Introduction

One of the most strategic steps in the cryptocurrency world in recent years was Ripple’s acquisition of global prime brokerage Hidden Road for $1.25 billion. This deal not only strengthens Ripple’s institutional presence but is also considered a critical milestone in terms of expanding the use cases of XRP. This report discusses Ripple’s acquisition of Hidden Road and its potential impact on XRP.

Hidden Road Acquisition Process

On April 8, 2025, Ripple announced the acquisition of Hidden Road in a $1.25 billion deal. According to a statement on Ripple’s official site, this deal is considered one of the largest acquisitions in the digital asset sector. With this deal, Ripple plans to integrate Hidden Road’s advanced infrastructure with XRP Ledger (XRPL), while expanding its vision of bridging digital assets and traditional financial markets.

Source: ripple.com

By injecting billions of dollars of capital into Hidden Road’s platform, Ripple aims to meet demand and increase scalability in prime brokerage, clearing and financing services. Ripple USD (RLUSD) stablecoin will also be actively used in this process.

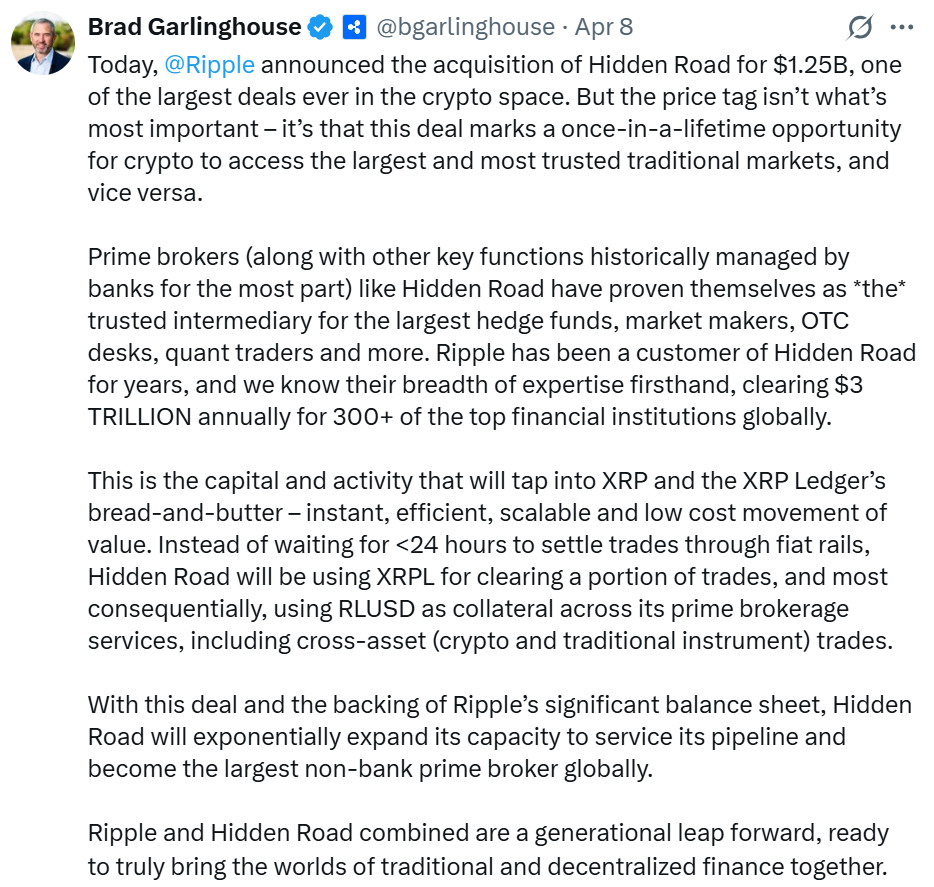

Ripple CEO Brad Garlinghouse stated that the most important aspect of the deal is not the price, but the integration of the trusted structures of traditional finance into crypto and XRP. According to Garlinghouse’s statement:

- Hidden Road serves more than 300 institutional clients with an annual trading volume of $3 trillion.

- XRP Ledger (XRPL) will take over part of these transactions, enabling instant, low-cost and efficient value transfer.

- The RLUSD stablecoin will be used in Hidden Road products as the first stablecoin to provide cross-margining between crypto and traditional assets.

These developments support XRP becoming not only a digital asset, but also a payment infrastructure that is actively used in the corporate finance world.

Source: x.com/bgarlinghouse

On April 17, 2025, Bloomberg reported that Hidden Road received a broker-dealer license. This is an important step in Ripple’s regulatory compliance strategy and gives Hidden Road a legal basis to expand its institutional customer base. This license reinforces Ripple’s strategy of “integrating digital assets and traditional finance” and paves the way for deeper integration of XRP and RLUSD with corporate finance structures.

Potential Impacts on XRP

The effects of the Hidden Road acquisition on XRP are multidimensional and include both direct and indirect repercussions:

- Increased Liquidity and Institutional Demand

The migration of Hidden Road’s trading infrastructure to XRP Ledger (XRPL) opens a new trading volume channel for XRP. Even if only a small percentage of the $10 billion in daily trading volume is routed through XRP, this could significantly increase liquidity. Institutional investors (hedge funds, OTC desks, market makers) may be forced to interact with XRP. This would increase direct demand for XRP and could accelerate institutional adoption.

- Integration with RLUSD Stablecoin

Ripple’s new USD-backed stablecoin RLUSD will be used as collateral for Hidden Road’s prime brokerage services. RLUSD is the first stablecoin to offer cross-margining between traditional financial products and digital assets. This is an important infrastructure move that integrates XRPL with corporate finance. The proliferation of RLUSD can directly fuel economic activity on the XRP Ledger.

- On-Chain Activity Increases on XRP Ledger

Hidden Road’s post-trade operations will be migrated to XRPL. This integration could increase on-chain volume on XRPL. Decentralized exchange (DEX) transaction volume, total value locked (TVL) and validator engagement are projected to increase. XRPL’s prominence for enterprise DeFi solutions will strengthen the chain’s technical infrastructure and ecosystem.

- Price Impact and Investor Perception

XRP price was bullish after the deal announcement. The limited price reaction is attributed to profit taking and general crypto market corrections. However, in the medium-to-long term, increasing institutional usage of XRPL could support XRP’s price potential.

General Evaluation

Ripple’s acquisition of Hidden Road is a strategic step that deepens XRP’s value proposition in terms of both technical infrastructure and institutional adoption. Increased liquidity, on-chain transaction volume, stablecoin integration and a bridge to traditional finance strengthen XRP’s long-term position. Taken together, the quartet of Ripple, Hidden Road, XRP Ledger and RLUSD is one of the biggest steps towards the full integration of digital assets into corporate finance.

Disclaimer

This content is for informational purposes only and does not constitute investment advice. All investment decisions are your own responsibility.