Introduction

The Polygon blockchain network successfully implemented a major protocol upgrade (hard fork) called “Madhugiri” on December 9, 2025. The primary goal of this upgrade was to increase the network’s scalability and speed, laying a strong foundation for future use cases. With the Madhugiri hard fork, the Polygon network’s transaction capacity increased by approximately 33%, and the block creation and consensus time was reduced to approximately 1 second. This means that transactions on the network can be completed with lower latency; the goal is to provide a smoother experience for users in interactions such as token transfers, Decentralized Finance (DeFi) transactions, and NFT activities.

In this report, we cover the technical details of the Madhugiri upgrade, its expected effects on the network, and its potential implications for the POL token.

Technical Improvements Brought by the Madhugiri Hard Fork

The Madhugiri hard fork delivers significant improvements in the Polygon network’s core performance metrics. Updates to the consensus layer (under the PIP-75 proposal) have reduced block production time from 2 seconds to 1 second. This change has increased the number of transactions the network can process per second by approximately one-third, resulting in a 33% capacity increase.

Importantly, this upgrade does not require any additional action from users or application developers, as the changes are implemented at the protocol level. Since the changes were automatically applied at the protocol layer, the transition was completed without any downtime or compatibility issues for node operators and validators. The hard fork did not cause a chain split, and the existing POL token continues to be used seamlessly on the upgraded network.

Flexible Block Time and New Transaction Types

Another critical innovation introduced with Madhugiri is the ability to adjust block time settings more flexibly in the future. While previous versions may have required a new hard fork to change the block time, Polygon developers can now adjust the block creation time as needed without requiring a new fork. This modular consensus approach enables the network to perform rapid performance optimizations based on demand.

For example, if transaction demand increases significantly in the future or network conditions change, block time can be re-optimized through software adjustments to increase capacity. The upgrade also introduces a new transaction type for bridge traffic from Ethereum to Polygon. This will make cross-chain asset transfers and state updates more efficient and consistent.

By including StateSync transactions in blocks under PIP-74, the goal is to accelerate cross-chain state updates and reduce edge state errors. Furthermore, improved node synchronization mechanisms aim to make data synchronization faster and more reliable through validator and full node participation in the network. Although these types of background improvements are not directly visible to users, they make a difference in terms of sustainability as the network grows. These technical steps support the Polygon PoS mainnet’s resilience, enabling it to serve a growing user base without experiencing scaling issues.

Ethereum “Fusaka” EIPs and Network Security

Polygon’s Madhugiri hard fork also integrated some critical Ethereum Improvement Proposals (EIPs) from Ethereum’s Fusaka update into its own protocol. Proposals such as EIP-7823, EIP-7825, and EIP-7883, in particular, focus on limiting the processor and gas consumption of high-cost computations.

The practical result of this approach is that it becomes more difficult for a single transaction to clog the network by consuming disproportionately high resources. This keeps transaction fees more predictable while reducing the impact of spam and network clogging attacks. The effective limit on maximum gas usage per block after Madhugiri acts as a security and stability layer, preventing individual transactions within a block from consuming all resources on their own.

Enhanced compatibility with Ethereum also supports developers in benefiting more quickly from security improvements on Ethereum via Polygon. In summary, Madhugiri presents itself as an update that seeks to advance both speed and security predictability in the same package.

Network Performance and Impact on Future Use Cases

The reduction of block finality time to approximately 1 second with the Madhugiri hard fork stands out as a technical threshold that significantly increases the competitive power of the Polygon network, especially in latency-sensitive use cases.

Faster and more consistent transaction confirmations improve the user experience in applications requiring instant response, such as Web3-based games, high-frequency trading scenarios, and micropayments, while also contributing to more predictable price slippage, arbitrage, and risk management processes on the DeFi side.

The same infrastructure gain could also position Polygon as a more attractive network for stablecoin usage, where high volume and low latency are fundamental requirements, as well as for real-world asset (RWA) tokenization projects, where expectations for reliability, transparency, and operational continuity are high. However, shorter block times do not completely eliminate the need for monitoring and optimization, as they make timing and resource management more sensitive for validators during peak periods.

Potential Effects on the POL Token and Market Repercussions

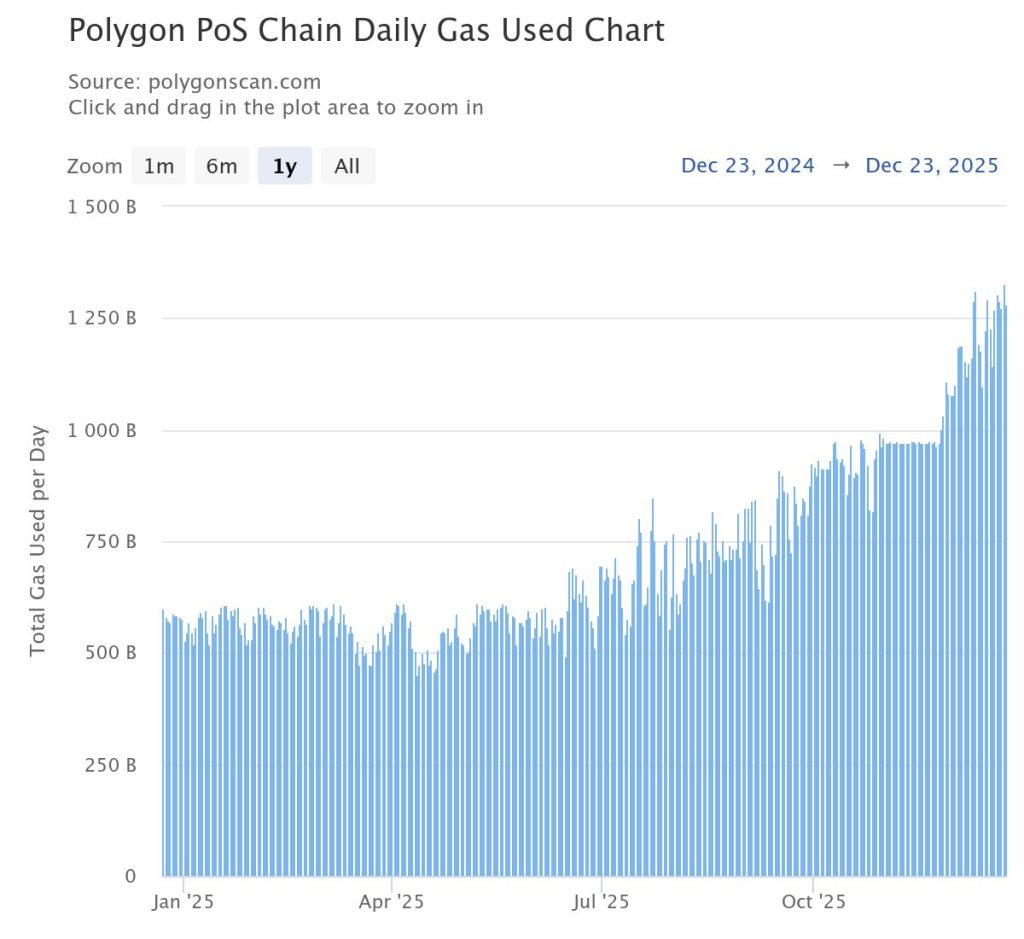

The increase in network usage metrics observed after the Madhugiri hard fork shows that the upgrade was not merely a technical improvement but also supported interest in the Polygon ecosystem in practice. The rise in transaction numbers and active addresses indicates that the network is operating faster and more efficiently, lowering the usage threshold, while the strengthening of fee collection dynamics may create an indirect channel of impact for the POL token economy.

Polygon’s possession of a burn mechanism similar to Ethereum’s EIP-1559 model offers a structure that could contribute to a partial reduction in inflationary pressure on supply in the long term if network activity increases permanently. However, this strengthening of the network’s fundamentals does not necessarily translate directly into prices in the short term.

Indeed, the POL price experienced a significant decline, falling from approximately $0.29 in September 2025 to around $0.10 by mid-December, illustrating a temporary divergence between fundamental indicators and market pricing. Such divergences do not always indicate project-specific weaknesses. General market sentiment, fluctuations in risk appetite, derivative market positioning, and temporary supply behavior resulting from the transition from MATIC to POL may have put pressure on the price.

On the other hand, Madhugiri’s update profile, which does not involve coin creation directly affecting POL supply, preserves the validity of existing balances after the upgrade, and requires no additional action from users, paints a picture of an infrastructure improvement that enhances performance without creating uncertainty. This suggests that if network usage becomes permanent, it could form a more solid foundation for POL valuation in the medium to long term.

Conclusion

The Madhugiri hard fork upgrade represents a significant technical and strategic milestone for the Polygon network. The approximately 33% increase in transaction capacity, the reduction of block time to 1 second, flexibility in consensus settings, and gas consumption limits on the security side make Polygon more prepared for high-volume use scenarios.

This enables the network to offer a more competitive performance profile in areas such as Web3 games, stablecoin transfers, DeFi applications, the NFT ecosystem, and RWA tokenization. On the POL token side, the upgrade’s impact is primarily indirect. Factors like increased network usage, fee burning, and ecosystem growth could lay a healthier foundation for token valuation in the medium to long term.

Although the price may remain weak in the short term, the impact of infrastructure updates on market prices is often delayed. Therefore, rather than expecting immediate price movements, usage persistence is a better indicator.

Disclaimer

The purpose of this content is to provide information and only education. Neither does it give financial, investment, legal nor tax advice. Cryptocurrency markets are extremely volatile; trading in them carries great risks. Views and opinions contained herein are based on information that is already available to the public at the time of writing. They may change without notice. Readers must conduct their own independent research as well as consulting qualified professionals before making any financial or investment decisions. Defichain and its affiliates assume no responsibility for any loss to you as a result of using the material.