Cryptocurrency in Social Life

In recent years, cryptocurrencies have evolved from being just investment and speculation tools to being used in different areas of social life. With the year 2025, the momentum of this transformation has increased significantly. Cryptocurrencies have now crossed the boundaries of the financial world and started to integrate into our daily lives. Successive developments in the July-August 2025 period revealed that this process accelerated on a global scale. The United Arab Emirates (UAE) is taking a leading role in this transformation. In the country, it has become possible to pay with crypto in many areas from real estate sales to school installments, from public transportation to airline tickets. This shows that digital assets are now touching the lives of the masses, not just tech enthusiasts. The crypto integration of Emirates and Air Arabia airlines stood out as one of the most concrete steps in this process. The entry of globally recognized companies into this field opens a new page for the sector in terms of scale.

The integration of cryptocurrencies into social life draws attention as a step that both enriches the individual user experience and shapes the future vision of states and companies. These developments are a strong indication that digital assets have become an integral part of the economy of the future. In this report, we will discuss how cryptocurrencies are being adopted in different areas of social life and what concrete developments have taken place recently.

Traveling with Crypto on Airlines

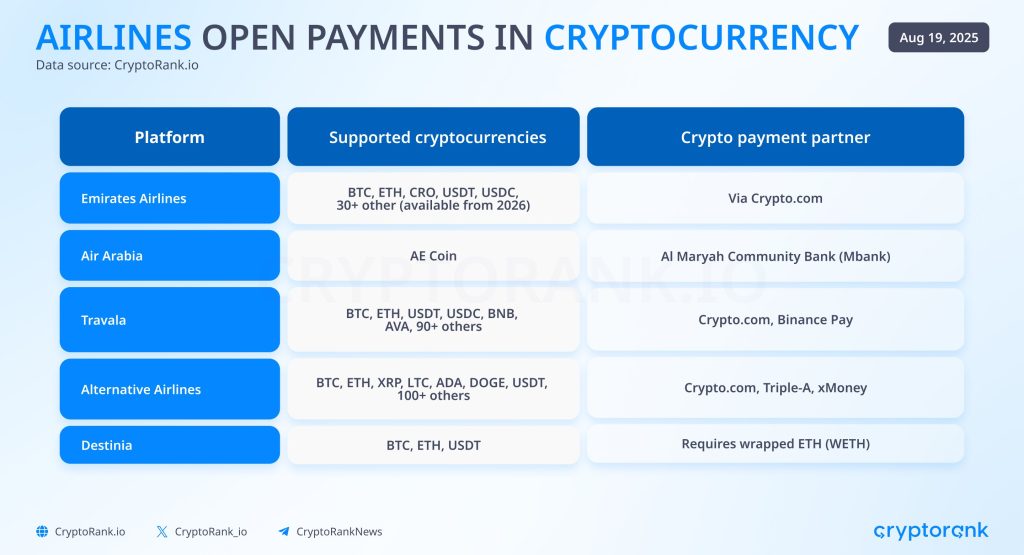

The use of cryptocurrency in the aviation industry, once seen as a distant possibility, is now becoming a reality with concrete steps. The leading airlines of the United Arab Emirates are at the center of this transformation. Emirates signed a preliminary agreement to launch its crypto payment infrastructure in July 2025. As part of this cooperation, passengers will be able to pay for flight tickets and in-flight expenses with cryptocurrencies such as Bitcoin, Ethereum and Tether by 2026. Emirates executives describe this step as a strategic move in line with the company’s digital transformation vision and aimed at its young, tech-savvy customer base. Air Arabia, another Dubai-based airline, has been early adopters, accepting the United Arab Emirates dirham (AED)-pegged AE Coin stablecoin for ticket bookings. This stablecoin, which is Central Bank approved, provides the user with low transaction costs and price stability. Thus, crypto payments are integrated not only on a global scale but also into the local economy.

Source: cryptorank.io

These developments demonstrate the functionality of the country’s regulatory framework for crypto assets (VARA), while also supporting Dubai’s vision of becoming a center of attraction for tech-savvy tourists and investors. Emirates’ step in this area is seen as a turning point in global aviation in terms of scale. Although Latvia-based airBaltic and some Asian airlines have started similar practices before, the adoption of crypto by a globally known player like Emirates means a remarkable threshold in the sector.

As a result, crypto integration in airlines is a strategic innovation in tourism, finance and technology policies. This trend is expected to inspire other airlines in the coming period and create wider adoption on a global scale.

Crypto Investments in Real Estate

Cryptocurrencies are playing an increasingly visible role in the real estate sector. While the idea of “buying a house with Bitcoin” once seemed like a dream, examples of crypto payments in real estate transactions have rapidly increased in many countries as of 2025. Dubai, in particular, has become the pioneer of this transformation with its crypto-friendly regulations, while in July 2025, the Dubai Land Department’s cooperation with a crypto exchange paved the way for title deed transactions with digital currency. As a matter of fact, in the same year, around 3% of the sales at the project stage in Dubai were realized in crypto, largely due to the interest of foreign investors.

Similar developments are taking place in the luxury real estate market. In the summer of 2025, Christie’s International Real Estate established a special unit for customers who want to transact with crypto and put over $ 1 billion worth of luxury housing on sale with crypto. Examples like the $65 million mansion in Beverly Hills show that digital wealth holders prefer crypto for real estate investments.

Source: New York Times

While the direct use of crypto on the payment side is possible in countries such as the UAE, Portugal and El Salvador, in the US, UK and Germany, crypto payments are usually converted into fiat money instantly and the transaction is completed. In Turkey, although crypto payments are not legally accepted directly, it is a practical solution that crypto assets can be converted into TL and title deed transactions can be made with intermediary platforms if the parties agree.

According to data from the article titled “Buying Real Estate with Cryptocurrency: How and Where to Do It in 2025” published on Astons:

Crypto Real Estate Overview

| Country | Direct payment in crypto is allowed | Possibility of purchase via conversion | Taxes on purchase | Taxes on gains |

|---|---|---|---|---|

| Portugal | Yes | Yes, if you sell crypto on a licensed exchange | 0-8% transfer tax + 0.2-0.5% notary | 0% if held for >365 days; 28% if <365 days |

| Germany | No | Yes, only through conversion | 3.5-6.5% Grunderwerbsteuer + 1% notary | 0% if kept >12 months; 0-45% if <12 months |

| Switzerland | Yes | Yes | 0.25-1% notary and cadastral fees | 0% if you trade irregularly |

| Bulgaria | No | Yes | 0.1-1.5% notary | 10% if held <3 years |

| Montenegro | Yes (through a barter agreement) | Yes | 3% registration | 15% if conversion is within the country |

| Belarus | Yes | Yes | 0.2% state duty | 0%, until the end of 2025 |

| Cyprus | No (gray area) | Yes | 0-0.2% stamp duty | 20% on growth |

| Georgia | Yes | Yes | 0.05% state duty | 0% if held for >1 year; 5% if <1 year |

| Turkey | Yes | Yes | 4% fee + 0.1-0.3% cadastral | 0% if held for >1 year |

| Singapore | No | Yes | 3-4% stamp duty + 0.1-0.2% notary | 0% if private investment |

| Indonesia | No | Yes | 10% VAT + 1% notary | 0.1% from operation + 10% if kept <1 year |

Source: Astons

On the other hand, the most innovative reflection of crypto in the real estate world is tokenization. Dividing properties into digital tokens and making them accessible to small investors increases the possibility of partnership in large projects. According to Deloitte’s projections, this market could reach a trillion-dollar size by 2035. Thus, crypto provides speed and global reach in high-value real estate transactions, while at the same time making real estate investments more democratic and accessible for small investors.

Cryptocurrencies in Sports and Entertainment

The appeal of cryptocurrencies is also growing rapidly in the mass sports and entertainment sector. Fan tokens and NFT collections have become new tools for clubs and artists to connect with their audiences. FC Barcelona, Paris Saint-Germain, Manchester City and many other football clubs have launched their own fan tokens, while Juventus’ “Crypto Fan Zone” platform allows fans to buy tickets and merchandise, access special events and vote with crypto. Thus, fandom is transforming into an interactive and investment-oriented experience in the digital age.

The integration of crypto into sports is not limited to fan interaction; sponsorship and brand collaborations also create a huge market. While the name sponsorship of crypto brands stands out in many organizations from Formula 1 to the NBA, the logos of crypto exchanges have started to appear on the shirts of clubs in European football. According to sports economists, $5 billion of the sports sponsorship market is expected to come from blockchain companies by 2026. While this process opens new revenue doors for clubs, it also provides crypto companies with brand awareness on a global scale.

On the entertainment side, NFT tickets, digital collections and token-based funding models stand out. Hollywood studios are releasing special NFT collections for movies, while in the music world, artists have started to release NFT albums and directly increase their revenues. Ticketmaster’s NFT ticket applications launched in 2025 reduced the problem of counterfeit tickets and offered fans a digital souvenir at the same time. On the gaming and metaverse side, blockchain integration is providing gamers with new ways to earn and trade through NFT ownership. Despite all the ups and downs, experts see the integration of crypto into sports and entertainment as a lasting transformation.

Crypto in Daily Life and Retail Shopping

The most visible face of the social integration of cryptocurrencies is the payment option in daily shopping. By 2025, the use of crypto in coffee, grocery and e-commerce payments will be much more accessible than in the past. Major brands accept crypto directly or through gift card/payment instrument integrations, while giant platforms such as Amazon have made it possible to shop with Bitcoin through third-party solutions. This diversity shows that crypto is moving from a “niche investment” perception to a multi-sectoral use base.

The real accelerator of adoption is the integration of payment infrastructures. In the model announced by PayPal in 2025, businesses can receive payments in more than 100 cryptocurrencies. The amount is converted into stablecoins or fiat money at the time of the transaction, eliminating exchange rate risk. Crypto cards, which are being spread through Visa/Mastercard partnerships, allow users to spend the digital assets in their wallets just like a debit card. POS manufacturers and e-commerce infrastructures are standardizing crypto extensions, while at the city level, Bitcoin/USDT acceptance is spreading in cafes, shops and even local tax payments. This picture shows that crypto is working “in the background”, becoming invisibly integrated into the user experience.

The role of stablecoins in everyday payments is critical. Dollar-pegged assets like USDT/USDC minimize price volatility and serve as “alternative cash” in inflationary economies. Local currency-stablecoin conversions via P2P channels facilitate daily purchases. Still, regulation, taxation, periodic network fees and user experience remain the main thresholds for widespread adoption. The overall picture is clear: crypto payments, which offer cost and speed advantages in cross-border transactions and create new customer segments for businesses, are cementing their place as a permanent alternative to cash and cards in the retail ecosystem.

Overall Assessment

By 2025, cryptocurrencies have gone beyond being an investment tool and are rapidly integrating into different areas of social life. From airline transportation to real estate, sports to retail, crypto is becoming a natural part of everyday life.

While regulatory uncertainty and technical challenges remain, the proliferation of stablecoins and the development of payment infrastructures are accelerating this transformation. The future of crypto is not to replace cash or cards, but to create a permanent alternative to them.

In conclusion, the integration of cryptocurrencies into social life is no longer a passing trend, but a powerful transformation that will permanently shape our economic habits in the coming period.

Disclaimer

The information, comments, and analyses contained in this article do not constitute investment advice. Investment advisory services are provided individually by authorized institutions, taking into account investors’ risk and return preferences. The opinions expressed here are general in nature and may not be suitable for your financial situation or investment goals. Making investment decisions based solely on this article may result in unexpected outcomes.