Introduction

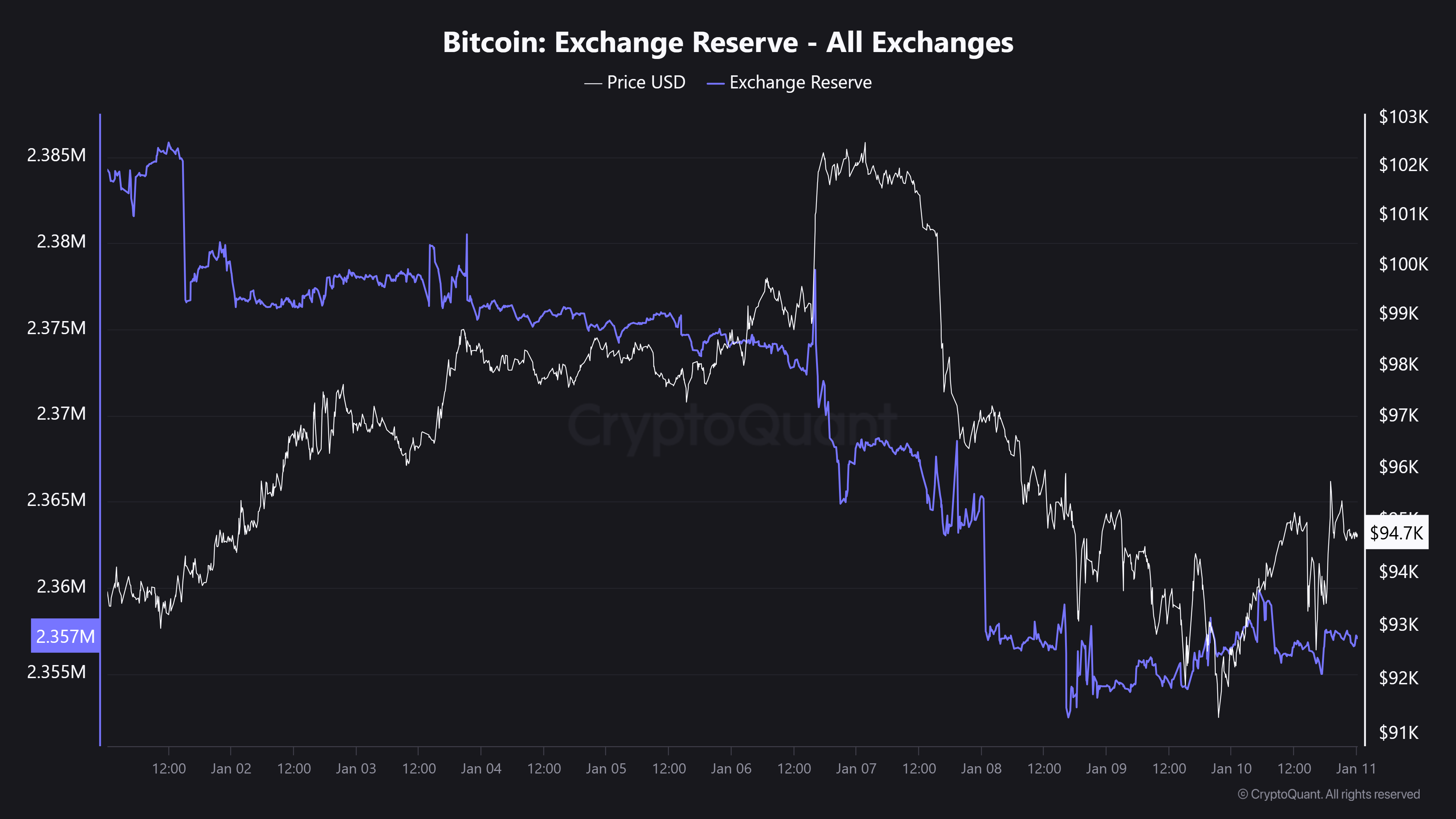

This report examines the trends observed in the change in exchanges’ Bitcoin reserves and the Bitcoin price between January 01-11, 2025. The report highlights the significant correlations between exchanges’ Bitcoin reserve levels and Bitcoin’s market price and emphasizes the impact of economic developments on these variables.

Analysis

- Ahead of January 7, 2025: Decline in Exchange Reserves and Increase in Bitcoin Price

Between January 01, 2025, and January 07, 2025, there was a steady decline in Bitcoin reserves across exchanges. At the same time, a significant upward movement in the Bitcoin price was recorded. This can be explained by the following reasons:

Declining Exchange Reserves: Investors are withdrawing Bitcoin from exchanges, indicating that assets are being transferred to long-term wallets or used outside exchanges. This reduced the selling pressure on the market and supported the price increase.

Increasing Market Demand: Continued market demand amid dwindling reserves has put upward pressure on the Bitcoin price.

- After January 7, 2025: Decline in Exchange Reserves and Bitcoin Price

Impact of Macroeconomic Factors: Economic data released in the US increased risk aversion in the markets. Investors avoided risky assets such as Bitcoin and turned to safer havens. This was one of the main reasons for the decline in Bitcoin price.

Declining Exchange Reserves: During the same period, there was an additional decline in Bitcoin reserves on exchanges. This may indicate that investors were preparing for the potential of a future recovery by withdrawing their assets from the market. However, this reduction was not enough to curb the decline in prices.

General Market Uncertainty: The simultaneous decline in reserves and prices reflects an environment of heightened concerns about the future of the market.

The volatility in the market during this period clearly demonstrates the impact of economic data and the behavior of market participants on prices.

Economic Data and Market Impact

The release of US economic data is seen as an important event that has an impact on the crypto market. Such events often lead to increased volatility as market participants react to changes in interest rate expectations, inflation reports or other economic indicators.

- Risk Aversion Behavior: Economic data, especially indicators such as interest rate hike expectations, have caused investors to turn to safer havens. This has put risky assets such as Bitcoin under selling pressure.

- Change in Reserves: Declining Bitcoin reserves may indicate that long-term investors are withdrawing from the market. However, the decline in prices suggests that buyers are abstaining and the overall market sentiment is negative.

- Short-Term Volatility: Economic data releases increased short-term volatility and caused simultaneous declines in both prices and reserves.

General Evaluation

The relationship between stock market reserves and price movements can be evaluated in the context of investor behavior and macroeconomic developments as follows:

- Long Term Perspective: The inverse relationship observed until January 7, 2025 is in line with historical trends where declining stock market reserves put upward pressure on the price. This suggests that market dynamics continue in the context of supply-demand balance.

- Short-Term Uncertainty: The declines in both reserves and prices following economic data releases suggest that macroeconomic factors play a decisive role in market sentiment.

- Investor Strategies: While the decline in Bitcoin reserves suggests that investors are acting on long-term strategies, price fluctuations suggest that market sentiment is still fragile.