Introduzione

Bitcoin exchange-traded funds (ETFs) have played an important role in bringing cryptocurrencies to a wide range of investors. In many parts of the world, investors have been able to gain access to the asset class through ETFs rather than buying Bitcoin directly. While this trend started earlier in places like the US and Europe, it has gained momentum in the Asia-Pacific region in recent years. The Asia-Pacific region is an emerging player in the global cryptocurrency ETF market, witnessing new ETF launches, growing trading volumes and regulatory approval processes. This report provides information on the current BTC ETFs operating in the region and the growth potential of crypto ETFs.

Existing Bitcoin ETFs in the Asia-Pacific Region

The Asia-Pacific region has a rapidly growing and diversifying market for Bitcoin ETFs. In particular, ETFs traded in Hong Kong, Australia and New Zealand provide investors with direct or indirect access to Bitcoin. Below is a list of Bitcoin ETFs traded in the region:

Hong Kong Stock Exchange (HKEX)

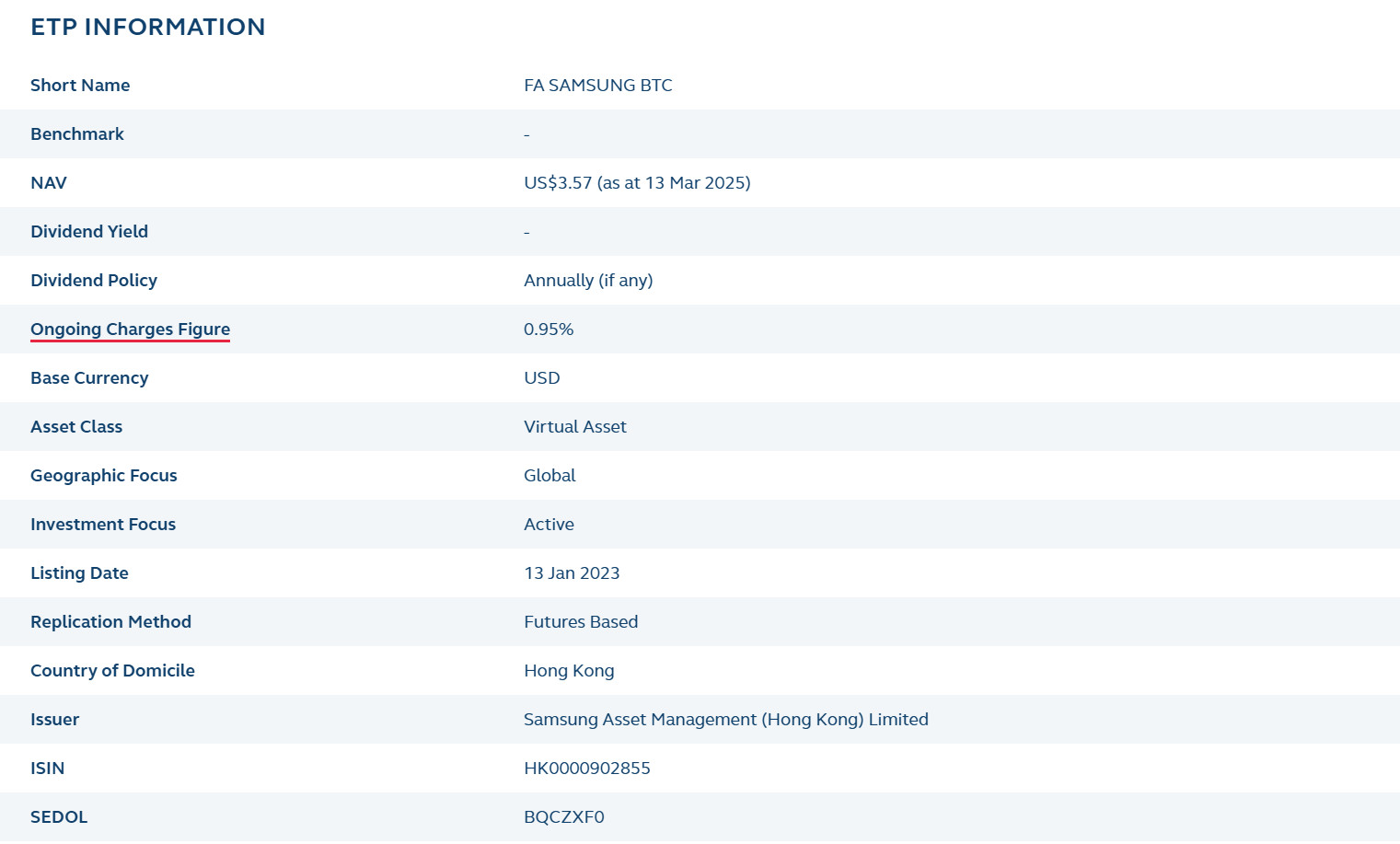

Samsung Bitcoin Futures Active ETF (3135)

- Company: Samsung Asset Management

- Inception Date: Gennaio 2023

- Fund Objective: To track Bitcoin price movements by investing in Bitcoin futures.

Source: HKEX – Market Data

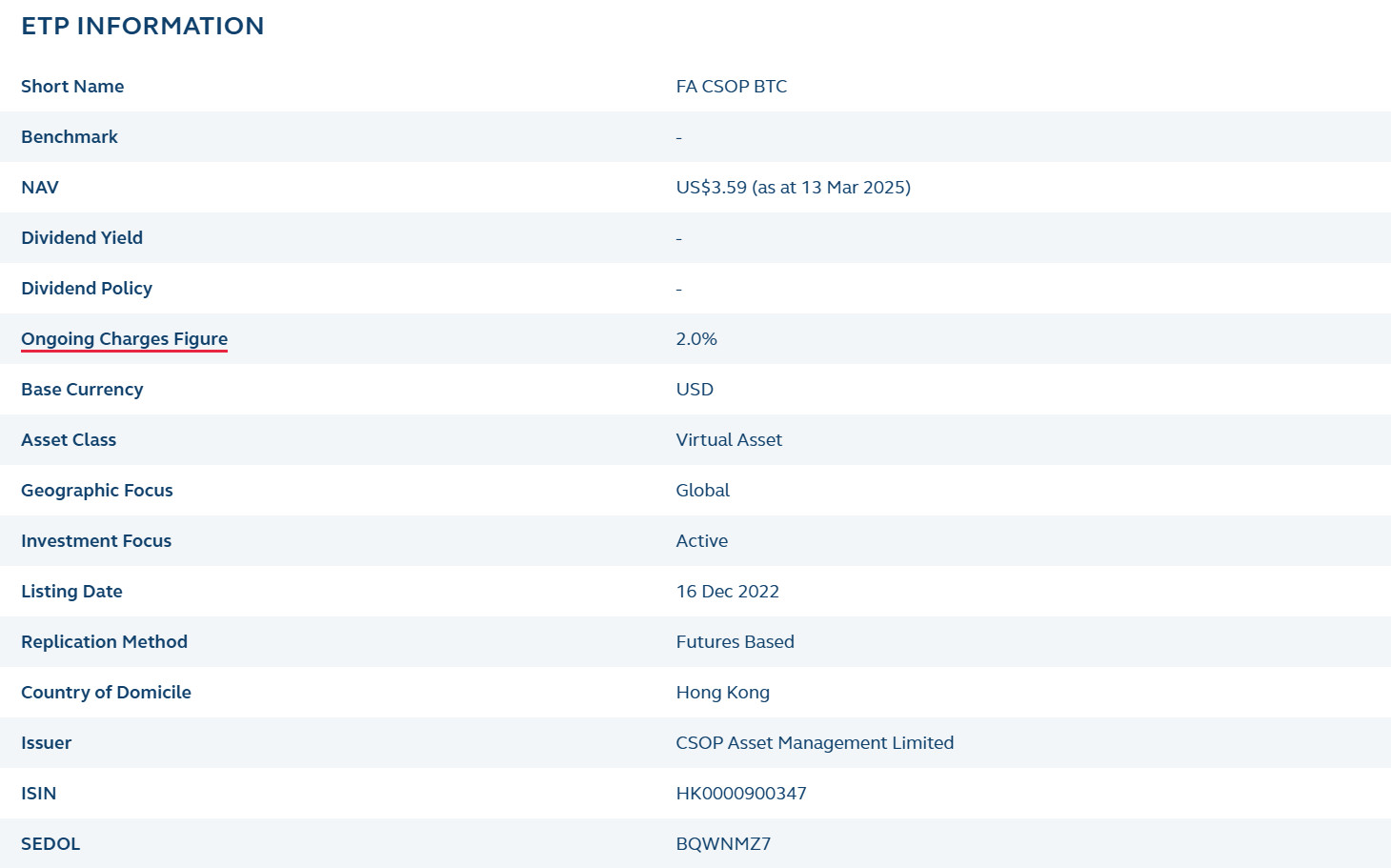

- Company: CSOP Asset Management

- Inception Date: Dicembre 2022

- Fund Objective: To provide investors with exposure to Bitcoin price movements by investing in Bitcoin futures.

Source: HKEX – Market Data

Harvest Bitcoin Spot ETF (3439, 9439)

- Company: Harvest Global Investments

- Inception Date: Aprile 2024

- Fund Objective: To follow Bitcoin price movements by investing directly in Bitcoin.

Source: HKEX – Market Data

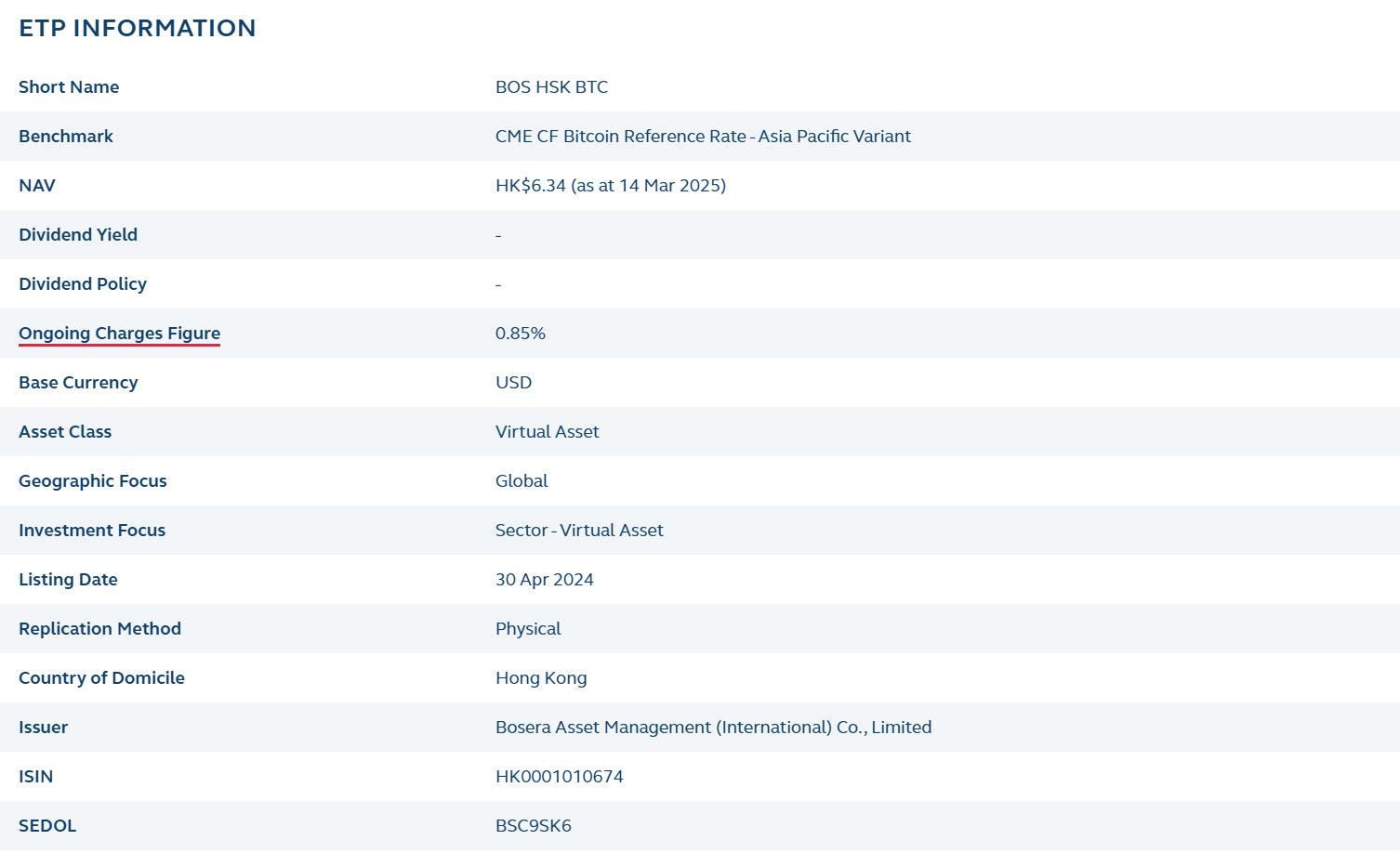

Bosera HashKey Bitcoin ETF (3008, 9008)

- Company: Bosera Asset Management & HashKey Group

- Inception Date: Aprile 2024

- Fund Objective: To provide investors with direct exposure to Bitcoin price movements by investing directly in Bitcoin.

Source: HKEX – Market Data

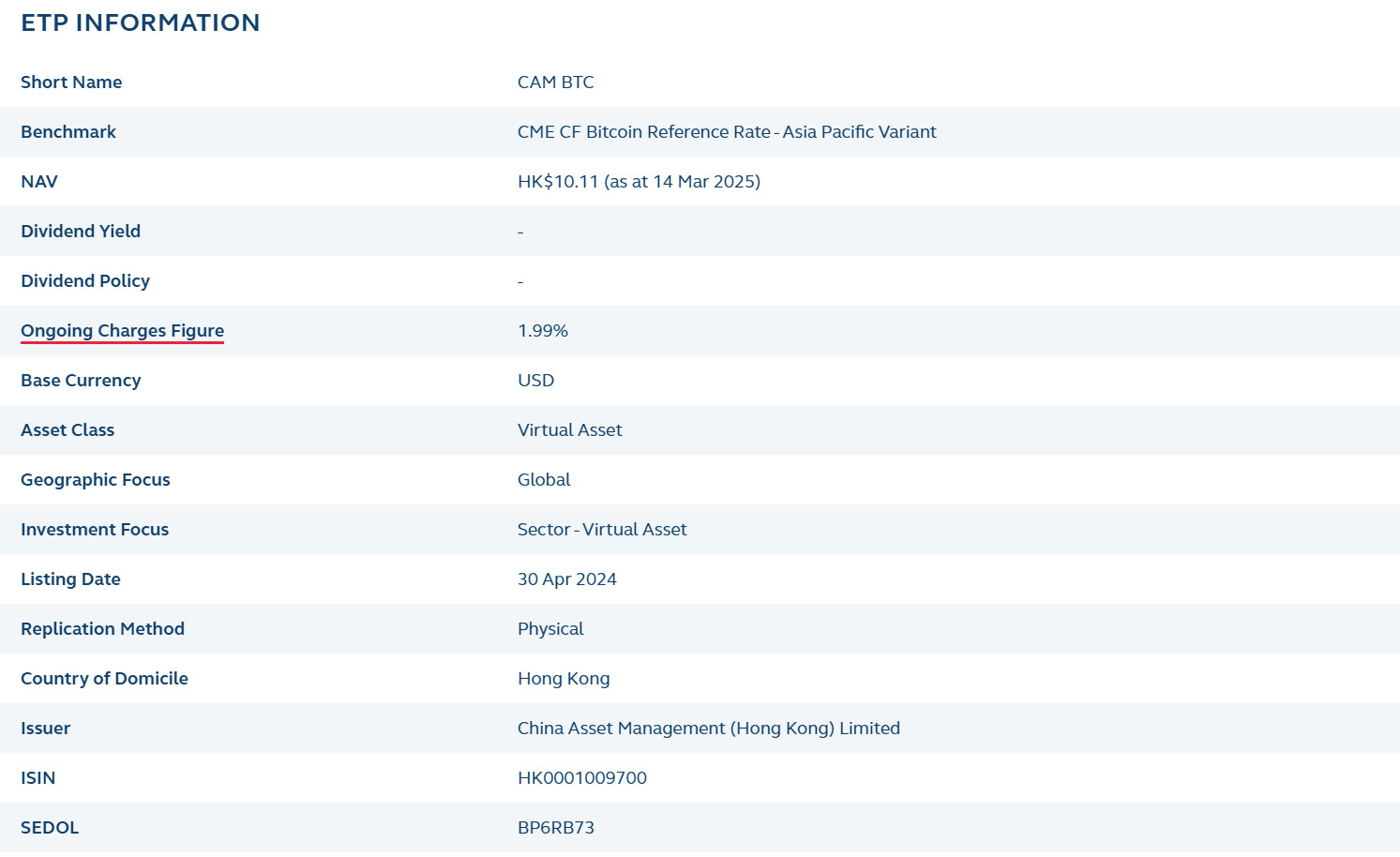

ChinaAMC Bitcoin ETF (3042, 9042, 83042)

- Company: China Asset Management Company (ChinaAMC)

- Inception Date: Aprile 2024

- Fund Objective: To provide access to investors by directly tracking the spot price of Bitcoin.

Source: HKEX – Market Data

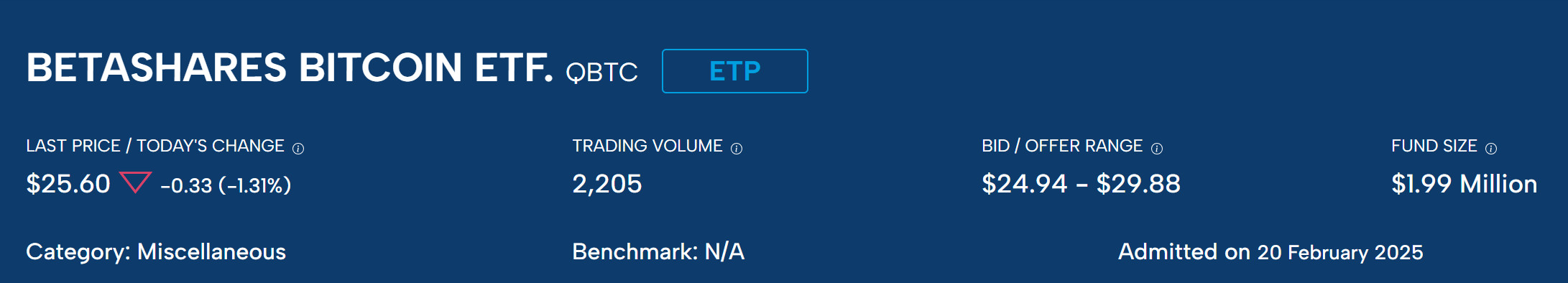

Australian Stock Exchange (ASX)

- Company: BetaShares

- Inception Date: Novembre 2021

- Fund Objective: To gain indirect exposure to the Bitcoin market by investing in crypto innovation companies.

Source: ASX – Market Data

VanEck Bitcoin ETF (VBTC)

- Company: VanEck

- Inception Date: Giugno 2024

- Fund Objective: To directly track the price of Bitcoin

Source: ASX – Market Data

DigitalX Bitcoin ETF (BTXX)

- Company: DigitalX

- Inception Date: Luglio 2024

- Fund Objective: To directly monitor Bitcoin price movements.

Source: ASX – Market Data

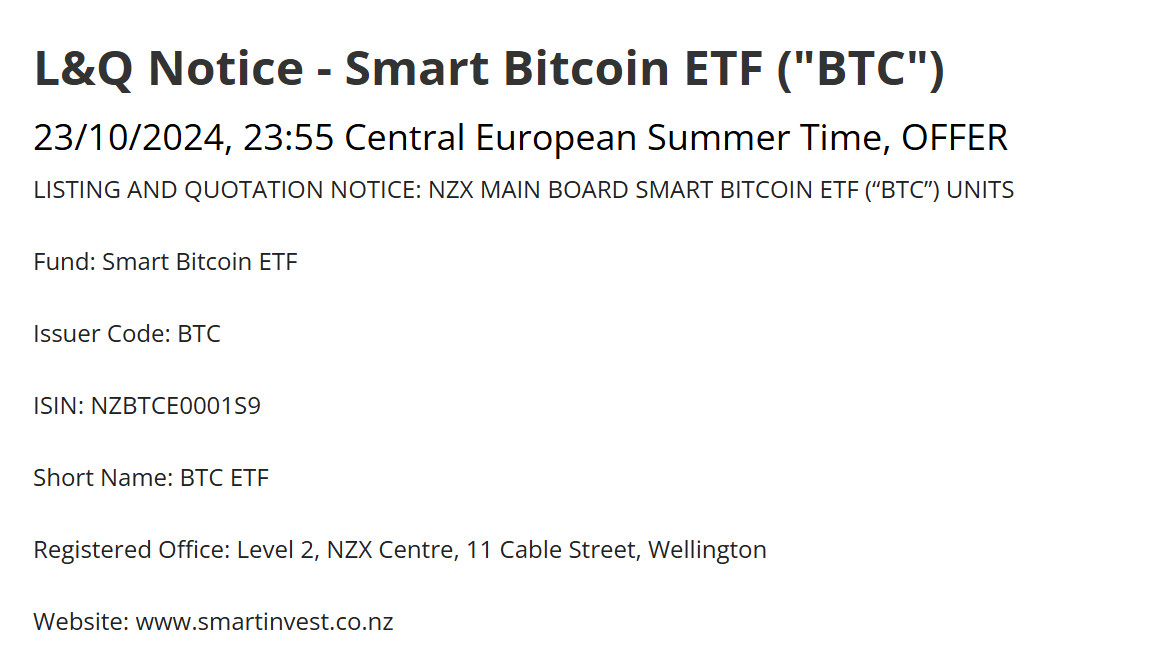

New Zealand Stock Exchange (NZX)

- Smart Bitcoin ETF (BTC)

- Company: Smartshares

- Inception Date: Ottobre 2024

Fund Objective: To follow Bitcoin price movements directly.

Source: NZX – Market Data

Growth Potential of Crypto ETFs

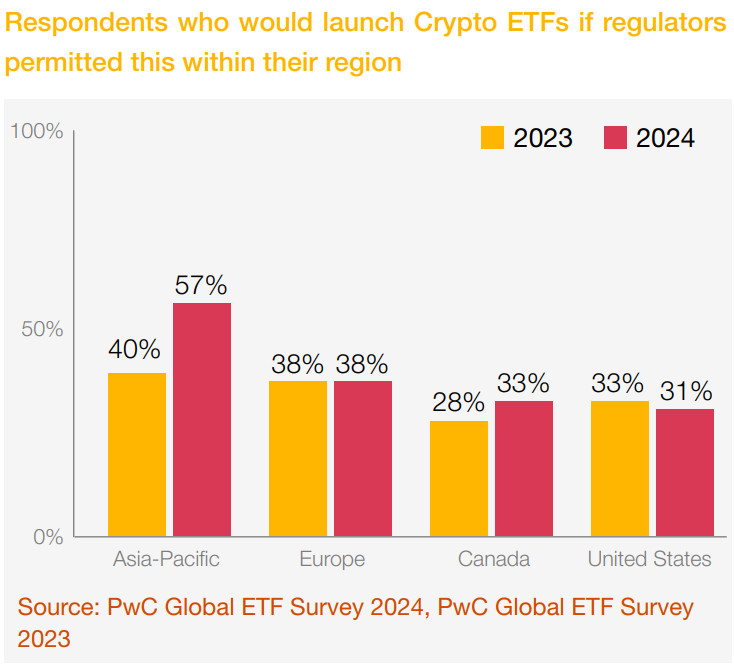

Crypto ETFs are still a relatively small segment compared to traditional financial products. However, with the removal of regulatory barriers, it is observed that they have significant growth potential globally, especially in the Asia-Pacific region.

Source: PwC ETFs 2029

According to graphical data from PwC’s Global ETF Survey 2024 and Global ETF Survey 2023 reports covering 2023 and 2024, there have been significant increases in the proportion of those planning to launch crypto ETFs if regulatory approvals are granted:

- Asia-Pacific: 40% in 2023 and 57% in 2024. This reveals that Asia-Pacific is the region with the highest growth in demand for crypto ETF launches.

- Europe: remained stable at 38%.

- Canada: 28% in 2023, rising to 33% in 2024.

- UNITED STATES: 33% in 2023, declining slightly to 31% in 2024.

In light of this data, Asia-Pacific is expected to benefit most strongly from improvements in the regulatory environment. While positive regulatory developments have been seen in the US and Canada, the stable trend in Europe suggests that crypto ETF launches have not gained momentum on this continent. The Asia-Pacific region is poised to be one of the most important points of global growth in the future, both in terms of current and potential crypto ETF launches. This rapid increase in investor demand could lead the region to take a leading position in the crypto ETF market, should regulatory frameworks improve further.

Conclusion and Future Prospects

The BTC ETF market in the Asia-Pacific region continues to expand in line with regulatory developments and investor interest. While existing ETFs offer reliable access, future ETFs will increase market diversification. The dynamic nature and growth potential in the region is noteworthy.