US Spot Altcoin ETF Process

In recent years, there has been a rapid proliferation of ETF products for US investors that provide access to crypto assets through traditional financial channels. The year 2024 marked the turning point in this transformation. In January 2024, the SEC approved 11 Spot Bitcoin ETFs, which began trading on exchanges in January 11, sparking significant institutional interest.

Source: SEC

Subsequently, in July 2024, 9 different Spot Ethereum ETFs started trading, opening the door to a new era in the markets.

Source: x.com/JSeyff

The path paved by Bitcoin and Ethereum ETFs has brought a similar expectation for other major altcoins. The re-election of Donald Trump, who stood out with a pro-crypto rhetoric in the US presidential elections held at the end of 2024, greatly reduced the uncertainties over the sector. Immediately after this period, the departure of SEC Chairman Gary Gensler, long known for his tough stance against crypto assets, led to a brand new page in the market.

This wind of change has also mobilized major ETF issuers. Fund managers, looking for opportunities for new products that will attract institutional investors, have successively applied for Spot ETFs for major altcoins such as Ripple, Solana, Avalanche, Cardano, Dogecoin, Polkodat, Sui and Tron by 2025 to diversify their crypto portfolios. Thus, the door opened by Bitcoin and Ethereum has turned into a new corridor to institutional capital for altcoin markets.

One of the remarkable developments in this process took place in July 2025. The first staking-enabled Spot Solana ETF started trading on the Cboe BZX exchange, marking the first altcoin ETF launch outside of Bitcoin and Ethereum. This was an important milestone not only for the altcoin markets but also for the inclusion of staking-enabled projects in institutional investment products.

In this report, we will take a look at the altcoin projects that have filed with the SEC as of July 2025. We will present details such as for which crypto asset the application was made, when the form was submitted, at what stage the SEC is at, and the earliest expected approval dates with tables and analysis.

Applications Pending SEC Approval – Ongoing Processes

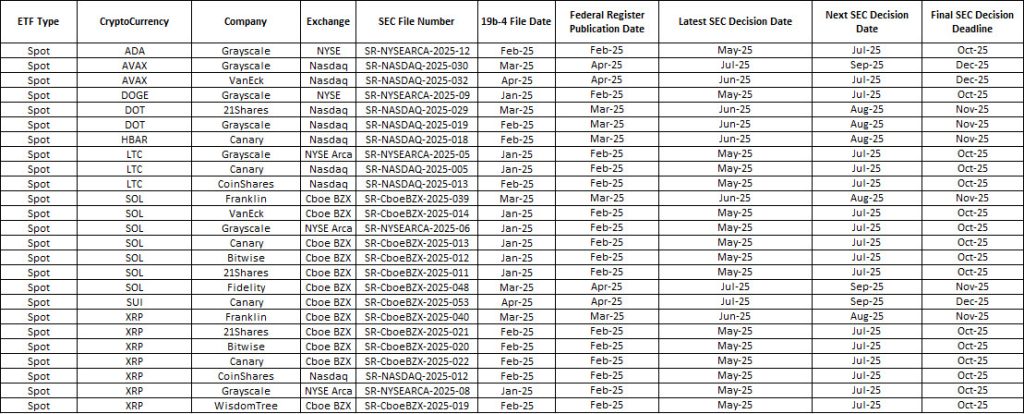

There is a significant list of altcoin ETF applications filed since the first quarter of 2025 that have yet to be finalized by the SEC. Some of these applications are past the first postponement date, while others are approaching the third and final evaluation stage.

Especially for Solana (SOL), Ripple (XRP), Litecoin (LTC), Cardano (ADA), Avalanche (AVAX) and similar projects, the “Final Deadline” dates in the SEC calendar are critical. If there is no approval or rejection by this date, the SEC will have to make a decision. This points to October – December 2025 for the majority of applications.

“SEC – Spot Altcoin ETFs Image Will Be Added”

*This table is based on the application filings and decision texts published on the official website of the US Securities and Exchange Commission (SEC) as of July 25, 2025. Subsequent updates or new filings may not be reflected in this table.

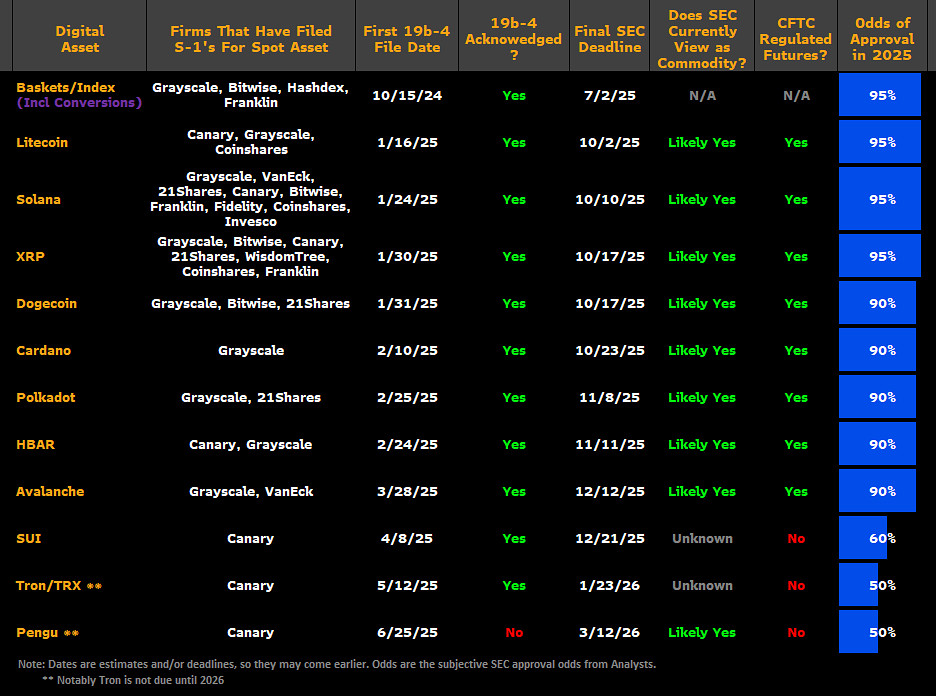

Similarly, the following table on Spot Altcoin ETFs, prepared by Bloomberg ETF analysts James Seyffart and Eric Balchunas on June 30, 2025, presents the Spot Altcoin ETF applications most likely to be approved by the end of the year. According to Seyffart’s assessments, the SEC is expected to consider many altcoin ETF applications in the second half of 2025, with significant waves of approvals expected.

Link: https://x.com/JSeyff/status/1939795594148540610

Source: x.com/JSeyff

New Applications – Which Altcoins Have Joined the Race?

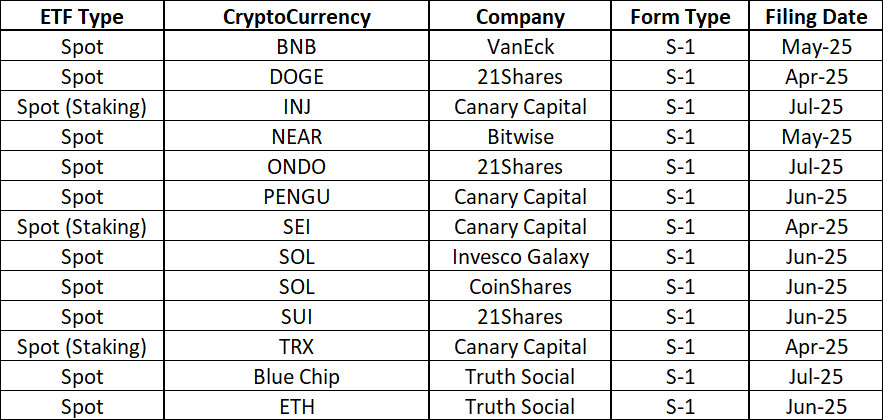

As of the second quarter of 2025, Spot Altcoin ETF filings have gained momentum. For the first time, many ETF issuers submitted their applications to the SEC on the S-1 form. Most of these filings are still only at the S-1 stage, meaning that Form 19b-4 has not yet been filed and they are not yet eligible to be traded on exchanges. There are still many technical and regulatory steps ahead for these products to be listed.

*This table is based on the US Securities and Exchange Commission’s (SEC) EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system as of July 25, 2025.

The new applications focus on projects such as Solana, Injective, Sui, Near, Ondo, BNB, TRX, DOGE and Pengu. Some of these have been offered with staking features. In particular, Canary Capital and Bitwise stand out in this area with ETF drafts that include staking integration. In addition, the applications of politically reflexive organizations such as Trump Media (Truth Social) are also noteworthy. General basket-themed applications such as “Cryptocurrency Blue Chip ETF” were also submitted to the SEC during this period.

Closest to Launch – Who Could Be the First to List?

According to the SEC’s calendar, many altcoin ETF applications will reach the “Final SEC Decision Deadline” in the fall of 2025. Legally, the SEC is required to make a decision no later than 240 days after an application is published in the Federal Register. The final decision deadlines for applications filed under this framework are now clear.

The table below shows the “Final SEC Decision Deadline” dates for ETF applications that are still in the evaluation process

| CryptoCurrency | Company | Final SEC Decision Deadline |

|---|---|---|

| ADA | Grayscale | Oct-25 |

| DOGE | Grayscale | Oct-25 |

| LTC | Grayscale, Canary, CoinShares | Oct-25 |

| XRP | 21Shares, Bitwise, Grayscale, Franklin, CoinShares, Canary, WisdomTree | Oct-Nov-25 |

| LEFT | VanEck, Grayscale, Bitwise, Franklin, 21Shares, Canary, Fidelity, Grayscale | Oct-Nov-25 |

| DOT | 21Shares, Grayscale | Nov-25 |

| HBAR | Canary | Nov-25 |

| AVAX | Grayscale, VanEck | Dec-25 |

| SUI | Canary | Dec-25 |

In the Solana and XRP applications, although the applications of different firms were filed on different dates, the SEC’s tendency to issue simultaneous decisions is noteworthy given its past practices. Therefore, it seems quite likely that a collective decision will be announced in the October-November period for all Solana or XRP ETF applications.

A critical development occurred on June 10, 2025, when the SEC formally requested that S-1 filings for Solana ETFs be updated to include staking-related disclosures. This move confirmed that the filings remain under active regulatory evaluation, and that technical approval remains a possibility.

Following this update request, the SEC’s “Next Decision Date” for the Solana filings falls within the current week. If approval is not granted at this stage, the process will move directly to the Final Decision Deadline, making this a pivotal moment for the fate of Solana ETF products. Moreover, the SEC’s decision regarding Solana could set the tone for upcoming rulings on ADA, DOGE, and LTC, which are also entering their final evaluation stages in October.

Commenting on these developments, Bloomberg ETF analyst James Seyffart said in a statement on X.com:

“Eric Balchunas & I are raising our odds for the vast majority of the spot crypto ETF filings to 90% or higher. Engagement from the SEC is a very positive sign in our opinion”

Source: x.com/JSeyff

This comment makes it clear that not only market expectations but also analysts have adopted a positive stance on the SEC process.

General Status of the ETF Process

Altcoin ETF applications ushered in a whole new phase in the world of institutional investing in 2025. Applications have not only increased in number. They also showed a significant expansion in terms of content. No longer just “large cap coins”, but also staking-based structures, decentralized platform tokens and basket-themed products. This diversity means new technical and legal challenges for the SEC.

The process has not only a technical but also a political background. The re-election of Donald Trump in the US presidential elections at the end of 2024 was read by the cryptocurrency market as a signal of “regulatory softening”. After Trump’s inauguration, the resignation of former SEC Chairman Gary Gensler, known for his tough stance against cryptocurrencies, and the appointment of Paul Atkins, known for his crypto-friendly stance, radically changed the view of ETF application processes. With the arrival of Atkins as chairman, the SEC’s attitude towards applications seems to have become more transparent and constructive. The agency now responds to applications with technical notices and guidance, rather than outright rejection or silence. The June 10, 2025 staking update call to Solana ETFs was a concrete example of this approach.

A potential decision on the Solana applications this week could reflect how closely the SEC is engaging with the process. It could also set the tone for upcoming rulings on other major projects like XRP and ADA.

The fall of 2025 could be a turning point not only in terms of the outcome of these filings, but also in the trajectory of the entire ETF universe. The approval of applications of major projects such as XRP, SOL, ADA, etc. may affect pricing dynamics and open the door for new coins to apply. It is known that especially large fund companies are preparing for coins such as DOT, AVAX, SUI. Experts believe that this process will accelerate even more in 2026. Because the market interest after the first wave of approvals will pave the way for new applications and increase regulatory pressure so that the US does not fall behind in the global ETF competition. Therefore, there could be a wave of major expansion in the Spot Altcoin ETF market in 2026.

Ultimately, how the SEC approaches these filings will determine the overall direction of the altcoin market, not just specific coins. The next few months will therefore be historic in terms of the integration of cryptocurrencies into the traditional financial world.

Disclaimer

This article is for informational and educational purposes only and does not constitute investment advice or a solicitation to buy or sell any financial instruments. All views expressed are based on publicly available information and do not reflect the official stance of Darkex. Cryptocurrency and ETF investments involve risk, and regulatory decisions are subject to change. Readers should conduct their own research and consult with a licensed financial advisor before making any investment decisions.