As of 2024, net money flows in the entire cryptocurrency market have increased significantly, especially after the US elections. The winning candidate Donald Trump’s positive attitude towards cryptocurrencies and his statements on this issue seem to have had a significant impact on the market. Trump’s support for cryptocurrencies has increased interest in Bitcoin and altcoins as a profitable investment for big whales and institutional investors. These effects led the market to price in anticipation before the new president took office. Moreover, supported by the US interest rate cuts, the market is witnessing massive rises and unprecedented movements.

Bitcoin

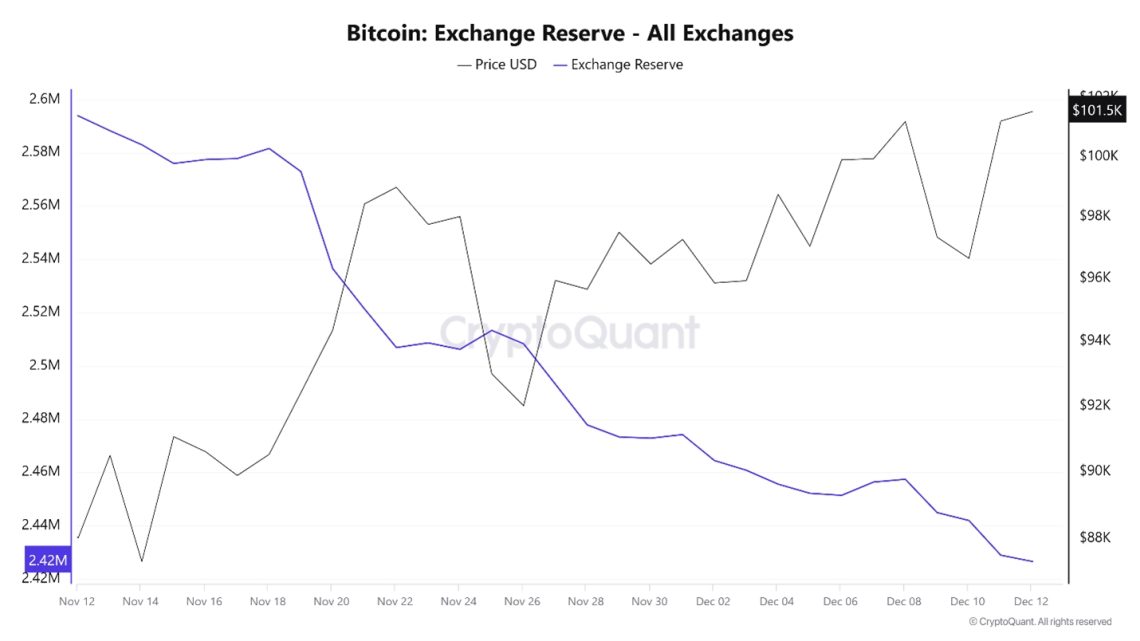

Large investors continue to buy Bitcoin on exchanges and transfer it to wallets. With the Bitcoin price reaching $100,000, massive withdrawals from exchanges to wallets have been observed. Withdrawals from exchanges are still predominant, suggesting that investors are collecting Bitcoin safely and expecting prices to rise further.

MicroStrategy

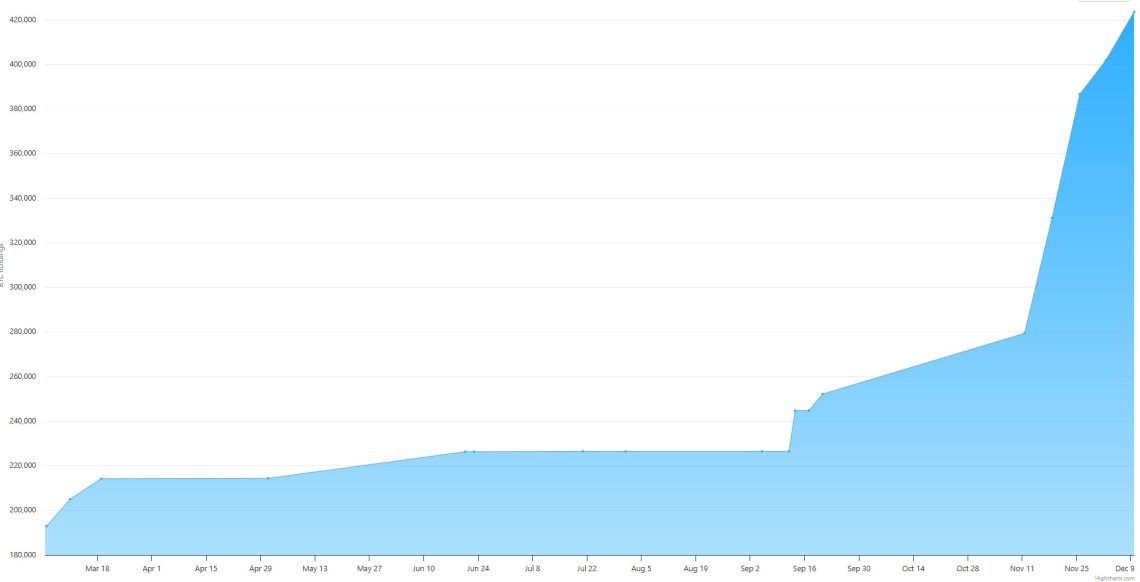

MicroStrategy, which has been buying Bitcoin steadily for a long time, more than doubled its holdings from 193,000 Bitcoin in March to 423,650 Bitcoin, making it one of the largest investors. MicroStrategy’s regular increase in Bitcoin purchases is causing the amount of Bitcoin in exchange reserves to decrease. This can be attributed to MicroStrategy’s purchases in parallel with the decline in exchange reserves.

BlackRock

Net inflows in BlackRock’s spot Bitcoin ETFs showed a remarkable increase from $28.92 billion to $35.06 billion. A total of $6.14 billion was net invested between November 12 and December 12, bringing the portfolio value to $53.86 billion. BlackRock’s Bitcoin purchases are among the largest in the market. These purchases not only contribute to the rise in the price, but also build confidence for institutional investors. This is also an invitation for big players who have not yet entered the market.

Ethereum

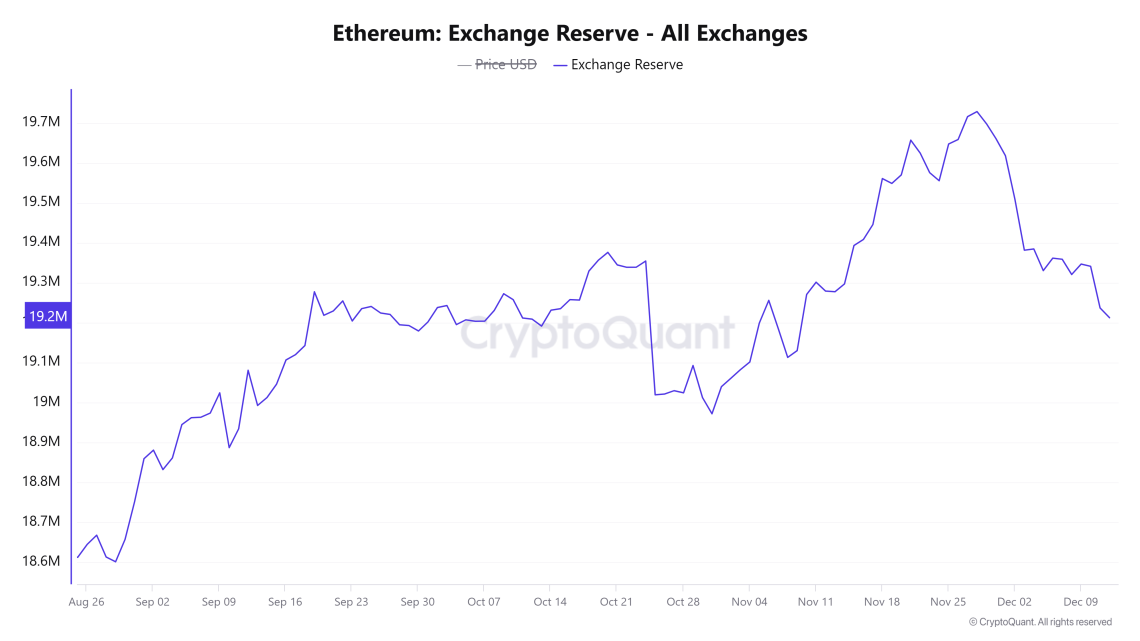

An analysis of Ethereum’s reserve movements across all exchanges shows that it has been on a volatile downward trajectory since June 2020. However, it has shown less pronounced bullish movements compared to Bitcoin. When the time period is narrowed a little more and analyzed since August 2024, it is noteworthy that Ethereum reserves on exchanges have increased.

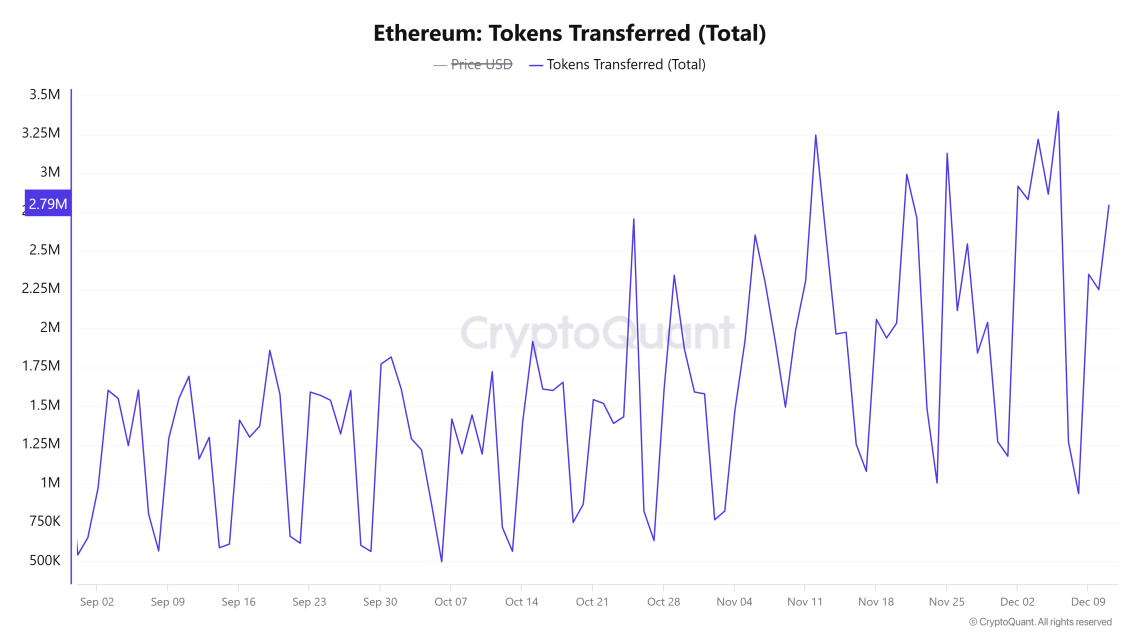

When transfer amounts are analyzed, it is observed that the total amount of Ethereum transferred during the day is approximately 60% lower on weekends (Saturday/Sunday) compared to weekdays. This may hint that large investors in Ethereum are institutional investors who do not trade on weekends. If this significant difference in transfer volumes is entirely attributed to institutional investors, it could mean that the total amount of Ethereum held by institutional investors is nearly twice as much as that held by the combined community of medium and small investors.

In this case, while institutional investors will drive the price of Ethereum, it can be said that it remains a potentially profitable investment opportunity as it has not yet made a new ATH (all-time high) and does not contain institutional investors like Bitcoin. Apart from transfers, when wallet movements are analyzed, it is observed that the number of active addresses has been increasing steadily since the last quarter of 2024. In particular, the number of active addresses in September was half the number of active addresses in December, and the number of active users on the Ethereum network has nearly doubled. This shows that the number of wallets cannot increase so much only with the transactions of institutional investors, so small investors are also starting to take positions in Ethereum.

In the case of Ethereum, which is positioned to continue its rise and see new highs, a market structure with many large and small investors is emerging. This suggests that the impact of different investor groups will be important in Ethereum’s future price movements.

Xrp

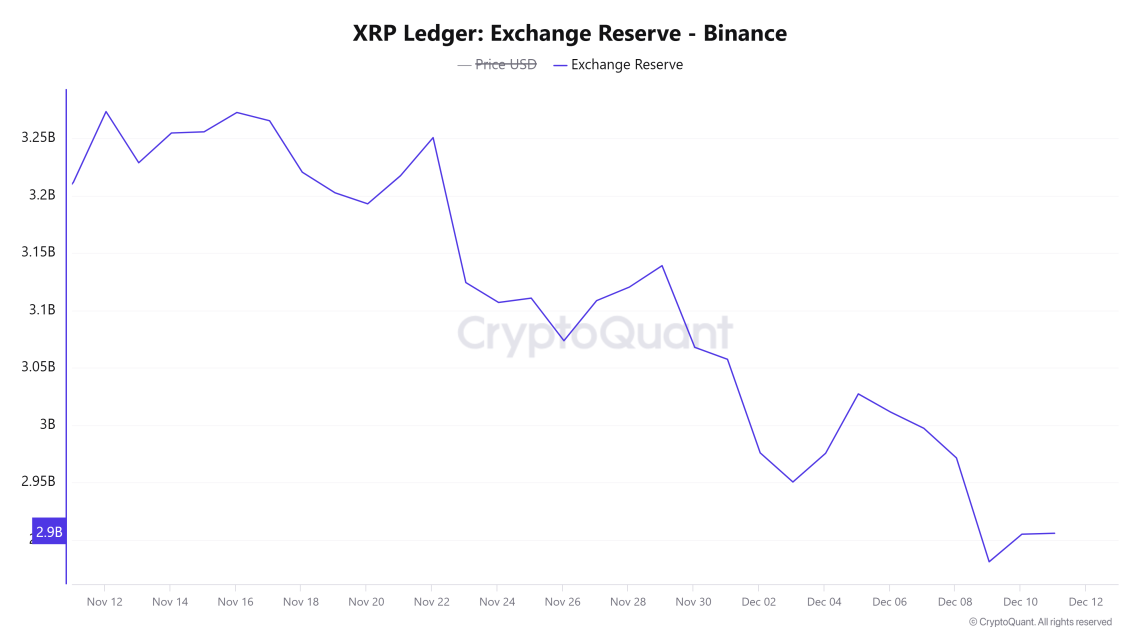

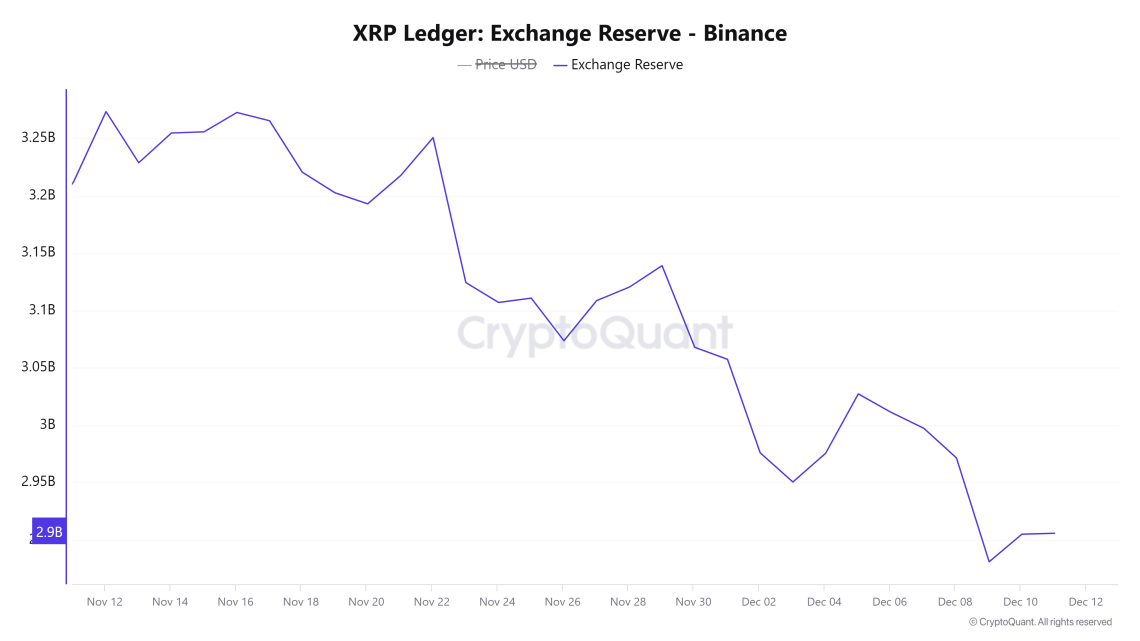

XRP, one of the most talked about coins in the crypto market, stands out as one of the major altcoins with the market capacity and volume suitable for whale movements. XRP, which has increased its market value more than 4 times in a short time, continues to grow by maintaining its potential. Increasing liquidity and the interest of large investors have a significant impact on XRP’s price volatility. It is observed that whale movements have increased from exchanges to wallets for XRP. Although it seems to have reached quite high levels in terms of price, XRP transfers from exchanges to wallets have continued in recent days. This suggests that whales are expecting much bigger rises in XRP.

Looking at XRP reserves, ongoing supply declines have been observed on the Binance exchange for the last month. The fact that the supply of XRP on the exchange has dropped by 9.5% in 1 month and has not yet started to increase creates the impression that whale expectations are shaping in a similar direction. This situation reinforces the expectation that large investors may continue their strategy of accumulating XRP and that the price may rise further as the supply decreases.

This situation reinforces the expectation that large investors may continue their strategy of accumulating XRP and that the price may rise further as the supply decreases.

In order to better understand the whale movements in XRP flows from exchanges to wallets, we need to separate and analyze the transactions based on the amount of XRP transferred. At this stage, when the movements that remove transfers over 1 million XRP from the exchange at once are scrutinized, we observe that this collection process actually started in January 2024. This collection situation, which continued throughout the year, seems to have been exited from the stock exchanges with a large number of transfers in a single day rather than being distributed over the days recently. Although this explains the whale movements behind the rapid increase in the price, there is no similar growth in the number of XRP entering the exchanges with whales. This can be interpreted as an indication that we are not yet close to the peak according to whales.

The overall picture is that whales and traders in the majors do not yet feel that they have reached saturation level profits. Investments continue to be made and some of the whales are still gathering assets, while the number of sellers is considerably lower than the number of gatherers. In the light of this data, the expectation is that the upside market will continue.