Introduction

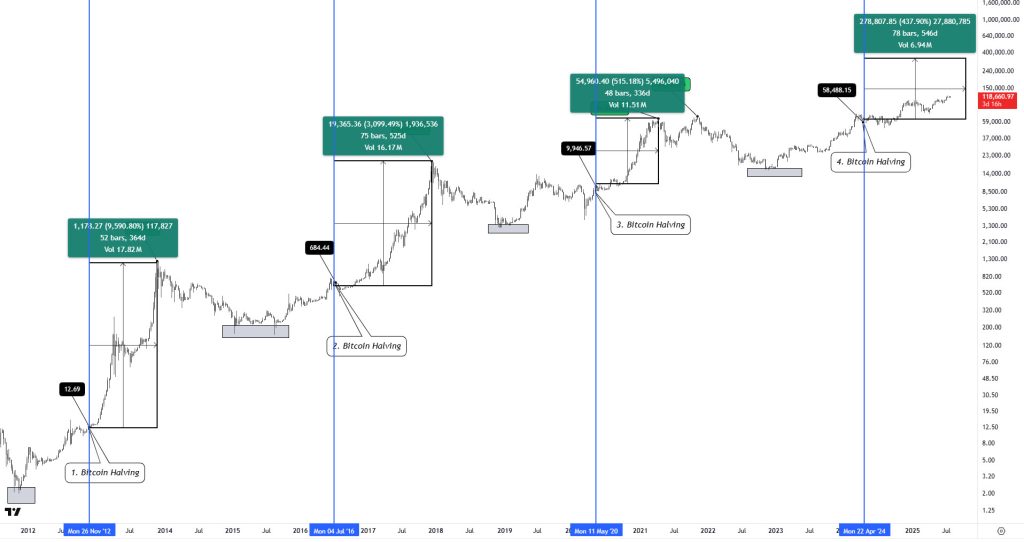

The Crypto Cycle refers to the cyclical nature of cryptocurrency prices, which frequently fluctuate between bull (uptrend) and bear (downtrend) markets. For example, the price chart of Bitcoin from 2009 to the present clearly shows these cycles. Each cycle has lasted about four years from peak to peak and are known as “halving” events. When defining a Bitcoin cycle, it is necessary to look at whether it is in the early, middle or late stages of the cycle. This can be done by looking at some indicators and on-chain analysis.

Has the Cycle Ended?

First of all, we can say that from the end of last year to the beginning of this year, BTC was very close to the end of this cycle. This is because the signals that have historically appeared at every peak during that period appeared. According to the four-year cycle, the peak time should be around the end of this year, probably between September and December. But if we go back to 2021, four years ago, the so-called first peak actually happened in April of that year. Because there were two peaks that year. Almost all the peak signals for the second peak took place in April 2021, not in November. The current cycle has actually repeated a similar situation.

We cannot know that there will definitely be a second peak soon, but the current situation is quite similar to that time. At that time, in March and April, BTC dropped from around $110,000 to $74,000 and then rose to a new high now. Some signals also occurred during the second peak in 2021. Many of these signals were already triggered at the first peak. Including divergences in capital inflow figures, vertical spikes, trends that did not retrace or consolidate much. Now, compared to the second peak in 2021, all these signals have reappeared.

Of course, every cycle is completely different. An important difference in this cycle is the structural change in participants. In simple terms, many organizations have entered. Many companies are reserving Bitcoin following the example of MicroStrategy, and recently even strategic reserves for Ethereum have started to appear. By looking at on-chain analysis to define the current cycle phase, we can predict that we are still nearing the end and currently mirroring the trend at the second peak of 2021.

More and more people are starting to see Bitcoin and even want to participate. BTC’s Market Capitalization is indeed increasing at a pace that everyone can see. This process reflected Bitcoin’s transition into the modern technological society. If this happens, firstly, the volatility of the Bitcoin market will decrease significantly. At the same time, various large institutional funds will come from traditional financial markets. Whether it’s arbitrage opportunities or high-frequency trading opportunities, they will all demand a piece of the pie. However, we can say that the Bitcoin market is still a very new market compared to traditional exchanges, Forex, commodities and raw materials. Therefore, the opportunities within the circle may diminish but compared to other mature markets, it still has many opportunities. We can also note that the 4-year cycle, once driven by halvings, interest rates and sector crashes, now has less impact under the lens, while regulatory clarity and institutional engagement suggest a more stable, long-term trajectory. It’s also worth emphasizing that ETF-driven adoption allocations could extend the bull run beyond 2025, and 2026 could potentially be a stronger year for Bitcoin.

Looking at the weekly BTC chart, the cycle after halvings has always been a working system. The cryptocurrency is currently on day 993 of a cycle that historically peaks around 1,070 days after the end of a bear market. If this pattern continues, a peak could occur by October 20, 2025, in line with Bitcoin’s four-year cycle and recent price action. On the other hand, if the traditional cycle continues, Bitcoin could target $360,000 by 2026. Alternatively, institutional adoption and tokenized assets could redefine the top of the market by prioritizing sustainable growth over speculative exuberance.

Impacts of Macro Developments

Whether it’s due to certain conditions in the crypto space or the macro market as a whole, such as tariffs imposed after Trump’s inauguration and talk of Powell’s firing, operating in this macro environment will be much more difficult than in 2021. The difficulty will certainly increase as institutions enter the market. The competitors are no longer the old whales or OGs, but hedge funds or algo funds that have been around for decades in the traditional financial market. Their entry leads to market maturity, and market maturity leads to more institutions participating, creating a cyclical process. As a result of this process, BTC’s volatility will drop significantly and the difficulty of hunting for Alpha will increase. Last month alone, 22 public companies added Bitcoin to their balance sheets, bringing the total to 160. This institutional adoption could delay the traditional altcoin-meme coin peak as investors shift their focus to tokenized real-world assets (RWAs). For example, Robinhood’s tokenized stock trading in Europe and Coinbase’s SEC approval efforts point to a broader shift towards utility-driven growth that could redefine market peaks.

If we look back to March 2024, BTC rose to $73,000, marking the first phase of major volatility. However, when comparing the sentiment of the crypto market to that of the US stock market, the US stock market was moving sideways with less enthusiasm, in contrast to the steady upward movement during the actual upswings. The sentiment in the BTC market was extremely positive. The macro environment at that point was that expectations of a rate cut had been severely suppressed. The US equity market had already reacted to this, but the Bitcoin market completely ignored it. But we see this lack of reaction slowly disappearing. This divergence raises questions about whether the 2025 cycle will follow past rhythms or evolve. If we consider this in two headings;

Crypto:

It’s definitely not a level one mega bull market right now. Since we entered the market in 2023, it’s been a little over two years since systems like the BTC ecosystem have been replicated or speculated on meme coins earlier this year. We can see external flows entering this market. Not just funds speculating on the ground, but there are also entries into the tier one market from off-site funds. However, it’s clear that the market is quite calm at the moment and it’s far from experiencing the feeling of a level one bull market. BTC and altcoins or the tier one market are quite disconnected in this cycle, also on altcoins. While BTC is developing on its own, altcoins and the tier one market sometimes don’t follow BTC’s uptrend at all. Therefore, we can consider the cycle separately for altcoins.

The US Effect:

The most unique aspect of BTC in this cycle is its independent bullishness, which means it stands out on its own. It seems to be the only rising instrument in the entire market. Another strange situation is that Trump’s election led to a tariff war in 2025. This happened at the beginning of April this year, and at that time the market had a serious panic because of the tariffs. Not only the Bitcoin market but also the US stock market faced similar situations. These two events have had and will continue to have a huge impact on everyone operating in the market. As the market matures, most immature tokens with empty content will gradually disappear. Therefore, BTC’s independent rise cannot be seen as surprising. As for the tariff war, nothing is likely to change for long-term BTC investors. But the cycle used to be the same for BTC and altcoins.

Assessment of the Altcoin Bull

Historically, the cryptocurrency market has seen cycles where Bitcoin has led bull runs and acted as the primary entry point for new capital. As Bitcoin’s price stabilizes or reaches new highs, some of this capital tends to move into altcoins, particularly those with strong fundamentals or emerging narratives. This rotation feeds the altcoin season, when a broader range of digital assets experience significant price gains. However, the current market environment, with the Altcoin Index at 45, shows how Bitcoin is again the asset of choice. This could be due to a variety of factors, such as institutional interest consolidating around Bitcoin ETFs, global economic uncertainties pushing investors into safer assets, or simply a period of consolidation after previous altcoin rallies.

While altcoins have experienced some rebounds and positive developments in recent weeks, they are still significantly behind BTC and ETH. Of course, altcoin season includes not only secondary symbols and altcoins smaller than Ethereum, but also some on-chain opportunities that on-chain transients are particularly interested in. When certain signals emerge, whether utility or joke tokens, retail investors flock and market liquidity increases. Then the bull market on the primary chain emerges, attracting external flow to push the market up. However, after the last joke token period, we witnessed a massive loss of capital from small investors or traders, so it’s clear that it actually needs a recovery period. On the other hand, it is now clear that the primary market is paying more attention to the experts than before and is more focused on whether there are speculators controlling the market.

While we don’t know if there will be an altcoin season, market fundamentals dictate that for altcoins to rise, there needs to be a significant inflow of funds. If there is going to be an altcoin season, this means that there needs to be a significant inflow of funds into all existing altcoins for it to be considered a season. However, with the current number of altcoins, such a large-scale rise is very difficult to achieve. One reason for this is that there is a much larger supply of altcoins than in 2021. At the beginning of the year during the first wave of the main uptrend in 2024, it may have been realized that the altcoin market was actually rising with Bitcoin. But after going through a relatively painful period, around the time of Trump’s election in November, altcoins saw another wave of increases. But this surge was very different from the one earlier in the year. Altcoins rose in rotation. For example, game today, AI coins tomorrow, defi coins the next day, and so on. Today, one sector can go up by tens of points, and two or three days later, it’s another sector’s turn. This is no longer the general rally seen at the beginning of the year. At least the election of a president perceived as crypto-friendly pushed Bitcoin above $100,000. But the performance of altcoins has shown only one rotation in price movements. This is the result of underfunding, so we can’t say it’s altcoin season.

When we look at the weekly TOTAL2 chart showing the altcoin season, the cycle always started rising and declined. Then, the asset, which moved horizontally until the Halving, came back to the beginning of the cycle and experienced a rise. Based on this data, we are in a bullish period for altcoins since the last halving on April 22, 2025. If the cycle continues as before, the current altcoin value of 1.38T should be worth about 8T by the end of the bullish period.

Conclusion

Bitcoin’s ongoing bull market remains to be seen whether the asset is nearing its peak in late 2025, as historical cycles suggest, or whether structural shifts are redefining its trajectory. At the same time, regulations are gaining clarity. Wall Street is building its infrastructure and billions of capital are entering the space. It is fueled by legislative breakthroughs like the recently passed Genius Act. Buyers of Bitcoin ETFs are relentless, even in the face of geopolitical tensions. According to the Dune Analytics dashboard, they currently hold 150 million Bitcoins worth around $1.29 billion. While the current situation points to a Bitcoin Season, the cryptocurrency market is cyclical. No season lasts forever. Several factors influence the transitions between Bitcoin and Altcoin Seasons, including Bitcoin halving cycles, the macroeconomic environment, institutional adoption, technological breakthroughs and the regulatory environment.

Whether in a bull or bear market, there will always be great opportunities to seize in the primary market. This is true for previous bear market cycles, such as during the Luna crash in May 2020 and the FTX crash in November 2022, when Ethereum could drop 20% in one day. Or the SOL fomo when Trump issued his own token. These are moments of extreme emotions. While these cycle-changing factors make it less likely that the cycle will repeat than in the past, it is always prudent to tread carefully at turning points.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency investments are highly volatile and may result in substantial losses. Please consult a professional advisor before making any financial decisions. Darkex is not responsible for any actions taken based on this content.