Economic Outlook for Cryptocurrencies as We Approach Year-End Closure

The Big Drop on the Night of October 11

In October, during the peak of US-China tensions, stocks and cryptocurrencies experienced significant liquidation losses simultaneously. On Friday, October 10, Donald Trump announced a decision to impose a 100% tariff on Chinese imports.

The market experienced a $19 billion liquidation. Bitcoin fell to $101,782 on October 10–11, losing more than 14% of its value from its peak of $122,574. Cryptocurrency positions worth $19,160 were liquidated. Of these positions, $16,070 were long positions, while short positions amounted to $2,430, with the number of liquidated traders reaching 1,630,000.

This decline was not a typical market correction. It was 19 times larger than the March 2020 crash and the November 2022 FTX crash. On the night of October 11, altcoins fell by nearly 70%. Ethereum dropped to the $1,380 level. Panic selling increased, and volumes in cryptocurrencies declined. The Fear and Greed Index fell to 9. For the first time in three consecutive weeks, such high declines were seen in the Fear & Greed Index. In November, when the US government reopened, the Fear & Greed Index rose to 29 levels, approaching the normalization zone of 30 to 50. This indicated a gradual easing from extreme fear.

The Adoption of Cryptocurrencies as a Means of Payment

By November, stablecoin volumes surpassed Visa, and the IMF systematically defined stablecoins. Visa announced a pilot program allowing businesses and platforms in the US to send payments directly to recipients’ stablecoin wallets. Visa explained that while payments for businesses using Visa Direct are financed in fiat currency, recipients can choose to receive their funds in US dollar-backed stablecoins such as USDC. In the US, the OCC (Office of the Comptroller of the Currency) granted banking licenses to major crypto firms. Giants like JP Morgan and BlackRock announced they would accelerate tokenization by launching their first money market fund on the Ethereum network.

In crypto markets, infrastructure has become more important than price. Regulatory changes have taken place. Circle announced it would launch tokenized Gold and Silver exchanges via USDC. With the integration of traditional finance into digital assets, many US companies have announced that they have begun working on issuing their own tokens. Coinbase announced a partnership with Circle, which is expected to affect USDC revenues and share values. JP Morgan, the giant of US investment companies, said, “Crypto is emerging as a tradable macro asset.” JPMorgan officially launched JPM Coin, a blockchain-based deposit token for its corporate clients. OpenEden announced that it has brought cUSDO, a regulated and yield-generating stablecoin fully backed by tokenized U.S. Treasury bonds, to the Solana ecosystem.

The EU Council approved the European Central Bank’s digital euro design, announcing support for both online and privacy-focused offline versions. With increasing demand for the euro, the issuance of a euro stablecoin is planned. This could represent significant potential in the tokenization of finance, with expected returns in liquidity and efficiency gains. EUR-SCs, along with USD-SCs, could accelerate efficiency gains that benefit multinational corporations, banks, and investment firms. Faster, cheaper payments and instant on-chain collateral between currencies will create a clear positive impact on corporate operational efficiency and potentially increase the profits and investor confidence of companies that successfully integrate these new infrastructures. If EUR-SC issuers hold their reserves in high-quality, short-term European debt, this could potentially reduce demand for US Treasury bonds (a typical reserve asset for USD-SC). This structural decline in demand for U.S. Treasuries could have a negative impact on the U.S. fixed income market and, consequently, the dollar’s global liquidity position. Going forward, this structural demand driven by tokenized real-world assets (RWAs) and corporate treasury flows could provide a fundamental force for the EUR/USD pair. The rapid growth and global use of SD-SC risks the “digital dollarization” of European economic activity outside the oversight of the European Central Bank (ECB), potentially weakening the euro’s domestic role and complicating monetary policy. EU banks are leveraging the clarity provided by MiCA (Markets in Crypto-Assets Regulation) to build digital infrastructure for euro liquidity, ensuring that digital payments in euros become a reality before USD-SC dominance solidifies in Europe.

Political Tensions..

Towards the end of 2025, US-Venezuela tensions peaked with the Trump administration seizing oil tankers, closing airspace, and ordering a two-month naval blockade over “narco-terrorism” allegations. The Russia-Ukraine war continued, and the global macro agenda increased geopolitical risks. Trump made statements about the Ukraine-Russia war, saying that the US and Ukraine are much closer to a peace agreement but that difficult issues remain. He then said, “Both presidents want to end the war. We have a chance to make a deal. I will call Putin again after this meeting. Zelensky has worked very hard. He is a very brave man. No other nation has experienced what the Ukrainians have experienced. Russia’s attacks on Ukraine in recent days show that Putin is not serious about peace.”

The economic blockade and military force projection that the US has imposed on Venezuela parallels Russia’s invasion of Ukraine. In both cases, great power competition comes to the fore. Recently, relations between the US and Venezuela have reached a level of tension not seen in a long time. Washington’s military operations in the Caribbean and eastern Pacific, launched on the grounds of drug trafficking, are seen not only as a security policy but also as an open projection of power. The US administration’s hardening rhetoric of putting the Maduro regime in Venezuela under both political and military pressure has created a new geopolitical risk in Latin America. Venezuela, which possesses one of the world’s largest oil reserves, has been in the spotlight due to a long-running conflict that began with the questioning of Maduro’s legitimacy, deepened with sanctions, and recently escalated to a military dimension on the grounds of drug trafficking. The Trump administration intensified pressure by accusing Nicolás Maduro of drug trafficking. Maduro accused the US of barbarism, describing the blockade as an imperialist attack that would damage the global economy. Although he stated that he was pro-peace and would defend territorial integrity, he claimed to have had a phone conversation with Trump, but no official meeting was confirmed. Venezuela’s economy was squeezed and oil shipments were blocked. Trump signaled regime change and called on Maduro to resign. Crypto assets priced these political tensions negatively.

Tariff Front in US-China Tensions

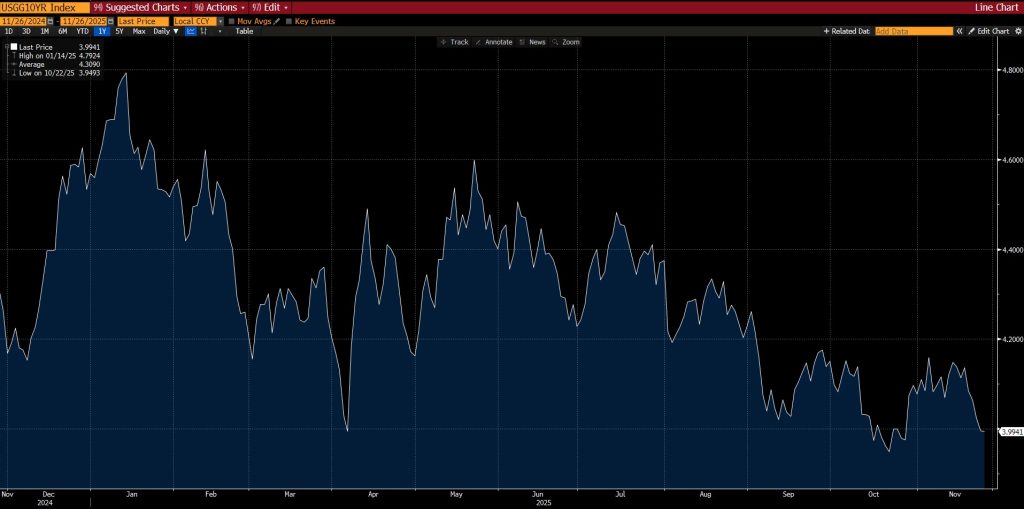

Tariff rates were adjusted in November. The tone shifted in December. Trump stated that if China restricted fentanyl exports, he could remove all tariffs on fentanyl-related products. This brought a flexibility unseen in US-China trade for years. Trump announced he would visit China in April 2026. The UK National Health Service (NHS) said it would pay its fair share and expected other European countries to do the same. Otherwise, it would impose customs duties. As of December, the US announced it would reduce customs duties on Chinese semiconductor products to 0% by 2027. Along with uncertainties centered on the Middle East and Russia, the US 10-year bond yield fell from 4.17% to 3.94%. The US Congress’ failure to agree on the budget in October, Trump’s statements on customs tariffs, and the uncertainty surrounding the US government shutdown showed a negative outlook for US stocks and an even more negative outlook for cryptocurrencies. This boosted safe-haven demand by creating positive pricing for bond markets.

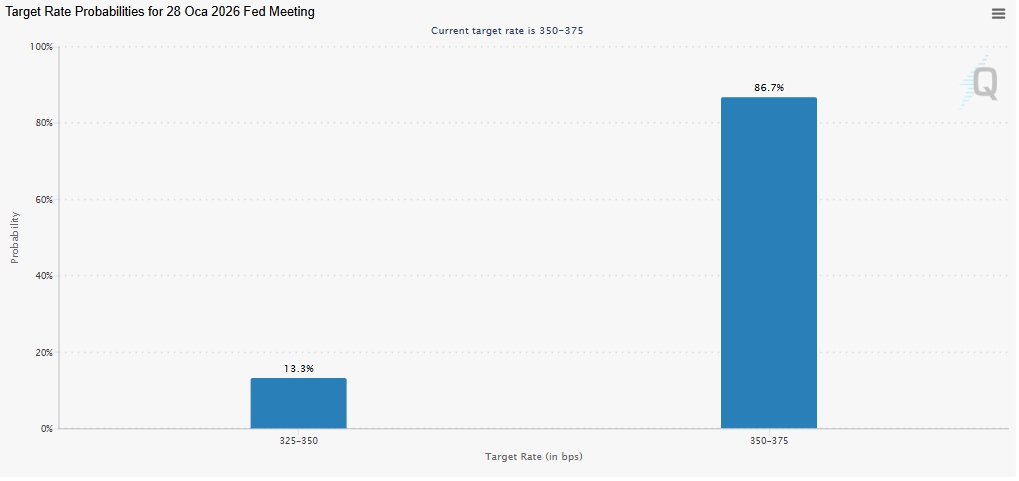

Having risen to 4.80% since January 2025, 10-year bond yields are set to close 2025 at 4.15%. This decline highlights expectations of easing interest rates in the long term. The probability of the Fed lowering interest rates by 25 basis points in January next year is 13.3%, while the probability of keeping them steady is 86.7%, indicating that growth expectations may weaken. The decline in interest rates has caused an increase in valuable assets such as US indices and gold, forming the basis of the discount rate for all global assets. Cryptocurrencies, as the most liquidity-sensitive assets, experienced downward pressure when bond yields rose. The US announced on December 10 that it would purchase $40 billion in Treasury bills over the next 30 days. Purchases began on December 12. With these announcements, the US debt problem grew, and fears that the Fed might not cut interest rates were priced in negatively. The effects of the government shutdown are expected to be offset by higher growth in the coming quarter as the government reopens. Current growth rates in the US indicate that layoffs and hiring remain low. The labor market continues to cool gradually.

Signals of Rate Cuts from Central Banks

With the Bank of England (BOE) and the European Central Bank (ECB) signaling easing, the market has now started pricing in the timing of interest rate cuts rather than rate hikes. The Bank of Japan (BoJ), on the other hand, raised interest rates, bringing its policy rate to 0.75%. Interest rates in Japan rose to their highest level in 30 years, while the 10-year bond yield reached its highest level in 27 years. The increases were supported by stronger wage growth and an improving economic outlook. Markets assess that the Bank of Japan is proceeding cautiously but decisively in its normalization process. Interest rate hike expectations for 2026 carry the risk of unwinding carry trades. This creates pressure on global liquidity. Bank of Japan Governor Kazuo Ueda’s dovish comments on monetary policy shaped expectations regarding the pace of rate hikes, while noting that there is still a wide range of uncertainty regarding neutral interest rate forecasts. He emphasized that monetary policy steps will be shaped by the economic outlook, inflation, and financial conditions. He stated that US tariffs are not creating a general pressure on the Japanese economy.

Expectations for the New FED Chair

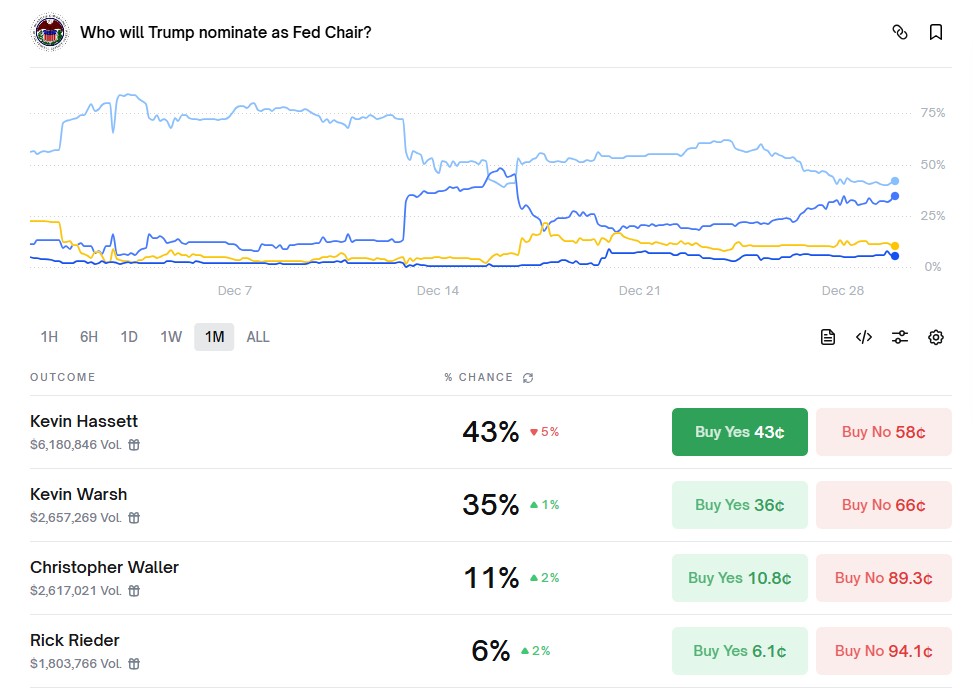

While Fed officials continue to disagree on the timing of interest rate cuts, the process of appointing a new Fed chair is also being closely watched by the market. The term of the current Fed Chair, Jerome Powell, ends in May 2026. The selection of the new Fed Chair is being closely watched in the financial world as it will have a major impact on global monetary policy. US President Trump: “If the markets are doing well, I want my new Fed chair to lower interest rates. No one who disagrees with me can be Fed chair. I want a market that rises on good news and falls on bad news. Inflation will take care of itself, and if it doesn’t, we can always raise rates at the appropriate time, but the appropriate time is not to kill rallies.”

Expectations are that Trump could appoint a new Fed chair by the first week of January. The new chair will have a global impact on determining interest rate decisions, the approach to inflation, and economic growth policies. Kevin Hasset is among the leading candidates. Hasset, who served as a White House National Economic Council Advisor during Trump’s presidency, is seen as the candidate with the highest probability in prediction markets. Known for his close ties to Trump, Hasset said, “We should continue to lower interest rates a bit more, and Powell probably agrees that lowering interest rates is a prudent decision. We need to follow the data on how interest rates should be lowered. Donald Trump has many good options for the presidential candidacy. But if that person is me, I would gladly accept the job. Positive supply shocks should help the economy.”

The second candidate is Miran, a member of the Fed. He said he is in favor of a half-point cut. Schmid and Goolsbee, on the other hand, expressed their opinion that interest rates should remain unchanged. However, Trump said that “urgent interest rate cuts are mandatory” for the new Fed Chair. Fed members, on the other hand, said they forecast a two-quarter-point interest rate cut for 2026. Miran’s unwillingness to act in line with these demands reduces his chances of becoming chairman. The other candidate is Kevin Warsh. A former Fed Board member and an experienced figure in economic circles, Warsh is priced as a rising alternative in prediction markets. According to some market forecasts, he is close to Hassett’s level. There are views that he is supported by major financial names such as JPMorgan. Christopher Waller is a current Fed board member and one of the names being considered for after Powell. He has been mentioned positively by Trump in public. He is priced lower in prediction markets but has supporters. Another candidate is Rick Rieder, a name from the global investment arena, such as BlackRock. These individuals are not priced as strongly as the leading trio but are being evaluated in this process.

Trump is calling for a low interest rate policy. This is a factor in expectations for the new chair. Names like Hassett and Warsh have differing views on supporting interest rate cuts. Bond and currency markets are sensitive to the selection debate among the candidates. Changing probabilities in prediction markets reflect market expectations.

Interest Rate Projection and US Economic Indicators

Pricing in the expectation of a 25 basis point interest rate cut from the Fed, Bitcoin rose above the $94,500 level for the first time since November 17. The Fed’s announcement that it had cut interest rates by 25 basis points brought the target range to 3.50%-3.75%. The initial impact was seen as a decline of over 2% in Bitcoin. US indices fell and the dollar turned negative. According to the Fed’s latest dot plot, the median forecast for the policy rate at the end of 2026 was 3.4% for 2026 and 3.1% for 2027 and 2028, with a long-term forecast of 3.0%. The projections point to 25 basis point cuts in 2026 and 2027. Policymakers forecast unemployment to fall to 4.4% in 2026, PCE inflation to decline to 2.4%, and GDP growth to rise to 2.3%. The projections show a 25 basis point cut in both 2026 and 2027. Trump said, “The Fed could have doubled the rate cut. If the market goes up, we should encourage it to go up more.”

Four FOMC members forecast at least three quarter-point cuts for 2026. In connection with the Federal Open Market Committee (FOMC) meeting held on December 9-10, 2025, meeting participants projected that real gross domestic product (GDP) growth could occur each year from 2025 to 2028 and beyond. Core PCE expectations were lowered by 0.1 percentage points for both years. Unchanged unemployment projections point to a balanced overall outlook despite risks on the employment front. The revision of PCE to 2.9% in 2025 (previously 3.0%) and to 2.4% in 2026 from 2.6% reinforces the assumption that inflation will gradually but steadily decline toward the 2% target. The Bureau of Labor Statistics (BLS) plans to release the December 2025 Producer Price Index on Friday, January 30, 2026. Labor market conditions are cooling, and inflation remains above expectations. The number of Americans filing initial jobless claims for the week ending December 6 was 236,000, compared to expectations of 220,000. This indicates that the outlook for employment inflation has not changed since the last meeting. Today, however, Powell took a more dovish stance at the press conference, contrary to his hawkish tone. US Gross Domestic Product (GDP) (quarterly) (Q3) was announced at 4.3%. US Initial Jobless Claims were announced at 214K. He stated that the Fed is in a good position to monitor economic developments and that the bar for further rate cuts could be raised, that downside risks in the labor market have increased and employment data may be overstated, that tariffs have only a temporary effect on inflation, and that goods inflation could peak in the first quarter of next year. He emphasized that artificial intelligence supports growth and contributes positively to the economic outlook. As 2025 draws to a close, the last data we will receive will be the release of the Federal Open Market Committee (FOMC) meeting minutes on Tuesday, December 30. Beth Hammack, President of the Cleveland Fed, who will have voting rights on the FOMC in 2026, took a hawkish stance, saying that “there is no need to touch interest rates for a few more months” after a total reduction of 75 bp in three meetings. On Wednesday, December 31, US Initial Jobless Claims will be announced.

The Impact of New Reserve Management Purchases on Cryptocurrencies

The tightening in the money market triggered a shift towards short-term Treasury bills, prompting the Fed to halt the reduction of its balance sheet. It announced that it would purchase short-term Treasury bills to ensure effective control of policy interest rates. These statements were considered an important signal in terms of liquidity and expectations. On December 12, the Fed announced that it would purchase $40 million in Treasury bills as part of its “reserve management purchases” aimed at maintaining reserves. Short-term Treasury bill purchases aim to ease funding difficulties in the repo market by injecting reserves into the banking system.

Morgan Stanley Investment Management stated that 10-year US Treasury yields are too low for the current economic outlook. According to the company, economic growth could come under pressure in 2026, which could lead to more persistent inflation. Therefore, it is thought that the Fed may lower interest rates less than market expectations over the next 12-18 months. This situation is easing financial conditions somewhat. More abundant and cheaper dollar liquidity can historically support demand for risky assets such as stocks and crypto. It could create a structural foundation for Bitcoin and other cryptos. Throughout 2025, the total nominal value of liquidated positions in the cryptocurrency market reached $150 billion. Investors experienced the peak on October 10-11, closing positions at a loss of $400 to $500 million on average per day. On the other hand, the difficulty of Bitcoin mining showed a net increase of 35% in 2025. Samson Mow, known as an entrepreneur in the blockchain ecosystem, says that 2025 is a bear market and that Bitcoin has entered a ten-year bull run.

Trump noted that purchases in the market reinforced signs of institutional demand. Cathie Wood, in an interview with Fox Business, said that large institutional investor inflows would disrupt Bitcoin’s traditional four-year cycle. According to Wood, these institutional flows will reduce Bitcoin’s volatility by mitigating sharp declines. She emphasized that Bitcoin has now become a “risk-taking” investment vehicle rather than a “risk-averse” asset. This is expected to contribute to long-term price stability. The US Senate is moving toward a final vote to confirm crypto regulators at the CFTC and FDIC. Lawmakers are meeting with bank CEOs about the structure of the cryptocurrency market. The US federal banking regulator says banks can buy, sell, and store cryptocurrencies. In such an environment, positive news flows such as ETF inflows, expectations of the launch of the Euro Stablecoin, companies issuing their own tokens, and the clarification of the regulatory process for cryptocurrencies could increase the likelihood of more sustained gains in 2026.