BETH and Ethereum Proof of Burn

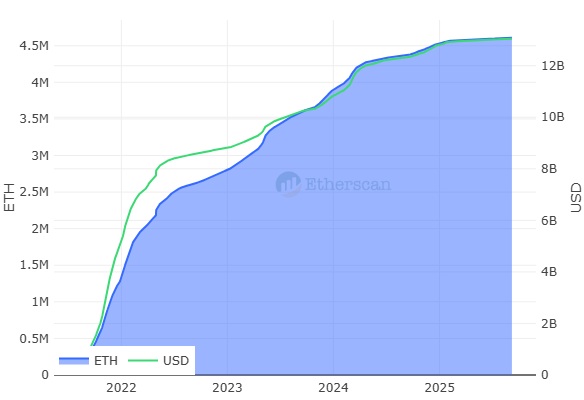

Source: Etherscan.io

The Ethereum Community Foundation launched a new token called BETH on August 28, 2025. BETH is a proof-of-burn asset that keeps an on-chain verifiable record of the amount of ETH that has been irrevocably burned on the Ethereum network. Each BETH token represents one unit of ETH permanently removed from circulation, making the burn process transparent and auditable. In this way, the burns that took place after the EIP-1559 update are moved from abstract accounting records to a tangible asset layer that investors can monitor. The foundation states that BETH aims to strengthen Ethereum’s mission to focus on ETH and solidify monetary policy in an environment where scarcity discussions are ongoing.

Technical Details and Operation

BETH is an ERC-20 token and its mechanism is quite simple. When users send ETH to the BETH smart contract, the contract sends it to an irrecoverable burn address and simultaneously mints and returns BETH to the user for the amount of ETH sent. Therefore, when 1 ETH is burned, 1 BETH is received (1:1 ratio). Initial on-chain observations indicate that BETH minting is limited for now and only a small number of addresses are testing the mechanism.

The minting process is entirely driven by the smart contract code. The contract’s immutable code redirects the sent ETH to an irrecoverable burn address, such as 0x000…000, and only when this happens is the BETH minting done. No other privileged address or administrative intervention is authorized to mint. Therefore, BETH leaves a definitive record on-chain in exchange for a given ETH burn; users can then trade this BETH but cannot redeem it directly back into ETH. BETH is therefore not a reserve-collateralized asset or a 1:1 redeemable cover of ETH. It functions as a receipt representing on-chain proof of ETH burned.

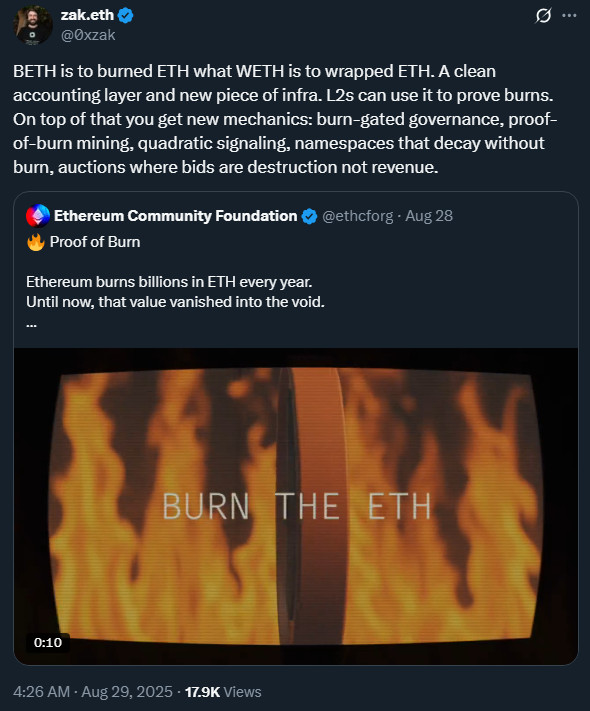

In the Ethereum community, BETH’s design has sometimes been compared to WETH (Wrapped ETH). Zak Cole, founder of ECF and Ethereum developer, has said that BETH is “WETH for burned ETH” and emphasized that BETH provides a clean layer for tracking burns, just as WETH moves ETH to a standard interface in smart contracts. Thanks to this architecture, the BETH contract records mint and burn transactions in a clear and provable way; all transactions are archived on the Ethereum blockchain. Thus, it is publicly verifiable which burn transaction each BETH token is associated with.

Investors and Market Impact

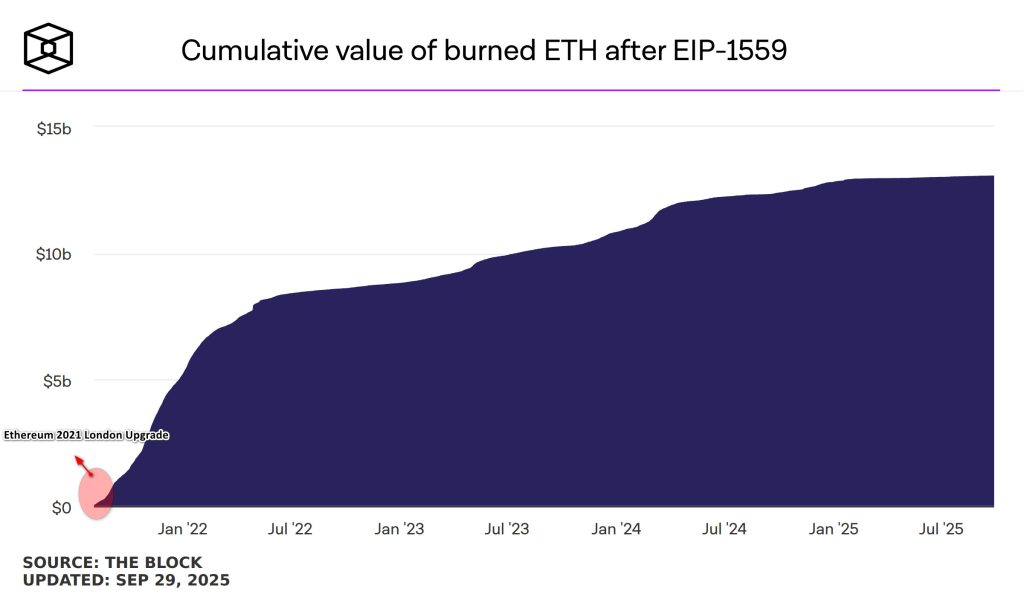

Source: Theblock.co

The introduction of BETH could strengthen investor confidence by making Ethereum’s deflationary mechanism visible. With the 2021 London update (EIP-1559), Ethereum started to automatically burn some ETH in every block, but the process did not provide users with a visible output. Thanks to BETH, “the burning process now leaves a tangible trace on the chain”; for example, the data that 4.6 million ETH was burned is now converted into BETH tokens, making it a clear proof-of-burn. In the market, this could give investors clear signals of deflationary supply dynamics.

Embodying Ethereum’s deflationary story is also seen as important for institutional interest. By making Ethereum’s burning activities auditable, BETH provides a new benchmark for investors’ portfolio allocation and risk analysis. For example, as a “burn receipt”, BETH can be used as a collateral indicator or price discovery tool in DeFi protocols. As institutional-level Ethereum ETFs and staking funds increase, the verifiability provided by BETH could be valuable for institutional risk management. Some analysts think that BETH could position Ethereum as a stronger deflationary asset; since each BETH represents ETH coming out of circulation, investors can directly monitor the supply contraction.

Source: Ultrasound.money

However, it is unclear how the market will appreciate the value of this new model. BETH has no additional asset reserve behind it; its value depends on the economic value of the ETH at the disposal of the investor who buys it and the liquidity in the market. Some experts therefore warn that BETH could weaken the deflation effect or create a speculative asset class. On Ethereum, for example, while around 4.6 million ETH have been burned since 2021, more than 8 million new ETH have been issued in the same period. This still paints an inflationary picture of total supply, and the emergence of BETH has reignited debate about Ethereum’s supply dynamics.

In light of these developments, there is a debate within the Ethereum community. While some see BETH as a “necessary step to bring scarcity to Ethereum”, others believe that it can only mislead users into a delusion. The foundation and the developer community emphasize that there are strong experiments and transparent code principles behind BETH. For example, the editors of BeInCrypto wrote that BETH is a “proof-of-burn building block” that can be used in voting and incentive models.

Criticisms and Debates

The launch of BETH has resurfaced deep debates about Ethereum’s monetary policy. Zak Cole, founder of the Ethereum Team Smart Contracts community, stated that BETH should not be treated as an appreciating asset; it should be viewed purely as proof of burn, not as a new asset. According to him, BETH serves as a receipt that defines “representative rights” to the burned ETH and cannot be directly converted back into ETH.

So far, economists and analysts have different views on the implications of the post-EIP-1559 burn rate. On the one hand, Ethereum’s token model is still not seen as aggressive enough to ensure a net scarcity, but on the other, investors are looking for new mechanisms to close the gap. Some critics argue that the reappearance of out-of-circulation ETH as BETH could call into question Ethereum’s “true deflation” story.

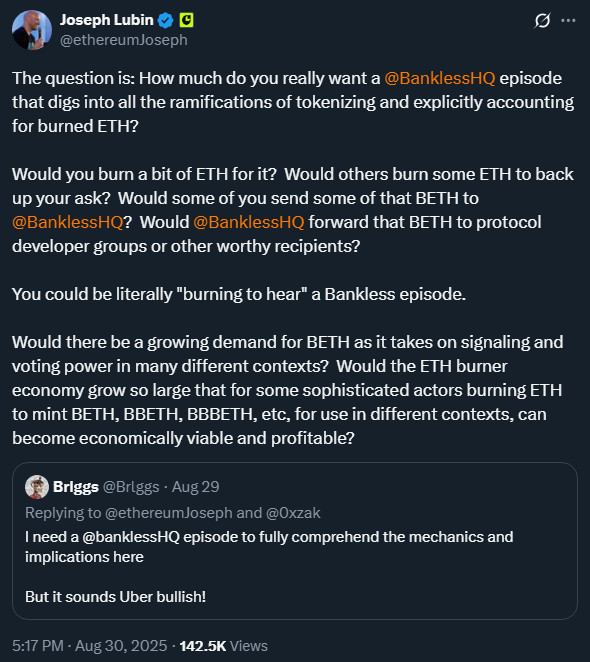

On the other hand, project supporters believe that this experimental structure will open new avenues of financial coordination in the long run. “Burning ETH on Ethereum will become very profitable, new industries will emerge,” said Joseph Lubin, one of the founders of Ethereum. According to Lubin, BETH is a mechanism that will popularize the act of burning in Web3 games and allow players to earn income by burning. This approach aims to bring a “creative scarcity” logic to the Ethereum ecosystem, not a deflationary one.

Future Plans

The Ethereum Community Foundation announced that the BETH launch is just the beginning. Additional token variants such as BBETH and BBBETH are also being worked on, according to the announcement. These future tokens could, for example, be building blocks that could separately track different types of burns (in-app burns, protocol-level burns, etc.). Foundation officials stated that this proof-of-burn layer could be differentiated as needed, allowing for more refined price discovery in secondary markets. In summary, BETH has demonstrated that a proof-of-burn can be tokenized and has turned this idea into a platform. The developer community plans to continue different projects and experiments using the BETH infrastructure.

Application Areas and Economic Impact

BETH offers many new use cases across the ecosystem. In financial protocols, BETH can function as collateral or a store of value, as it transforms the “intangible burn” of ETH into a tangible asset. For example, lending platforms can accept BETH as an asset that can be lent and borrowed; derivatives markets can design contracts that reference the BETH burn totals. Foundation documents and analyses place particular emphasis on integrating BETH into governance mechanisms. Developers are discussing building systems that give BETH token holders voting rights over burning. Similarly, auctions could be structured with burning-based bidding, meaning that participants could burn ETH to bid and compete.

Gaming and loyalty economies could also develop mechanics that fit the burn-to-earn model. As Joseph Lubin points out, the BETH mechanism could become a popular form of interaction in Web3 games, where players collect BETH by burning ETH instead of rewards, and redeem these BETH for in-game benefits or tokens.

In economic terms, BETH enters the market as an active market signal, not a passive supply reduction. Portfolio allocators can now factor in burn data; for example, bank boards or institutional investors can refer to BETH data to have accurate transparent data on Ethereum supply. The value of BETH is determined by the amount of burn behind it and market liquidity, which can lead to price volatility and parity divergence. Risk management therefore becomes important. Issues such as collateralization criteria, liquidation mechanisms and liquidity provision should be carefully considered. BETH’s legal status and regulatory framework is also unclear, as BETH is a proof token based on burned ETH and its trading may be subject to regulatory scrutiny.

Conclusion

As a result, BETH has made the network’s supply dynamics visible by moving Ethereum’s burning process to a transparent and programmable asset layer. For investors, BETH has become a verifiable receipt of burned ETH, and for developers, the infrastructure for new products and mechanics. With the right security practices and sufficient liquidity, the BETH model could, in the long run, make the balance between burning and minting on Ethereum manageable through market mechanisms. This could mean clearer signals for capital allocation and a more mature market infrastructure. Of course, BETH is still an experimental endeavor; its success depends on developer innovation, community adoption and market reaction. But one thing is certain: it has opened an important debate, bringing a new dimension to the discussion of Ethereum’s deflationary mechanism.