Introduction

ETF (Exchange-Traded Fund) processes have gained great importance in the cryptocurrency market in recent years. The approval of Bitcoin and Ethereum ETFs has largely attracted institutional investors to the crypto markets, allowing crypto assets to gain wider acceptance in the traditional financial world.

In this process, following the approval of Bitcoin and Ethereum spot ETFs, we see that ETF applications for many altcoins are rapidly increasing. In particular, crypto assets with large market capitalizations such as XRP, Solana, Litecoin, Dogecoin, Cardano, Hedera Hash graph and Polkadot are being sought to be converted into spot ETFs by investment funds.

In this report, we will examine the altcoins that have applied for spot ETFs and are awaiting approval, their common characteristics and potential approval times.

Altcoins with Spot ETF Applications and Processes

2024 was a year in which Bitcoin and Ethereum ETFs attracted a lot of attention, and these assets gained a solid foothold in the ETF market. This development increased the interest in altcoin ETFs and led to the rapid emergence of new altcoin ETFs in the financial world. In particular, the year 2025 attracted attention with a fast start in altcoin ETF applications.

Bloomberg ETF analyst Eric Balchunas noted in a post-dated January 21, 2025, that the number of cryptocurrency ETF filings with the SEC has reached 33, and this list continues to grow rapidly. As a matter of fact, many large financial companies, especially Grayscale, continued to submit spot ETF applications to the SEC for various altcoins.

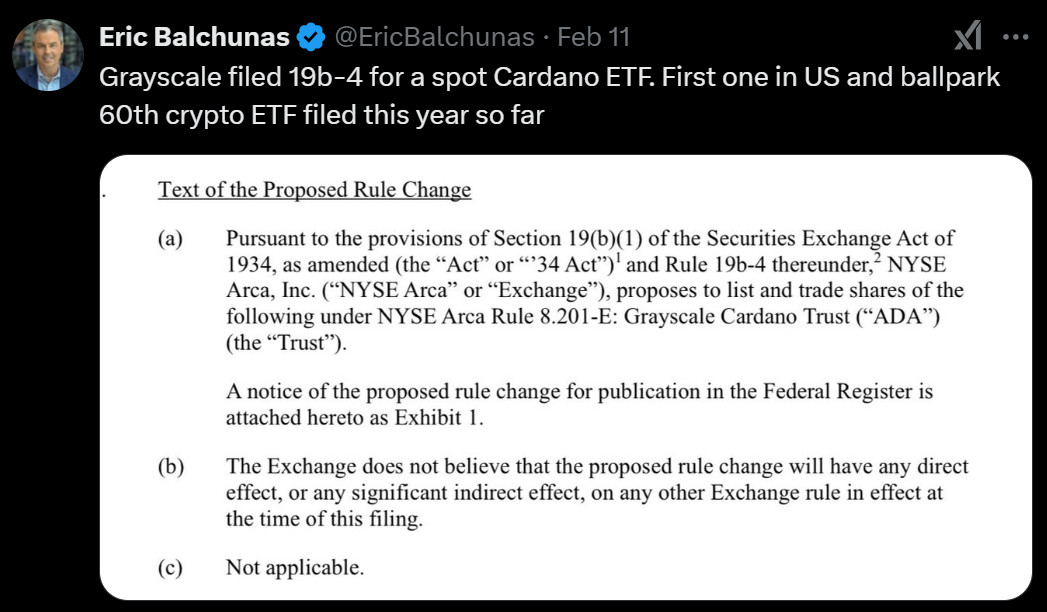

On February 11, 2025, Balchunas announced that Grayscale filed a 19b-4 application for the first spot Cardano (ADA) ETF in the US. This initiative, which is among the approximately 60th crypto ETF applications filed during the year, shows that the regulatory framework is rapidly expanding. If approved, the Grayscale Cardano Trust (ADA), which will be traded on the NYSE Arca exchange, will provide investors with direct access to ADA.

In addition to Grayscale, major investment firms such as VanEck, 21Shares, Bitwise and Canary have also accelerated ETF filings for Solana, XRP, Litecoin, Dogecoin and other altcoins.

On February 10, 2025, Bloomberg ETF analyst James Seyffart shared a table of the latest developments on altcoin ETFs. Seyffart stated that they are currently mainly focused on Litecoin, Solana, XRP and Dogecoin. Summary information about the altcoins in the table is presented below:

XRP (Ripple)

- Applicant Firms: Grayscale, Bitwise, Canary, 21Shares, WisdomTree

- First 19b-4 Application: January 30, 2025

- SEC’s Assessment Status: Not yet confirmed

- Approval Expected Date: October 17, 2025

- Chance of Approval: 65

Solana (SOL)

- Applicant Firms: Grayscale, VanEck, 21Shares, Canary, Bitwise

- First 19b-4 Application: January 24, 2025

- SEC’s Assessment Status: Approval process started

- Approval Expected Date: October 10, 2025

- Chance of Approval: 70%

Litecoin (LTC)

- Applicant Companies: Canary, Grayscale

- First 19b-4 Application: January 16, 2025

- SEC’s Assessment Status: Approval process started

- Approval Expected Date: October 2, 2025

- Approval Chance: 90%

Dogecoin (DOGE)

- Applicant Companies: Grayscale, Bitwise

- First 19b-4 Application: January 31, 2025

- SEC’s Assessment Status: Not yet confirmed

- Approval Expected Date: October 18, 2025

- Chance of Approval: 75

Cardano (ADA)

- Applicant Companies: Grayscale

- First 19b-4 Application: February 10, 2025

- SEC’s Assessment Status: Not yet confirmed

- Approval Chance: Unknown

Hedera Hashgraph (HBAR) and Polkadot (DOT)

- Applicant Companies: Canary (HBAR), 21Shares (DOT)

- SEC’s Evaluation Status: Under Review

- Approval Chance: Unknown

Common Features and ETF Market Relevance

- Market Capitalization and Liquidity

Spot ETF applicants are among the top 20 cryptocurrencies in terms of market capitalization and attract attention with their high trading volume. For mutual funds to consider a cryptocurrency for inclusion in an ETF, it is important that the asset has broad market acceptance, offers sufficient liquidity and has a trading volume that can attract institutional investors. These criteria ensure that the assets to be included in the ETF are more resistant to market manipulation and contribute to making it a more reliable investment instrument in the eyes of regulatory authorities.

In particular, cryptoassets such as Litecoin, Solana, XRP and Dogecoin have high daily trading volumes and are widely supported on centralized exchanges. This makes them more suitable for the ETF market. For example, the adoption of Solana and XRP by institutional investors and their listing on major exchanges are important factors supporting mutual funds’ preference for these assets.

- Regulatory Compliance

In regulatory assessments by the US Securities and Exchange Commission (SEC), one of the most critical elements is whether an asset is classified as a security. The SEC generally determines whether a digital asset is a security based on the Howey Test criteria. In this context, cryptoassets that gain value in anticipation of investors and are guided by a central authority may be considered as securities, which may cause them to face additional regulatory challenges in ETF processes.

Since assets like Litecoin and Dogecoin are not directly managed by a central organization or company, they are not considered securities and are treated as commodities by the SEC. This is one of the most important factors that increase the chances of Litecoin and Dogecoin receiving ETF approval. On the other hand, while assets like Solana and XRP have experienced regulatory wrangles with the SEC in the past, institutional investors’ interest in these assets continues. In particular, the development of Solana as an alternative to Ethereum and the use of XRP in financial payments make these assets a more powerful investment tool.

The SEC’s regulatory stance is a major determining factor for the future of the crypto ETF market. The previous approval of Bitcoin and Ethereum ETFs suggests that in the future, assets such as Litecoin, Dogecoin and Solana could also make progress in ETF processes. However, the possibility of the SEC classifying some altcoins as securities could complicate the ETF process for these assets.

- Technological Advantages

The suitability of altcoins for the ETF market is not limited to liquidity and regulatory compliance; technological infrastructure and use cases also play a critical role. Projects such as Solana, XRP and Hedera are making significant contributions in the areas of decentralized finance (DeFi), smart contracts, enterprise payment solutions and blockchain-based innovations.

- Solana (SOL): Positioned as a serious competitor to Ethereum with its high transaction speed and low-cost transactions, Solana is widely used in the DeFi and NFT ecosystems. Solana’s strong infrastructure makes it attractive to investment funds.

- XRP (Ripple): With strong integrations with banks and financial institutions, XRP has a leading role in cross-border payment solutions. Its use in decentralized payment systems makes XRP a reliable option for institutional investors.

- Hedera Hashgraph (HBAR): Using Hashgraph technology instead of traditional blockchains, Hedera prioritizes security and scalability while increasing transaction speed. Strengthened by large corporate partnerships, HBAR is especially preferred for enterprise blockchain solutions.

These technological advantages are seen as an important factor in the evaluation of altcoins in ETF processes. Elements such as DeFi, NFT, institutional finance and fast transaction technologies facilitate the integration of cryptocurrencies into the traditional financial system, enabling them to be accepted in the ETF market.

Potential Approval Times for Altcoin ETFs

The SEC’s review process for spot ETF applications typically takes 240 days. The approval of Bitcoin and Ethereum spot ETFs sets a positive precedent for other altcoins.

Estimated Approval Processes

| Altcoin | Expected Approval Date | Chance of Approval |

|---|---|---|

| Litecoin | October 2, 2025, | 90% |

| Solana | October 10, 2025, | 70% |

| XRP | October 17, 2025, | 65% |

| Dogecoin | October 18, 2025, | 75% |

General Evaluation

The year 2025 could be the beginning of a new era for cryptocurrency ETFs. The SEC’s changes to the regulatory framework and ETF approval processes will have a major impact on the crypto markets. Which altcoins will be approved after Bitcoin and Ethereum ETFs will continue to be a critical issue for the market.