Introduction

US President Donald Trump’s announcement on tariffs caused significant fluctuations in financial markets and the cryptocurrency market. In the same period, there were other important developments in the crypto sector. Spot ETF applications were filed with the SEC for some altcoins. Following these applications, a recovery trend was observed in the market, but price movements followed a volatile course due to the uncertainty created by the tariffs.

In this report, we will examine the price movements of altcoins with Spot ETF applications in the cryptocurrency market, which declined after Trump’s tariff announcement on February 1, 2025.

US Tariffs and Their Impact on the Crypto Market

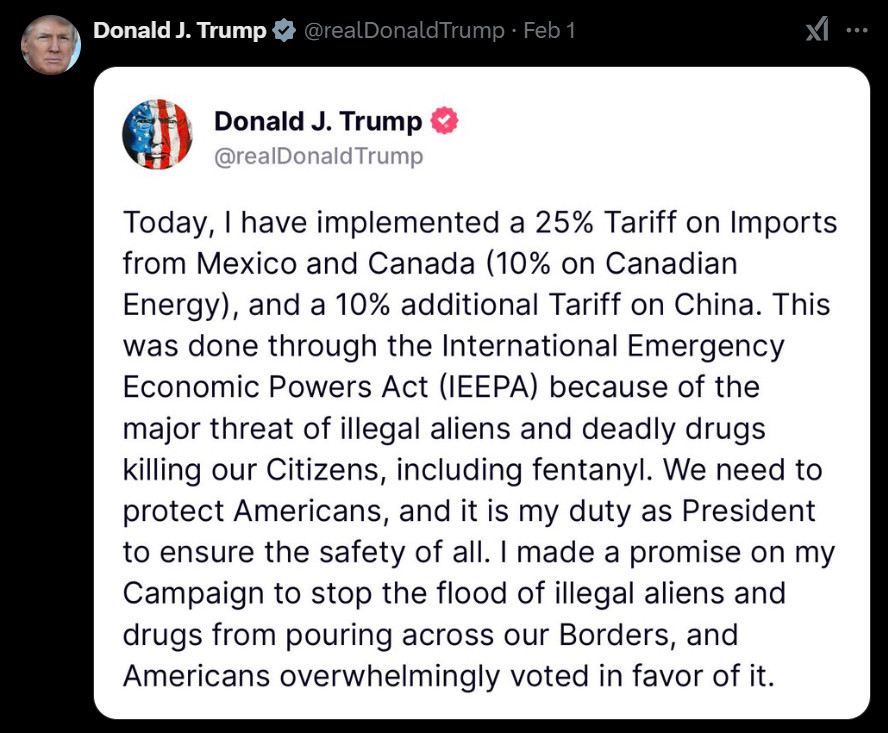

On February 1, 2025, US President Donald Trump announced a 25% tariff on imports from Mexico and Canada, as well as a 10% tariff on the Canadian energy sector and an additional 10% tariff on imports from China. This decision was taken under the International Emergency Economic Powers Act (IEEPA) to combat illegal immigration and drug trafficking.

Trump’s post was interpreted not only as ‘decisive steps to prioritize the security and national interests of the American people’ but also as the US starting a new trade war. This caused investors to avoid risky assets. In the cryptocurrency market, selling pressure on Bitcoin and altcoins increased, while investors’ risk appetite decreased. As a result of these developments, there were sharp declines in the cryptocurrency market.

Altcoin ETF Applications and the Change in the Price of Altcoins

ETF filings have increased institutional investors’ interest in the market, leading to price increases in some altcoins. As of February 1, 2025, altcoin ETF applications and price changes of the related altcoins are as follows:

- XRP (Ripple) ETF Filings and Price Change

- February 6, 2025

- Canary has filed for an XRP ETF with CBOE.

- 21Shares has filed for an XRP ETF with CBOE.

- Bitwise has filed for an XRP ETF with CBOE.

- WisdomTree has filed for an XRP ETF with CBOE.

- February 10, 2025

- CoinShares has filed for a Spot XRP ETF with Nasdaq.

- February 13, 2025

- The SEC accepted the amendment for the Grayscale Spot XRP ETF.

- February 14, 2025

- SEC accepted the application for 21Shares Spot XRP ETF.

XRP (Ripple) Price Change: XRP’s price increased by approximately 18% during this period. Investor interest surged significantly after the SEC accepted XRP ETF applications.

- Solana (SOL) ETF Applications

- February 11, 2025

- SEC accepts VanEck Spot Solana ETF application.

- The SEC accepted the application for the 21Shares Spot Solana ETF.

- SEC accepts Bitwise Spot Solana ETF application.

- The Franklin Solana Trust was officially registered in Delaware.

- The SEC has approved the application for the Canary Spot Solana ETF.

SOL (Solana) Price Change: Despite the SEC’s acceptance of Solana ETF applications, Solana’s price did not show significant changes, and the downtrend continued.

- Litecoin (LTC) ETF Applications

- February 5-6, 2025

- NYSE has applied to convert Grayscale’s LTC Trust into a spot Litecoin ETF.

- The SEC accepted the amendment for Grayscale’s Spot Litecoin ETF application.

- February 10, 2025

- CoinShares has filed for a Spot Litecoin ETF together with Nasdaq.

- February 14, 2025

- SEC accepts application for CoinShares Spot Litecoin ETF.

LTC (Litecoin) Price Change: LTC price increased by approximately 30% during this period. Investor interest surged after the SEC accepted Litecoin ETF applications.

- Dogecoin (DOGE) ETF Applications

- February 10, 2025

- The SEC accepted REX Advisers and Osprey Funds Dogecoin ETF application and started the formal review process.

- February 14, 2025

- The SEC accepted Grayscale’s Dogecoin ETF application and started the review process.

DOGE (Dogecoin) Price Variation: Dogecoin gained approximately 10% during this period. Investor interest increased as the SEC started the review process.

- Cardano (ADA) ETF Applications

- February 10, 2025

- Grayscale has filed for an exchange-traded fund (ETF) focused on Cardano (ADA). This is Grayscale’s first standalone ADA investment product.

ADA (Cardano) Price Change: Cardano (ADA) price increased by nearly 20% after ETF filing.

General Evaluation

SEC approvals of altcoin ETFs had a positive impact on the market in the short term. However, uncertainties in global trade policies have negatively impacted investor confidence and raised concerns about the sustainability of the gains. While the increases in XRP, LTC and ADA prices demonstrate the strong impact of ETF news on the market, Solana’s lack of significant price movement despite ETF applications shows that investors are cautious in the current market conditions. Dogecoin’s 10% appreciation following the ETF filings created a positive expectation in the market, but the impact of macroeconomic uncertainties should not be ignored.

As a result, crypto investors closely followed both ETF applications and macroeconomic developments. Although ETF applications and approval processes triggered rises in the market, global economic uncertainties caused fluctuations in the cryptocurrency market and caused the price movements of altcoins such as XRP, LTC, SOL, DOGE and ADA to remain volatile.