MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | 24h Change | Dominance | Market Cap. |

|---|---|---|---|---|

| BTC | 104,719.57 | -0.20% | 57.84% | 2,07 T |

| ETH | 3,357.43 | 3.20% | 11.28% | 404,54 B |

| XRP | 3.097 | 0.17% | 4.98% | 178,81 B |

| SOLANA | 240.59 | 0.22% | 3.27% | 117,17 B |

| DOGE | 0.3358 | 1.13% | 1.38% | 49,68 B |

| CARDANO | 0.9702 | 1.11% | 0.95% | 34,13 B |

| TRX | 0.2556 | 2.73% | 0.61% | 22,01 B |

| LINK | 25.66 | 4.00% | 0.46% | 16,38 B |

| AVAX | 35.31 | 3.27% | 0.41% | 14,55 B |

| SHIB | 0.00001938 | 3.71% | 0.32% | 11,42 B |

| DOT | 6.331 | 4.52% | 0.27% | 9,80 B |

*Prepared on 1.31.2025 at 14:00 (UTC)

WHAT’S LEFT BEHIND

US, Core Personal Consumption Expenditures Price Index Released

Announced: 2.8

Expectation: 2.8

Previous: 2.8

Hong Kong Issues First Crypto Licenses of 2025

The Hong Kong Securities and Futures Commission (SFC) has granted Panther Trade and YAX the first operating licenses of the year. Currently, only Bitcoin, Ether, LINK and AVAX trading are allowed in Hong Kong.

Partnership Announced in El Salvador: Bitcoin, USDT and Artificial Intelligence Unite

Tether and Lightning Labs have reached an agreement that will enable USDT to be used as a payment option over the Lightning Network. The integration will also support transactions between artificial intelligence and autonomous vehicles.

CZ: “The EU Needs Bitcoin”

CZ, the former CEO of Binance, emphasized that Europe needs Bitcoin. Previously, ECB President Christine Lagarde announced that Bitcoin would not be included in EU reserves.

Tether Integrates USDT into Bitcoin Lightning Network

Tether announced the integration of USDT into the Bitcoin ecosystem via the Lightning Network. This integration was achieved through the Taproot Assets protocol, which combines the decentralization of Bitcoin with the speed and scalability of the Lightning Network.

Vitalik Buterin: My BTC Holdings Less Than 10%

Ethereum co-founder Vitalik Buterin revealed that Bitcoin makes up less than 10% of his personal crypto holdings and that his non-ETH holdings are less than 10% of his total portfolio.

Canadian Purpose Investments Submits Preliminary Prospectus for Ripple (XRP) ETF

Canadian asset management firm Purpose Investments has filed an application with Canadian regulators for the world’s first Ripple (XRP) spot ETF. The ETF plans to invest the majority of its assets in XRP with the aim of providing long-term capital appreciation.

Layer Zero Settles with FTX Bankruptcy Estate, Returns $150 Million in Equity

Layer Zero Labs has reached a settlement with FTX bankruptcy assets, returning $150 million in equity and forgiving $45 million in debt. The deal ends a two-year legal dispute in which FTX accused Layer Zero of fraudulent trading.

HIGHLIGHTS OF THE DAY

Importanti dati del calendario economico

| Tempo | Notizie | Aspettative | Precedente |

|---|---|---|---|

| 14:45 | US Chicago PMI (Jan) | 40.3 | 36.9 |

INFORMAZIONI

*Il calendario si basa sul fuso orario UTC (Coordinated Universal Time).

The economic calendar content on the relevant page is obtained from reliable news and data providers. The news in the economic calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions. Darkex cannot be held responsible for possible changes that may arise from similar situations

MARKET COMPASS

The positive balance sheets of major US companies continue to overshadow the impact of the new tariffs on the markets. President Trump announced 25% tariffs on Mexico and Canada as of Febbraio 1st. Wall Street futures are pointing to a positive opening after Apple’s quarterly results. European stock markets also continue to trade in the green zone. The critical PCE Inflation data from the US also showed no bad surprises. Digital assets are trying to hold on to their post-Powell gains, although they gave some of them back later. We think that the horizontal course may continue for a while.

From the short term to the big picture.

Trump’s victory on Novembre 5, one of the main pillars of our bullish expectation for the long-term outlook in digital assets, produced a result in line with our predictions. In the process that followed, the appointments made by the president-elect and the increasing regulatory expectations for the crypto ecosystem in the US and the emergence of BTC as a reserve continued to take place in our equation as positive variables. Then, 4 days after the new President took over the White House, he signed the “Cryptocurrency Working Unit” decree, which was among his election promises, and we think that the outputs it will produce in the coming days will continue to reflect positively on digital assets.

On the other hand, the expectations that the FED will continue its interest rate cut cycle, albeit on hiatus for now, and the fact that the volume in crypto-asset ETFs indicates an increase in institutional investor interest, support our upside forecast for the big picture. In the short term, given the nature of the market and pricing behavior, we think it would not be surprising to see occasional pause or pullbacks in digital assets. However, at this point, it is worth emphasizing again that we think that the fundamental dynamics continue to be bullish.

TECHNICAL ANALYSIS

BTC/USD

In the crypto world, Hong Kong issued its first licenses of the new year, while in El Salvador an important partnership for the integration of Bitcoin and USDT was announced. On the other hand, CZ, the former CEO of Binance, argued that Europe needs Bitcoin. On the US side, Personal Consumption Expenditures were announced within expectations with 2.8%.

When we look at the technical outlook, BTC, which moved within the rising trend channel during the day, turned its direction upwards again with support at 103,800. With the weekend, BTC continues to push the resistance level of 105,000, preparing for the weekly close above six-digit levels. Currently trading at 104,650, the price continues to maintain its sell signal on the 4-hour chart, despite the buy signal on the hourly charts. Technical oscillators in the overbought zone are followed by a weakening momentum indicator. With the closing of the markets at the weekend, we will follow the 103,800 bollinger middle line if the price moves in a horizontal-downward direction. In the continuation of the rise, closures above 105,000 may trigger upward momentum again.

Supports 104,400 – 103,000 -101,400

Resistances 105,000 – 107,000 – 108,000

ETH/USDT

ETH, which managed to break through the falling trend line on the chart after 2,292 during the day, rose to 3,360 with a voluminous rise. With this price action, it can be said that a positive trend may start for ETH, which has experienced an important trend breakout.

Chaikin Money Flow (CMF) is on the rise, indicating new capital inflows into the market. Relative Strength Index (RSI) also continued to rise without negative divergence risks, indicating that the momentum on the price is rising. It is observed that the buy signal on the Ichimoku indicator is working. The fact that the price moved above the kumo cloud with this movement can be considered as one of the important factors indicating that the trend may continue.

As a result, provided that the 3,292 level is not breached, the uptrend can be expected to continue as the price crosses the very important trend zone. Loss of the 3,292 level may mean that the move remains a bull trap and may bring a decline.

Supports 3,292 – 3,131 – 2,992

Resistances 3,452 – 3,724 – 4,111

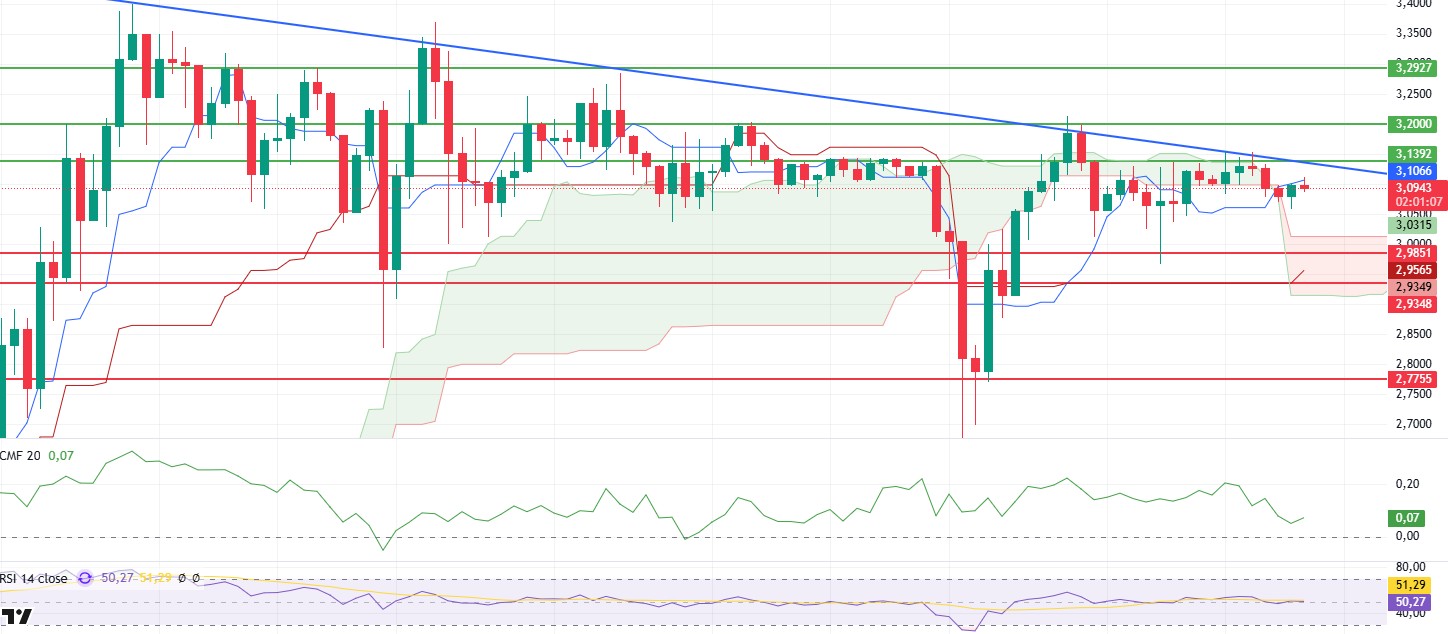

XRP/USDT

XRP is pricing at the 3.10 resistance level, moving relatively sideways and without volume during the day. With this move, some positive signals have been realized in the indicators.

First of all, Chaikin Money Flow (CMF) continues to decline and it is seen that liquidity outflows in the market have increased. However, with this decline in CMF, it is also seen that there is a positive divergence and can be expected to have a positive impact on the price. On the other hand, with the Kumo cloud level falling down, XRP is pricing above the cloud again and this strengthens the positive outlook.

It seems likely that we will see rises in the evening hours with closures above the 3.10 level. However, failure to break this level may weaken the momentum and cause slight pullbacks.

Supports 2.9851 – 2.9348 – 2.7755

Resistances 3.1392 – 3.2000- 3.2927

SOL/USDT

Blackrock-backed Securitize partnered with Wormhole to bring $1.3 Billion in loan funding to Solana. On the other hand, Pump.fun has filed a class action lawsuit alleging unregistered securities sales. According to court documents, the Solana-based meme coin platform allegedly operated an unauthorized securities exchange. Elon Musk’s Father introduces ‘Musk It’ Solana Meme Coin. Errol Musk announced that he would launch the coin to raise $200 million for a think tank without his son’s participation.

SOL has risen slightly, supported by the ceiling level of the downtrend that started on Gennaio 19. At the same time, it has shown a slight uptrend since our analysis in the morning. On the other hand, the asset is testing the ceiling level of the falling triangle pattern as of the time of writing. When we look at the volume, the weakness of the asset may create a false breakout. On the 4-hour timeframe, the 50 EMA (Blue Line) continues to be above the 200 EMA (Black Line). This could mean that the uptrend will continue in the medium term. At the same time, the asset started pricing between the 50 EMA and the 200 EMA, currently testing the 50 EMA as resistance. When we analyze the Chaikin Money Flow (CMF)20 indicator, it is in the neutral zone, but at the same time, money inflows and outflows are balanced. However, the Relative Strength Index (RSI)14 indicator is in the neutral zone and the RSI continues the uptrend that started on Gennaio 27. The 259.13 level is a very strong resistance point in the uptrend driven by both the upcoming macroeconomic data and the news in the Solana ecosystem. If it breaks here, the rise may continue. In case of retracements for the opposite reasons or due to profit sales, the 209.93 support level can be triggered. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 237.53 – 222.61 – 209.93

Resistances 247.43 – 259.13 – 275.00

DOGE/USDT

DOGE has been lacking volume since our analysis yesterday but has been slightly up since our analysis in the morning. Breaking the Dicembre 20 uptrend with a strong downside candle, the asset tested the base level of the uptrend as resistance and retreated from there, forming an ascending triangle pattern. At the time of writing, it is testing the ceiling level of the triangle. If this breaks the pattern to the upside, Dogecoin may continue its uptrend. On the 4-hour timeframe, the 50 EMA (Blue Line) continues to be below the 200 EMA (Black Line). This could mean that the decline could deepen in the medium term. At the same time, the price is below the 50 EMA (Blue Line) and the 200 EMA (Black Line). When we analyze the Chaikin Money Flow (CMF)20 indicator, it is in the neutral zone and money inflows and outflows are in balance. However, Relative Strength Index (RSI)14 is in negative territory. At the same time, the RSI indicator broke the downtrend by breaking the downtrend upwards and turned it from a resistance level to a support level and rose from there. This shows us that the price is strengthening here. The 0.39406 level is a very strong resistance level in the rises due to political reasons, macroeconomic data and innovations in the DOGE coin. In case of possible pullbacks due to political, macroeconomic reasons or negativities in the ecosystem, the 0.28164 level, which is the base level of the trend, is an important support. If the price reaches these support levels, a potential bullish opportunity may arise if momentum increases.

Supports 0.30545 – 0.28164 – 0.25025

Resistances 0.33668 – 0.36600 – 0.39406

AVVISO LEGALE

Le informazioni sugli investimenti, i commenti e le raccomandazioni contenute nel presente documento non costituiscono una consulenza sugli investimenti. I servizi di consulenza sugli investimenti sono forniti individualmente da istituzioni autorizzate che tengono conto delle preferenze di rischio e di rendimento dei singoli individui. I commenti e le raccomandazioni contenuti nel presente documento sono di natura generale. Tali raccomandazioni potrebbero non essere adatte alla vostra situazione finanziaria e alle vostre preferenze di rischio e rendimento. Pertanto, prendere una decisione di investimento basandosi esclusivamente sulle informazioni contenute nel presente documento potrebbe non produrre risultati in linea con le vostre aspettative.