Introduction

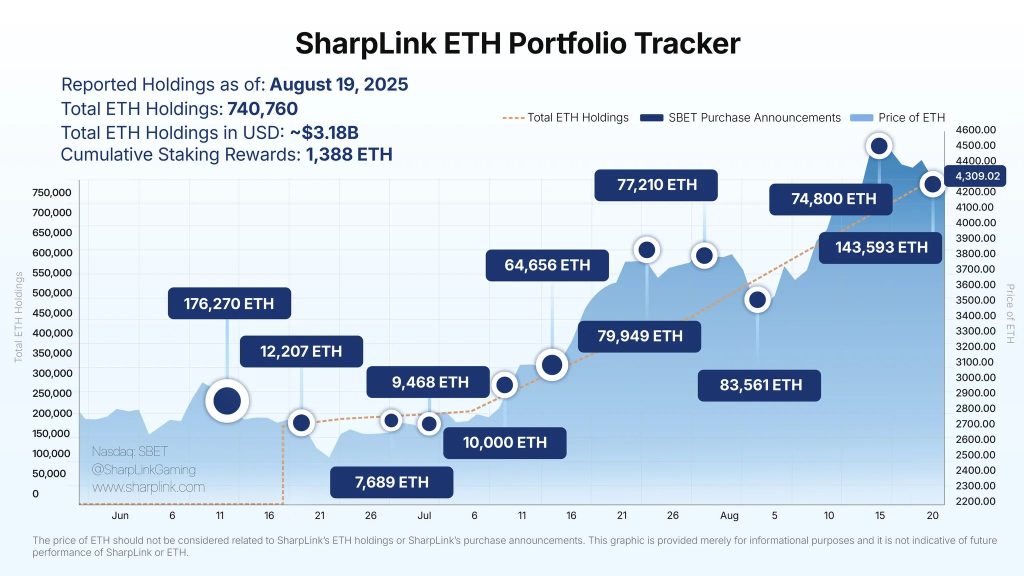

Sharp Link Gaming SBET declared Ethereum as the primary reserve asset of the ETH company treasury in June 2025 and reached a total accumulation of 740,760 ETH as of August 17, 2025, valued at approximately $3.18 billion. An additional purchase of 143,593 ETH in the last week accelerated this level and positioned the company as one of the largest publicly traded actors to adopt Ethereum as its primary reserve asset. This step signifies a shift from a cash-heavy traditional treasury approach to a data-driven model that generates returns through purchases spread over weeks and high-yield staking. This report clarifies the strategy’s architecture and performance metrics, systematically addressing the potential market impact of the purchases.

Strategic Framework

Sharp Link management established a clear vision and actionable roadmap when converting Ethereum into a treasury asset. Working alongside Joseph Lubin, who serves as chairman of the board, the team combined corporate capital discipline with deep technical expertise within the Ethereum ecosystem. The goal is not merely to accumulate ETH but to transform it into a yield-activated treasury instrument. Therefore, the strategy was built on disciplined buying spread over weeks, high-yield staking, transparent metrics, and regular reporting. While the business model continued with sports betting and iGaming marketing activities, an Ethereum-centric financial architecture was built on the treasury side. Thus, the company both maintained its current operations and created a digital capital-based growth layer on the balance sheet.

The operational framework was designed at an enterprise scale. Experienced industry suppliers were engaged for custody security, key management, multi-signature authorization schemes, node management, and validator operations. Nearly all acquired ETH was staked, contributing to network security and generating reward flow. Risk management was supported by procedures to minimize slashing possibilities, network outages, and infrastructure failures. On the financial reporting side, weekly updates and metrics such as ETH Concentration were adopted. These metrics made the accumulated ETH value per shareholder visible despite changes in the share base and enabled monitoring of capital utilization efficiency.

Asset Management Partnerships. Sharp Link entered into Asset Management Agreements with ParaFi and Galaxy Asset Management to strengthen corporate-scale oversight and execution of the Ethereum treasury strategy. This framework aims to oversee treasury policy in conjunction with company management, ensuring that staking policy, validator selection, liquidity and risk management, reporting cycles, and compliance processes are executed to corporate standards. The partnerships aim to improve execution quality, reduce operational and slashing risk, increase resilience through a multi-counterparty structure, and support regular public reporting. Thus, the strategy aligns the board’s vision with the field experience of corporate asset managers, strengthening the reliability of the treasury architecture.

Technology and collaboration have become the leverage points of the strategy. The infrastructure established for on-chain monitoring, accounting reconciliation, integration with staking pools, and liquidity management has made the purchase-to-staking cycle seamless. The management team has defined a flexible framework that will use different funding channels, such as ATM programs, registered direct sales, and, in the future, debt or derivative instruments, as needed. As a result, SharpLink’s strategic framework represents a holistic structure where governance, operations, and finance are aligned toward the same goal. This structure transforms Ethereum from a passive reserve into an active treasury asset that is measured by its data and generates returns.

Capital Formation and Acquisition Mechanism

Sharp Link finances its Ethereum accumulation through a flexible, multi-channel capital structure. In June 2025, the foundation was laid with a $425 million private capital investment, part of which was provided directly in ETH. Subsequently, the At the Market (ATM) program was launched, enabling the rapid generation of cash by issuing shares at market price when needed. Weekly announcements indicate that hundreds of millions of dollars in funding were secured through the sale of millions of shares. For example, at the end of the week of July 13, 2025, approximately 24.6 million shares generated $413 million in net revenue, while the week of July 27 saw 10.8 million shares generate $279.2 million, and the week of August 3 saw 13.6 million shares generate $264.5 million. This pace confirms the capacity to raise large amounts of funds from equity markets in a short period of time.

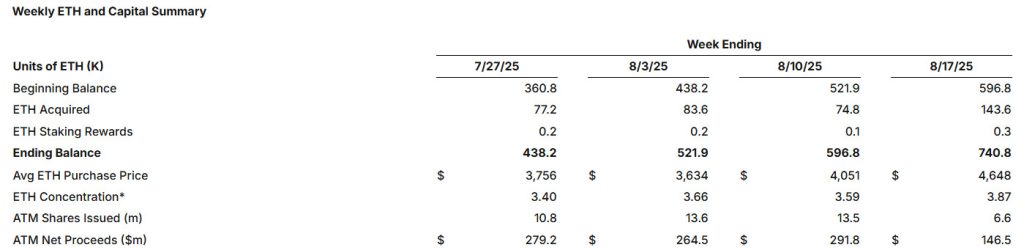

The collected funds were directed directly towards ETH purchases. The company spreads the transaction volume over weeks rather than concentrating it in a single day, thereby reducing pressure on liquidity and spreading the cost over time. This approach is consistent with the dollar cost averaging principle. Purchases continued uninterrupted as the price climbed from $2,500 to $4,600 between the end of June and mid-August. This discipline points to a long-term accumulation goal rather than short-term speculation. The capital mix is kept flexible. In addition to ATMs, registered direct sales and, if necessary, debt or derivative financing options can be utilized. The goal is to maintain the ETH purchase program without interruption, depending on market conditions and investor demand. The Weekly ETH and Capital Summary table below quantifies this flow on a weekly basis.

Source: investors.sharplink.com

The table shows that the total balance grew by 69% from 438.2 thousand to 740.8 thousand between the closing weeks of July 27 and August 17. Over four weeks, 379.2 thousand ETH net purchases and 0.8 thousand ETH staking rewards moved the starting level of 360.8 thousand to 740.8 thousand. Average purchases were made at $3,756, $3,634, $4,051, and $4,648, maintaining the pace of purchases despite the rising price environment. ETH Concentration rose from 3.40 to 3.66, briefly corrected to 3.59, and then rose to 3.87 on August 17, signaling a sustained strengthening in ETH concentration per share. On the financing side, the ATM- s program generated net revenues of $279.2 million, $264.5 million, $291.8 million, and $146.5 million, respectively, with approximately $390 million in direct sales recorded during the week of August 17. This outlook clearly demonstrates that accumulation is scaled with discipline and flexible capital flows spread over weeks.

Purchase Timing and Price Effect

Source: investors.sharplink.com

Sharp Link purchases are not concentrated on a single day. The reporting window is weekly, with the Week Ending date indicating Sunday. Cash flow primarily consists of ATM and recorded direct sales between Monday and Friday, with this cash being directed toward incremental purchases throughout the week. This spreads the transaction volume across days, limits pressure on liquidity and reduces the impact of a single-day price effect. During the period of the highest weekly purchase, the price climbed to around $4,600, then fell below $4,300 due to general market weakness. The average purchase reported that week was $4,648, approximately 8% above the week’s closing price. This table shows that, despite the supportive role of institutional demand, the price is subject to multifaceted dynamics on a global scale and that the company manages timing for risk distribution using weekly windows. In addition, a cash buffer of approximately $84 million provides flexibility for additional purchases under favorable market conditions.

Performance Metrics and Reporting

Sharp Link has developed proprietary metrics to measure the success of its Ethereum treasury strategy and shares them regularly. The most notable indicator is the ETH Concentration metric. This metric expresses the ratio of the total ETH held by to the company’s outstanding and potential diluted share count, effectively showing the amount of ETH per 1,000 assumed diluted shares. This allows the company to transparently demonstrate the value accumulated per share despite frequent share issuances.

ETH Concentration has risen steadily since its launch in early June 2025. The value, which was around 2.0 at the time of the initial announcement, reached 2.37 within three weeks. It reached 3.40 by the end of July, 3.66 by the beginning of August, and 3.87 as of August 17, 2025. This latest level represents a 94% increase from the start. In other words, even as the company expanded its share base, it increased shareholder value by growing its ETH holdings at a faster rate.

Staking returns are the second key indicator. Since almost the entire treasury is staked, additional ETH is generated over time. As of July 4, 2025, 322 ETH in rewards had been earned. By August 3, 2025, the total reward reached 929 ETH. As of August 17, 2025, the accumulated staking yield has reached 1,388 ETH. As the asset grows, the daily and weekly reward amounts increase, and the restaking of yields creates a compounding effect, translating to millions of dollars in additional revenue in absolute terms.

Company performance is reported transparently in weekly newsletters. ETH and capital summaries include purchases for that week, average costs, number of shares issued, cash provided, and current metrics. Over the last four weeks, the total ETH balance has grown by 69%, rising from 438,000 to 740,000. During the same period, ETH Concentration rose from 3.40 to 3.87. Approximately $982 million in additional capital entered the treasury through ATMs and direct sales, and was efficiently converted into ETH. This data-driven and transparent reporting strengthens shareholder confidence and sets an exemplary standard of accountability for corporate finance.

Risks and Scenarios

- Price volatility and market risk: ETH’s high volatility rapidly impacts financial statements. An approximately 8% pullback after a large purchase creates a paper loss. Fair value measurement yields fluctuating results; if the price falls below the average cost, impairment may become an issue. SBET is often sensitive to ETH, and a 7% decline has been observed in a stock following a similar strategy.

- Staking and operational risk: Validator operations carry cybersecurity, infrastructure failure, and slashing risks. Network outages and smart contract vulnerabilities may temporarily halt reward flows. Protocol changes may reduce returns or extend withdrawal times. The tax and legal classification of staking rewards is unclear in some jurisdictions.

- Regulatory and compliance risk: The regulatory approach to crypto assets, particularly staking and crypto fundraising, is variable. Additional reporting and compliance burdens may arise. Online gaming and betting licensing processes become more complex when combined with crypto, making adaptability to different jurisdictions critical.

- Capital and dilution risk: The strategy relies on continuous funding. In weak markets, more shares must be issued for the same amount, diluting existing shareholders’ stakes. The market may price the company like an ETH fund, suppressing share performance. Alternatively, when borrowing becomes necessary, collateral and interest costs introduce new risks.

- Liquidity and execution risk: Purchases are large in size. Buying pressure can increase costs during periods of weak market depth. A slowdown in ATM speed during sudden declines can disrupt the purchase plan. The timing of the cash position is critical.

- Strategic concentration risk: The Treasury’s concentration in Ethereum increases dependence on a single asset. If ETH fails to meet technical or economic expectations, the balance sheet strength and sustainability of the strategy will be challenged. The scope for diversification remains limited.

- Scenario and mitigation framework: In a positive scenario, increased adoption and price growth rapidly expand assets. In a negative scenario, prolonged decline and regulatory pressure degrade funding and metrics. Management aims to mitigate risks through transparent weekly reporting, expert partnerships, flexible financing tools, and high-yield staking.

Conclusion

Sharp Link’s conversion of Ethereum into a treasury asset represents a new threshold for corporate finance. The reserve size, which quickly reached 740,000 ETH, and the management vision supporting it, demonstrate that Ethereum can secure a strategic place in corporate balance sheets. This framework offers investors direct ETH exposure while positioning the company among the pioneers of the digital capital theme.

The model’s execution is data-driven. Purchases spread over weeks, high-yield staking, flexible capital provision, and transparent reporting supported by metrics such as ETH Concentration form the backbone. This allows for disciplined accumulation and makes performance trackable on a weekly basis.

The future outlook is two-sided. In a positive scenario, adoption and price increases rapidly grow the reserve value and offer strong leverage to shareholders. In a negative scenario, prolonged declines and regulatory pressure could strain funding and metrics. Management aims to balance these risks through regular data sharing, expert partnerships, and financing flexibility.

Ultimately, Sharp Link’s approach offers a practical model that combines traditional treasury thinking with decentralized finance. High risk and high return potential are balanced by disciplined execution and transparency. The application to date provides a strong indication that Ethereum can position itself as a sustainable reserve asset in corporate treasuries.

Disclaimer

This report is provided for informational and educational purposes only and does not constitute financial, investment, or legal advice. Strategies such as treasury management with Ethereum, staking, and capital market financing carry significant risks, including volatility, operational failure, regulatory uncertainty, and potential loss of capital. Past performance and data presented herein are not guarantees of future outcomes. Readers should conduct independent research and consult licensed financial professionals before making any investment or strategic decisions. Neither the authors nor publishers accept liability for any losses incurred from reliance on this material.