MetaMask Ondo Global Markets

MetaMask, the leading self-custody crypto wallet developed by Consensys, and Ondo Finance, the leading tokenized real-world asset platform, announced an integration that will bring tokenized US stocks, ETFs, and commodities directly to the MetaMask wallet via Ondo Global Markets starting February 3, 2026. Eligible mobile users in supported non-US jurisdictions can access over 200 tokenized US securities, including Tesla, NVIDIA, Apple, Microsoft, Amazon, and ETFs such as SLV (silver), IAU (gold), and QQQ, without opening a traditional retail brokerage account and while remaining entirely on crypto rails.

This integration, announced at the Ondo Global Summit, represents one of the first examples of local access to tokenized US stocks and ETFs within a large self-custody wallet. The increasing adoption of tokenization and its progression beyond early use cases toward broader distribution reflects a wider shift in market infrastructure.

Ondo Finance and Metamask Technical Working System

The integration operates on the Ethereum mainnet and allows users to directly exchange USDC for Ondo’s “Global Market” (GM) tokens. These tokens are total return trackers that reflect the price movements and reinvested dividends of underlying assets held 1:1 by licensed US custodians. While trading technically occurs 24/7 on-chain, liquidity peaks during US market hours (5/24) and offers a “Robinhood-like” experience with self-custody security. This launch marks a significant milestone in the “Corporate Era” of 2026. MetaMask and Ondo scale the “Open Money Stack” for global users by eliminating the need for fragmented brokerage accounts and traditional trading windows. With the total locked value of tokenized RWA exceedingly approximately $24 billion at the time of writing, this vertical integration proves that the future of finance is not just about “crypto,” but about moving all traditional treasury and equity assets onto transparent, interoperable blockchain rails.

Key Features Offered in the MetaMask RWA Launch:

- Over 200 tokenized US stocks and ETFs on the Ethereum mainnet

- 24/5 trading access via MetaMask Swaps.

- 24/7 transfers: Send and receive Ondo tokens anytime.

- Unified portfolio management: Hold tokenized securities alongside crypto assets in a single multi-chain account without leaving the MetaMask app.

The Impact of MetaMask’s Partnership with Ondo on the RWA Token Sector

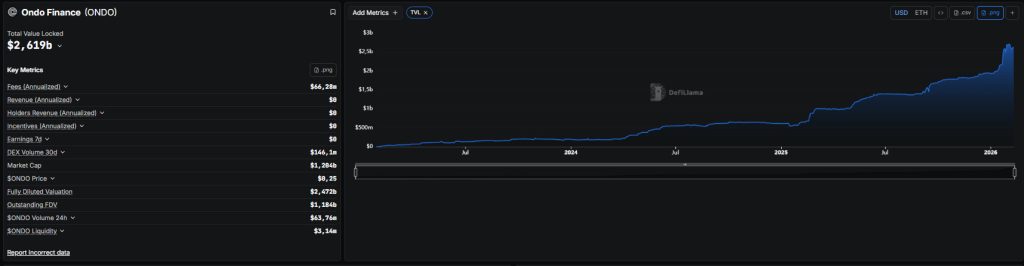

While integration is a technical milestone, the addressable market remains small. The market appears to view the integration as insignificant in terms of token value. Looking at the monthly chart, ONDO has shown a steady downward trend from around $0.45 at the beginning of January to its current level of $0.24. The MetaMask news failed to reverse this downward trend. In fact, it couldn’t even stop it. Market data shows that ONDO’s market capitalization has exceeded $1.19 billion and its total locked value has surpassed $2.61 billion. The mismatch between protocol metrics and token performance reflects a broader trend in the real-world asset sector. MetaMask integration will enable Ondo’s growth if regulatory environments improve. Until key markets open up, the practical impact will remain limited.

Source: defillama

Which Tokenized Assets Can Be Accessed Through Ondo?

Current tokenized US securities include giants such as Tesla (NASDAQ: TSLA), Nvidia (NASDAQ: NVDA), Apple (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT), and Amazon (NASDAQ: AMZN), as well as gold, silver, and ETFs linked to the Invesco QQQ Trust (NASDAQ: QQQ). This launch represents one of the first examples of local access to tokenized US stocks and ETFs within a large self-custody wallet, reflecting the growing push to bring traditional financial assets onto the blockchain rails.

Key Highlights:

Joe Lubin, founder and CEO of Consensys and co-founder of Ethereum, stated, “Access to U.S. markets is still provided through legacy systems. Brokerage accounts, fragmented applications, and rigid trading windows have not evolved meaningfully.” He added, “Bringing Ondo’s tokenized U.S. stocks and ETFs directly to MetaMask shows what a better model looks like. A single self-custody wallet where people can move between crypto and traditional assets without intermediaries and without relinquishing control. That is the future we are actively building in MetaMask.”

Ondo Finance CEO Ian De Bode said, “MetaMask is a platform where millions of users already manage their on-chain assets, and the integration of Ondo Global Markets brings a completely new asset class to this familiar wallet experience. By integrating Ondo Global Markets, MetaMask can offer its users access to tokenized US stocks and ETFs at prices reflecting traditional brokerage markets and move the economics of platforms like Robinhood to an on-chain wallet with self-custody capabilities. If you tokenize something, you make it easier to access or use as collateral. Stocks fit both categories and are priced like assets people actually understand, not like a building in Manhattan.” De Bode argued that a major advantage is instant minting and burning. This allows large investors to trade millions of dollars worth of tokenized stocks at prices mirroring their brokerage accounts, without premiums or losses.” However, de Bode noted, “Liquidity still drops on weekends, as crypto markets and decentralized finance (DeFi) operate 24/7 while traditional finance (TradFi) operates Monday through Friday. This mismatch makes it difficult for market makers to hedge risks for stock tokens. If the NYSE and Nasdaq implement their plans to support 24/7 tokenized stock trading, effectively synchronizing TradFi and DeFi hours, this situation could change. “If TradFi starts operating 24/7, that would be a blessing. Our goal is not to compete with exchanges,” he said. “We are empowering them. Think of us as Tether for stocks.”

Which Investors Can Access It?

Ondo Global Markets tokens (including Ondo tokenized stocks and Ondo tokenized ETFs) are not registered under the amended U.S. Securities Act of 1933 (“Act”) or any other jurisdiction’s securities or financial instruments laws. The tokens may not be offered or sold in the United States or to U.S. persons unless they are registered under the Act or exempt from registration requirements. They are offered and sold only to qualified investors or professional clients in certain jurisdictions, including the European Economic Area, the United Kingdom, and Switzerland. Restrictions and limitations based on other jurisdictions also apply. The token issuer is not registered as an investment company under the U.S. Investment Company Act of 1940, as amended, or as an Alternative Investment Fund or Undertaking for Collective Investment in Transferable Securities in the European Economic Area, or under the securities or financial instruments laws of any other jurisdiction.

Integration is available in MetaMask Mobile for eligible users in supported jurisdictions. Ondo tokenized assets are generally designed for investors outside the United States and are offered to MetaMask users via MetaMask Swaps, subject to certain jurisdictions and other restrictions.

The following regions are excluded The following regions are excluded:

Afghanistan, Algeria, Belarus, Brazil, Canada, China (including Hong Kong), Crimea, Cuba, Democratic People’s Republic of Korea, Donetsk People’s Republic (DNR), Eritrea, European Economic Area, Iran, Kherson and Zaporizhzhia regions (Ukraine), Libya, Luhansk People’s Republic (LNR), Malaysia, Morocco, Myanmar, Nepal, Russia, the city of Sevastopol, Singapore, Somalia, South Sudan, Sudan, Switzerland, Syria, the United Kingdom, the United States (all states, territories, regions, and federal districts included), and Venezuela.

About Consensys

Consensys is the leading Ethereum software company developing the infrastructure, tools, and protocols that power the world’s largest decentralized ecosystem. Founded in 2014 by Ethereum co-founder Joseph Lubin, Consensys has played a fundamental role in Ethereum’s growth, from pioneering products like MetaMask, Linea, and Infura to shaping protocol development and staking infrastructure. With its global product portfolio and deep roots in the ecosystem, Consensys is uniquely positioned to accelerate Ethereum’s role as the trust layer of the new global economy.

Disadvantages

Tokens provide holders with economic exposure to the value of underlying publicly traded assets, including dividend values (excluding applicable tax deductions). However, Tokens are not themselves stocks or ETFs and do not grant holders the right to acquire or purchase the underlying assets. The Token issuer, its affiliates, related shareholders and members, and their respective officers, directors, employees, advisors, agents, and representatives do not endorse, represent, or warrant anything.

Tokenized Securities for Self-Directed Investors:

The broad cryptocurrency and digital asset market is increasing interest in tokenized stocks, ETFs, and commodities. Demand for online brokerage and fintech services from industry leaders such as Robinhood and E-TRADE has increased in recent years, but self-custody options for these services are relatively limited.

Conclusion

Integration with MetaMask strengthens Ondo’s position at the infrastructure level. The company is laying the groundwork for the future on-chain securities market. However, for ONDO holders, this serves as a reminder that product development and token dynamics may follow different paths. While key markets remain closed and the value distribution model retains its uncertainty, token prices continue to be a question mark. The RWA market is maturing. However, tokens in this sector still operate according to speculation rules rather than fundamental demand. At the same time, country restrictions sharply reduce the impact. In fact, only certain emerging markets with more relaxed regulations have gained access. This situation sharply narrows the potential audience and explains the limited response from investors. Technically, integration is important. From a business perspective, its impact is still limited. Consequently, whether this integration will maintain its permanence in the broader economic world, depending on the shape of its development and growth, is likely to remain a topic of debate for some time.

FAQ (Frequently Asked Questions)

Do I need a special version of MetaMask to access tokenized assets?

The new functionality will only be available in the MetaMask mobile app when it launches. However, the company plans to extend support to the desktop version and browser extension by the end of February.

Are tokenized stocks the same as owning actual stocks?

Most tokenized stock platforms aim to track the price of real stocks by backing these tokens 1:1 with the real stocks they hold. So yes, this is equivalent to owning real stocks.

What happens to my tokenized assets if Ondo Finance shuts down?

These are tokens existing on the blockchain and generally represent rights associated with real assets. These tokens, which you hold in a self-custodial wallet such as MetaMask, are controlled by your private keys, similar to a balance on a normal exchange. If the tokens are truly standard tokens such as ERC-20 on the chain, technically no one can delete them from you, and they will not disappear from the blockchain even if the platform closes.

Can I use tokenized assets as collateral in DeFi protocols?

While this is technically possible, it is necessary to research which protocol it is on and how secure it is under what conditions.

Are there any fees besides standard gas costs?

There are costs associated with tokenized RWA. These include management fees, spreads, and other such costs.

Disclaimer

The information, comments, and assessments in this article are for educational and informational purposes only; they do not constitute investment advice, financial advice, or recommendations for buying or selling any asset.

Tokenized securities, real-world assets (RWA), and digital asset investments carry significant risks, including market volatility, liquidity risks, technological risks, regulatory uncertainties, and legal restrictions that vary by country. Access to tokenized assets may be completely restricted or prohibited in some countries.

Unless explicitly stated otherwise, the tokenized assets mentioned in this content do not confer direct ownership, voting rights, or legal ownership of the underlying stock, ETF, or commodity.

Readers are advised to conduct their own research and consult with qualified financial advisors before making investment decisions. The developments, technological advancements, or market analyses presented in this article do not guarantee future performance.

The author or publisher cannot be held responsible for any investment decisions made or financial consequences arising from the information contained in this content.