Weekly Fundamental Analysis Report

Indice di paura e avidità

Source:Alternative

Change in Fear and Greed Value: -7

Last Week Level: 61

This Week’s Level: 54

The Fear and Greed Index fell from 61 to 54 this week, indicating a marked cooling in market sentiment. While the Fed kept the interest rate unchanged, it lowered its 2025 growth forecast to 1.4% and raised its inflation expectation to 3%, while Maggio PCE inflation came in at 2.3% y/y and core inflation at 2.6%, which increased investor indecision. In the Eurozone, annual inflation declined to 1.9% from 2.2% previously, in line with expectations. Although this decline eased the global liquidity perception to some extent, its impact was limited. In institutional buying, Metaplanet bought 1,112 BTC, bringing its reserve to 10,000 BTC, and Strategy acquired another 10,100 BTC at an average of $104,080, confirming that demand is still brisk. Although the passage of the GENIUS Act bill in the Senate clarified regulatory uncertainty, the Fed’s increase in the probability of a rate cut in Settembre to 71% caused investors to remain in a wait-and-see mode. In the light of these developments, the index could not sustain the strong rise of the previous week and fell from 61 to 54, indicating that the cautious mood in the market continued.

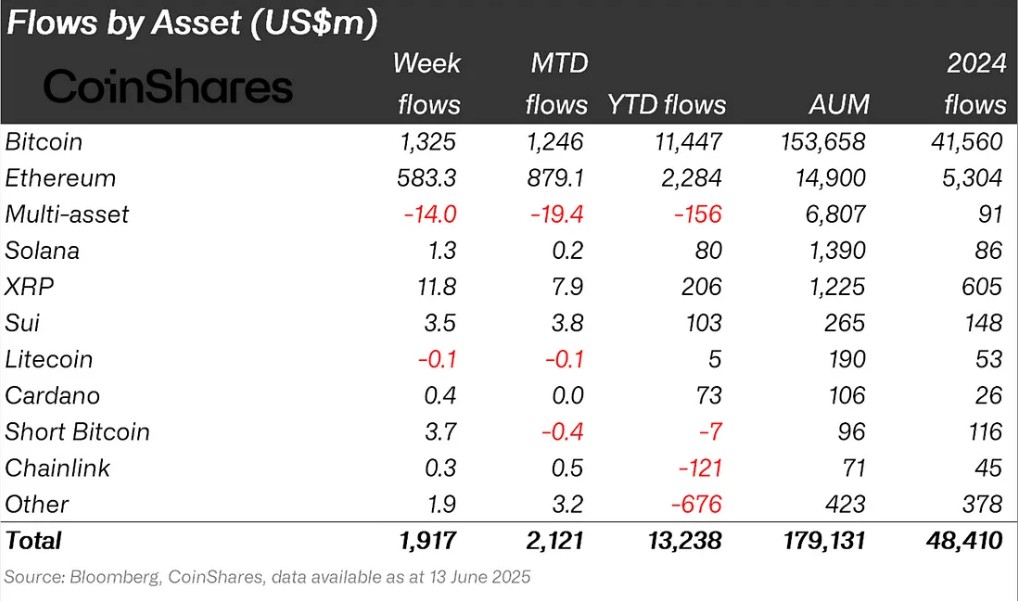

Fund Flows

Source: CoinShares

Overview While the crypto market had an up and down week amid macroeconomic uncertainties and regulatory news, the ongoing IRAN-ISRAEL stalemate in the Middle East and the US involvement in the war created a lot of volatility in Bitcoin. The gain in Bitcoin reached 2%.

Entrate del fondo:

Bitcoin (BTC): Macroeconomic uncertainties and the constant news of war in the Middle East led to a decline in Bitcoin after it approached the ATH point, which led to fund outflows. Bitcoin fund inflows reached $1.3 billion this week.

Ethereum (ETH): Spot ETH has performed strongly on the back of institutional interest. This week, $583.3 million flowed into Ethereum.

Short Bitcoin: Inflows into short bitcoin positions totaled $3.7 million. ATH expectation continues.

Ripple (XRP): In the most anticipated development in the market, the judge postponed the status report on the case between Ripple and the SEC. This report could affect the course of the case and the course of a possible settlement. Fund inflow in Xrp this week was $11.8 million.

Solana (SOL): One of the key hot topics is the growing anticipation for Solana ETFs. 8 major companies have applied for spot Solana ETFs and there is talk that these ETFs could potentially be approved in 2025, significantly increasing the likelihood of approval, while Solana saw an inflow of $1.3 million.

Cardano (ADA): Cardano continues to work on the Voltaire upgrade, which aims to implement full on-chain governance. This upgrade will allow ADA holders to vote on network offerings. This is an important step towards making Cardano a more decentralized and community-driven platform. This week saw $0.4 million inflows into Cardano.

SUI: Sui’s BTC TVL (total value locked) has exceeded $200 million. In addition, the significant presence of Sui assets in digital asset funds shows that institutional investors continue to be interested in the network. Sui saw $3.5 million in inflows this week.

Chainlink (LINK): Chainlink has partnered with major financial institutions such as UBS Asset Management and Swift for tokenized fund deals, taking important steps in its goal to gain a share of this huge market. Upon the announcement of this collaboration, Link saw an inflow of $0.3 million this week.

Other: Altcoins saw sectoral and project-based rallies. These attacks brought an inflow of 1.9 million dollars in fund flow data.

Fund Outflows:

Multi-asset: The volatility in the market also led to outflows in the multi-asset group despite the ETF data.

Litecoin (LTC): Its long-term prospects remain buoyant with a potential spot ETF approval and the adoption of technological innovations such as MWEB. Ltc saw a fund outflow of -0.1 million dolae this week.

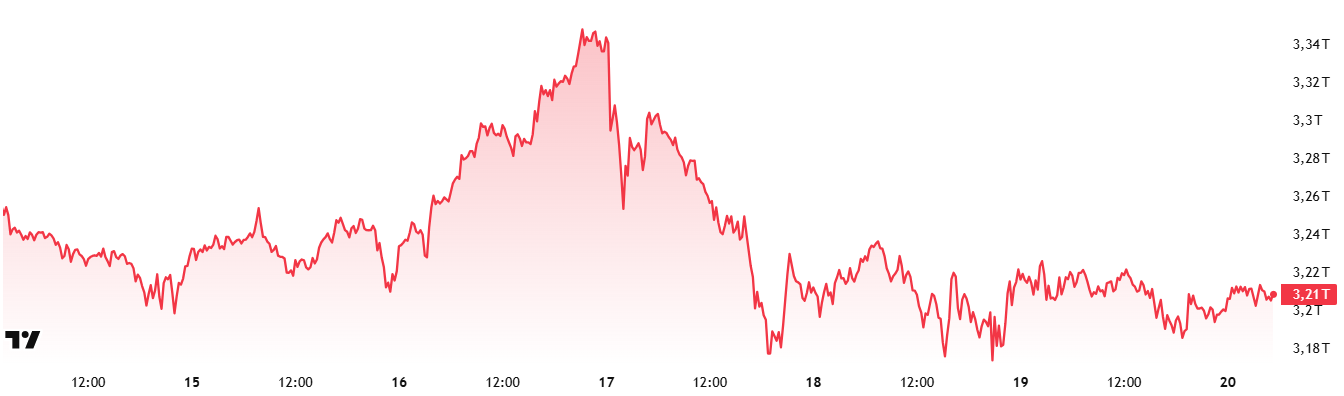

Capitalizzazione totale di mercato

Source : Tradingview

- Last Week Market Capitalization : 25 Trillion Dollars

- Market Capitalization This Week: 21 Trillion Dollars

The cryptocurrency market lost 1.13% this week with a meltdown of $36.83 billion. Thus, the total market capitalization fell to $3.21 trillion. This made it four consecutive weeks of declines. Although this move may seem like a technical correction, the tension of the global agenda will continue to be one of the most critical factors that will continue to influence the market in the coming period.

Totale 2

Total 2 started the new week with a market capitalization of $1.15 trillion, down 1.66% to $18.98 billion. With this movement, it fell to $ 1.13 trillion. Total 2, which declined at a higher rate compared to the overall decline rate of the Total Market, shows that the retreat in altcoins is more severe compared to Bitcoin. In short, the withdrawal in altcoins seems to be more than bitcoin.

Totale 3

Total 3, which started the week at $838.43 billion, retreated by 1.83% to $823.06 billion with a loss of $15.37 billion on a weekly basis. According to these calculations, the total outflow on Ethereum accounts for 16% of the total outflow in the altcoin market, but since it accounts for an average of 28% of the altcoin market, it can be said that it is more robust than the altcoin average.

While the rate of decline has been lower in margin coins, it seems to have been higher in coins with low market capitalization. This gives clues that the market has not yet signaled a divergence in altcoins.

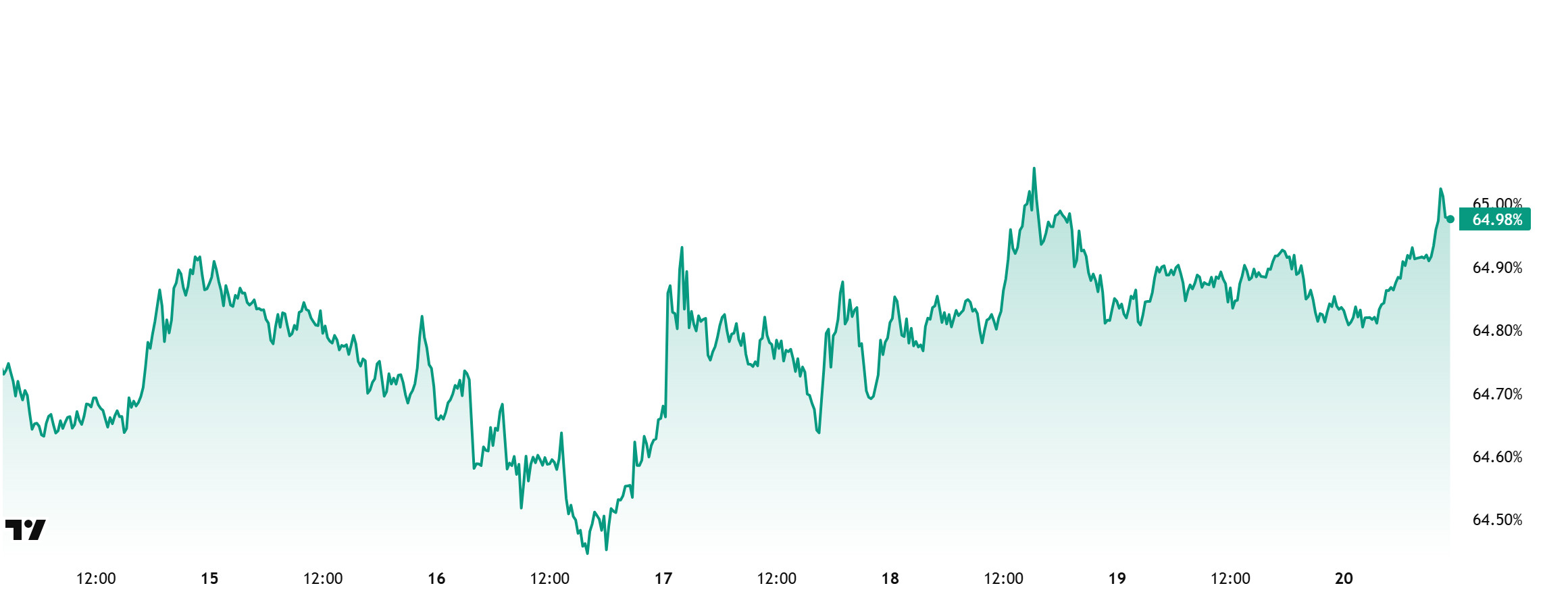

Il dominio di Bitcoin

Il dominio di Bitcoin

Bitcoin dominance, which started the week at 64.65%, rose as high as 65.04% during the week. After this increase, dominance retreated slightly and is currently at 64.98%.

10,100 units of Bitcoin were bought by Strategy and 1,112 units of Bitcoin were bought by Metaplanet this week.

Data on Bitcoin spot ETFs show a total net inflow of $1.02 billion to date.

Geopolitical risks remain due to the tensions between Israel and Iran, which have persisted throughout the week, and this situation increases the selling pressure on risky assets from time to time.

Tensions in the Middle East have led to selling pressure across the market. While this pressure affects altcoins more, Bitcoin, which is seen as a relatively safer haven, experiences a more limited depreciation in this process. This situation brings an increase in Bitcoin dominance.

Continued institutional buying, strong net inflows into spot Bitcoin ETFs, and the strengthening risk aversion due to heightened geopolitical uncertainties have led capital flows to shift back towards Bitcoin. Accordingly, in the current environment, where market participants maintain cautious positioning and risk appetite remains weak, Bitcoin dominance is expected to consolidate in the range of 63.5%-65.5% next week.

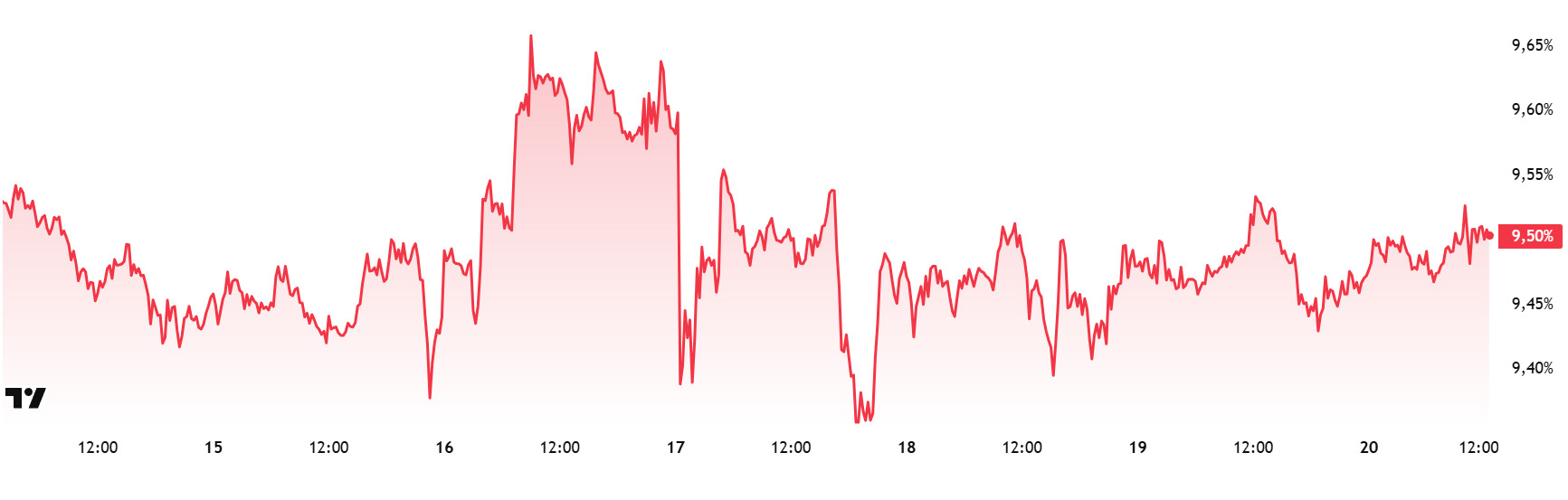

Dominio di Ethereum

Fonte: Tradingview

Weekly Change:

- Last Week’s Level: 9.48%

- This Week’s Level: 9.50%

Ethereum dominance continued its upward trend, which started at around 7% as of Aprile, and reached up to 10% as of last week. However, the dominance, which could not exceed these levels, has generally followed a horizontal course in the last six weeks. In the current week, positive movements were recorded.

In this context, Ethereum dominance ended last week at 9.48% and is currently trading at 9.50%.

In the same period, Bitcoin dominance, similar to Ethereum, displayed a positive outlook and showed an upward trend.

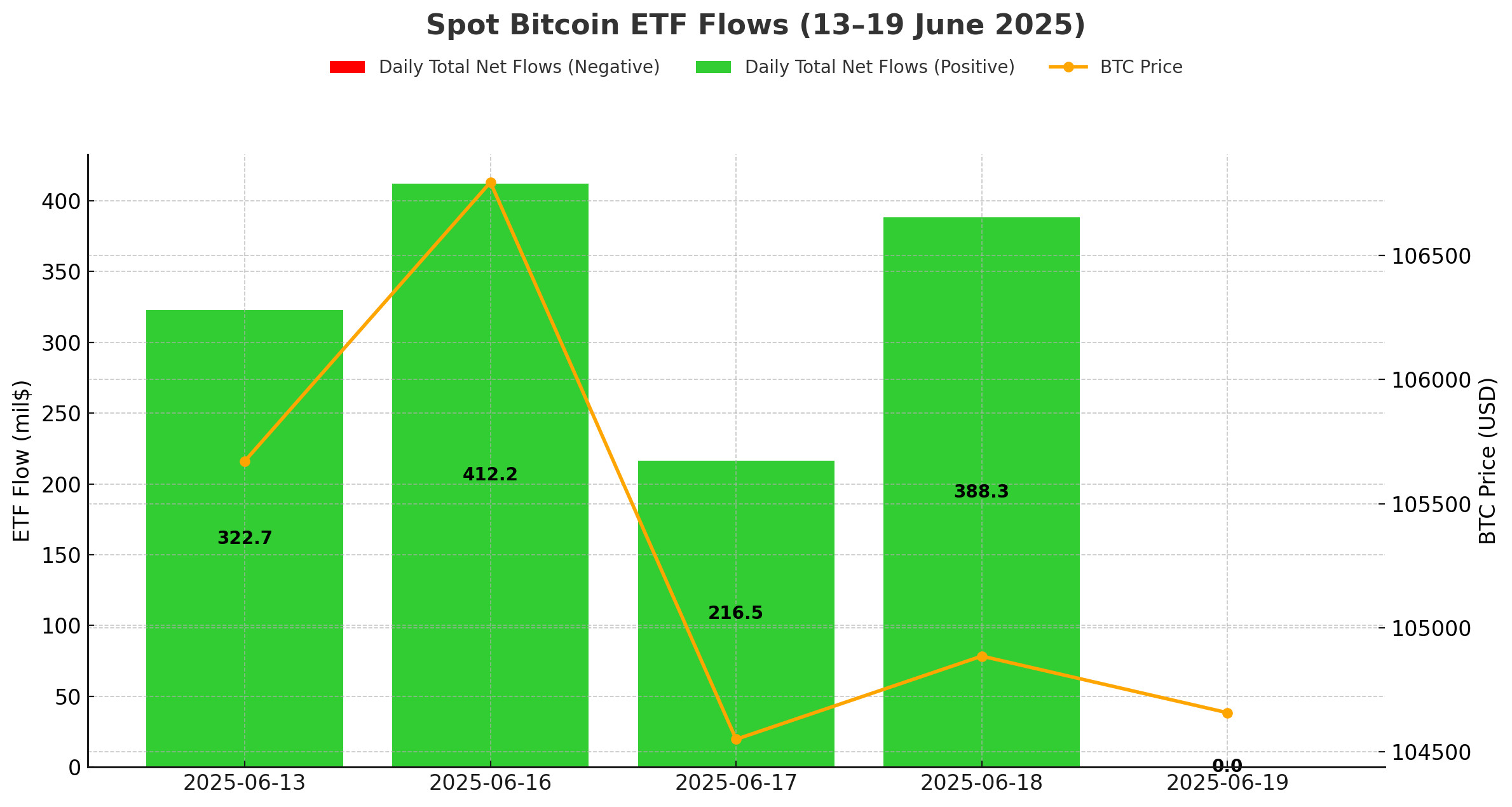

ETF Bitcoin Spot

Netflow Status: Between Giugno 13-19, 2025, Spot Bitcoin ETFs saw net inflows totaling $1.34 billion. On Giugno 17, heavy inflows into BlackRock’s IBIT ETF stood out with $639.2 million, while outflows of $208.5 million from the Fidelity FBTC ETF and $191.4 million from the Ark ARKB ETF stood out on the same day. On the other days of the week, steady purchases from IBIT confirmed that institutional interest in the ETF market continued.

Bitcoin Price: Bitcoin, which opened at $105,671 on Giugno 13, closed at $104,658 on Giugno 19, losing 0.96% of its value in the process. While a fluctuating course was observed on a weekly basis, especially the 2.10% drop in Bitcoin price on Giugno 17 caused a cautious stance among investors.

Cumulative Net Inflows: The total cumulative net inflows of spot Bitcoin ETFs reached $46.63 billion as of the end of the 360th trading day.

| DATE | COIN | PRICE | ETF Flow (mil$) | ||

| Open | Close | Change % | |||

| 13-Jun-25 | BTC | 105,671 | 106,066 | 0.37% | 322.7 |

| 16-Jun-25 | 105,594 | 106,794 | 1.14% | 412.2 | |

| 17-Jun-25 | 106,794 | 104,551 | -2.10% | 216.5 | |

| 18-Jun-25 | 104,551 | 104,886 | 0.32% | 388.3 | |

| 19-Jun-25 | 104,886 | 104,658 | -0.22% | 0 | |

| Total for 13 – 19 Jun 25 | -0.96% | 1339.7 | |||

The series of positive net flows in the Spot Bitcoin ETF market between Giugno 13-19, 2025 has reached the eighth day. The continuation of ETF inflows despite the decline in Bitcoin price during this period indicates that investors are maintaining their positions in the long-term perspective. Despite the rising geopolitical tensions, especially in the Middle East, and the uncertainty in global markets, institutional interest remains strong, indicating the persistence of the impact of Spot Bitcoin ETFs on the market. The current data reveals that investors have not lost confidence in Bitcoin.

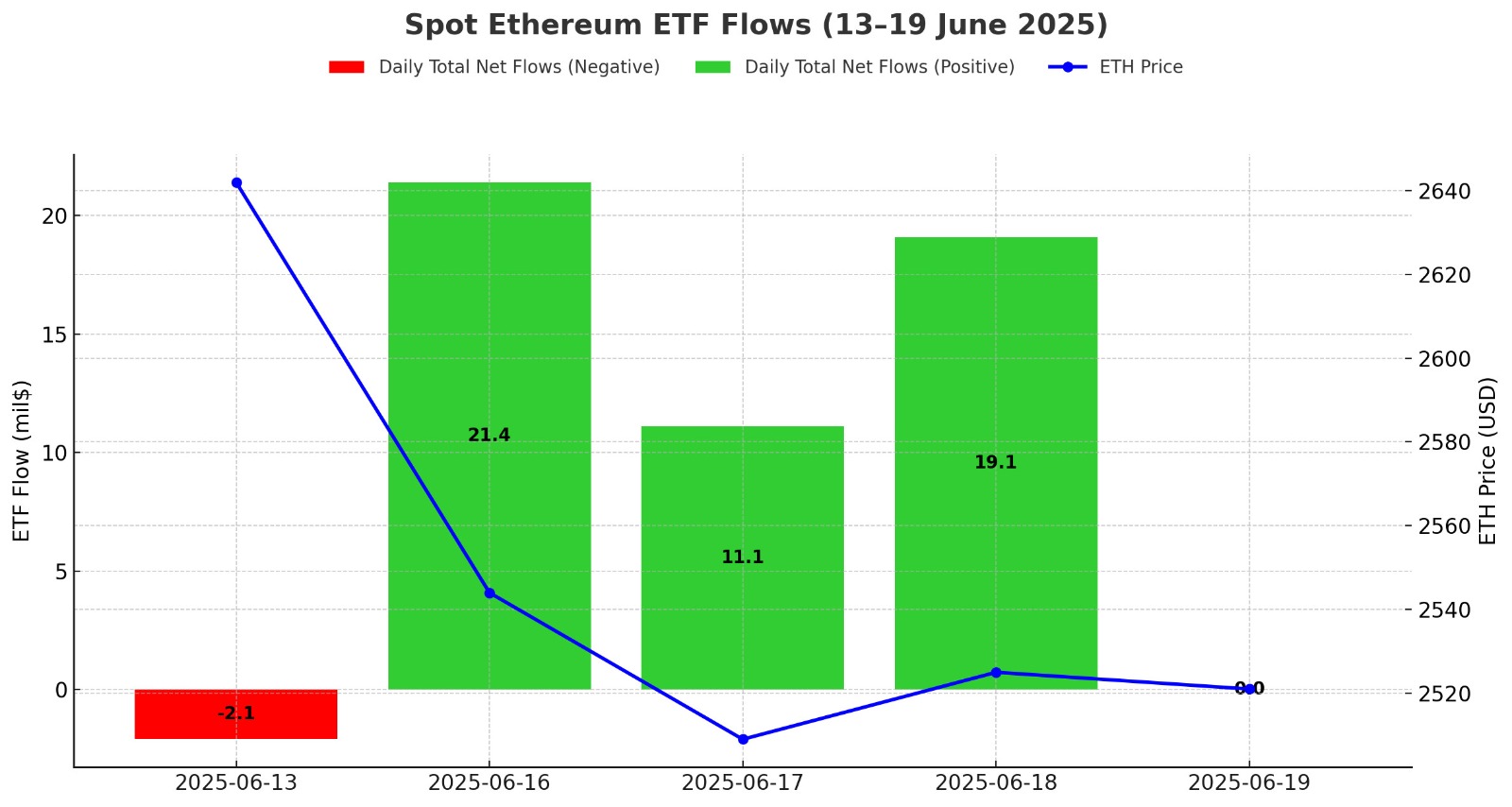

ETF a pronti su Ethereum

Between Giugno 13-19, 2025, Spot Ethereum ETFs saw a total net inflow of $49.5 million. The strongest inflow of the week was recorded on Giugno 16 with $21.4 million. During this period, inflows of $ 67.9 million into BlackRock’s ETHA ETF stood out, while outflows of $ 23.7 million from Fidelity’s FETH ETF attracted attention. The total cumulative net inflows of Spot Ethereum ETFs at the end of the 228th trading day rose to $3.924 billion. The 13-day positive net flow series ended with a limited outflow of $ 2.1 million on Giugno 13, 2025.

| DATE | COIN | PRICE | ETF Flow (mil$) | ||

| Open | Close | Change % | |||

| 13-Jun-25 | ETH | 2,642 | 2,579 | -2.38% | -2.1 |

| 16-Jun-25 | 2,547 | 2,544 | -0.12% | 21.4 | |

| 17-Jun-25 | 2,544 | 2,509 | -1.38% | 11.1 | |

| 18-Jun-25 | 2,509 | 2,525 | 0.64% | 19.1 | |

| 19-Jun-25 | 2,525 | 2,521 | -0.16% | 0 | |

| Total for 13 – 19 Jun 25 | -4.58% | 49.5 | |||

Between Giugno 13-19, 2025, the price of Ethereum fell by 4.58%, while the Spot Ethereum ETF market witnessed a period in which institutional interest did not weaken but inflow volumes slowed down noticeably. What was noteworthy during this period was the return of positive net flows in Spot Ethereum ETFs, despite increased geopolitical tensions. Between Giugno 16-18, ETFs saw a total net inflow of $51.6 million. This points to the tendency of institutional investors to use short-term price declines as an opportunity. If geopolitical uncertainties diminish or prices flatten in the coming days, it is possible to see strong buying in Spot Ethereum ETFs again.

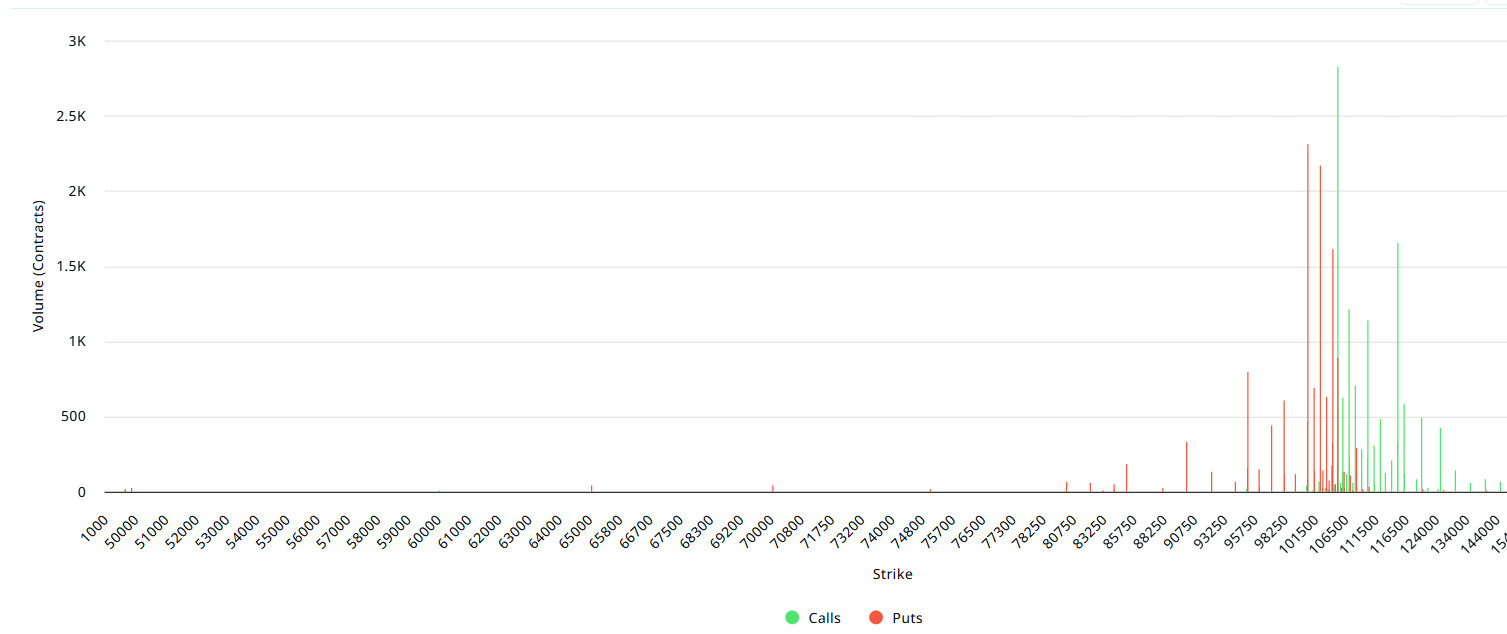

Bitcoin Options Distribution

Fonte: Laevitas

BTC: Notional: $3.3B | Put/Call: 1.16 | Max Pain: $106K

Deribit Data: Deribit data shows that BTC options contracts with a notional value of approximately $3.3 billion expired today. At the same time, according to the data in the last 24 hours, if we look at the risk conversion in the next 1-week period, put options are the dominant side in hedging more than call options. This indicates that the expectation of a decline is increasing. When we look at the expected volatility, it is above the realized volatility. This indicates that call option fees are expensive. On the other hand, the positive spread value shows that investors are acting appetite. Skew values suggest that there is selling pressure today and next week.

Laevitas Data: When we examine the chart, it is seen that put options are concentrated in the band of 95,000 – 105,000 dollars. Call options are concentrated between $103,000 and $125,000 and the concentration decreases towards the upper levels. At the same time, the $ 100,000 level is seen as support and the $ 115,000 level as resistance. On the other hand, there are 2.42K put options at the $ 100,000 level, where there is a peak and there is a decrease in put volume after this level. However, it is seen that 2.82K call option contracts peaked at $ 105,000. When we look at the options market, we see that call and put contracts are in balance on a daily and weekly basis.

Option Expiration:

Put/Call Ratio and Maximum Pain Point: In the last 7 days of data from Laevitas, the number of call options increased by about 15% compared to last week to 77.88K. In contrast, the number of put options increased by 41% compared to last week to 91.52K. The put/call ratio for options was set at 1.16. This indicates that call options are less in demand among investors than put options. Bitcoin’s maximum pain point is seen at $106,000. It can be predicted that BTC is priced at $106,400 and if it does not break the pain point of $106,000 downwards, the rises will continue. In the coming period, there are 1.23K call and 1.36K put options at the time of writing.

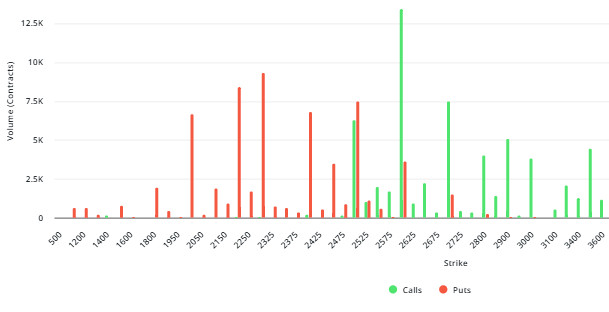

Distribuzione delle opzioni su Ethereum

Fonte: Laevitas

ETH: 546M notional | Put/Call: 0.68 | Max Pain: $2,600

Laevitas Data: Looking at the chart, put options are concentrated between $2,050 and $2,500. The highest volume of put contracts is around 9K at the $2,300 level. This indicates that option market participants see the $2,300 level as a strong support. On the other hand, there is heavy call option volume at the $2,500 and $2,700 levels. Especially $2,600 stands out as a possible resistance zone due to the high volume (13.5K).

Deribit Data: At-the-Money (ATM) volatility rates were 39.14% on Giugno 20, 52.20% on Giugno 21 and 50.01% on Giugno 22. These ratios point to increased short-term price volatility and heightened uncertainty, especially in Giugno 21-22 maturities. Likewise, the negative values and downward trend in the 25 Delta Risk Reversal (RR) data indicate that the market places a higher premium on put options, i.e. it prices downside risks more On the other hand, put volume increased by 37.7% in the Giugno 20 expiry while call volume declined by 34%. Similarly, there is a sharp decline of 53.01% in Giugno 21 call option volume. This suggests that investors are losing faith in the recovery scenario, especially in the short term, while increasing their hedging positions.

Option Expiration:

Ethereum options with a notional value of $546 million expire on Giugno 20. The Max Pain level is calculated at $ 2,600, while the put/call ratio is at 0.68.

AVVISO LEGALE

Le informazioni, i commenti e le raccomandazioni sugli investimenti contenuti nel presente documento non costituiscono servizi di consulenza sugli investimenti. I servizi di consulenza sugli investimenti sono forniti da istituti autorizzati su base personale, tenendo conto delle preferenze di rischio e di rendimento dei singoli. I commenti e le raccomandazioni contenuti nel presente documento sono di tipo generale. Tali raccomandazioni potrebbero non essere adatte alla vostra situazione finanziaria e alle vostre preferenze di rischio e rendimento. Pertanto, prendere una decisione di investimento basandosi esclusivamente sulle informazioni contenute nel presente documento potrebbe non portare a risultati in linea con le vostre aspettative.