Introduction

BNB (Build and Build) emerged as the native cryptocurrency of the Binance ecosystem and has evolved into a strategic asset used for transaction fees and governance processes. BNB Chain is an Ethereum Virtual Machine (EVM)-compatible layer that executes smart contracts. This structure enables Ethereum-based applications to be easily migrated to BNB Chain while offering users the advantages of low costs and high speeds. The system, which can produce a block every three seconds on average, provides the scalability required by the Web3 world.

BNB Chain’s security is based on the Proof of Staked Authority (PoSA) mechanism. In this hybrid model, both the amount of BNB staked and the authority of the validators come into play. Validators with the most BNB staked gain the right to produce blocks, while the system’s limited number of validators increases network speed. Transaction fees are paid in BNB, and since no new tokens are minted, there is no inflationary pressure. Additionally, Binance’s regular automatic burns reduce the BNB supply over time, ensuring long-term sustainability for the token economy.

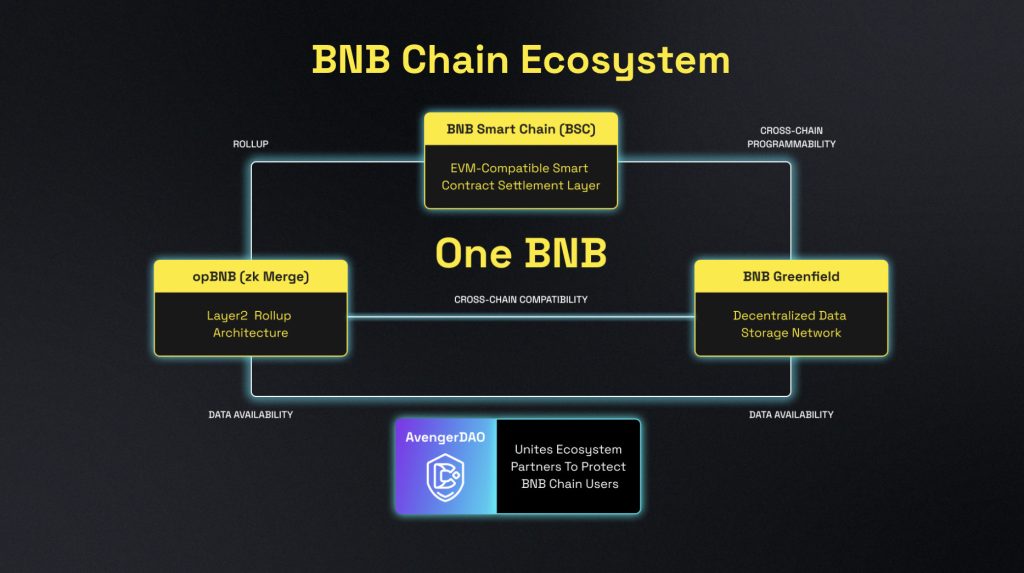

The BNB Chain ecosystem consists of three main layers:

- BNB Chain: A robust infrastructure for Decentralized Finance (DeFi) applications

- opBNB: A Layer-2 solution that enhances transaction capacity

- BNB Greenfield: On-Chain Data Storage

All these layers are interconnected under the “One BNB” vision and enable cross-chain compatibility across the ecosystem.

Source: https://docs.bnbchain.org/#chains

BNB Chain Ecosystem Performance Review

Today, BNB Chain stands out not only for its technical capabilities but also for the wide range of use cases it offers. From DeFi protocols to Non-Fungible Tokens (NFTs) and gaming applications, and from data storage to AI integration, numerous innovative solutions are being brought to life within this ecosystem. With over 20 million BNB staked and tens of thousands of delegates, the strong community support enhances the chain’s security while reinforcing its decentralized structure.

In short, BNB Chain has secured a solid place in the Web3 world by combining speed, low costs, and a broad ecosystem. Continuing to offer new opportunities to both developers and users in line with its “Build and Build” philosophy, this ecosystem will play a critical role in the growth of decentralized applications in the coming period.

In addition to centralized exchanges, BNB Chain also holds a strong position in the Decentralized Finance (DeFi) space. With its large user base, high capital turnover rate, and extensive DApp ecosystem, it demonstrates a strong presence not only in transaction volume but also in innovative product diversity. In this regard, BNB Chain has established itself as a reliable alternative ecosystem for both investors and users.

When compared to its competitors based on Total Value Locked (TVL), it forms the third largest ecosystem in DeFi. Ethereum network ranks first with a TVL of $89 billion, Solana ecosystem ranks second with a TVL of $10.36 billion, and BNB Chain ranks third with a TVL of $7.47 billion.

In the DeFi ecosystem, which has a total TVL of approximately $149 billion, BNB Chain’s TVL of $7.47 billion accounts for approximately 5% of the total.

Source: https://defillama.com/chain/bsc

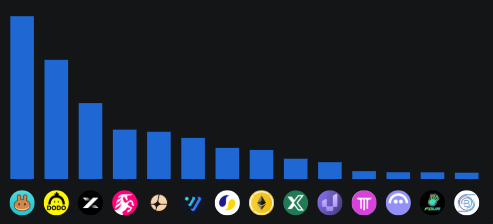

While the average daily chain fee rate hovers around $400K, approximately 10% of this is calculated as the network’s direct revenue. This volume is primarily driven by the use of Decentralized Applications (DApps) that fuel the DeFi ecosystem.

DApps on the BNB Chain offer users many opportunities such as lending, staking, liquidity management, launchpad, and trading. Transactions take place on the network as users take advantage of these opportunities. These transactions generate fees on DApps and directly support the network’s sustainability and revenue stream.

Source: https://defillama.com/chain/bsc

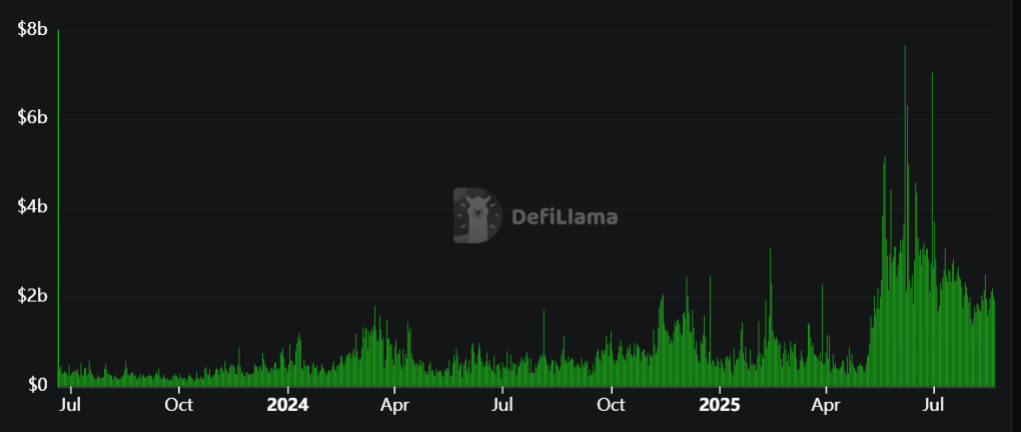

Looking at the data on the graph, we can see that activity on DEXs has increased approximately sixfold over the past year. The May 2025 period stands out as the starting point of this upward trend. After this date, there has been a noticeable acceleration in on-chain transaction volumes and user engagement, indicating that the growth of the BNB Chain ecosystem on the DeFi side is accelerating.

Source: https://defillama.com/chain/bsc

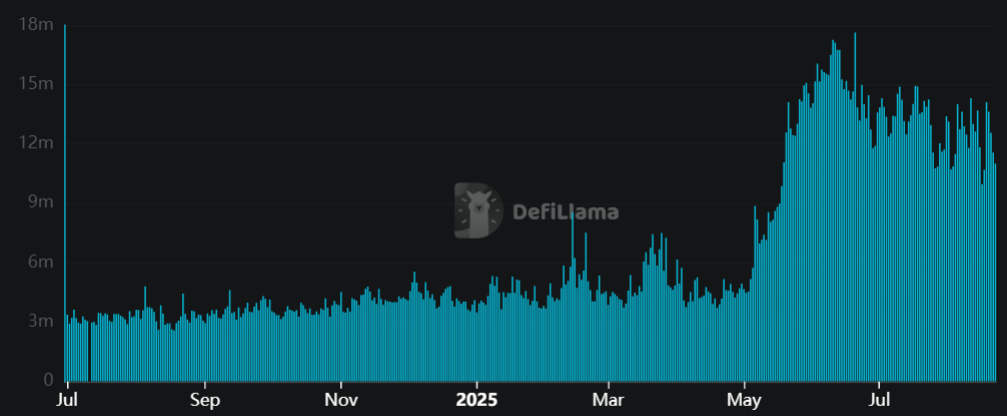

When examining the impact of volume on DApps on the network’s total activity, it can be seen that transaction rates on the network have increased by approximately 8 times on average over the past year, parallel to the increase in DEX volumes. This reveals that the growth in DApp usage directly fuels transaction intensity on the chain and plays a critical role in the scalability of the ecosystem.

Source: https://defillama.com/chain/bsc

BNB Chain Project Reviews

Over the past year, the BNB Chain ecosystem has hosted numerous new projects across various sectors, including decentralized finance (DeFi), gaming, meme, NFTs, and infrastructure solutions. BNB Chain’s low transaction fees, high speed capacity, and developer-friendly structure offer an attractive environment for entrepreneurs and investors, while the diversity of projects launched on the chain highlights the ecosystem’s dynamism. During this period, projects that generated short-term hype as well as those aiming for long-term sustainability caught attention. New-generation applications that have captured users’ interest extend beyond financial tools, creating a broad use case through gamification and Web3 integration. This analysis will examine projects that emerged on the BNB Chain over the past year, providing a comprehensive review of their technical features, use cases, and roadmaps.

MemeCore

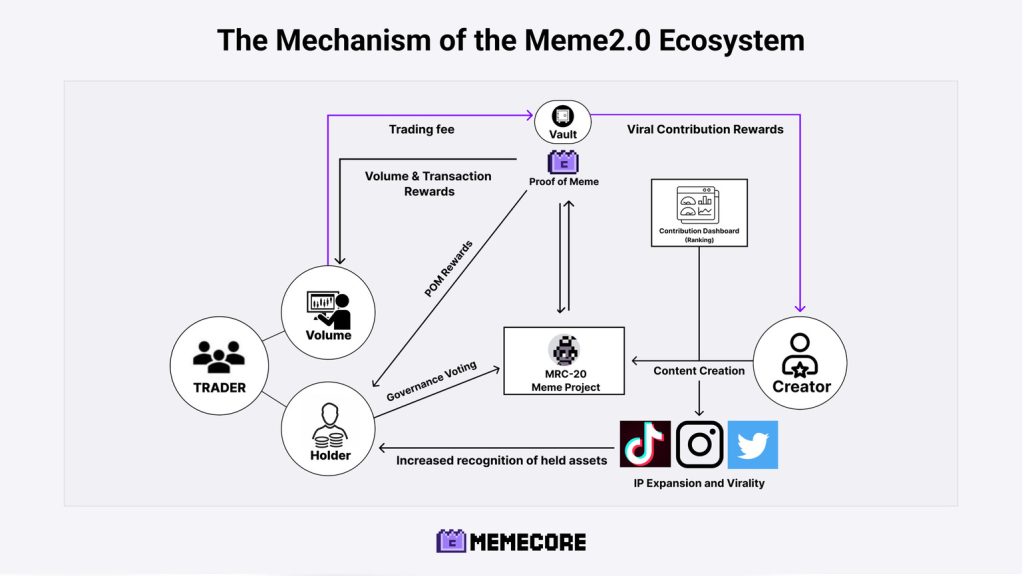

MemeCore stands out as the first EVM-compatible Layer-1 blockchain designed to advance the “Meme 2.0” paradigm. While most traditional memecoins have evolved into short-lived, speculation-driven projects, MemeCore aims to break this trend. All users, traders, validators, and stakers participating in its ecosystem are considered important contributors. MemeCore has developed a transparent on-chain “Contribution Protocol” that measures cultural and economic contributions, rewarding both the viral spread of meme content and economic activity on the chain to create a sustainable “viral economy.”

MemeCore’s unique consensus mechanism is called “Proof of Meme (PoM).” This system rewards not only block production but also cultural contributions such as the creativity of meme content and user interaction. Currently, the PoM-based infrastructure is implemented using the PoSA (Proof of Staked Authority) system. During a specified epoch (e.g., one day), selected validators ( ) produce blocks, and at the end of the epoch, new validators are elected through voting. With each block production, M tokens are minted, and these rewards are directed to the validator contract. Additionally, validators that fail to meet performance criteria (e.g., node downtime or failure to produce blocks) are penalized through a slashing mechanism.

From an economic incentive perspective, an Meme Vault is automatically created when each MRC-20 meme token is created. This vault is designed to reward creators, community members, and token holders within the ecosystem. Additionally, 10% of block rewards are allocated to the “Viral Grants Reserve” to provide additional funding to projects that meet specific criteria.

MemeCore’s roadmap consists of three phases:

- Phase 1: The initial launch of MemeX, “Ants Maker” v2, and early development and promotional activities such as the Telegram bot Memechellin Guide V1.

- Phase 2: The launch of expanded partnership versions of MemeX, Memechellin Guide V2 (TG Mini App), and the initial launch of Every Swap aim to reach a broader audience.

- Phase 3: Achieving the Tam Meme 2.0 standard; completion of the PoM consensus, development of services such as MemeX and Memechellin Guide (mobile application).

Bio Protocol

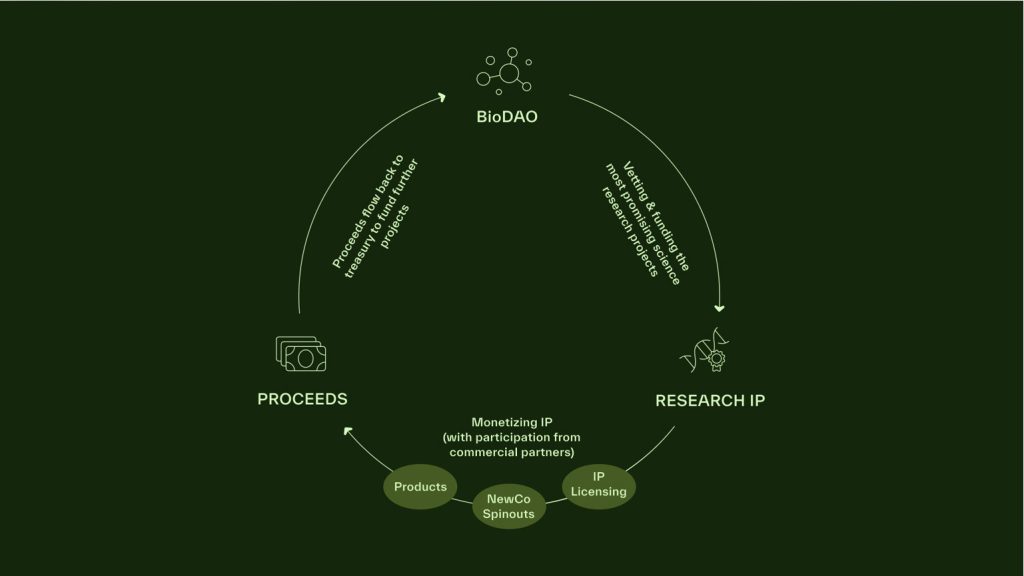

Bio Protocol (BIO) is a blockchain-based decentralized science (DeSci) platform designed to fund, coordinate, and develop biotechnology and medical projects. It aims to support scientific research in its early stages, democratize funding in areas such as rare disease research, and bring together researchers, investors, and community members. This platform operates through blockchain communities called BioDAO and rewards participants with point systems such as BioXP.

As one of the pioneering projects in the decentralized science space, the Bio protocol accelerates life-saving discoveries by removing traditional biotechnology barriers and providing a permissionless framework, making these discoveries more accessible to everyone.

BioDAOs are community-owned intellectual property (IP) production engines focused on specific biotechnology fields. These DAOs develop and commercialize biotechnology IP by producing IP-NFTs and IP Tokens (IPT), establishing companies, and licensing IP to traditional biotechnology companies. The revenue generated is reinvested into BioDAO treasuries to fund the next generation of R&D and advance BioDAO’s mission. BioDAOs typically focus on new and emerging scientific fields where liquidity is limited, talent and data are dispersed, and

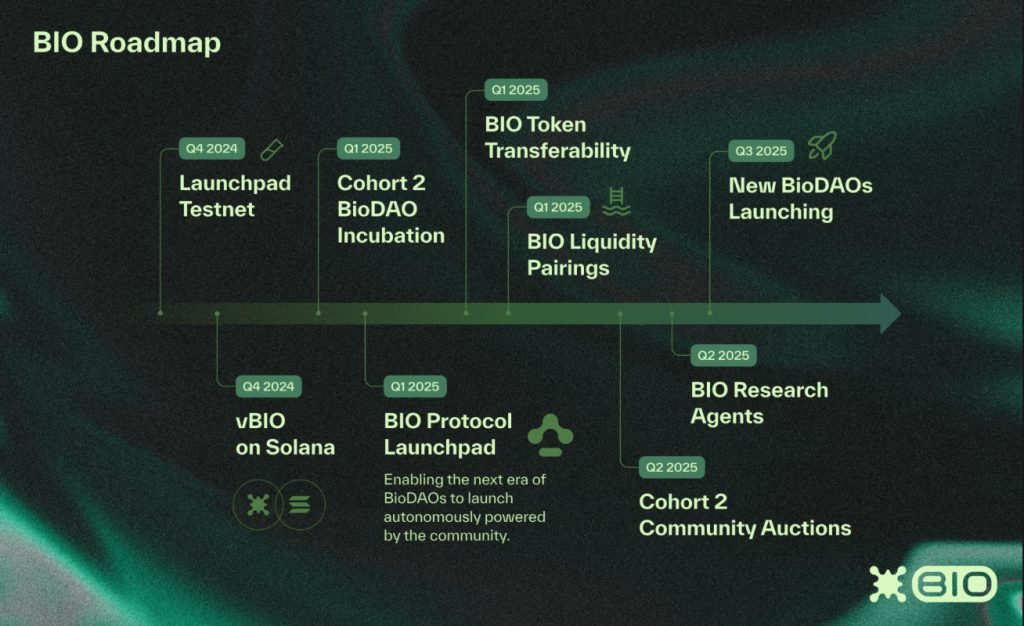

According to the BIO project roadmap,

- Q1 2025: Cohort 2 BioDAO Incubation, BIO Token Transferability, BIO Liquidity Matching, and BIO Protocol Launchpad were implemented.

- 2025 Q2: Cohort 2 Community Auctions and BIO Research Agents activities were initiated.

- 2025 Q3: The launch of new BioDAOs will be carried out.

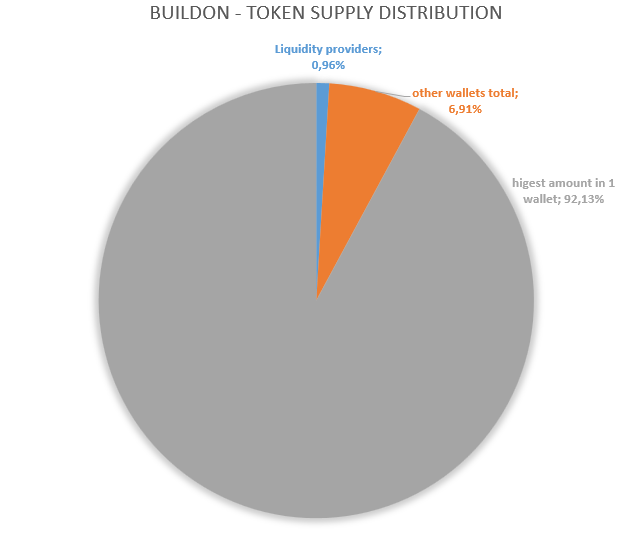

BuilDon (B)

BUILDON is the official mascot of the first USD1 Launchpad and USD1 ecosystem structure supporting real-world use cases across chains.

The project’s mission is to build a USD1 ecosystem that encompasses all use cases. Positioning itself as critical infrastructure within the USD1 ecosystem, it supports on-chain USD1 usage. Through its Agent-to-Agent (A2A) architecture, it enables users to access automated portfolio management by analyzing smart algorithms and market movements within seconds.

BuilDon is the first meme project funded by Trump-backed World Liberty Finance and the first memecoin to launch the USD1 trading pair. Additionally, it is the first project to list the USD1 trading pair on centralized exchanges (CEXs). As part of its ecosystem expansion, BUILDon will launch the BUILDon Launchpad platform, a real-world use case for USD1 with cross-chain and multi-functional features. This platform aims to support IDO, IEO, INO, SHO, and Fair Launch, thereby addressing various project needs and engaging diverse user communities.

BUILDon’s roadmap:

- Q3 2025: Launchpad platform will be launched with staking and liquidity mining modules.

- Q4 2025: Transition to a DAO governance model and introduction of tokenized yield products backed by USD1.

- 2026: Multi-blockchain integration (Ethereum, Solana, and Base) will be implemented.

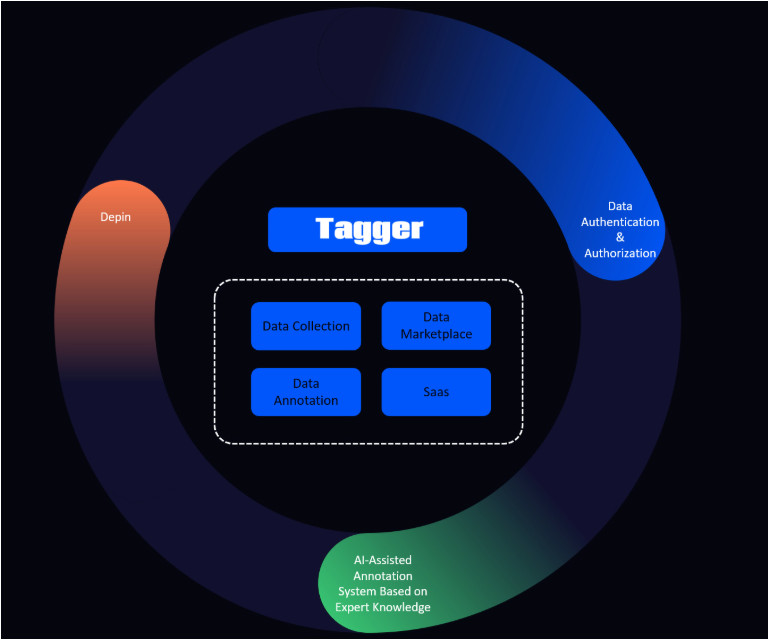

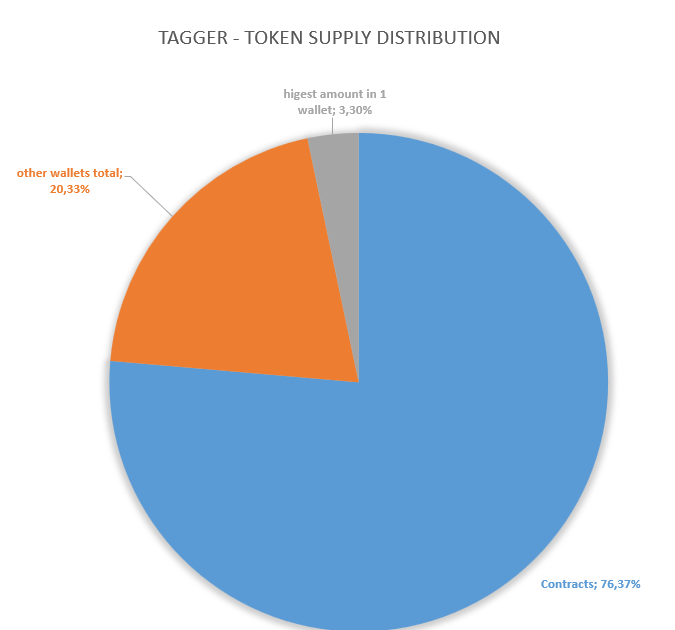

Tagger (TAG)

A full-stack AI data solutions platform that establishes a cross-border data verification protocol and creates a permissionless hub for data collection, labeling, management, and trading. This approach begins by leveraging Web3’s crowd-sourcing advantages for data labeling and collection. It then uses the core essence of blockchain technology to create a permissionless data identity verification and trading system. This addresses the issues of data silos, data identity verification chaos, and the shortage of professional annotators prevalent in the current data environment.

TAGGER is a comprehensive AI data solutions platform that combines the principles of decentralization, as seen in Bitcoin, with the transformative potential of artificial intelligence. By using blockchain technology to create a decentralized protocol for data verification, the project is establishing a cross-border and permissionless ecosystem that encompasses data collection, labeling, management, and trading processes. This approach directly challenges the centralized data control of the Web2 world and offers a more equitable and secure alternative.

Tagger’s solutions include DePIN-based infrastructure for cross-border data collection and sharing, Web3 crowdsourcing, instant global payment systems, and AI-powered labeling tools. Additionally, it enhances data labeling processes by making them more efficient and accessible through features such as a permissionless AI marketplace and human-in-the-loop (HITL) labeling.

TAG is the native currency supporting Tagger and is fairly produced through a proof-of-work model based on the effort of data workers. TAG can be used to publish data tasks, stake, purchase datasets, use datasets, subscribe to software services, customize AI models, and more.

Tagger’s roadmap includes:

- 2025 Q1: Establish a decentralized data collection hardware network, launch a wearable personal health data collection device, build a developer community, and establish a complete data ecosystem.

- 2025 Q2: Providing comprehensive AI data solutions services, agent-based data acquisition and usage services, and the launch of AGI Smart Contracts.

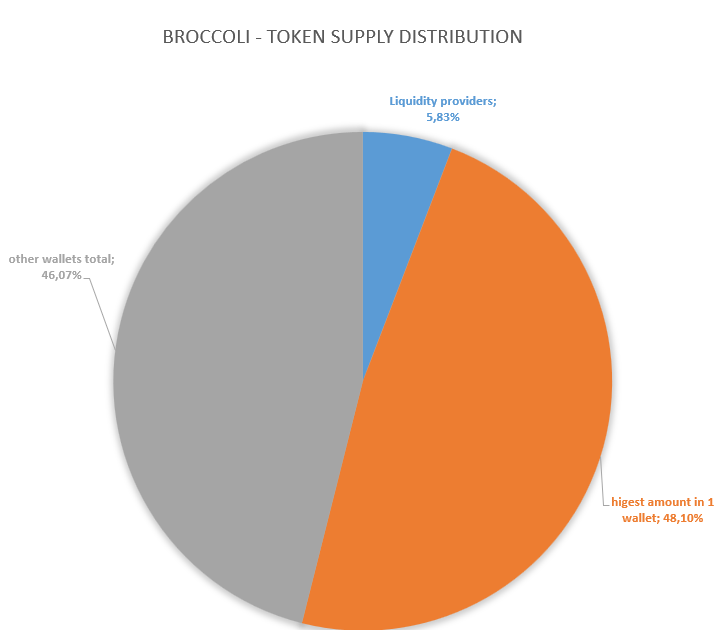

CZ’s Dog (BROCCOLI)

A meme project that gained attention when a user asked Changpeng Zhao, the former CEO of Binance, about his dog’s name. CZ later revealed his dog’s name, sparking the meme.

The project aims to rescue animals in need worldwide. Since its launch, a total of 1,041 animals have been rescued.

You can contribute to the project through the donation option on the project page or report animals in need of assistance directly through the same page.

Simon’s Cat (CAT)

Simon’s Cat ($CAT) is an official meme token associated with the popular animated series Simon’s Cat. It is one of the projects aiming to bring the deep-rooted brand loyalty from the Web2 world into the Web3 space. CAT is available on both the BNB Chain and Solana networks, enabling faster transaction speeds and increased accessibility.

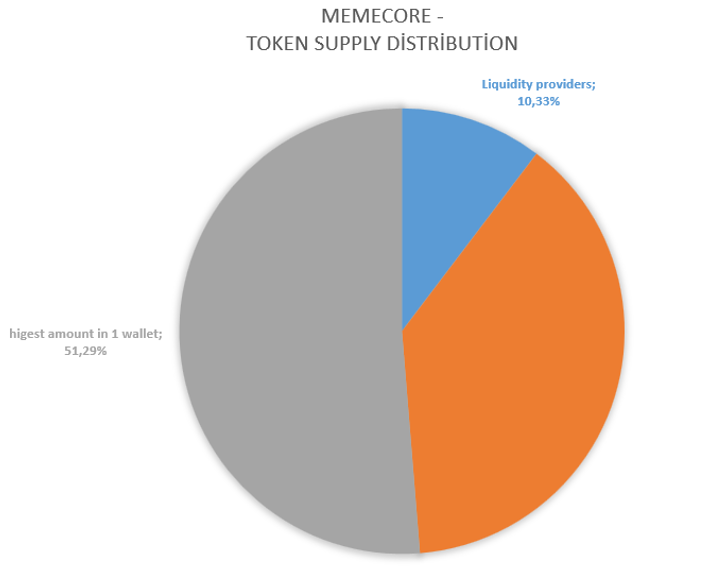

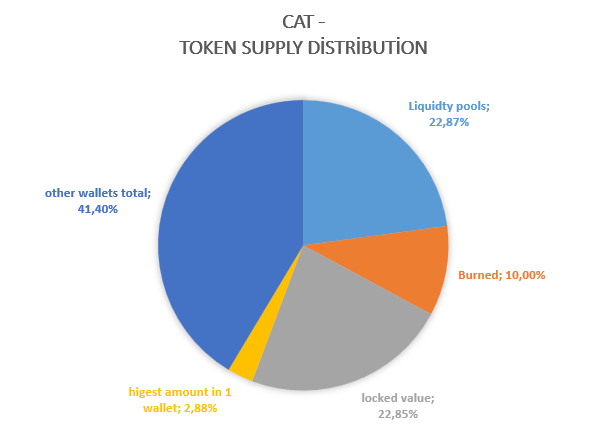

With a maximum supply of approximately 9 trillion, the CAT token currently has 6.75 trillion units in circulation. This supply is distributed across approximately 271,000 different wallets. 10% of the total supply has been completely burned, while 22.87% is held in liquidity pools. The remaining 22.77% is being held in a single wallet for future circulation. The remaining tokens are distributed across various wallets. The wallet with the highest balance holds approximately 2.2 million dollars worth of CAT tokens (equivalent to 2.88% of the maximum supply).

Bugs Coin (BGSC)

Bugs Coin is a cryptocurrency designed as a Web3-based investment education and simulation platform. It aims to enable users to trade in real market conditions without taking risks, thereby learning while earning. This allows investors to put their theoretical knowledge into practice.

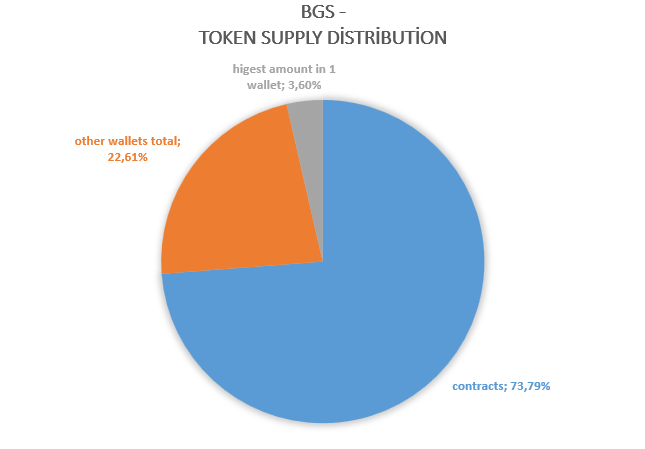

Launched on July 2, 2025, BGSC currently has a market value of between $40 million and $80 million. The coin, which is only traded on the BNB Chain ecosystem, has a maximum supply of 100 billion, with 8.5 billion currently in circulation. With over 37,500 wallets holding BGSC, 73.79% of the circulating supply is held in contracts, while the remaining 26.21% is in user wallets. The wallet holding the largest share of tokens holds 3.6% of the total supply.

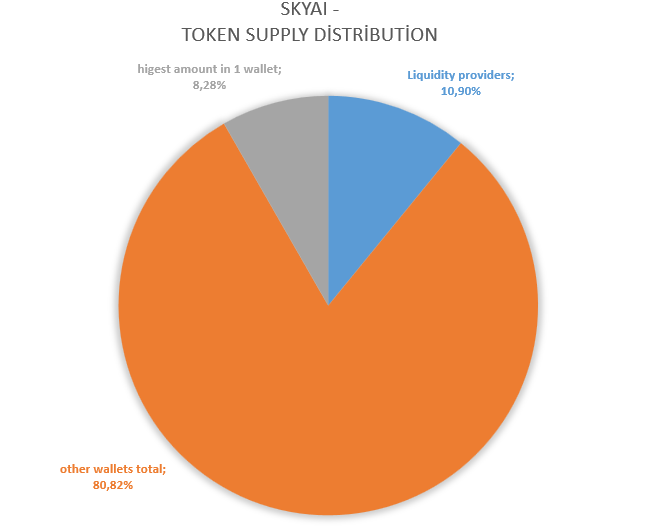

SkyAI (SKYAI)

Launched on April 25, 2025, SKYAI is an AI-focused infrastructure project built on the BNB Chain. Using a technology called Model Context Protocol (MCP), it integrates AI agents with multi-chain blockchain data. This enables scalable and interoperable solutions for decentralized applications. With features such as AI-powered analytics, automated decision-making processes, and advanced data security, it aims to optimize operations in sectors like DeFi, gaming, and supply chain management.

The project token, with a maximum supply of 1 billion, is entirely in circulation. These tokens in circulation are distributed across over 52,500 wallets. The supply in liquidity pools within the DeFi ecosystem accounts for 10.9% of the total, while the remaining portion is distributed across user wallets. The project token listed on centralized exchanges has its largest holder wallet on GateIo, holding 8.28% of the total supply.

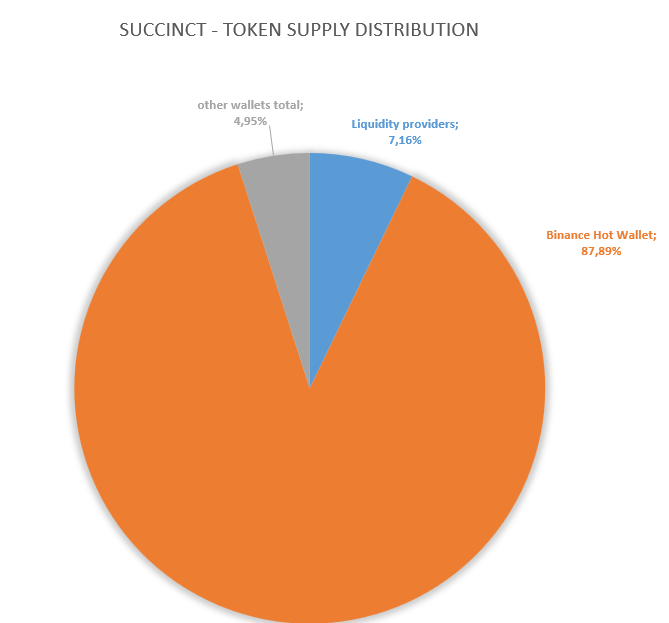

Succinct (PROVE)

Succinct is a powerful infrastructure project aimed at making zero-knowledge proof (ZKP) technology accessible to developers. The project’s open-source virtual machine, SP1, simplifies the creation of ZKPs using languages such as Rust and C++. Additionally, it ensures that these proofs are produced securely and efficiently through a decentralized “prover network.”

The market value of the PROVE token is approximately $228 million, with a maximum supply of 1 billion and a circulating supply of 195 million. The project, which was made available to users through Binance Alpha and listed on Spot in August 2025, made a remarkable debut with a trading volume exceeding $200 million on its launch day. Its quick listing on major exchanges like Binance, Coinbase, and Ku Coin demonstrates the high level of community interest. However, the sharp volatility observed on the first trading day caused the price to drop by up to 40% in a short period. Despite this, it is expected to play a significant role in the DeFi and ZKP sectors in the long term, thanks to its strong funding and technical infrastructure.

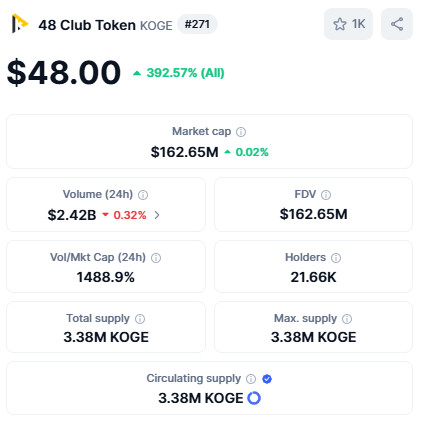

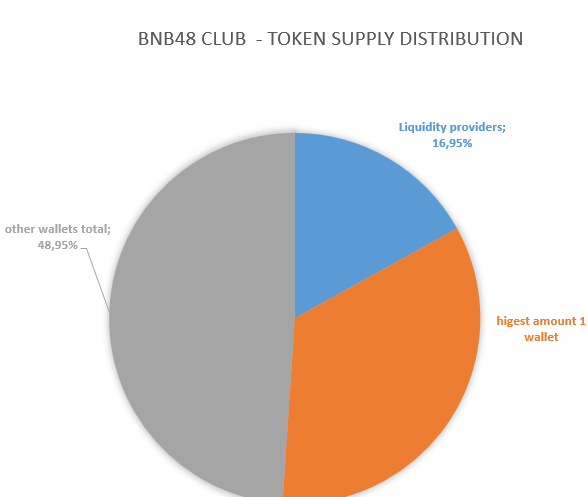

BNB48 Club Token (KOGE)

KOGE is a governance token launched on the BNB Chain and managed through a community-focused DAO structure. KOGE is used in decision-making processes within the international community operating under the BNB48 Club umbrella, while also playing a role in product development and node construction.

quite limited, with only 3.38 million tokens available, all of which are in circulation. The trading volume over the past 24 hours stands at $2.42 billion, indicating strong community and investor interest.

Source: https://coinmarketcap.com/currencies/bnb48-club-token/

One of KOGE’s standout features is its buyback-burn mechanism. This allows tokens to be purchased from the market, reducing supply and aiming to preserve value in the long term. Operating on the BNB Chain, the token uses the Proof of Staked Authority (PoSA) mechanism to offer secure, fast, and low-cost transaction advantages. With the DAO model, community members directly participate in decision-making processes, positioning KOGE as a sustainable and community-driven power center within the BNB ecosystem.

Chain GPT (CGPT)

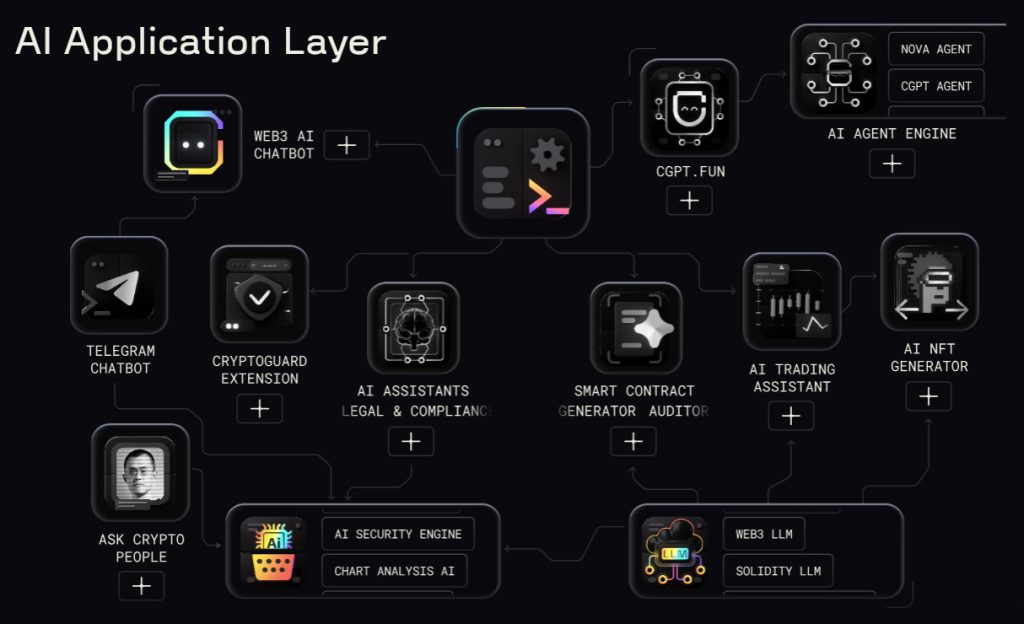

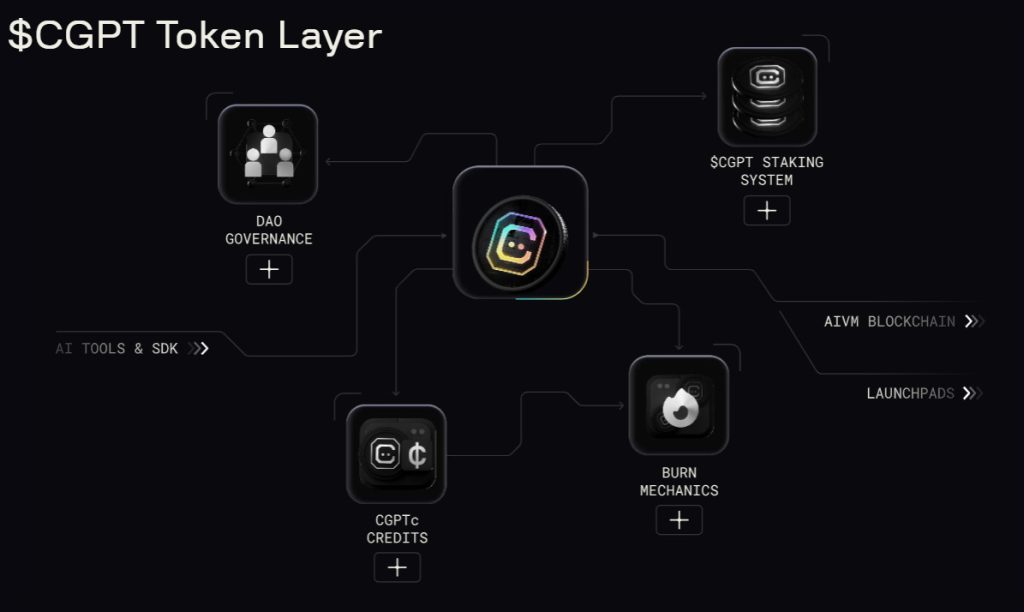

ChainGPT is an innovative platform that combines artificial intelligence with blockchain technology. At the heart of the project is the AI Virtual Machine (AIVM), which supports a wide range of features such as smart contract creation and verification, NFT creation, market analysis, and an AI-based trading assistant. The platform also offers no-code tools like AI chatbots, AI Trading Assistants, AI NFT Generators, and CGPT.Fun, enabling users to easily create AI agents or NFTs.

At the heart of the ecosystem lies the CGPT token. This token offers access to premium AI tools, participation in DAO governance, staking, and farming rewards. Additionally, through its burning mechanism, a portion of transaction fees is used for token purchases and burning, ensuring long-term value preservation. Developers can integrate this infrastructure into their own projects using the APIs and SDKs provided by Chain GPT.

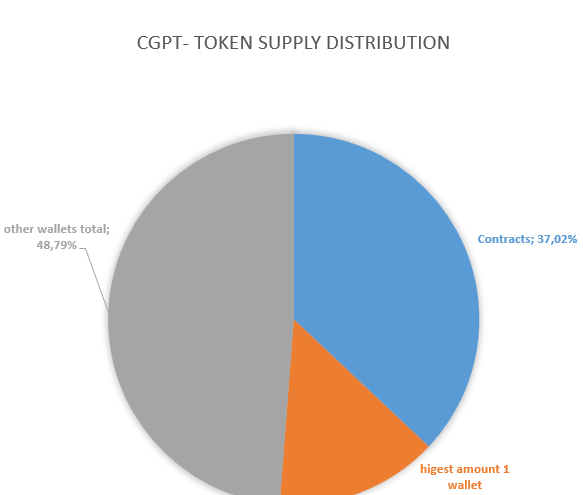

According to current data, CGPT’s market value is approximately $84.5 million. Its maximum supply is 1 billion, with a circulating supply of 856.7 million CGPT. The 24-hour trading volume is $17.8 million, indicating strong investor interest due to the token’s ecosystem-specific use cases.

One of Chain GPT’s key strengths is that it not only provides AI + blockchain tools but also involves the community in governance through a DAO model and ensures long-term sustainability through a buyback-burn mechanism. These features position CGPT as one of the pioneers of AI integration in the Web3 world.

Disclaimer

The information provided in this article about the BNB Chain ecosystem is for educational and informational purposes only. It should not be considered as financial, investment, or trading advice. Cryptocurrency markets are highly volatile, and past performance of projects, tokens, or ecosystems does not guarantee future results. Readers are encouraged to conduct their own research (DYOR) and consult with a licensed financial advisor before making any investment decisions. Darkex does not endorse or promote any specific projects mentioned and assumes no responsibility for potential financial losses arising from the use of this information.