Induction

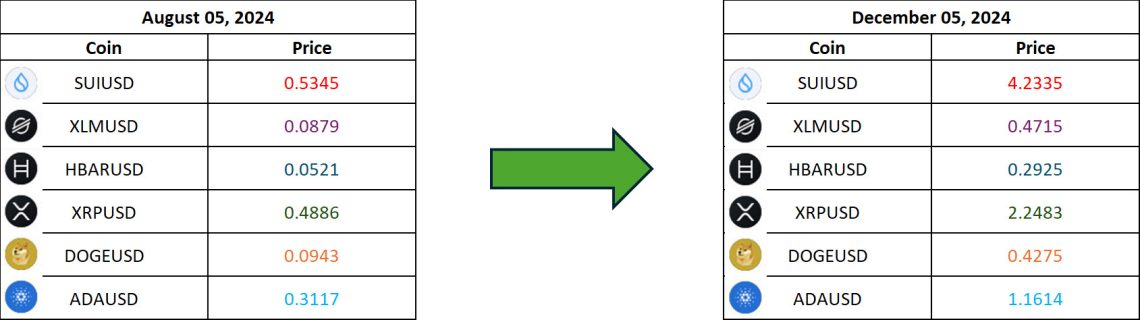

Bitcoin started the year 2024 with an upward trend, rising to $73,700 on March 13, 2024, then declined and fell to $49,000 on August 5, 2024. After August 5, 2024, the rise in Bitcoin was the beginning of a rise that would go up to over $ 100,000 on December 5, 2024. In this article, we will examine the 6 altcoins that are in the top 20 in terms of market volume in the cryptocurrency market and have the best rise by following Bitcoin’s rise in the upward journey that started after seeing $ 49,000 levels on August 5, 2024.

SUI, XLM, HBAR, XRP, DOGE and ADA, which are in the top 20 of the cryptocurrency market in terms of market volume, stood out with their rises in Bitcoin’s upward journey to over $ 100,000.

Sui Coin (SUI)

Founded in 2022, Sui’s main network was launched in May 2023. Sui has since taken its place in the crypto world as the native coin of the Sui Network.

Sui Network is a Layer-1 blockchain solution developed to provide high performance and scalability. The working logic of the network aims to increase transaction speed and reduce costs by offering an innovative approach compared to traditional blockchain models. Sui has the ability to process transactions in parallel. This allows the network to increase transaction speed by processing different transactions simultaneously. And Sui Network uses an object-based data model to validate transactions.

Sui is characterized by its ability to handle thousands of transactions per second, verify and complete them quickly, and handle more transactions as the network grows without performance degradation.

In Bitcoin’s bullish journey, SUI rose by nearly 700% from $0.53 to $4.23. This rise in SUI;

- The surge in interest in the cryptocurrency market created by the rise in Bitcoin,

- Investors turning to altcoins with high potential,

- Sui’s Layer-1 technology and network growth,

- Favorable market conditions in Bitcoin have allowed speculative capital to flow into emerging projects,

- Sui’s unique technological structure and community-oriented strategies will further strengthen this process.

For these reasons, Sui’s price increase accelerated in parallel with the Bitcoin-driven market impact.

Stellar (XLM)

Stellar (XLM) is the native cryptocurrency of the Stellar network, founded in 2014 by Jed McCaleb and Joyce Kim to facilitate international financial transactions. Stellar was developed to provide a solution for decentralized financial transactions with low transaction fees and fast transfer times.

Launched in 2015, XLM was one of the first altcoins to support blockchain-based asset transfers.

XLM stands out in the cryptocurrency market because it is completely decentralized, has low transaction fees and links fiat currencies and digital assets to the blockchain through trusted assets known as anchors.

In Bitcoin’s bullish journey, XLM rose by about 440% from $0.087 to $0.471. This rise in XLM;

- Investors turning to alternative projects in Bitcoin’s upward journey,

- Stellar’s efforts to expand its user base,

- The Stellar network offering an alternative to Bitcoin for international payments and the increased use of fast transfer and low transaction fee networks with increasing transaction volumes across the cryptocurrency market.

These items appear to be significant factors in XLM’s price increase.

Hedera (HBAR)

Founded in 2018 in the US, Hedera is a distributed ledger technology that supports the development of decentralized applications and offers an alternative approach to blockchain technology. Thanks to its hashgraph algorithm, the Hedera network offers a faster, energy efficient and scalable technology compared to blockchain. Hbar is the native cryptocurrency of the Hedera network, used to pay transaction fees, secure the network and for staking.

What makes the Hedera network different from other networks is that it uses hashgraph instead of blockchain, and with this technology, it offers faster transaction verification and low energy consumption. In addition, Hedera’s board of directors consists of big companies such as Google and IBM.

In Bitcoin’s bullish journey, HBAR rose by about 460%, from $0.0521 to $0.2925. This rise in HBAR;

- Hedera announces new collaborations and improvements to the network,

- The Hedera network offers a unique alternative for dApp developers and increases the attractiveness of the network,

- Investors are turning to different technologies like Hedera

- Increasing transaction volumes with the rise across the cryptocurrency market, driving users to fast and low-fee networks.

These substances were effective in the increase in HBAR.

Ripple (XRP)

The Ripple network was developed by Ripple Labs in 2012 to enable fast and low-cost financial transactions between banks and financial institutions. XRP is the native cryptocurrency of the Ripple network. The Ripple network aims to make worldwide financial transactions faster and more efficient by acting as a bridge between financial transactions.

High transaction speed (completed in a few seconds), low cost, decentralized structure are the features that make XRP stand out. In addition, the Ripple network, unlike other networks, has a mechanism called Federated Consensus. The structure of this mechanism is a technology that provides energy efficiency and increases transaction speed in the Ripple network.

On Bitcoin’s bullish journey, XRP rose by about 360%, from $0.4886 to $2.2483. This rise in XRP;

- Positive developments in Ripple Labs’ ongoing litigation process with the SEC (with Donald Trump winning the US Presidential elections, cryptocurrency-friendly people will take part in Trump’s team and therefore in the SEC)

- SEC Chairman Gary Gensler, known for his negative stance on the cryptocurrency sector during the ongoing litigation process with the SEC, will leave his post.

- Ripple to expand the use of XRP by establishing strategic partnerships with major financial institutions,

- New enhancements to the Ripple network and integration of decentralized finance solutions.

- The increase in trading volumes brought about by the rising investor interest in the cryptocurrency market with the rise of Bitcoin.

These substances have been effective in the rise in XRP.

Dogecoin (DOGE)

Founded in 2013 by Billy Markus and Jackson Palmer, Dogecoin belongs to the “meme coin” category in the cryptocurrency world. Initially created as a joke, DOGE has taken its place in the market as a cryptocurrency that has gained a large community and popularity over time. Dogecoin, which runs on Litecoin’s infrastructure, is also in the category of payment-oriented cryptocurrencies. Thanks to its low transaction fees and fast transfer features, it is preferred for micropayments and payments on social media platforms.

In Bitcoin’s bullish journey, DOGE rose by about 353% from $0.0943 to $0.4275. This rise in DOGE.

- Elon Musk’s frequent endorsement of Dogecoin and the fact that Elon Musk will be on his team after Donald Trump won the US Presidential election,

- The Department of Government Efficiency (D.O.G.E.), which will be established under Donald Trump’s new administration, will operate under the leadership of Elon Musk. The name of the newly established department will be abbreviated as DOGE and will be headed by Elon Musk,

- Elon Musk’s recent social media posts and his introduction of himself as “DOGE Father”,

- Dogecoin, which usually moves in parallel with Bitcoin, shows an increase in value during Bitcoin’s rise,

- Dogecoin’s high social media popularity and increased investor interest.

These items were effective in the rise in DOGE.

Cardano (ADA)

Developed in 2017 by Ethereum one of co-founder Charles Hoskinson, Cardano aims to provide a sustainable and scalable blockchain technology. ADA, the native coin of the Cardano network, is used to execute transactions on the network, run smart contracts and contribute to the consensus mechanism through staking.

Adopting the PoS consensus mechanism from the beginning, Cardona follows a development process based on academic research and uses peer-reviewed protocols. With Hard Fork Combinator technology, it has a system that makes it possible to update without interrupting the network.

In Bitcoin’s bullish journey, ADA rose by about 272% from $0.3117 to $1.1614. This rise in ADA.

- Cardano’s network updates and innovations in smart contracts,

- Developments of the Cardano ecosystem for DeFi projects and the NFT market,

- Cardano’s PoS mechanism is that it rewards users with staking,

- Demand for Bitcoin has also led investors to turn to other large infrastructure projects,

- Increased trading volume in the cryptocurrency market with the rise of Bitcoin.

These items were effective in the rise in the ADA.

General Evaluation

The upward journey in Bitcoin, which started on August 5, has increased investor interest in the cryptocurrency market. This also positively affected altcoins, and as Bitcoin rose, altcoins also rose. In particular, this process caused investors to turn to projects with a strong infrastructure and long-term potential. In addition, increasing transaction volumes in the cryptocurrency market have led to an increase in the number of transactions in Layer-1 projects and the appreciation of their local coins.

In addition, the fact that Donald Trump won the US Presidential elections and that his team will include cryptocurrency-friendly people has been effective in the rise of Bitcoin and altcoins. Especially XRP and DOGE have been the prominent coins in this process. The possibility of a positive outcome of XRP’s SEC lawsuit process in the new period and the fact that Elon Musk, the biggest supporter of DOGE coin, will be included in Trump’s team have been effective in the rise of the price of these 2 coins.