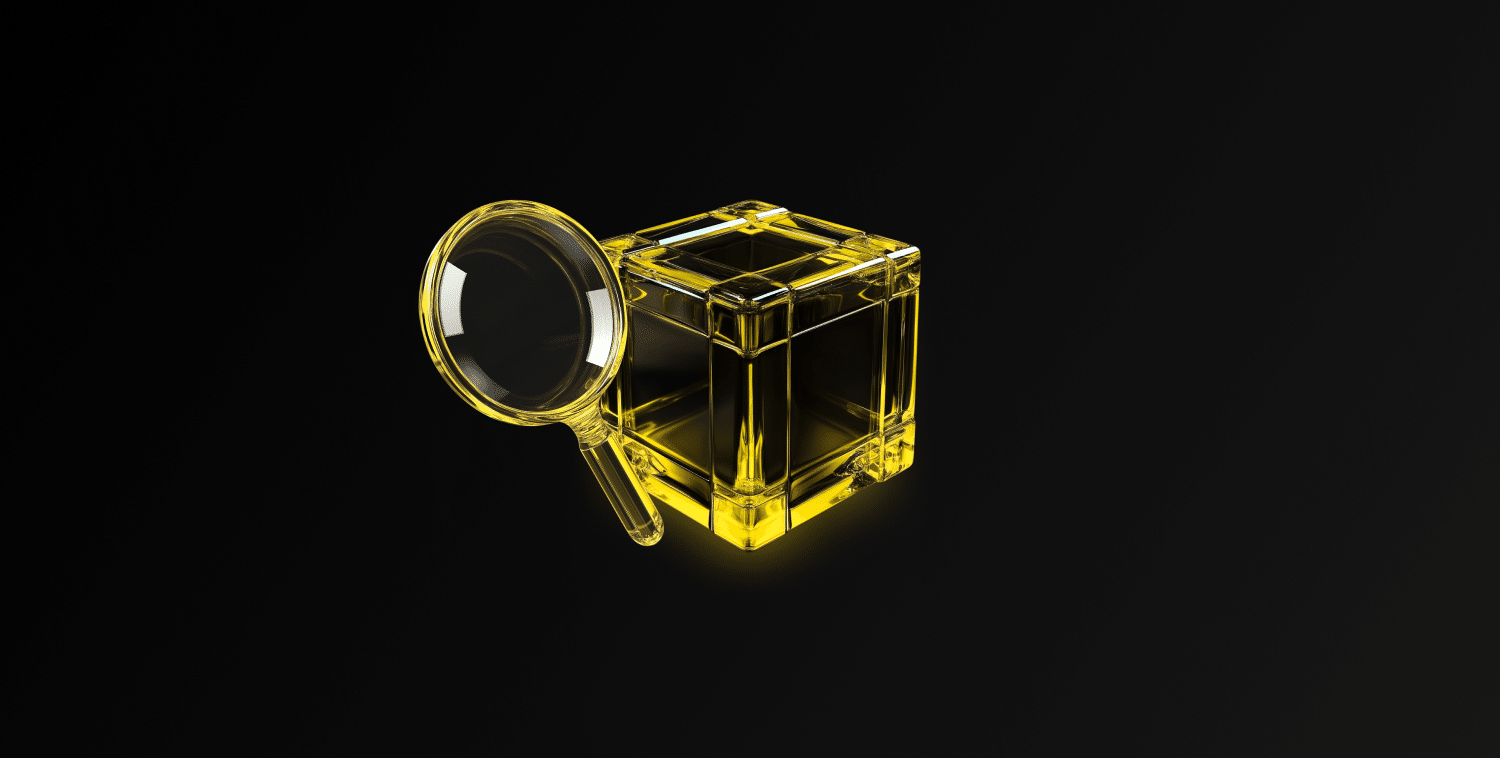

Active Addresses

In terms of the number of active addresses, there were 450,860 active entries on the ETH network between Aprile 2 and Aprile 9, 2025, this week. Ethereum fell to $1,552 during this period. The chart shows that Ethereum purchases are gradually decreasing in the area where the price and the number of active addresses intersect. When we follow the 7-day simple moving average, it is observed that the price follows an upward trend on the dates when this average cut the price. This situation indicates that the Ethereum price is experiencing entries from the $ 1,805 levels.

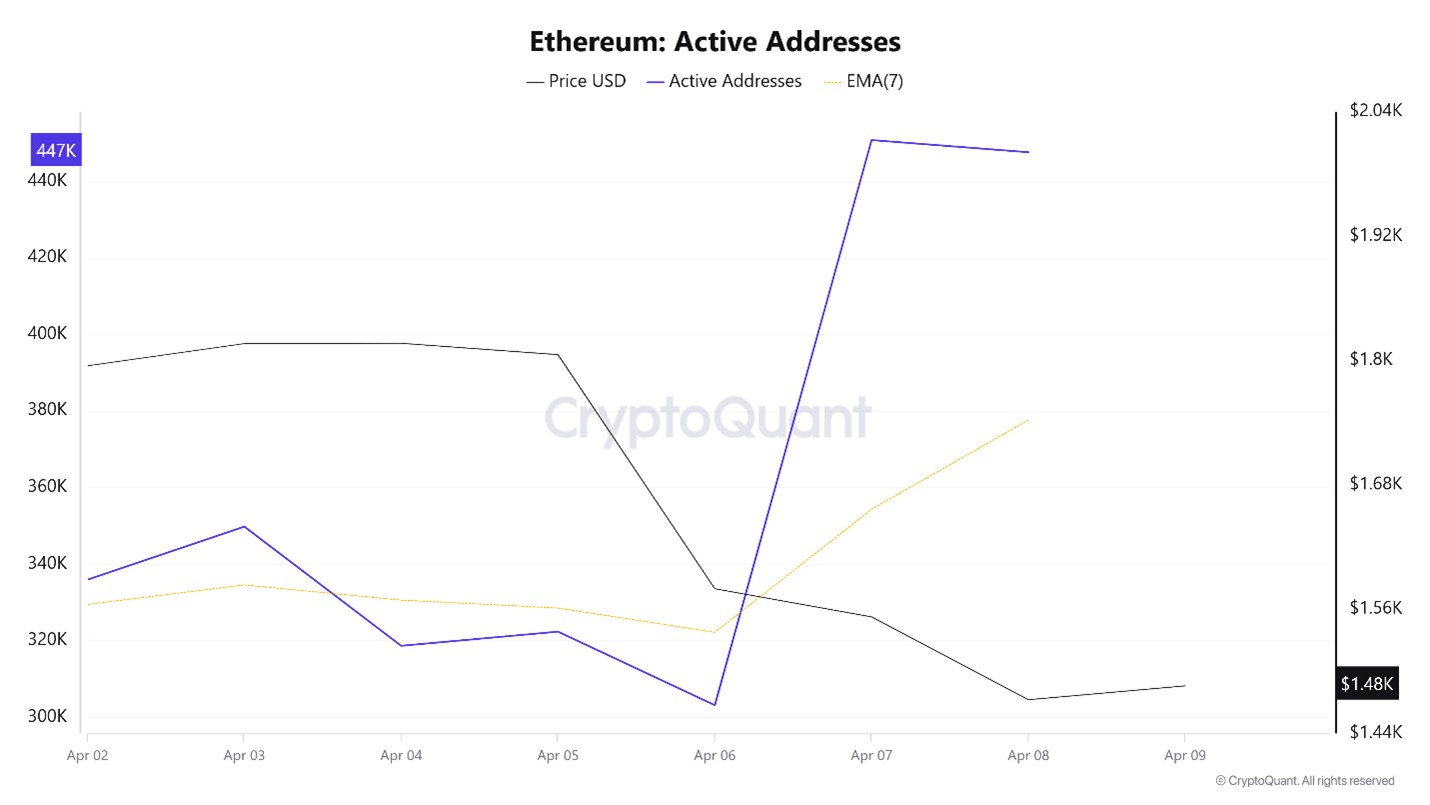

Active Sending Addresses

With the Black Line (price line) in active shipping addresses, there was a significant drop in active shipping addresses on Aprile 6. On the day when the price hit its lowest point, active shipping addresses fell as low as 215,758, indicating that buyers sold their positions as Ethereum remained at 1,472 for a while. As a result, it is seen that price drops cause an acceleration in sending addresses.

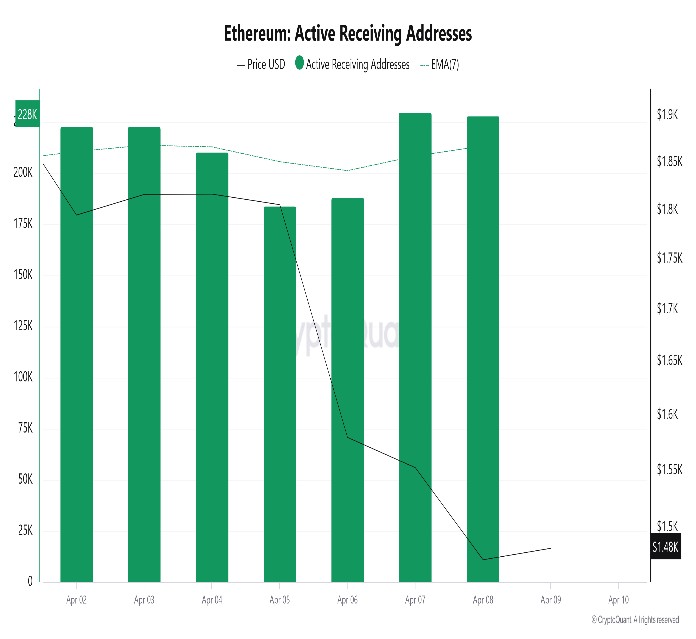

Active Receiving Addresses

Along with the Black Line (price line) in active sending addresses, there has been a significant drop in active buying addresses after Aprile 8. On the day of the price low, active shipping addresses rose as high as 228,113, indicating that buyers took their positions at Ethereum’s $1,472 level.

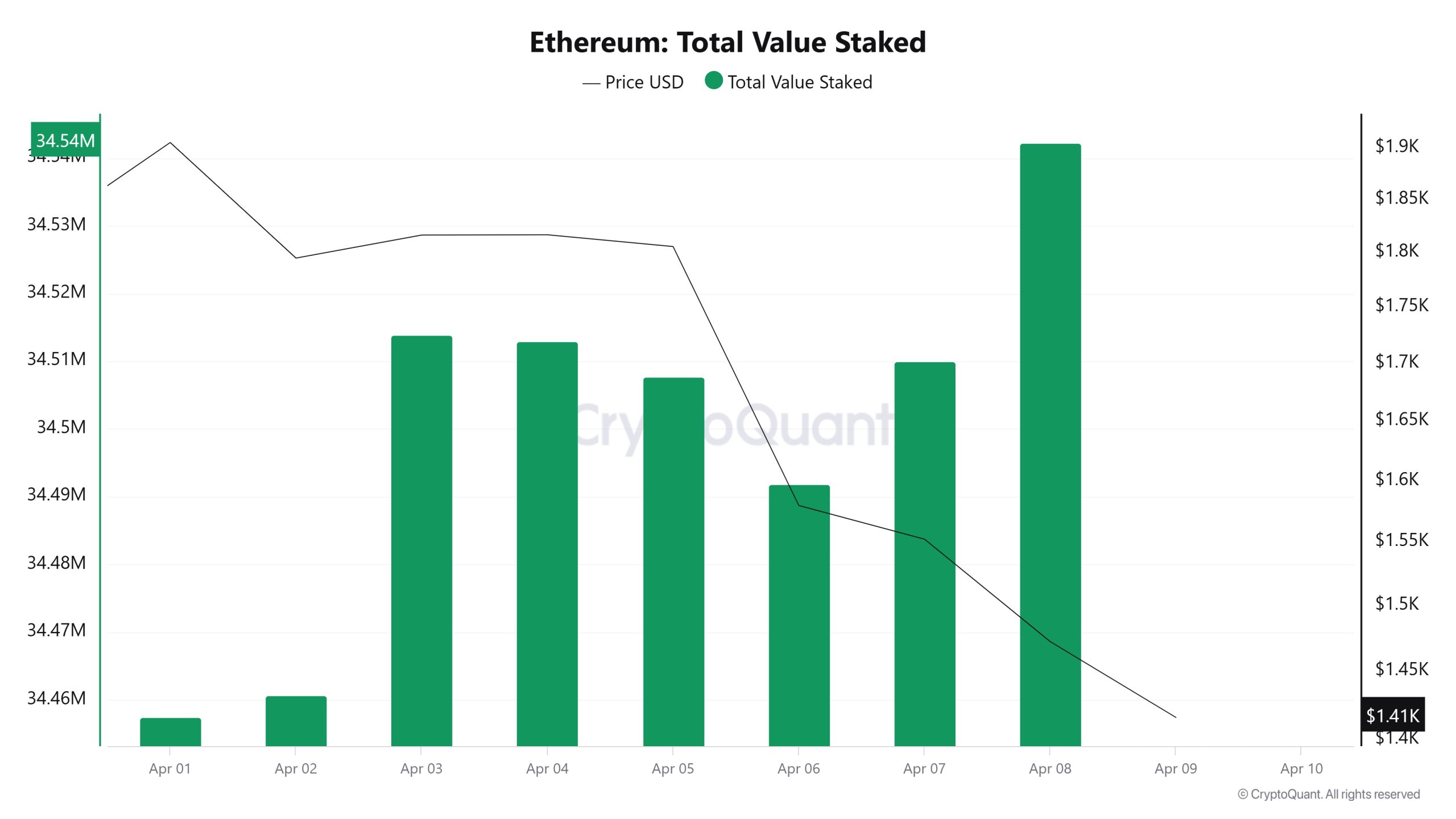

Total Value Staked

On Aprile 2, ETH price was 1,794 while Total Value Staked was 34,460,717. As of Aprile 8, ETH price decreased to 1,472 while Total Value Staked Ratio increased to 34,542,331. Compared to last week, ETH price decreased by 17.95% while Total Value Staked Ratio increased by 0.24%.

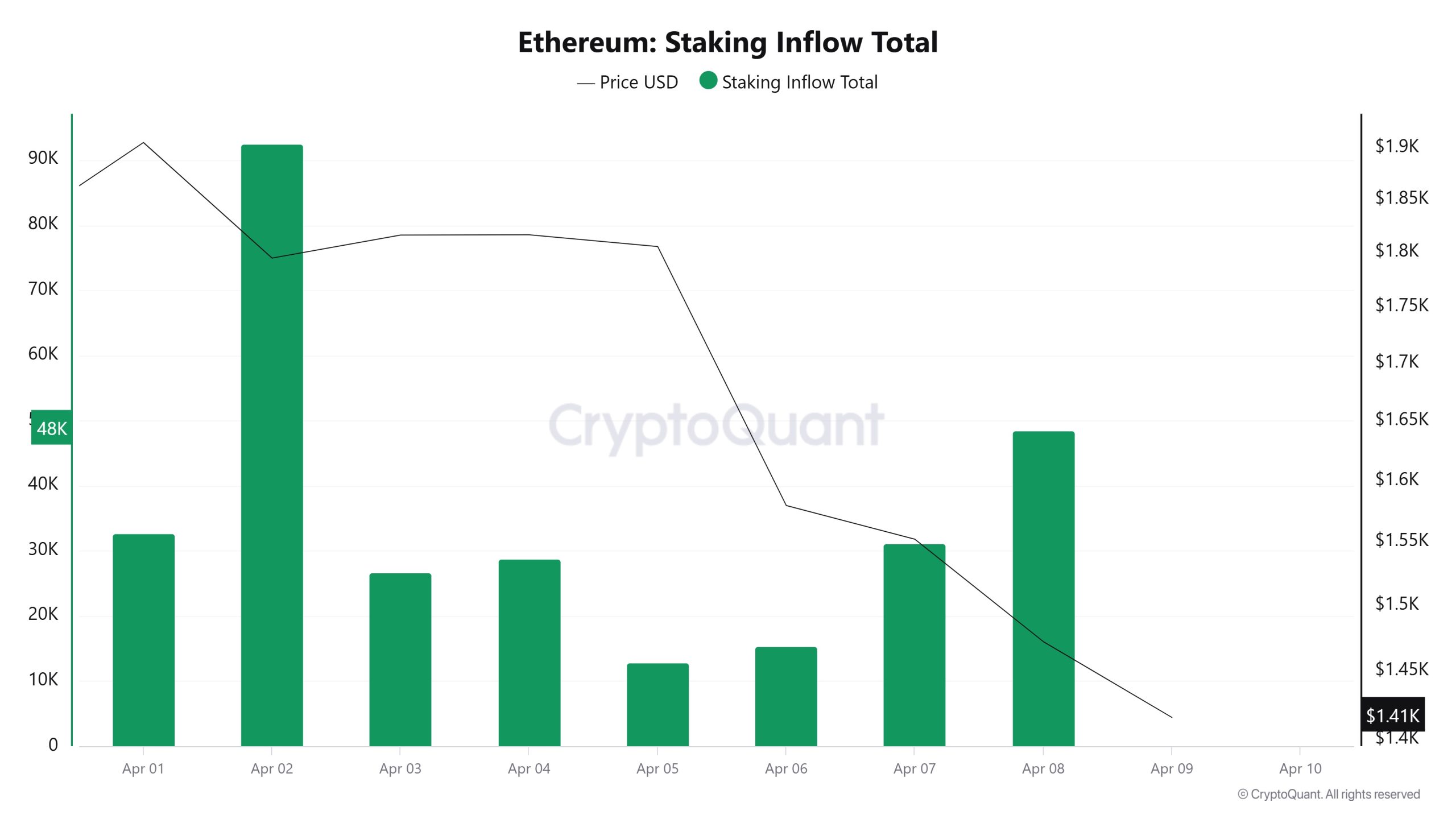

Staking Inflows

On Aprile 2, the ETH price was at 1,794, while the Staking Inflow Ratio was 92,494. As of Aprile 8, the ETH price decreased to 1,472, while the Staking Inflow Ratio decreased to 48,485. Compared to last week, there was a 17.95% decrease in ETH price and a 47.61% decrease in Staking Inflow Ratio.

Derivatives

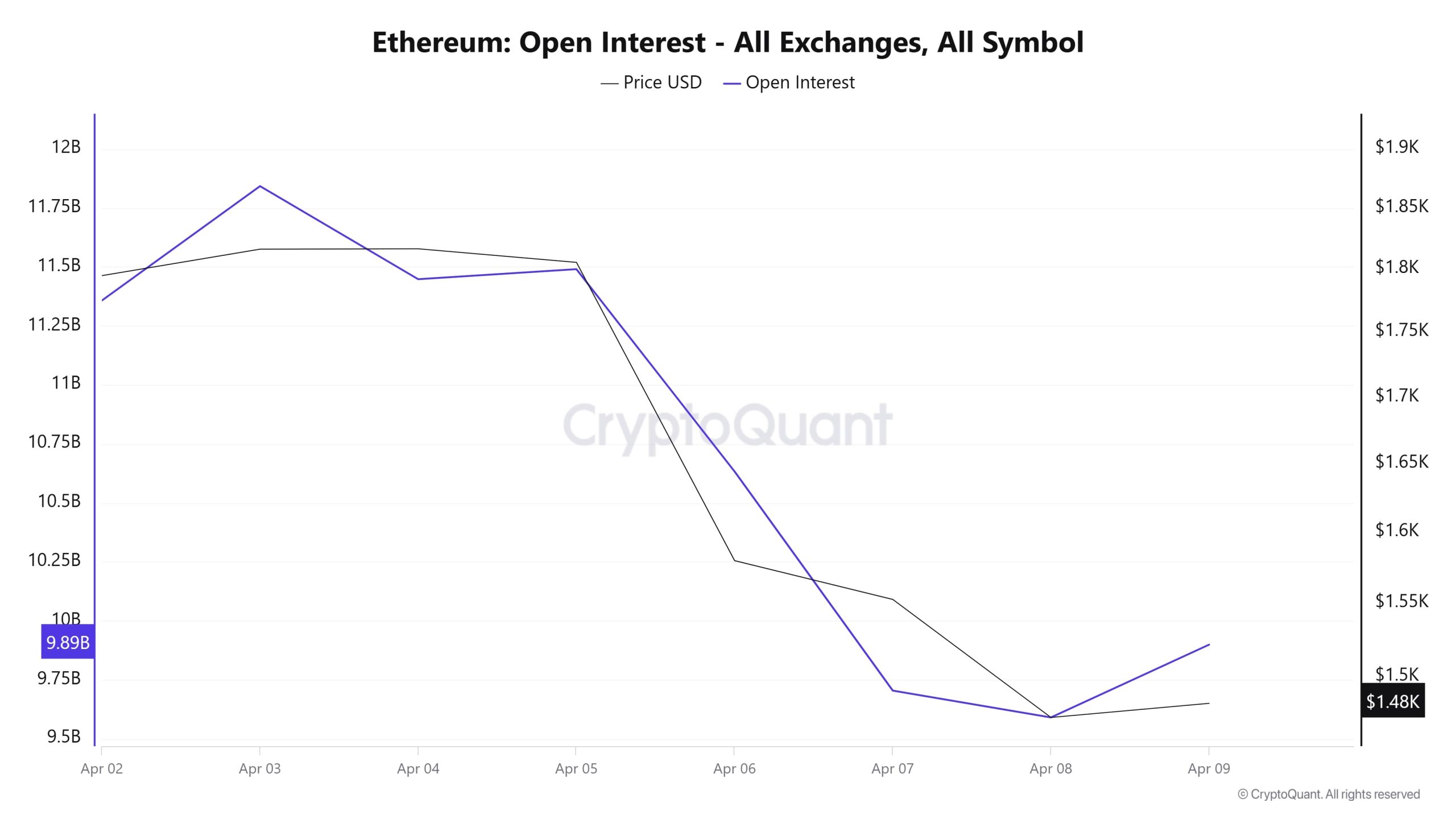

Open Interest

Until Aprile 3, open interest was rising while the price was flat to positive, indicating an increased appetite for positioning in the market. However, as of Aprile 5, both open interest and price fell sharply. This parallel decline indicates that positions are being closed en masse and liquidations are taking place. Especially on Aprile 6-7, as the declines accelerated, open interest also declined, indicating that leveraged positions in the market were quickly cleared. On Aprile 8, as the price bottomed, open interest dropped to very low levels, suggesting that fear and cautious behavior prevailed in the market. On Aprile 9, there is a limited rebound in both price and open interest, but this does not yet signal a strong turnaround. Overall, this chart shows that Ethereum futures are undergoing a serious liquidation process and leveraged risk appetite has weakened significantly. In the short term, caution may continue.

Until Aprile 3, open interest was rising while the price was flat to positive, indicating an increased appetite for positioning in the market. However, as of Aprile 5, both open interest and price fell sharply. This parallel decline indicates that positions are being closed en masse and liquidations are taking place. Especially on Aprile 6-7, as the declines accelerated, open interest also declined, indicating that leveraged positions in the market were quickly cleared. On Aprile 8, as the price bottomed, open interest dropped to very low levels, suggesting that fear and cautious behavior prevailed in the market. On Aprile 9, there is a limited rebound in both price and open interest, but this does not yet signal a strong turnaround. Overall, this chart shows that Ethereum futures are undergoing a serious liquidation process and leveraged risk appetite has weakened significantly. In the short term, caution may continue.

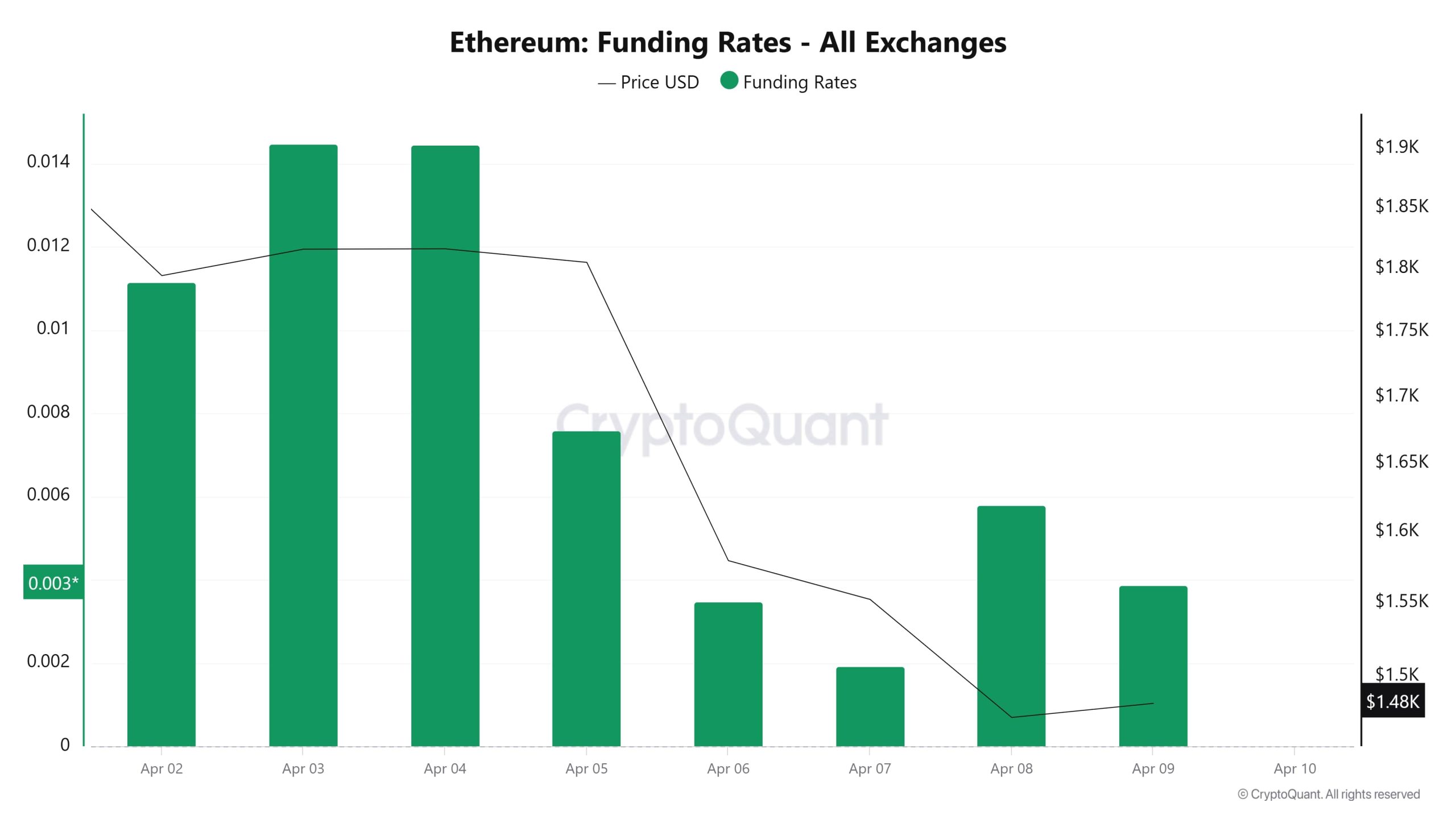

Funding Rate

The chart shows Ethereum’s funding rates on all exchanges along with its price movement. In the first few days, Aprile 2-4, the funding rate was quite high, hovering around 0.014%. This shows that long positions were concentrated in the market and investors were expecting the price to rise. However, what is interesting is that when the funding rate is so high, the price stays flat and then falls sharply. This suggests that although long positions dominated the market, there was a “long trap” as the price did not go up, and then these positions were most likely liquidated. From Aprile 5 onwards, the funding rate starts to fall drastically, and between Aprile 6-9 it drops by almost a third from previous levels. During this period, the price also continues to fall, reaching a low of $1,385. The fact that the funding rate fell as the price fell suggests that investors are now more cautious, and the market is shifting to the neutral or short side. In other words, the previous excessive optimism seems to have given way to some fear or indecision.

Finally, the funding rate is low, and the price is moving sideways. This usually indicates that the market is searching for a balance, and no clear direction has been decided. If funding turns negative, it could mean excessive short positioning, which could signal a potential bottom. If both price and funding turn upwards at the same time, this could be a strong signal for a trend reversal. For now, the market is searching for a new direction, and it may be worth being cautious before a clear breakout occurs.

Long & Short Liquidations

ETH, which fell sharply due to the impact of tariffs in the US, caused the liquidation of long positions at a very high level of 770 million dollars. In the same period, 317 million dollars worth of short positions were liquidated due to its volatility.

| Data | Long Amount (Million $) | Short Amount (Million $) |

|---|---|---|

| Aprile 02 | 113.95 | 38.40 |

| Aprile 03 | 44.74 | 23.17 |

| Aprile 04 | 48.29 | 29.58 |

| Aprile 05 | 15.61 | 6.02 |

| Aprile 06 | 203.67 | 42.41 |

| Aprile 07 | 263.78 | 140.38 |

| Aprile 08 | 80.75 | 37.04 |

| Total | 770.79 | 317.00 |

Supply Distribution

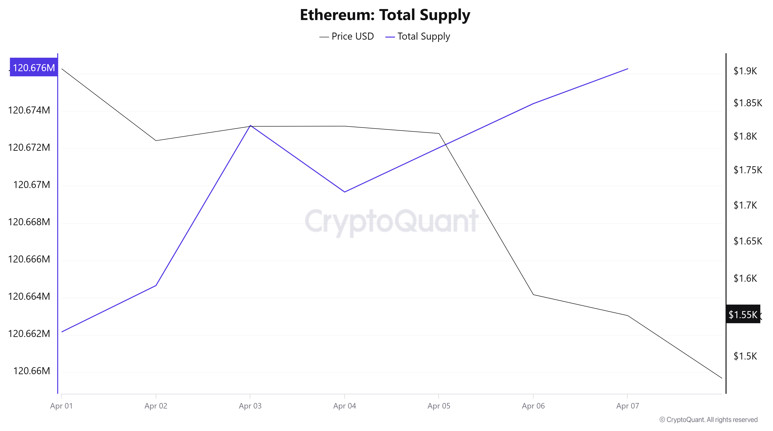

Total Supply: Increased by about 0.020% from last week to 120,652,063 units.

New Supply: The amount of ETH produced this week was 24,219.

Velocity: Velocity, which was 7.67 last week, was 7.69 as of Aprile 7.

| Wallet Category | 1.04.2025 | 7.04.2025 | Variazione (%) |

|---|---|---|---|

| 100 – 1k ETH | 9.4365M | 9.3971M | -0.4175% |

| 1k – 10k ETH | 12.6099M | 12.6666M | 0.4495% |

| 10k – 100k ETH | 16.3243M | 16.3439M | 0.1201% |

| 100k+ ETH | 5.3926M | 5.4636M | 1.3161% |

According to the latest data, 100 – 1k ETH wallets saw a decrease of 0.4175%, while 1k – 10k ETH holders experienced an increase of 0.4495%. While a slight increase of 0.1201% was recorded in the 10k – 100k ETH category, the most notable change was a significant increase of 1.3161% in 100k+ ETH holders.

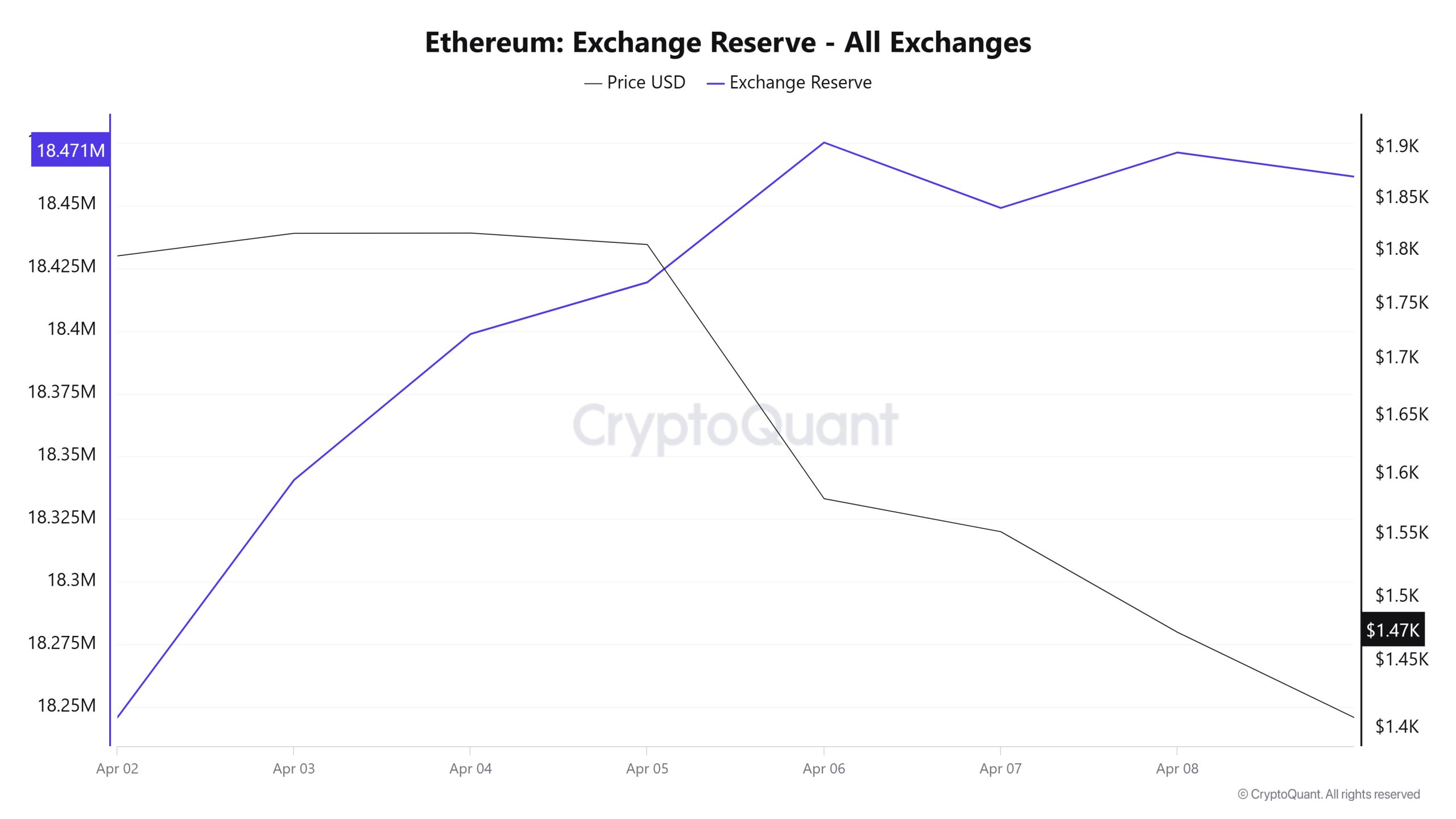

Exchange Reserve

Between Aprile 2-8, 2025, Ethereum reserves on exchanges increased from 18,246,034 ETH to 18,471,005 ETH. During this period, there was a total net inflow of 224,971 ETH and the Ethereum reserves of exchanges increased by 1.23%. The Ethereum price fell by approximately 17.9% during the same period. On Aprile 2, 2025, Ethereum closed at $1,795, and on Aprile 8, 2025, it closed at $1,473. Strong inflows to the stock markets indicate that investors may increase their selling tendency. The recent increase in tariffs and economic warfare on a global scale has weakened investor confidence and triggered a general decline in crypto markets. The continuation of this trend in the coming period may cause increased selling pressure on prices as strong inflows to stock exchanges continue.

| Data | 2-Apr | 3-Apr | 4-Apr | 5-Apr | 6-Apr | 7-Apr | 8-Apr |

|---|---|---|---|---|---|---|---|

| Exchange Inflow | 621,839 | 691,074 | 704,955 | 318,234 | 866,726 | 1,713,300 | 870,585 |

| Exchange Outflow | 692,472 | 596,515 | 646,801 | 297,659 | 811,067 | 1,739,374 | 848,487 |

| Exchange Netflow | -70,633 | 94,559 | 58,153 | 20,575 | 55,660 | -26,074 | 22,098 |

| Exchange Reserve | 18,246,034 | 18,340,593 | 18,398,747 | 18,419,322 | 18,474,981 | 18,448,907 | 18,471,005 |

| ETH Price | 1,795 | 1,816 | 1,817 | 1,806 | 1,580 | 1,553 | 1,473 |

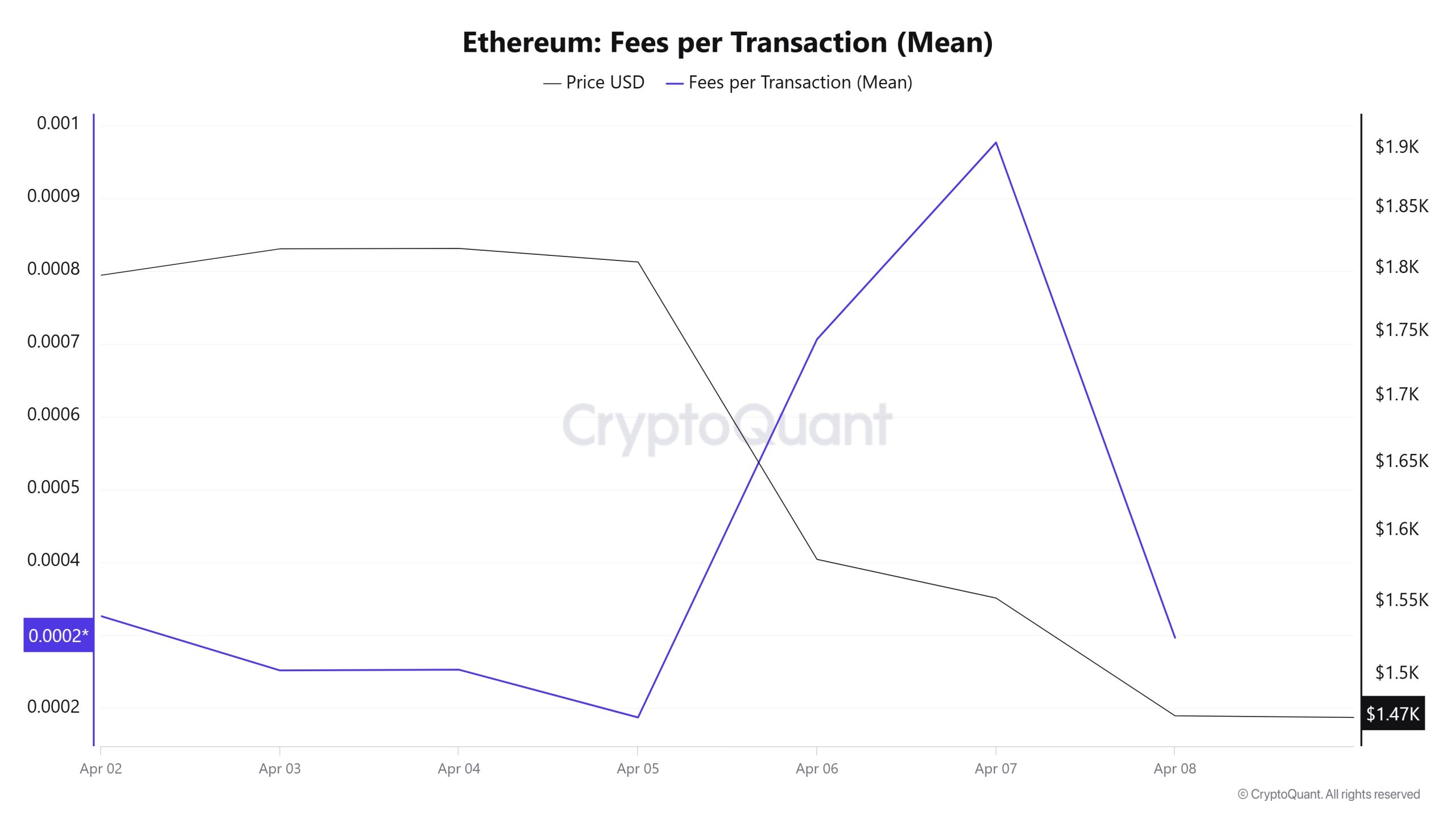

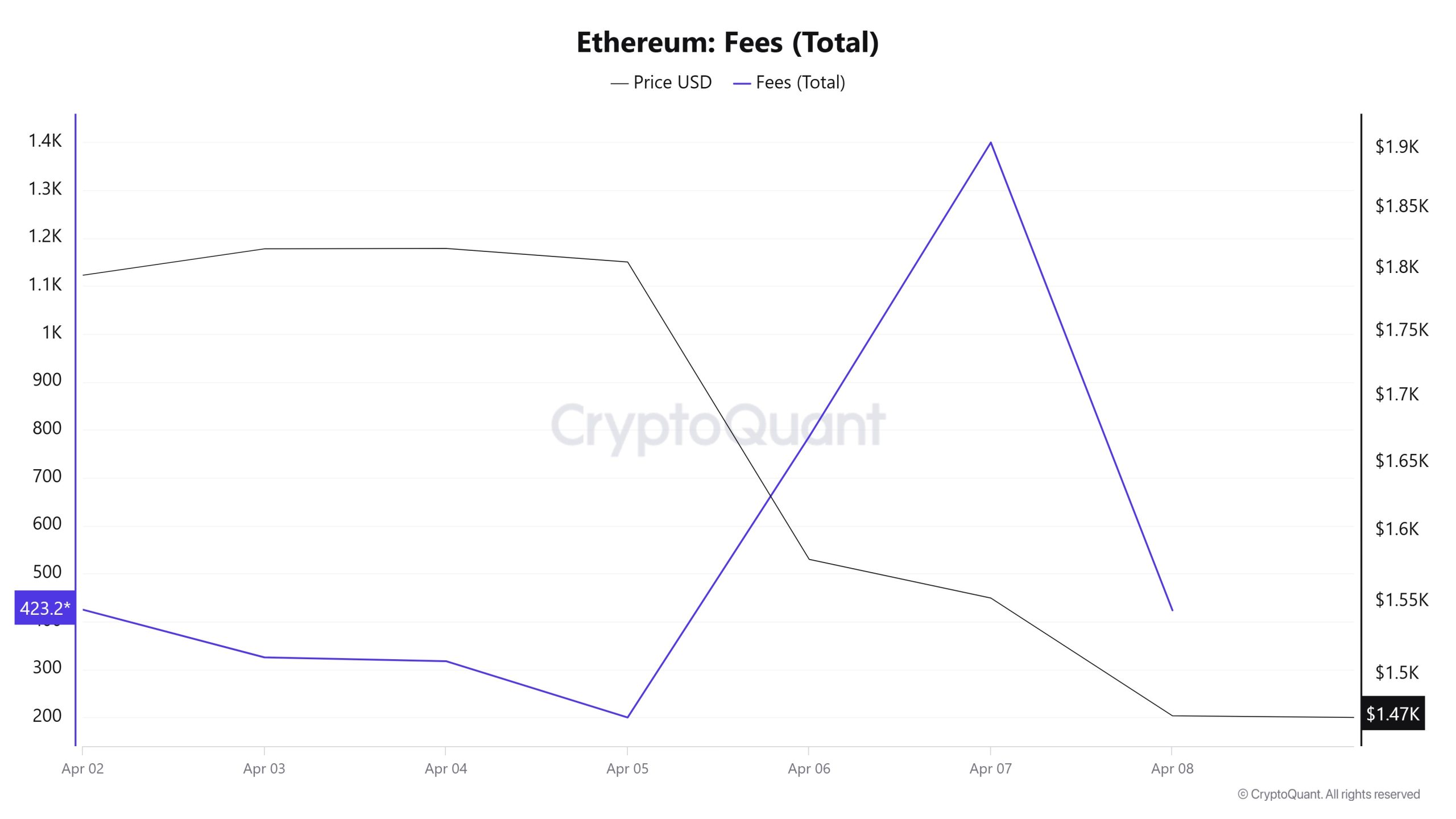

Fees and Revenues

When the Ethereum Fees per Transaction (Mean) data between Aprile 2- 8 is analyzed, it is seen that this value was at the level of 0.000326031468215476 on Aprile 2, the first day of the weekly period. Until Aprile 5, the value, which showed a downward trend, recorded the lowest value of the week with the level of 0.000186843923903236 on this date.

As of Aprile 5, the value, which gained upward momentum again with the fluctuations in the Ethereum price, closed at 0.000296370995058201 on Aprile 8, the last day of the weekly period.

Similarly, when the Ethereum Fees (Total) data between Aprile 2 and Aprile 8 were analyzed, it was seen that this value 424.54481061999616 on Aprile 2, the first day of the weekly period. Until Aprile 5, the value, which showed a downward trend, recorded the lowest value of the week with 199.67655144083412 on this date.

As of Aprile 5, the value, which gained upward momentum again with the fluctuations in the Ethereum price, closed at 423,2334886058493 on Aprile 8, the last day of the weekly period.

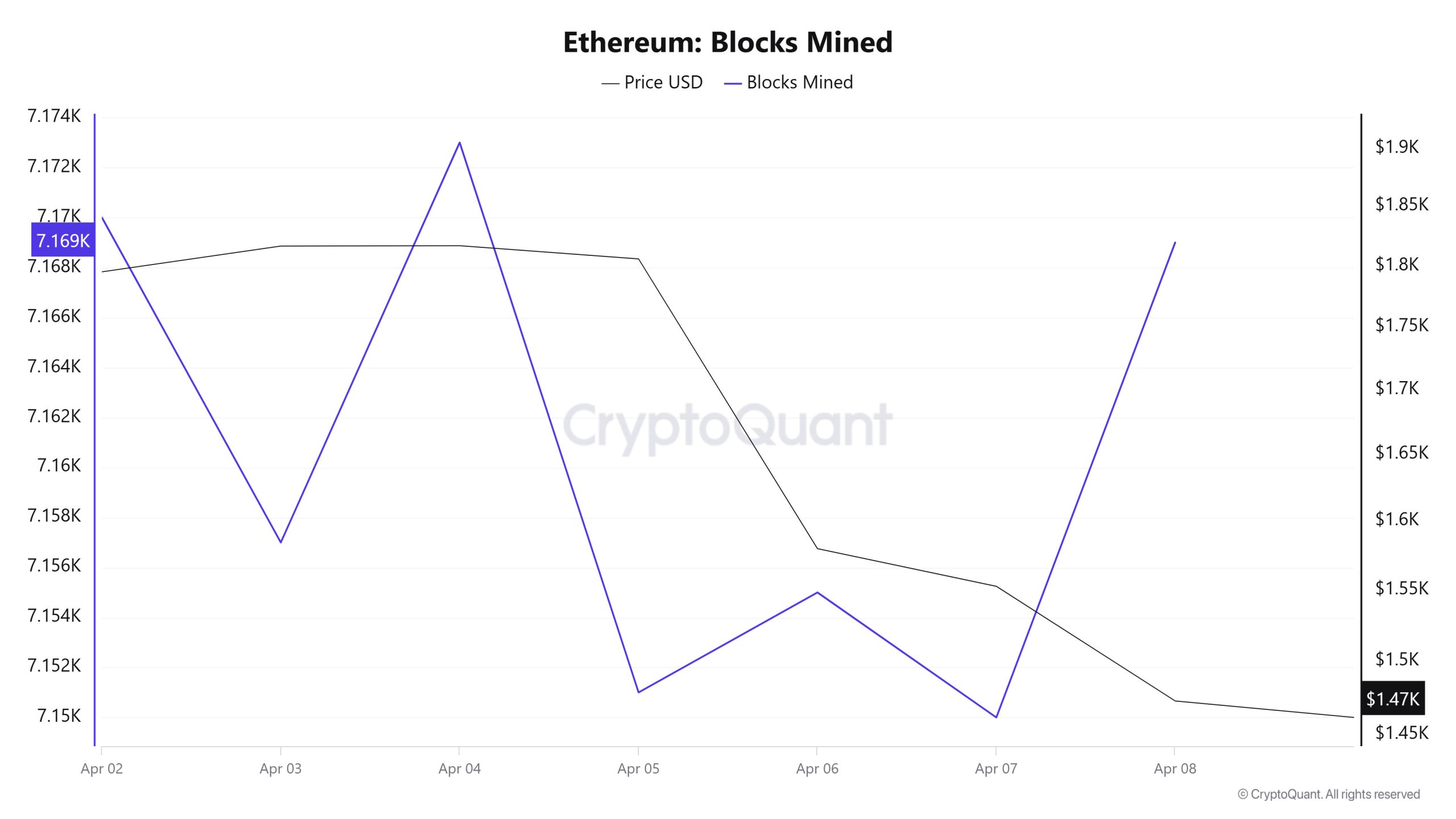

Blocks Mined

Between Aprile 2 and Aprile 8, when we examine the Ethereum Blocks Mined table, the number of blocks produced decreased towards the middle of the week but increased towards the end of the week. While 7,170 blocks were produced on Aprile 2, this number was 7,169 on Aprile 8. There was a negative correlation between Blocks Mined and Ethereum price during the week.

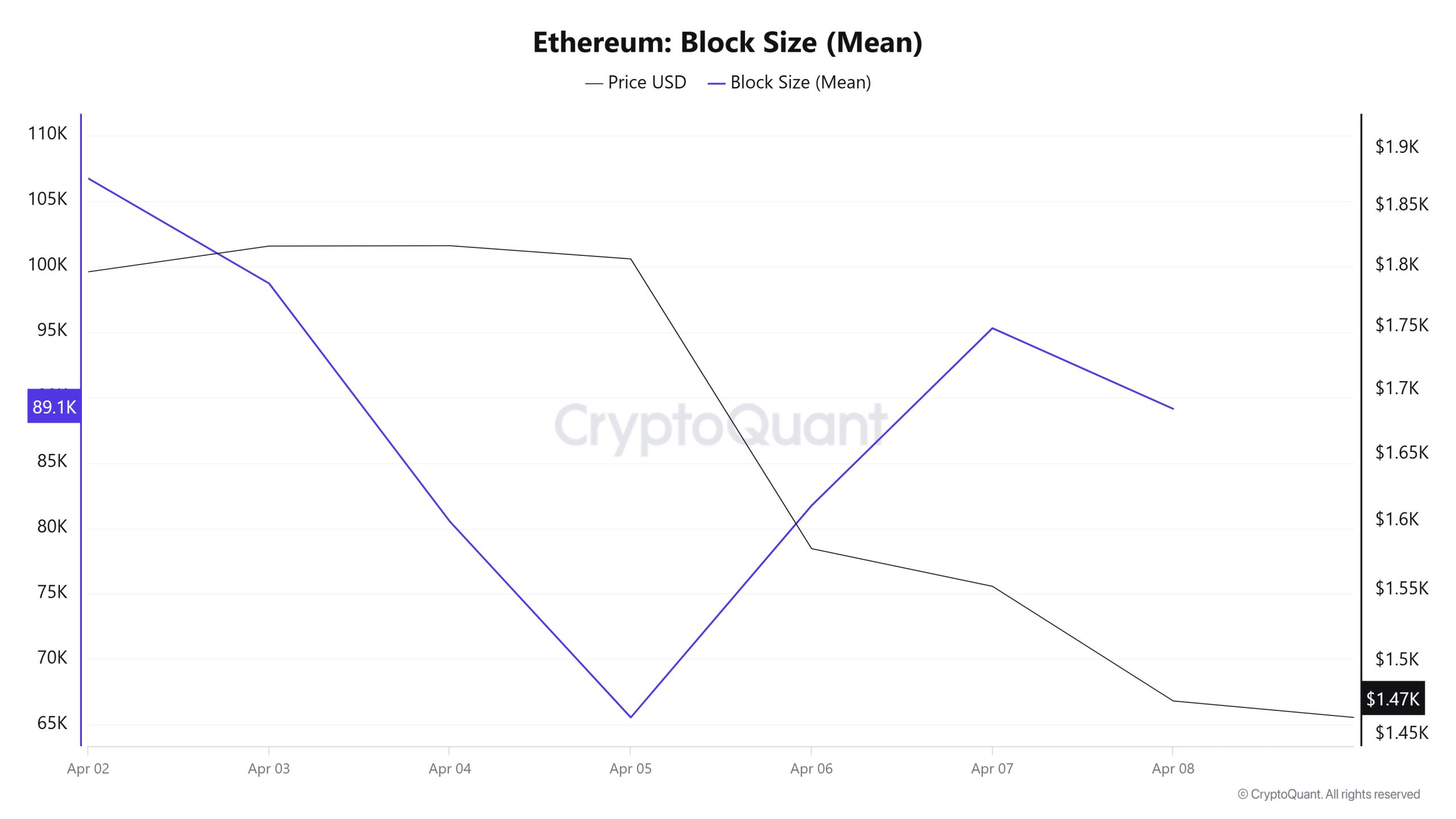

Block Size

Between Aprile 2 and Aprile 8, when we examine the Ethereum Block Size table, there was a slight decrease in the middle of the week, but then it increased towards the end of the week. The block size of 106,711 bytes on Aprile 2 reached 89,117 bytes by Aprile 8. There was a negative correlation between Block Size and Ethereum price during the week.

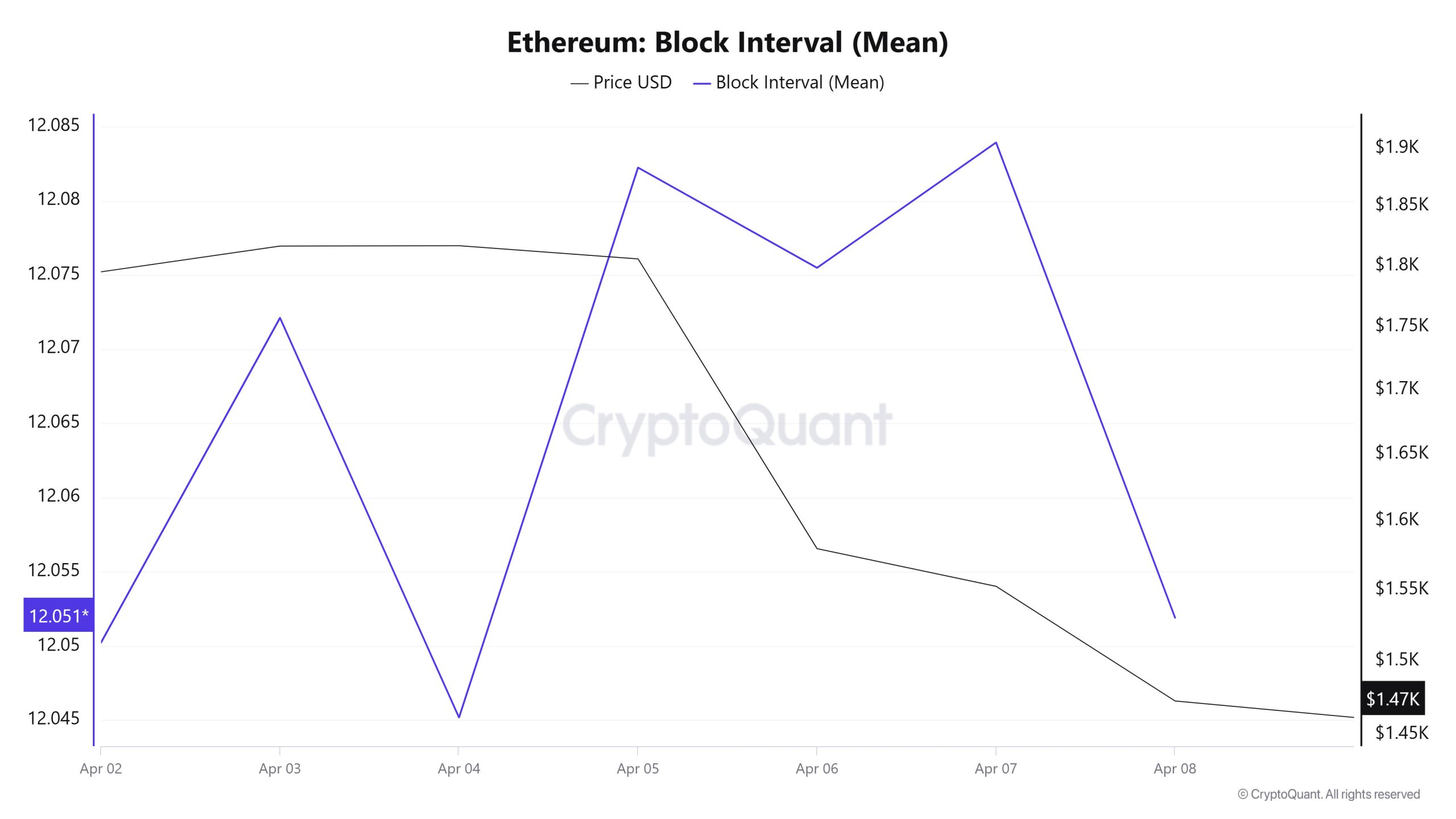

Block Interval

Between Aprile 2 and Aprile 8, when we examine the Ethereum Block Interval table, although there was an increase towards the middle of the week, there was a slight decrease in the time between blocks at the end of the week. The time between blocks, which was 12.05 seconds on Aprile 2, was 12.05 seconds on Aprile 8, with the same duration. During the week, a positive correlation was observed between Block Interval and Ethereum price.

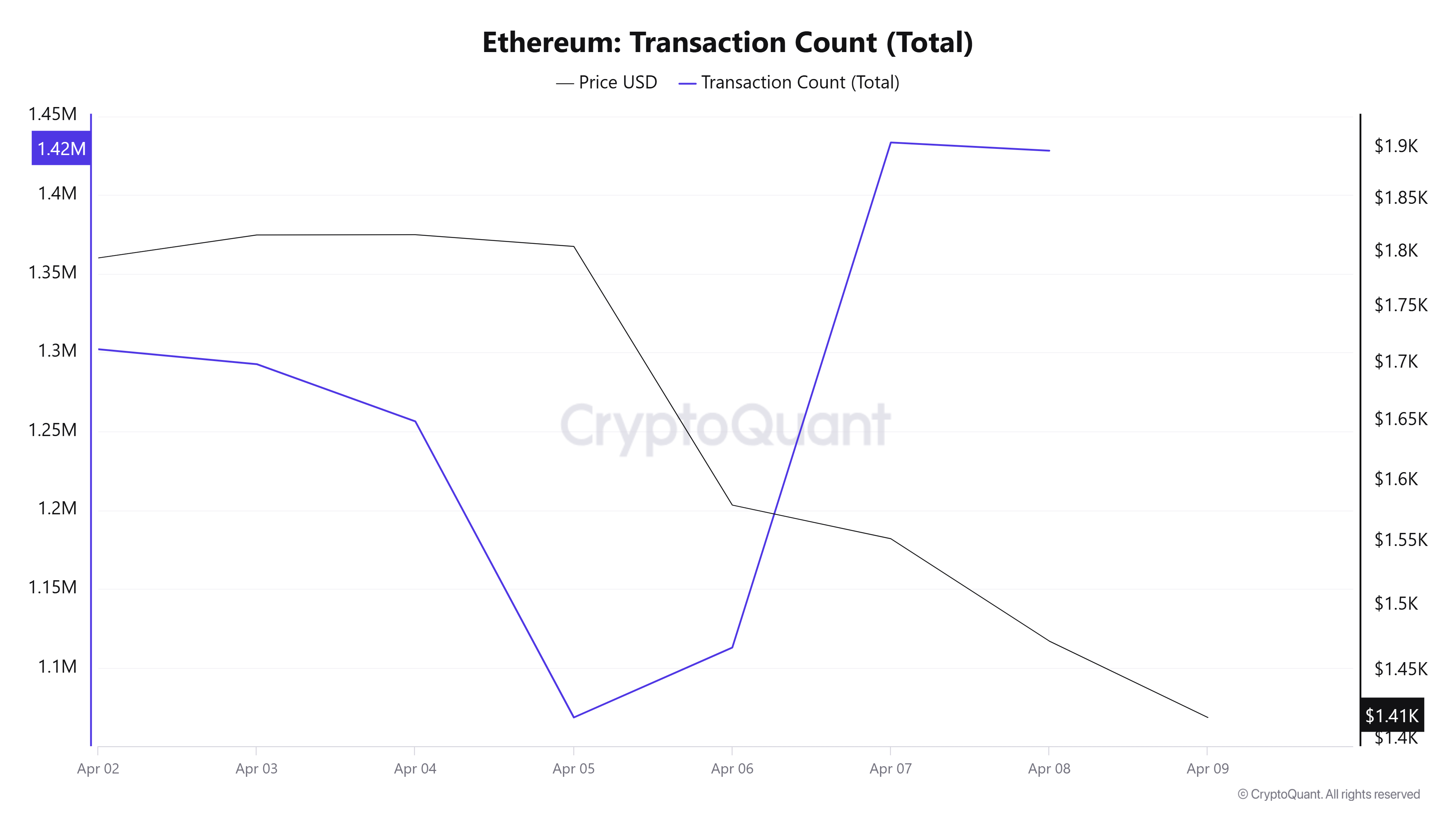

Transaction

Last week, 8,693,201 transactions were processed, while this week’s number decreased by about 9.19% to 7,894,241. The highest number of transactions was 1,433,231 on Aprile 7, while Aprile 5 saw the lowest number of transactions on the network for the week with 1,068,681 transactions. The significant decrease in the number of transactions compared to last week seems to be quite negative in terms of network utilization. The negative correlation between price movements and the number of transfers throughout the week can be seen as another negative indicator.

Tokens Transferred

While the amount of Ethereum transferred last week was 9,866,637, 12,523,626 Ethereum was transferred this week, an increase of 26.9%. On Aprile 7, 3,707,566 Ethereum transfers were recorded, the highest token transfer number of the week and the 3rd highest token transfer number of 2025. On Aprile 5, the lowest transfer amount of the week was 695,415 Ethereum transfers.

In addition to the decrease in the number of transactions, the increase in the amount of Ethereum transferred shows that the activity on the weakening network has been selling throughout this week. If this situation continues, it raises concerns that the ETH price could fall further.

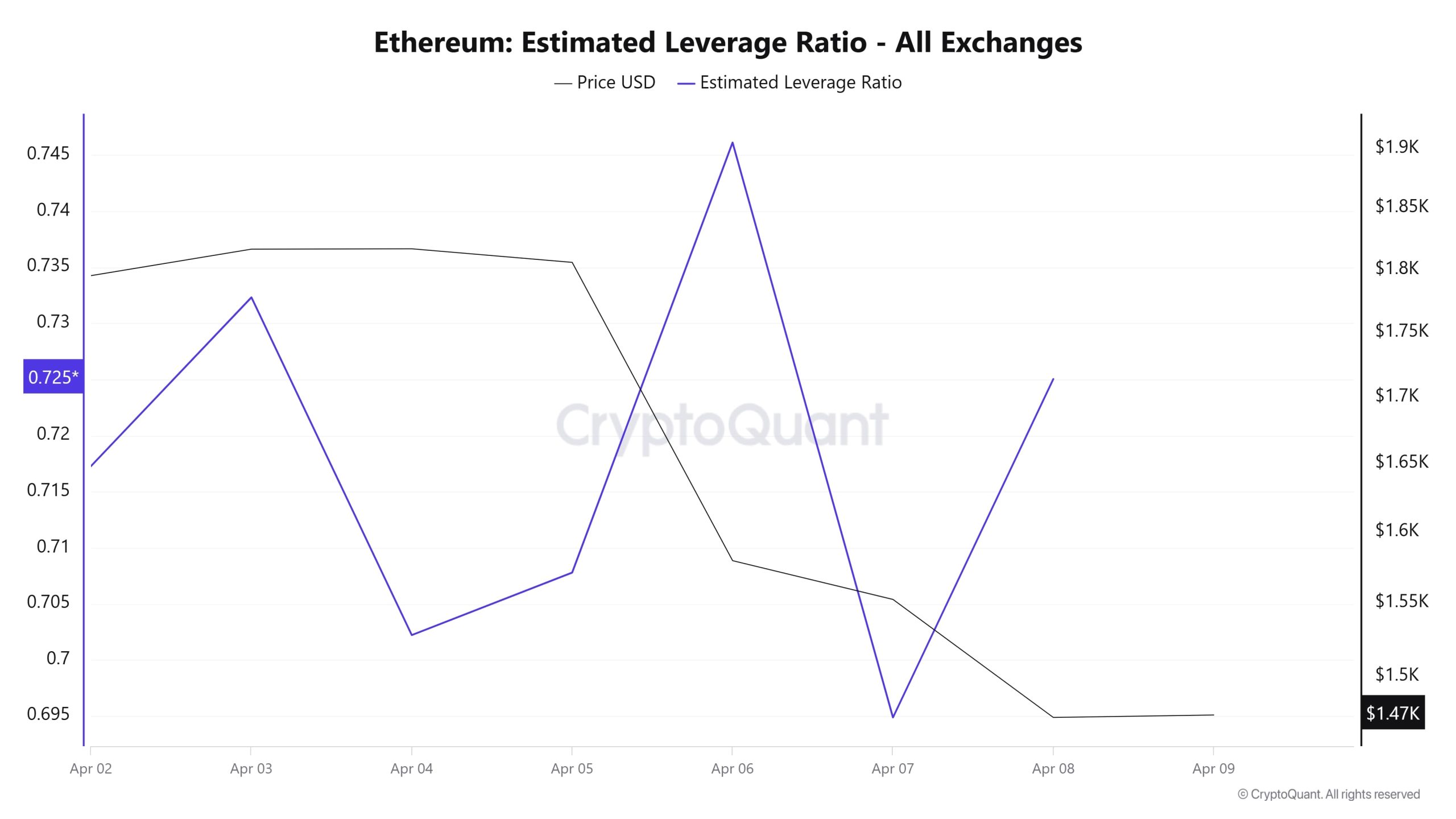

Estimated Leverage Ratio

During the entire 7-day period, the metric exhibited a turbulent movement with a lot of volatility. ELR (Estimated Leverage Ratio), which had a value of 0.717 at the beginning of the process, increased towards the middle of the process and reached 0.732, but retreated from the peak in the last period of the process and is currently at 0.725. The peak in this process was measured as 0.746 on Aprile 6. A higher ELR means that participants are willing to take on more risk and usually indicates bullish conditions or expectations. It should be noted that these rises can also be caused by a decrease in reserves. When we look at Ethereum reserves, while there were 18.24 million reserves at the beginning of the process, this figure continued to increase towards the end of the process and increased to 18.47 million. At the same time, Ethereum’s Open Interest is seen as 20.55 billion dollars at the beginning of the process. In the middle of this process, it decreased to 20.08 billion dollars. It currently stands at $ 17.04 billion. With all this data, the ELR metric did not move stably. The price of the asset moved in parallel with the open interest and fell from $1,950 to $1,450. While the increase in the amount of reserves and the decrease in the open interest rate should cause a decrease in the ELR rate, the turbulent movement of the ELR rate reveals that the bear and bull are at war on the ETH front. As a result, the increase in reserves and the decrease in open interest show that pessimism continues in this market, but considering that the accumulation is increasing with the increase in volume-based transactions, the dynamics show us that it may be bullish.

Avviso legale

Le informazioni, i commenti e le raccomandazioni sugli investimenti contenuti nel presente documento non costituiscono servizi di consulenza sugli investimenti. I servizi di consulenza sugli investimenti sono forniti da istituti autorizzati su base personale, tenendo conto delle preferenze di rischio e di rendimento dei singoli. I commenti e le raccomandazioni contenuti nel presente documento sono di tipo generale. Tali raccomandazioni potrebbero non essere adatte alla vostra situazione finanziaria e alle vostre preferenze di rischio e rendimento. Pertanto, prendere una decisione di investimento basandosi esclusivamente sulle informazioni contenute nel presente documento potrebbe non portare a risultati in linea con le vostre aspettative.

NOTE: All data used in Bitcoin onchain analysis is based on Cryptoqaunt.