Introduction

Recently, Avalanche has been gaining prominence not only for its technical capabilities but also for the bridges it has built with institutional capital. In particular, the interest in tokenization of real-world assets (RWA) and the increasing volume of transactions has placed the network at the center of growth.

Source: https://x.com/avax

During 2025, names such as Visa, Circle, VanEck and Skybridge stepped into the Avalanche ecosystem, transforming the network from an alternative Layer-1 to a platform that has direct contact with the financial world.

In this report, we look at the fundraising process launched by the Avalanche Foundation, the reasons behind investor interest and the potential impact on the ecosystem.

Avalanche Foundation’s Fundraising Plan

The Avalanche Foundation aims to raise a total of $1 billion. The aim is for AVAX to gain a stronger foothold among institutional investors and provide liquidity to the ecosystem.

Source: https://x.com/AvalancheFDN

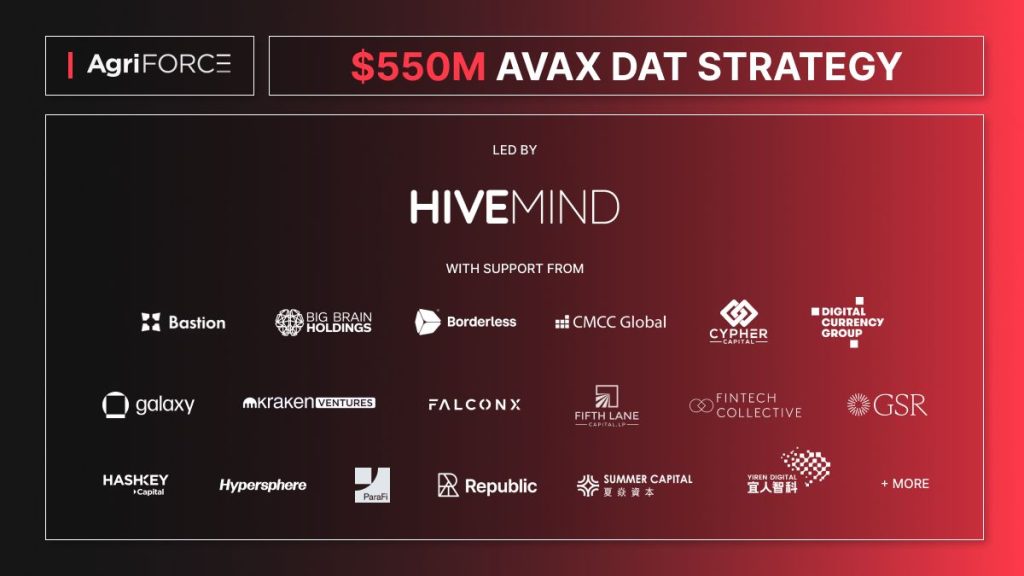

AgriFORCE, which was initially traded on Nasdaq, was transformed into an Avalanche-focused structure under the name “AVAX One”. It is expected to raise 550 million dollars in funding. This model is an industry first for a public company to connect directly to the Avalanche ecosystem.

Source: https://x.com/agriforcegs

The second phase is to raise an additional $500 million through a SPAC led by Dragonfly Capital. If successfully completed, this move will further strengthen the link between the US capital markets and Avalanche.

A significant portion of the funds raised will be dedicated to AVAX token purchases. This has a twofold benefit:

- It provides cash flow to the Avalanche Foundation and the cash flow will be used to support projects in the ecosystem

- Institutional investors will give a vote of confidence to the ecosystem by adding AVAX to their balance sheets with a long-term accumulation strategy

This funding plan is not just a short-term financing quest. At the same time, it stands out as a strategy that strengthens Avalanche’s role as an institutional bridge and aims to establish permanent ties between capital markets and the Web3 world.

Investors and Reasons for Avalanche

There are three major players that stand out in Avalanche’s fundraising plan. These are Hivemind Capital, Dragonfly Capital and Anthony Scaramucci’s SkyBridge Capital. Their interest in Avalanche is driven not only by the search for short-term gains, but also by long-term strategic goals and a strong vision of the future.

One of the most attractive aspects of Avalanche for investors is its high performance and low cost structure. The network can complete thousands of transactions per second at low fees. Mark Phillips, founder of Grove Labs, summarizes the reasons for choosing Avalanche as “high performance, low transaction cost and transaction certainty”. These features make Avalanche stand out, especially in areas such as corporate credit and asset management.

In addition, Avalanche’s tokenization capability is one of the most important factors that attract investors. Thanks to its subnet architecture, companies can tokenize RWA by establishing their own private chains. The tokenization of the KKR fund on Avalanche and the cooperation with Centrifuge have been strong examples of this capability. This makes Avalanche a reliable option for institutional investors looking for regulatory compliant infrastructure.

One of the most notable steps is AgriFORCE’s “AVAX One” transformation, which allows traditional investors to enter the ecosystem without having to buy tokens. Thus, investors who do not want to buy tokens directly can participate in the Avalanche ecosystem in a different way. This approach creates a permanent bridge between blockchain and traditional capital markets.

In addition, RWA-focused partnerships are also increasing the interest of institutional investors. Collaborations such as Grove Labs and Centrifuge demonstrate that Avalanche is becoming a network that facilitates the representation of real-world assets on the blockchain. Such projects help institutional actors diversify their portfolios and serve their long-term capital strategies.

Source: https://x.com/avax

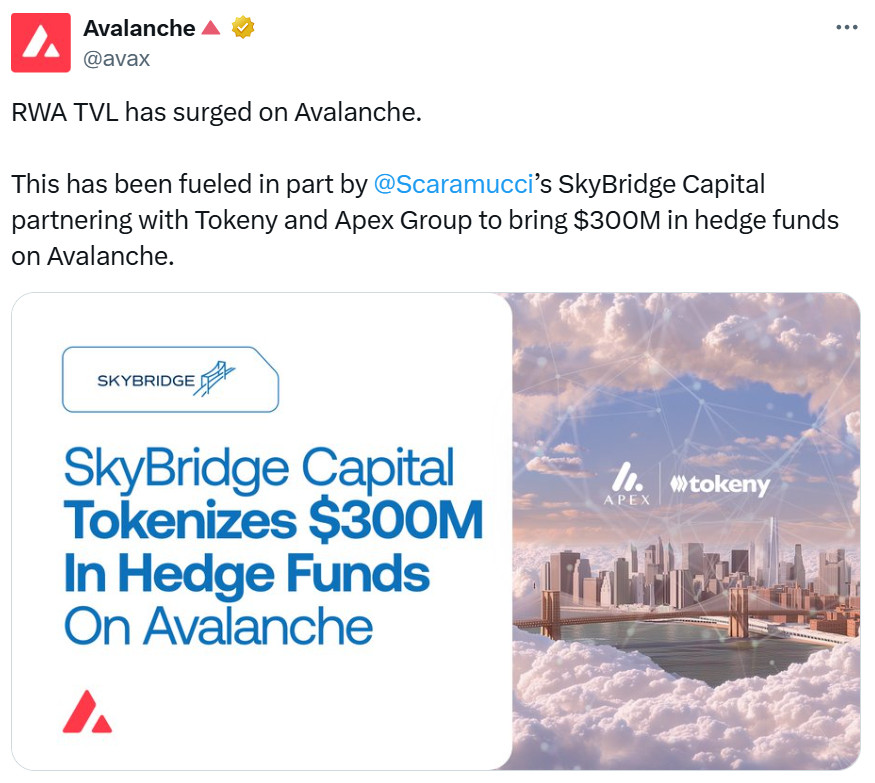

SkyBridge Capital is an important part of this vision. By tokenizing its $300 million hedge fund on Avalanche, the company both increased the interest of institutional investors and contributed to Avalanche becoming one of the preferred addresses for moving real assets to the chain.

In short, Avalanche is on the radar of institutional investors thanks to its technical capacity, tokenization power and the trust it has gained in the business world. These steps make it not only a blockchain network but also the capital bridge of the future.

Impact on AVAX Ecosystem

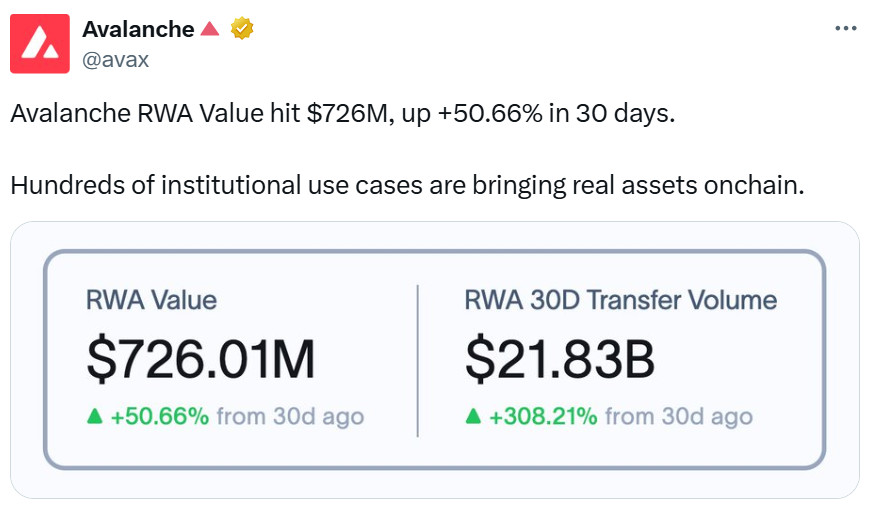

There has been a remarkable momentum in the Avalanche ecosystem in recent months. Total locked assets (TVL), which was around $1 billion in April 2025, reached $2.1 billion as of September. Institutional capital inflows, projects in the gaming ecosystem, and updates to the network have played an important role in this increase.

The fundraising process and incoming investments were also reflected in the AVAX price. Following the news, the token gained more than 10% in a short period of time and rose above the $30 level. This showed that corporate initiatives have a direct positive impact on price and liquidity. Increased trading volume and reduced circulating supply created upward pressure for AVAX.

Growth also accelerated on the DeFi side. A significant portion of Avalanche’s TVL is still provided over protocols such as Aave and Benqi. The entry of institutional funds into the ecosystem could both increase the amount of assets in existing DeFi applications and encourage the emergence of new projects. In addition, Avalanche stands out in the tokenization of real-world assets (RWA). With partnerships such as the Avalanche Vista program and SkyBridge, a wide range of assets from hedge funds to securities are being moved to the chain. New funding could increase financing in this area and strengthen Avalanche’s role in traditional financial markets.

Source: https://x.com/avax

Decentralization is one of the determining factors in the healthy growth of the ecosystem. Today, the Avalanche network has a strong decentralized structure with more than 155 thousand delegators and over 1,700 validators. Instead of undermining this decentralized structure, institutional capital inflows are encouraging more participation and trust. These developments may bring price and liquidity gains for AVAX in the short term, and in the long term may strengthen its competitive edge against major competitors such as Avalanche, Ethereum and Solana.

General Evaluation

The Avalanche Foundation’s fundraising initiative is not just a financing move. It is a permanent bridge between traditional finance and Web3. In the short term, this process may support the AVAX price and ecosystem liquidity. In the long term, however, the measure of success will be whether the capital raised is channeled into real projects, into user-facing applications.

Institutional capital interest is a strong signal, but competition is fierce: Ethereum has the regulatory advantage, while Solana is growing fast with broader community support. Avalanche’s rise to prominence depends on its ability to sustain RWA tokenization and corporate partnerships.

Source: https://x.com/avax

As a result, Avalanche has entered a new phase of Layer-1 competition by 2025. If the funding plan is successful, AVAX could become not just an ecosystem token, but an asset on corporate balance sheets.