Introduction

By 2025, with its integration into the Web3 world, Telegram has evolved beyond a classic messaging app into a powerful platform that offers interaction with on-chain digital assets. One of the most striking examples of this transformation is the ability to turn digital gifts sent in chat into collections in NFT format. This structure on the TON blockchain offers not only a technical solution, but also an NFT usage model that puts social interaction at its center and emphasizes fast and economical transaction structure. This report takes a holistic look at the architecture of the Telegram Web3 ecosystem, the trading volume explosion on TON, and the opportunities and risks from an investor perspective.

The NFT Ecosystem with Digital Gifts and the Stars Mechanism

Telegram has added a new dimension to the platform by integrating the ability to convert digital gifts that users can send to each other in chat into NFTs. With this feature, gifts can be turned into collectible NFTs and displayed as profile badges, animated stickers, and more. They can also be traded or sold on the TON blockchain. Each NFT has unique characteristics, such as a randomly assigned model, background colour and icon, and is valued differently among collectors based on their rarity.

Stars, Telegram’s internal economy tool, is used both to send gifts and to upgrade to NFTs. Stars can be purchased in-app or in crypto. Thanks to the Telegram Gift Market, which launched in May 2025, users can now make NFT purchases directly and securely within the app. These developments have turned Telegram into a bridge between social media and blockchain.

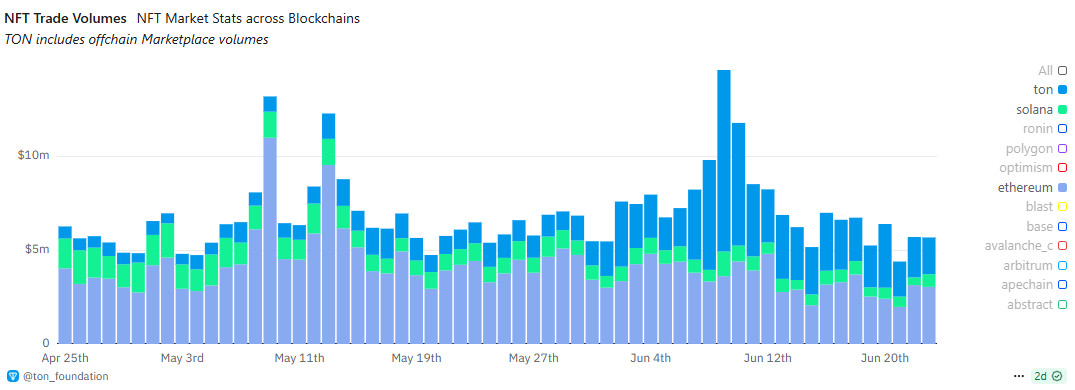

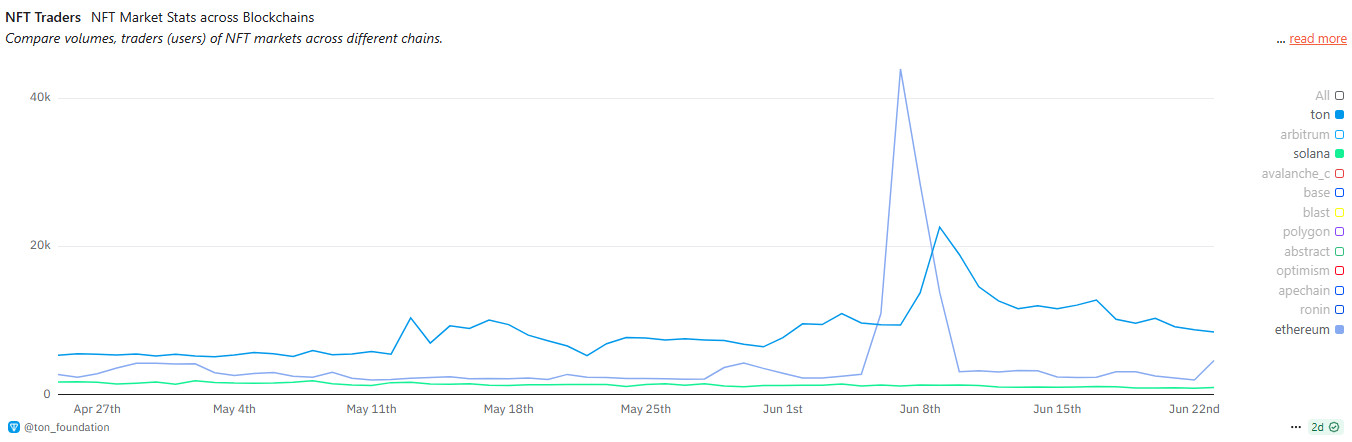

Telegram’s NFT-enabled digital gifts have generated a dramatic increase in transaction volume on the TON blockchain as of mid-2025. Especially in the first week of June, when both on-chain and off-chain data were included, TON’s total daily NFT throughput surpassed Ethereum and Solana on some days. This data can be verified through the TON Foundation dashboards in Dune Analytics.

For example, between June 7-9, 2025, TON NFT volume jumped from $3 million to over $9 million. During the same period, the number of active wallets on TON increased by 12% to 3.4 million in just one day. The number of daily transactions on-chain increased by 45% to 1.2 million in the first week of June, indicating significant usage momentum across the network.

Telegram-originated NFT trading totalled more than $2025 million over the course of 36 years, while the number of wallets holding these digital assets exceeded 184,000. The fact that more than 50% of these addresses were created in 2025 alone reveals that new entrants to the ecosystem are intensifying. In addition, with over 5,000 daily active NFT traders, TON has become one of the relatively high-interaction chains in the stagnant NFT market.

In an environment where trading volumes in the overall NFT market have fallen by more than 90% compared to the 2022 peak, TON’s divergence is not just hype, but points to a growth model underpinned by sustainable factors such as social usage, easy access, and in-platform integration.

Reasons for TON’s rise in the NFT Rankings

TON’s rapid rise to the top in NFT volume is driven by the accessibility and user flow enabled by Telegram integration. Telegram users can buy and sell NFTs without the need for technical knowledge, bringing TON to millions beyond the crypto world.

In addition, Telegram giveaways quickly went viral in the spring of 2025 through influencer accounts and communities. Collections like “Plush Pepe”, in particular, quickly surpassed $16,000 in price due to limited supply and visual appeal. Likewise, series like “Durov’s Caps” were also in high demand. These dramatic price increases attracted both collectors and speculators, driving up trading volumes.

The Telegram team has constantly innovated to keep demand alive. January brought the NFT badge feature, February brought Valentine’s Day-themed gifts, March brought a multi-showcase update, and May brought an in-app marketplace. These strategic steps both increased social prestige and expanded usage areas.

In particular, the “FOMO” effect created by limited-time gift series kept collector interest dynamic. For example, one of the new series launched on June 1 sold out in just 37 minutes. Such timed launches have managed to multiply transaction traffic on TON in short periods of time.

Telegram Sourced Featured NFT Collections

The NFT ecosystem on the TON blockchain is largely centered around Telegram-sourced collections. The highest-volume assets are usually NFTs that Telegram directly supports or integrates.

Anonymous Telegram Numbers (Anonymous Number NFTs) is one of the largest collections on TON. These NFTs enable the creation of a Telegram account without the need for a SIM card. As of June 2025, it leads with a weekly volume of approximately 977,000 TON. Their base price is at 820 TON.

Telegram Usernames is another important collection of prestigious and short usernames sold in NFT format. These NFTs offer permanent ownership and have a weekly trading volume of around 364,000 TON. Due to the large supply, some username NFTs are trading at prices as low as 6 TON.

Prominent series in the Collectible Gifts category include “Plush Pepes” and “Durov’s Caps”. Plush Pepes are limited edition cute frog-themed NFTs with a base price of 5,100 TON and a leading position. Durov’s Caps stands out with its founder-inspired theme and a base price of around 875 TON. Other series such as Loot Bags, Precious Peaches, Toy Bears and Swiss Watches have also seen volume increases of 150%-300% in recent weeks. As most of them are limited editions that Telegram offers on special occasions, the lack of supply is pushing prices higher.

NFT trades on TON are taking place on Telegram’s own internal marketplace (Gift Marketplace) as well as on third-party platforms. One of the biggest is TONNEL, which made waves in June 2025 when it surpassed OpenSea in daily volume, despite only supporting TON NFTs. In addition, platforms such as Portals and Getgems are among other major hubs growing TON’s trading volume. Fragment, Telegram’s official auction platform, plays an active role in @username and anonymous number sales. All of these marketplaces function as hubs where NFT liquidity in TON is distributed and contribute to the growth of the ecosystem.

NFT Analysis Compared to Ethereum and Solana

As the birthplace of the NFT revolution, Ethereum is still the chain with the largest total NFT value. But high transaction fees and declining interest from 2023 onwards caused volumes on Ethereum to drop by more than 95%. Today, only a few “blue-chip” collections remain active. High gas fees for small transactions are driving users to more convenient alternatives.

This is where TON stands out. Low transaction costs and ease of in-platform trading have been one of the main factors that have popularized the use of NFTs on TON. While even micro-value transactions remain affordable on TON, the fact that it surpasses even Ethereum in terms of transaction volume on some days is a concrete indicator of this efficiency.

Solana, on the other hand, had a big breakout in the NFT market in 2021-2022, but lost serious momentum after the FTX collapse. Popular collections moving to other chains and a shrinking user base led to a decline in volumes. TON’s debut in 2025 coincided with this gap. Thanks to Telegram integration, TON built a larger user base and surpassed Solana in both number of transactions and volume.

While technically TON and Solana are similarly fast and low-cost blockchains, TON’s difference lies in its integration with the social layer from Telegram. Whereas NFTs on TON were mostly focused on social interaction (gifts, usernames, numbers), Solana emphasized community and art.

However, the TON ecosystem is still growing in a relatively narrow space – almost entirely dependent on the Telegram app. Ethereum, on the other hand, has a much wider variety of NFTs, with numerous games, metaverse and collection projects. While TON’s success in this area is noteworthy, Ethereum’s cost-cutting with Layer-2 solutions (Arbitrum, zkSync, etc.) and Solana’s efforts to come back with new strategies show that competition will continue.

Opportunities and Risks for Investors

Telegram’s NFT integration and the trading volume explosion on TON present remarkable opportunities for investors. First, thanks to increased network usage, TON’s native token Toncoin has been in demand, gaining over 8% to $6.85 by early June 2025. The increase in NFT trading volume is strongly correlated with the Toncoin price, offering the possibility to anticipate price movements of NFT activity.

New collection announcements or trading records can create short-term spikes in Toncoin. This momentum is supported by technical indicators (e.g. RSI, moving averages). Likewise, opportunities for high returns can arise for early-stage investors in rare NFT collections on TON. For example, the price of the Plush Pepe series, which can reach thousands of dollars, is an example of such gains.

In the medium term, TON’s success in integrating NFTs into messaging and social media platforms could start a new industry-wide trend. This could create opportunities not only for Toncoin, but also for other projects targeting similar integrations. In addition, the TON Foundation’s efforts to expand into Western markets and gain global exposure through celebrity collaborations (e.g. Snoop Dogg, Pudgy Penguins) may increase institutional investor interest.

However, some risks should be taken into account when assessing this outlook. The TON NFT market is currently heavily dependent on Telegram, and interest is largely based on a social trend. While new collections sell out quickly, over time, oversupply may build up and the rarity effect may weaken. Unpopular series can quickly lose value.

There are also challenges on the liquidity side. The TON NFT ecosystem does not yet have a deep pool of capital. High-priced NFTs may not always find buyers easily. This can lead to sudden selling pressures and high volatility. Also, a change in Telegram’s Stars system or NFT policies could directly affect the ecosystem.

Additionally, restrictions on in-app purchases by platform providers like Apple and Google could slow the expansion of the Stars economy. And of course, a sudden drop in the overall crypto market could drag down Toncoin and NFT prices.

Conclusion

The NFT use cases enabled by the TON blockchain through Telegram integration point to the rise of social function-driven digital assets in the Web3 world. The transformation of NFTs from mere investment vehicles or artistic collectibles into tools of in-platform prestige, identity and interaction heralds a paradigm shift in the industry. Projects that work integrated with platforms with a high user base, such as Telegram, make a difference not only with their technical capacity but also with their potential for mass adoption. This wave of growth in TON has already demonstrated how critical social context and accessibility will be in the future of NFTs.

Disclaimer

This content has been prepared by the Darkex Research Team for informational purposes only. It does not constitute investment advice. All risks and responsibilities arising from your investment decisions are solely your own.