In the past few weeks, the world of digital assets has witnessed some very unusual developments. We have witnessed both state leaders and global stars destabilize the ecosystem by issuing tokens.

These tokens, especially in the SOL ecosystem, raised the SOL price to 295 levels with the effect of hype at first. However, this movement, which also damaged the ecosystem, continued with the theft of nearly $ 1.5 billion of Ethereum by hacking a centralized exchange in a short period of 1 month. In this process, the SOL price dropped to 135 dollars. In the period that followed, the marginal benefit of these changes in the ecosystem influenced by both US President Donald Trump and famous names such as CZ seems to have diminished. We think that the ecosystem and SOL, which is also the local token, will gradually enter its natural process again. For these reasons, when we evaluate the price changes in BTC and the metrics based on it, we predict that SOL may target the $225 level in technical terms.

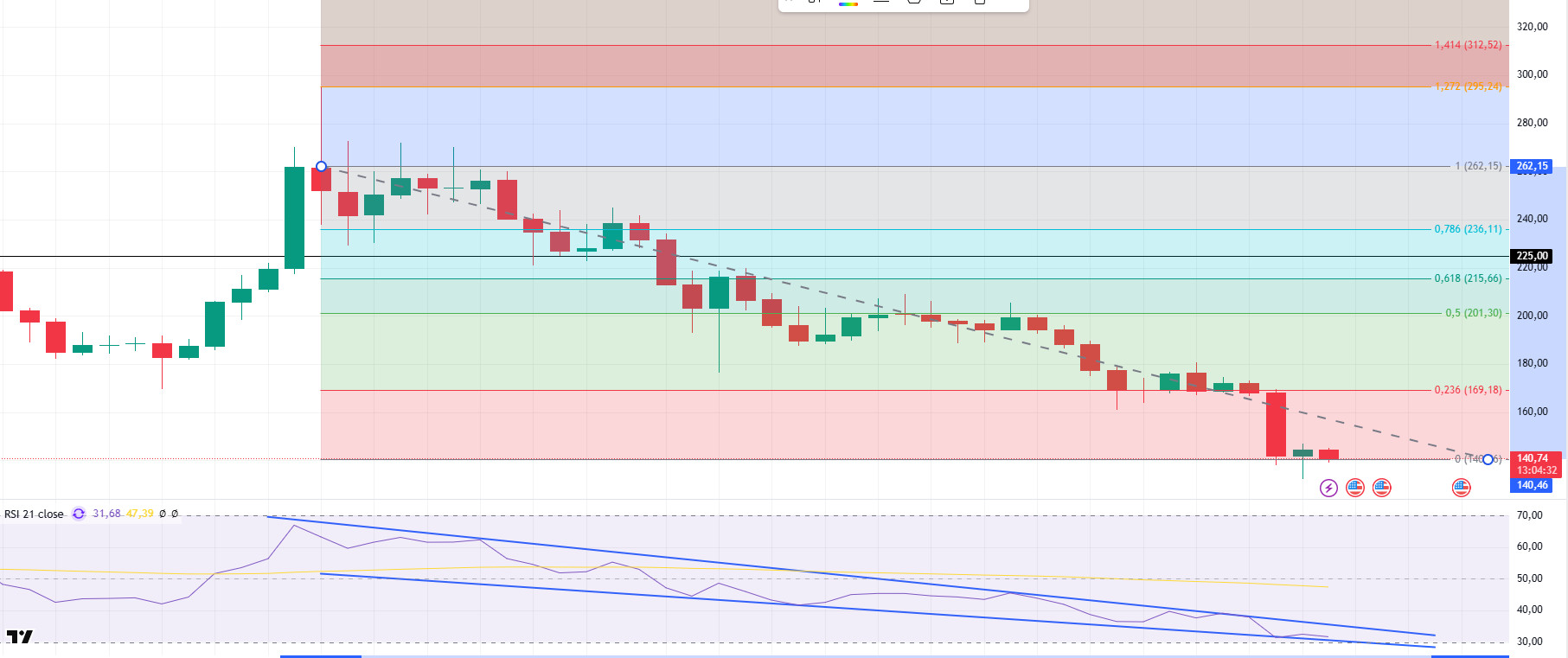

As can be seen on the daily chart, when we look at the falling wedge pattern formed in the relative strength index RSI – 21) and the fibonacci retracement, we set the $225.00 level as our target point between the 0.618 – 0.786 band, which is the retracement point of the downtrend. Considering that the asset, which is currently at $141, is also the key opening of 11.2 million SOLs on Marzo 1, it is necessary to be flexible against the possibility of a slight pullback. Considering all these data (technical and fundamental indicators), we think that the asset points to the mentioned level band, although it contains certain risks.

AVVISO LEGALE

Le informazioni sugli investimenti, i commenti e le raccomandazioni contenute nel presente documento non costituiscono una consulenza sugli investimenti. I servizi di consulenza sugli investimenti sono forniti individualmente da istituzioni autorizzate che tengono conto delle preferenze di rischio e di rendimento dei singoli individui. I commenti e le raccomandazioni contenuti nel presente documento sono di natura generale. Tali raccomandazioni potrebbero non essere adatte alla vostra situazione finanziaria e alle vostre preferenze di rischio e rendimento. Pertanto, prendere una decisione di investimento basandosi esclusivamente sulle informazioni contenute nel presente documento potrebbe non produrre risultati in linea con le vostre aspettative.