Introduction

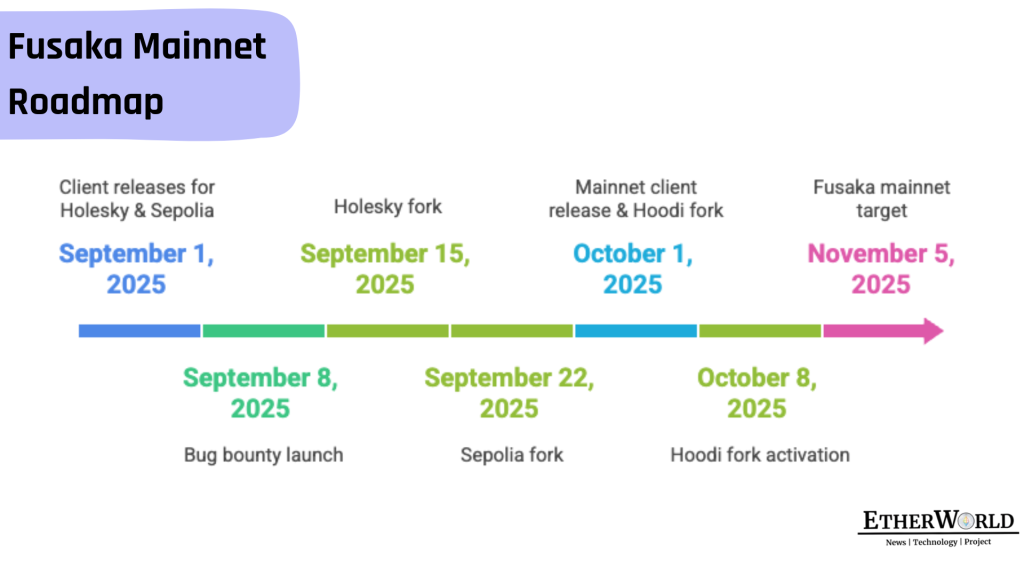

Ethereum core developers completed the distribution of the Fusaka package on test networks in October, positioning the mainnet target for December 2025. Fusaka offers a framework that scales data accessibility and aims to reduce fee volatility under heavy load as a simultaneous combination of the Fulu and Osaka updates. L2 fees had already shifted to a low regime after Dencun; Fusaka aims to make costs more predictable by increasing capacity on this foundation and reducing the risk of congestion during peak times. Thus, while Ethereum’s role as the core settlement and security layer strengthens, the investment narrative is evolving from a “fee-burning-focused return” perspective to the identity of “the native collateral and reserve of a scalable and secure network.”

Source: Etherworld.co

What is Fusaka and Its Scope

Fusaka is designed as a package of approximately twelve EIPs that update both the execution and consensus layers simultaneously. The package highlights security and efficiency-focused adjustments such as data accessibility sampling with PeerDAS, gradual increase of blob parameters without expecting major forks using the BPO approach, preventing transaction monopolization of a block with a gas limit of approximately 2^24 per transaction, and imposing a 10 MiB upper limit on the RLP block size. The package also includes CLZ-like low-cost bit-level primitive commands that improve developer ergonomics and a bridge to device-local authentication flows with secp256r1 precompilation. Making block proposer visibility deterministic simplifies pre-approval and “based rollup” designs. Although sometimes confused in field expectations, Verkle Trees are not part of this package; they are addressed as a separate phase.

PeerDAS and BPO: Impact on Capacity and Predictability

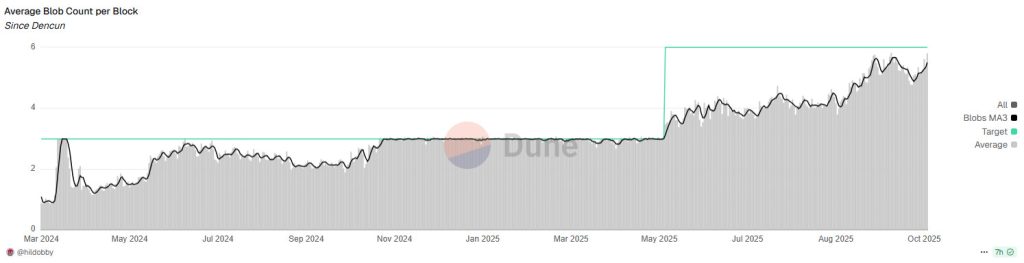

PeerDAS allows validators to verify the blob data written by L2 to L1 by randomly sampling it without downloading the entire data. This allows the network’s blob capacity to be increased while keeping bandwidth and storage requirements in balance. This design aims to produce a more predictable fee and confirmation time profile on the user side by smoothing out queues and sudden fee spikes during peak hours. The BPO approach, on the other hand, enables blob targets and upper limits to be increased in small increments based on the “measure-monitor-increase” principle. This allows capacity increases to be managed without relying on major hard forks, increasing centralization risk, or overburdening client teams.

Source: Dune.com

Gas Architecture and Security Limits

Fixing the single-transaction gas ceiling at approximately 16.78 million prevents a single transaction from monopolizing the entire block, narrowing the denial-of-service attack surface. The RLP-based block size limit of approximately 10 MiB creates a protective layer over the physical packet size. When these two limits work together, block occupancy is expected to be distributed more homogeneously, and mempool pressure is expected to be more controlled during busy periods. On the execution side, bit-level and logarithmic operations become cheaper with primitive commands such as CLZ, while the total cost of applications that utilize proof generation and cryptographic operations can decrease. With the secp256r1 precompilation, passkey and biometric-based signature flows are more naturally transferred to the EVM side; the friction created by seed word management is reduced, and user adoption is facilitated.

Performance and Fee Dynamics: Differentiation in Optimistic and ZK Rollups

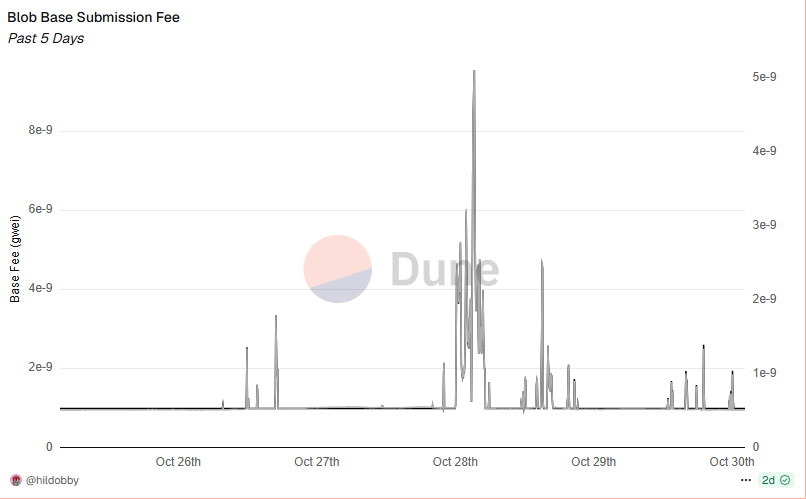

Source: Dune.com

Fusaka’s primary benefit is not so much to reduce fees absolutely, but to increase capacity and reduce the volatility of fees and confirmation times. With Dencun, L2 fees had fallen to a low level; the congestion and queue cost spikes seen during peak hours were related to data accessibility bottlenecks. PeerDAS and the BPO increases built upon it alleviate this bottleneck. The distribution of the effect varies depending on the rollup type. On the optimistic rollup side, since L1 data publication and sorting dominate the cost basket on networks such as Arbitrum and Optimism, Fusaka’s effect is relatively more visible, and a significant reduction in fee and confirmation time deviations is expected. On the ZK rollup side, since proof generation dominates the total cost, improving data accessibility is beneficial, but the effect is relatively limited; in the medium term, the effect is expected to increase when combined with hardware and algorithm efficiency gains in proof generation. The threshold where the effect will be most clearly visible is mainnet activation; gradually increasing blob capacity with subsequent BPO steps could further reduce fee volatility.

Operational Effects: Nodes, Validators, and Developers

Using sampling instead of full downloads with PeerDAS creates a sustainable bandwidth profile in home and virtual server configurations, facilitating the participation of solo validators and small operators in the network. This trend serves the goal of reducing centralization pressure. On the developer side, low-cost bit-level operations and modern authentication bridges with secp256r1 simplify new user onboarding. History cleanup and lighter state synchronization accelerate new node launches. The targeted higher block execution capacity for the default gas limit produces more predictable performance for applications during peak hours. The deterministic appearance of the block proposer order simplifies pre-approval mechanisms, enhancing users’ early certainty experience.

Investment Thesis: ETH’s Value Storage and Reserve Asset Identity

As L2 activity increases, L1 fee burning and revenue flow transition to a more volatile regime, while Fusaka scales the security and settlement layer. Within this framework, ETH’s investment narrative shifts from an asset where fee revenue is paramount to a monetary asset that secures the network and serves as collateral for the ecosystem. The strengthening of ETH’s collateral and reserve role in corporate treasuries and DeFi protocols supports this narrative. While dilution risk may periodically come to the fore for non-staking investors, as the network’s use case expands and capacity management progresses incrementally with BPO, the value proposition increasingly reads through usage and security.

Conclusion

Fusaka represents a critical milestone in Ethereum’s scalability roadmap with its capacity increase focused on data accessibility and security constraints. It improves the end-user experience by reducing the risk of congestion during peak hours and making costs more predictable. While the effect is expected to be more pronounced in Optimistic rollup networks due to the nature of the cost basket, improvements in ZK rollup networks will be reflected gradually alongside efficiency gains in proof production. A more accessible operating profile for nodes and validators, modernized primitive commands for developers, and identity verification bridges support the ecosystem’s expansion. This overall effect strengthens the narrative that positions ETH as the native collateral and reserve of a scalable and secure settlement layer, moving away from a short-term fee-burning-focused interpretation of its investment thesis. Following mainnet activation, this effect is expected to gradually solidify with subsequent increases in the blob parameter.

Disclaimer

This article is for educational and informational purposes only. It does not constitute financial advice. Cryptocurrency investments carry risk; always conduct independent research before investing.