What is a Solana Treasury?

Solana treasuries are corporate strategies in which companies hold SOL on their balance sheets in order to benefit from long-term price appreciation and reap the rewards of SOL staking.

Advantages of Solana Treasuries

Solana treasuries offer companies the opportunity to participate in Solana’s fast-growing ecosystem to their advantage, allowing them to combine potential asset value growth with additional revenue streams.

High Staking Returns:

Unlike Bitcoin, SOL can be staked for an annualized return of around 8%, creating a predictable revenue stream. For companies, this turns a volatile asset into an asset that can generate constant returns.

For example, Upexi provides a clear example with its strategy of staking almost all of the 2,018,419 SOL treasuries, earning about $65,000 per day or about $23-27 million annually. This income not only helps stabilize SOL’s price volatility, but also positions Solana treasuries as a more dynamic reserve strategy.

Growing Solana Ecosystem and Network Effects:

Solana has established itself as a leading blockchain for high-throughput applications, including decentralized finance (DeFi), non-fungible tokens (NFTs) and tokenized assets. The blockchain has recorded significant growth in DeFi Total Locked Value (TVL) and ranks among the best blockchains in terms of on-chain liquidity and capital deployment.

This increases the usefulness of SOL treasuries as staked or held SOL can be more easily integrated into DeFi through lending, collateralization or liquid staking. At the same time, Solana’s mature infrastructure enables companies to participate more actively in the network.

Operational Treasury Advantages:

A decisive advantage of Solana treasuries is that they can actively generate returns through staking, offering companies a regular income stream. This return component effectively turns treasury reserves into a productive asset. By running validator nodes, companies can generate additional revenues on top of staking rewards. This operational layer strengthens alignment with the Solana ecosystem and offers diversification beyond the potential token value increase.

LSTs like dfdvSOL allow companies to stake SOL while keeping their positions liquid, so they can redeploy capital or use staked assets as collateral. Companies can also retain the option to exit positions more easily by converting or swapping LSTs, reducing liquidity risk. This provides flexibility and capital efficiency compared to traditional staking.

Smaller Market Cap with Higher Growth Potential:

Another advantage of investing in Solana is that SOL has a smaller market capitalization than Bitcoin and Ethereum, which gives it higher growth potential. While this makes SOL more volatile, it also means that new investments and adoption can have a greater impact on its price. For companies, holding SOL is not only a way to have a reserve asset, but also a way to capture potential high growth opportunities as Solana continues to expand its role in DeFi, NFTs and tokenized assets.

Challenges of Solana Treasury

Solana treasuries also bring challenges for companies to manage, from high price volatility to operational risks arising from the validator infrastructure.

Legal Uncertainty:

Unlike Bitcoin, there is still no precise legal classification for Solana in the US. This creates legal and reporting risks that could affect the valuation or accounting treatment of treasuries. It could also expose companies to sanctions if regulations are tightened. Companies should therefore plan for more thorough legal reviews of securities law risks, prudent disclosures about risks, and flexible operational structures that can adapt to changes in regulations.

Validator Outages and Operational Risks:

Operating validators adds another layer of risk and responsibility for companies managing Solana treasuries. The most direct risk comes from outage penalties imposed if a verifier is found guilty of double signatures or other malicious activity. While routine outages in Solana usually result in a loss of rewards, misconfigured or compromised validators can still expose staked assets to penalties.

Beyond that, running validators requires 24/7 infrastructure maintenance. This is because downtime for validators quickly leads to loss of rewards. This means that treasury operators need specialized technical expertise in DevOps, security and monitoring to ensure continuous uptime, manage software upgrades and mitigate risks. This model also imposes significant hardware and operational costs, such as high-performance servers, monitoring tools and specialized staff.

FASB Fair Value Accounting Volatility:

In December 2023, the Financial Accounting Standards Board (FASB) issued ASU 2025-2025-2023, a new accounting standard for crypto-assets that takes effect in 08. This rule requires publicly traded companies to measure eligible crypto assets at fair value and recognize changes in net income.

For treasury managers, this has several implications, including quarterly earnings volatility, as the SOL’s price fluctuations will be reflected directly in the income statement instead of being held at historical cost. In bull markets this can inflate reported earnings, but in down periods it can result in sharp losses that negatively impact quarterly results. Even if long-term conviction in the SOL remains, short-term market declines can compress reported net income and unsettle investors unfamiliar with digital asset volatility. In addition, reporting requirements are becoming more complex as companies are required to track fair value adjustments at each reporting period and make more extensive disclosures about valuation techniques and crypto-specific risks.

Market Volatility and Limited Risk Management Tools:

Another risk of Solana treasuries is their exposure to higher market volatility compared to Bitcoin. SOL remains more volatile due to its smaller market capitalization, faster growth profile and sensitivity to network or ecosystem shocks.

While Bitcoin benefits from deep institutional hedging markets, including Chicago Mercantile Exchange (CME) futures, spot ETFs and a wide range of structured products, Solana’s toolkit is still under development. The CME took the first step towards institutional adoption by launching Solana futures in March 2025, but liquidity is still low and usage is limited compared to Bitcoin and Ethereum contracts.

Outside the CME, most SOL derivatives are concentrated on cryptocurrency exchanges with lower liquidity and limited regulatory oversight. Structured products such as covered options or volatility hedges are also rare. This exposes companies with Solana treasuries more directly to price fluctuations and does not offer the breadth of enterprise-level risk management options available for more established assets.

Large Corporates Adopting Solana Treasuries

With the inclusion of Bitcoin on corporate balance sheets on the agenda, many companies have started holding Solana’s native token SOL in their treasuries. These developments show that publicly traded companies are looking to take advantage of an ecosystem with higher growth potential as Solana is known as a blockchain designed for speed, scalability and programmability. Companies adopting Solana treasuries aim to have a dynamic crypto asset that grows while differentiating in the market.

Accumulating SOL not only benefits from potential long-term price growth, but also from staking returns. Since Solana works with the Proof-of-Stake consensus mechanism, holders can earn returns by helping to secure the network by staking or locking their tokens. Companies are not only buying SOL but also staking it to earn additional rewards and strengthen the decentralization of the blockchain.

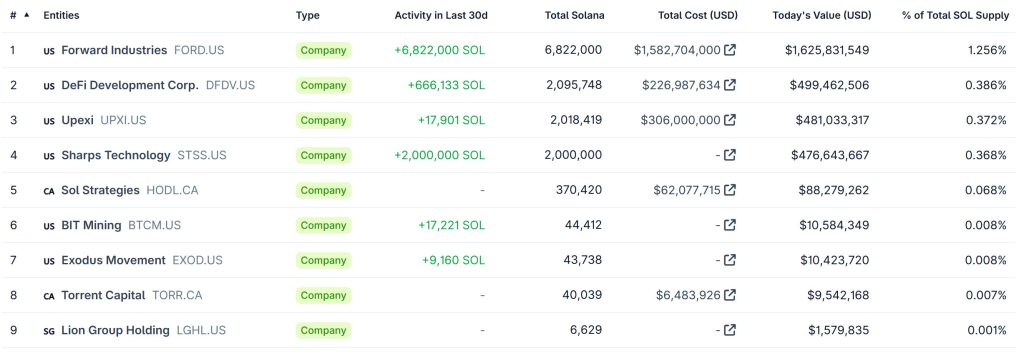

The top four public companies with Solana treasuries have a total of nearly 13 million SOLs in their treasuries as of mid-September 2025.

Forward Industries (FORD):

Forward Industries is a diversified company previously known for providing cases for medical and consumer electronics. It has now become the latest company to turn to the Solana treasury, with a variety of strategies to create value within the ecosystem. While it is the latest company to make this transformation, it has already cemented its place at the top of the list.

After completing a $1.65 billion public equity private placement (PIPE) on September 11, 2025, the company wasted no time and acquired 6,822,000 SOLs at a total cost of approximately $1.58 billion. The PIPE financing was led by investors Galaxy Digital, Jump Crypto and Multicoin Capital. In addition, Kyle Samani of Multicoin Capital, Christopher Ferraro of Galaxy, and Saurabh Sharma of Jump Crypto serve on the Board of Directors of Forward Industries.

The company’s strategy is focused on acquiring SOL and generating revenue by utilizing it through staking, lending and various other DeFi activities. The proceeds will be used to acquire more SOLs.

DeFi Development Corp (DFDV):

DeFi Development Corp (DFDV) has structured the Solana treasury around infrastructure integration and yield optimization. The company has grown its assets to over $400 million, worth more than 2 million SOLs, with the SOL price at the time of writing at $208. The SOL accumulation was partly financed by a capital increase of $125 million.

One factor that sets DFDV apart is its adoption of liquid stake token (LST) technology through its liquid stake token dfdvSOL, developed in partnership with Sanctum. It is the first public company to incorporate Solana-based LSTs into its treasury, allowing it to accumulate staking rewards while maintaining liquidity. To optimize its returns, the company has optimized its cyclical staking strategy, which yields around 12%.

Beyond staking, DFDV has established a validator node collaboration with Bonk to deepen its staking capacity and signed a strategic agreement with Solflare to become the official Solana wallet provider for DFDV’s ventures. This structure makes DFDV’s treasury a mix of balance sheet risk and ecosystem infrastructure plays.

Upexi Inc (UPXI):

Leading the adoption of the Solana treasury is Upexi Inc (UPXI), a Tampa-based consumer products company. This company has made one of the most aggressive corporate moves into Solana. Following the SOL’s $208 price at the time of writing, it has built a treasury of more than 2 million SOLs worth over $425 million. The company started accumulating early in the year after announcing a $100 million fundraising dedicated to SOL purchases. Later, this amount was increased by an additional $200 million in funding and a $500 million credit line.

After Solana announced the treasury strategy, Upexi’s share price increased by more than 330%. This shows that investors see the company as a high growth potential vehicle for direct exposure to the SOL.

Upexi invests almost all of its holdings and earns a return of about 8%, or about $65,000 per day. In addition, about 57% of the company’s SOLs were purchased as locked tokens at about a 15% discount to the market price. This gives shareholders an immediate profit when these tokens are unlocked.

Sharps Technology (STSS):

Adding further impetus to Solana’s treasury adoption is Sharps Technology, Inc. which recently announced one of the most ambitious strategies. Known as a medical device manufacturer, the company has directed part of its strategy towards Solana’s treasury. The new treasury strategy is led by Alice Zhang (Chief Investment Officer) and James Zhang (Strategic Advisor), who have deep ties to the Solana ecosystem.

On August 25, 2025, Sharps announced a private placement of over $400 million with support from investors such as ParaFi, Pantera and FalconX. Then on September 2, 2025, it was announced that the funding was used to purchase over 2 million SOLs for long-term holding and staking proceeds. In addition, Sharps signed a non-binding letter of intent with Solana Foundations to secure the purchase of $50 million of SOLs at a 15% discount to the 30-day time-weighted average price.

To further deepen its participation in the Solana ecosystem, the company plans to stake a portion of its SOL in BonkSOL, BONK’s liquid stake token (LST) product. In addition, the plan is to collaborate with Pudgy Penguins to conduct joint promotional activities and create new interaction opportunities for users.

Reasons for Adopting the Solana Ecosystem

Direct SOL Purchase and Staking:

The simplest method is direct token purchase followed by staking. In this model, companies raise capital or reallocate balance sheet cash to purchase SOL on the open market, then invest these tokens on the Solana network to generate returns.

This provides exposure to the potential price appreciation of SOL, while at the same time generating a regular income stream from staking rewards, which typically range between 6-8% annually.

Validator Operating Model:

Companies can also implement Solana treasuries by operating or partnering with validator nodes to secure the network and earn staking rewards. Unlike simple token staking through third-party providers, this model provides more direct control over the infrastructure and higher potential returns.

SOL Strategies, a Solana treasury company with more than 370,000 SOLs, has significantly expanded its validator operations, delegating 3.6 million SOLs from its own treasury and third-party wallets as of August 25, 2025. The company has also attracted more than 7,000 unique wallets to its validator network, including institutional mandates such as ARK Invest’s Digital Asset Revolutions Fund.

Liquid Staking Integration:

Liquid staking is the process by which companies earn rewards by staking SOL while receiving Liquid Staking Tokens (LSTs) in return. These LSTs maintain liquidity by allowing the staking position to be traded, borrowed or redeployed to other return strategies. This model improves capital efficiency by allowing companies to accumulate rewards.

DeFi Development is the first public company to adopt this approach with dfdvSOL, partnering with Sanctum. The company is able to generate staking income while maintaining liquidity and building a more flexible balance sheet.

Governance and Operational Framework:

Companies can implement Solana treasuries by establishing a clear governance and operational framework to effectively manage their assets. Some companies have begun to formalize their governance structures to highlight how decisions are made, how performance is measured, and how risks are managed.

For example, DeFi Development publishes regular updates on its SOL Per Share (SPS) metric to align treasury growth with shareholder value. SOL Strategies publishes financial statements detailing both treasury value and confirmatory income. Upexi integrates this method by disclosing staking returns and net asset value (NAV) multiples to investors.

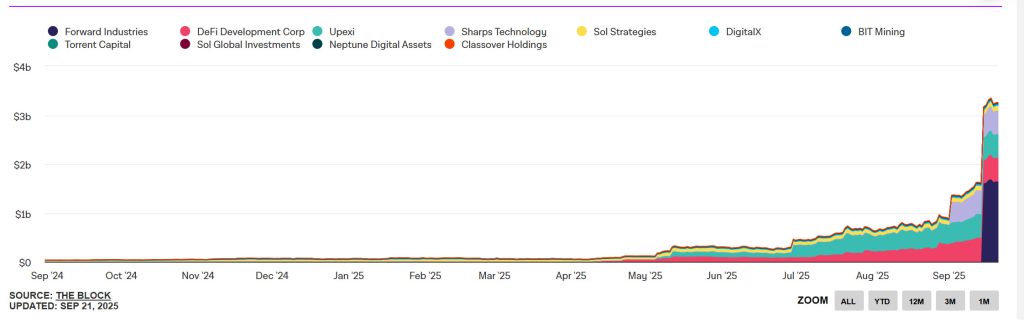

SOL Price Impact

In total, Solana treasuries currently hold around 1.79-2% of the SOL supply, with 16 firms managing over 11 million SOL tokens worth $2.5-2.84 billion. Large-scale treasury initiatives could reduce the circulating supply of SOL. This could potentially push prices higher and increase market volatility. As of April 1, 2025, a drastic increase in purchases has led to a surge in the price of Solana. The price has increased by about 104% and could rise further if market conditions are favorable. The downside is that such a large number of holders may abandon this plan and dispose of their SOL tokens. However, market conditions remain unfavorable.

Technical Analysis

Looking at the daily chart, the Sol price continued to accelerate in the upper zone of the ascending line formed on April 7 with the entry of institutions on April 1. It is currently testing the $ 206.23 level, which is a strong resistance. In the case of candle closures above this level, it may continue its rise and rise to $ 295.18, the level on January 20, and form a bowl formation. In case of a pullback, it may test the rising line as support.

The asset is trading between the 50 EMA (Exponential Moving Average – Blue Line) and 200 EMA (Black Line) moving averages, indicating that the asset is in the decision phase. Moreover, the fact that the 50 EMA continues to be above the 200 EMA indicates that a “golden cross” formation is in progress from a technical perspective. This shows that the upside potential continues in the medium term. On the other hand, the large gap between the two moving averages increases the likelihood of a sideways move or a decline. RSI (14) is at a negative level. At the same time; there is a positive divergence. This may create buying pressure. If macroeconomic data remains positive and ecosystem developments remain positive, the first major resistance point of $247.30 could be retested. Conversely, in case of possible negative news flow or deterioration in macro data, the $184.42 level can be monitored as a potential buying opportunity.

Conclusion

The rise of Solana treasuries opens a new chapter in the adoption of institutional digital assets, moving beyond Bitcoin’s passive reserves towards more dynamic, return-generating strategies. Companies such as Upexi, DeFi Development Corp., SOL Strategies and Sharps Technology have developed different approaches that demonstrate Solana’s versatility as a treasury asset.

This momentum is likely to continue as Forward Industries launched its own Solana treasury strategy with $1.65 billion PIPE, becoming the largest Solana treasury overnight. This suggests that we are only at the beginning of this trend and as Solana’s ecosystem continues to expand, more public companies will follow suit.