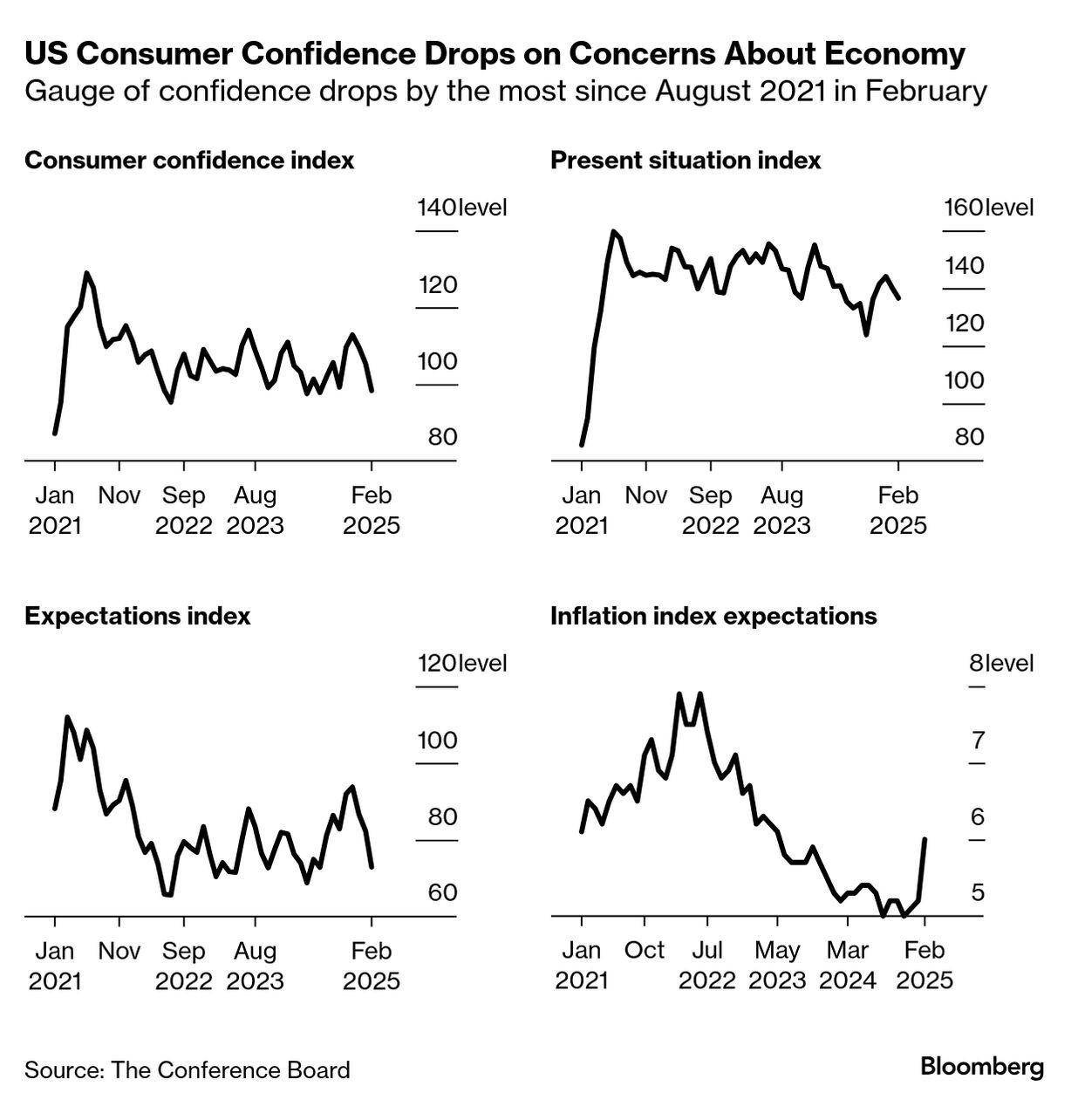

Consumer Confidence Declined in the US

Ahead of tomorrow’s growth data and Venerdì’s PCE Price Index, which will provide information about the health of the US economy, the Conference Board (CB) Consumer Confidence data was on the agenda in global markets yesterday.

The uncertainty and unpredictability brought by the new US President’s administration caused consumer confidence in the country to fall to its lowest level since Agosto 2021. In addition, according to CB data, consumers’ inflation expectations rose.

This deterioration in consumer confidence ahead of critical data caused investor sentiment to continue to deteriorate and, along with concerns over Trump’s “tariffs”, served as the main driver of asset prices. US stock markets fell, 10-year bond yields and the dollar declined, while digital assets were also negatively affected.

In Search of Stabilization in the Markets

After yesterday’s decline in Wall Street indices due to concerns about the US economy’s ability to grow and inflation, global markets are more balanced this morning. Asian stock markets have a mixed outlook. Hong Kong stocks supported the positive momentum after DeepSeek reopened its API service, which had been suspended for 3 months. US and European futures stock indices are slightly positive.

The State of Digital Assets

The decline in digital assets, which started with the hacking incident, expanded with the impact of the deterioration in traditional markets. While risk aversion caused major cryptocurrencies to lose value, Bitcoin, which fell to around $ 86,000 during European transactions yesterday, managed to find some balance and reaction afterwards.

Today is not a busy day in terms of the economic calendar, but market sentiment regarding the health of the US economy and possible statements from the Trump administration will remain under scrutiny. We maintain our expectation for crypto assets to be volatile in the short term, pressured in the medium term and bullish in the long term.

HIGHLIGHTS OF THE DAY

Importanti dati del calendario economico

| Tempo | Notizie | Aspettative | Precedente |

|---|---|---|---|

| Conflux (CFX) – XSpace with GraFun | |||

| 13:30 | FOMC Member Barkin Speaks | - | - |

| 15:00 | US New Home Sales (Jan) | 679K | 698K |

| 17:00 | FOMC Member Bostic Speaks | - | - |

INFORMAZIONI

*Il calendario si basa sul fuso orario UTC (Coordinated Universal Time).

Il contenuto del calendario economico sulla pagina corrispondente è ottenuto da fornitori di notizie e dati affidabili. Le notizie contenute nel calendario economico, la data e l'ora dell'annuncio delle notizie, le possibili variazioni delle cifre precedenti, delle aspettative e delle cifre annunciate sono state realizzate dalle istituzioni fornitrici di dati. Darkex non può essere ritenuta responsabile di eventuali cambiamenti che potrebbero derivare da situazioni simili.

AVVISO LEGALE

The investment information, comments and recommendations contained in this document do not constitute investment advisory services. Investment advisory services are provided by authorised institutions on a personal basis, taking into account the risk and return preferences of individuals. The comments and recommendations contained in this document are of a general type. These recommendations may not be suitable for your financial situation and risk and return preferences. Therefore, making an investment decision based only on the information contained in this document may not result in results that are in line with your expectations.