Introduction

In recent years, exchange-traded funds (ETFs) have become a popular investment tool in the financial world. Thanks to their low cost, diversification, and ease of access, ETFs have garnered significant attention in global markets. However, these financial instruments have initiated a revolution not only in traditional asset classes but also in the world of digital assets. The unique dynamics of cryptocurrency markets have resulted in a more complex and profound impact from ETFs.

The emergence of crypto ETFs has been a game-changer for both individual and institutional investors. ETFs have significantly lowered the barriers to entry in the crypto market, especially by addressing the challenges posed by high volatility and technical complexities. Investors can now participate in the digital asset market without delving into the intricacies of wallet management or blockchain technology. This has amplified interest in cryptocurrencies and bolstered confidence in the sector.

This article explores the historical development of crypto ETFs, their impact on leading crypto assets such as Bitcoin and Ethereum, and the broader market effects. Additionally, it predicts which cryptocurrency ETFs might emerge in the future.

The Journey of Crypto ETFs: Bitcoin and Ethereum ETFs

Since Bitcoin’s inception, investors have sought reliable and straightforward ways to trade digital assets. However, the inherent volatility of crypto markets has often deterred traditional investors. To address this challenge and widen access to crypto assets, Bitcoin ETFs were proposed.

In 2013, Cameron and Tyler Winklevoss submitted the first Bitcoin ETF application to the U.S. Securities and Exchange Commission (SEC). However, the application was rejected due to concerns surrounding market volatility and regulatory risks. This rejection ignited widespread debate in the financial world about the future of crypto ETFs.

Despite this initial setback, numerous companies and mutual fund providers continued to submit applications for ETFs tied to Bitcoin and other cryptocurrencies. These persistent efforts marked a turning point in integrating the crypto market with traditional financial systems.

In 2021, Canada approved the world’s first Bitcoin spot ETF, the Purpose Bitcoin ETF (BTCC), setting a global precedent. Shortly after, the U.S. SEC approved Pro Shares’ Bitcoin Strategy ETF (BITO), a futures-based Bitcoin ETF. By 2024, the first U.S. spot Bitcoin ETFs and spot Ethereum ETFs received approval, making history. Notable among these were BlackRock’s iShares Bitcoin Trust (IBIT) and iShares Ethereum Trust (ETHA), which drew widespread attention and significantly influenced the crypto markets.

How ETFs Reshaped the Crypto Market

Crypto ETFs have profoundly transformed the digital asset market. Their impact can be summarized as follows:

- Increase in Institutional Investments: ETFs have enabled institutional investors to overcome the risks associated with volatility, bringing substantial capital into the crypto ecosystem.

- Legitimacy and Trust: SEC-approved ETFs have enhanced the perception of digital assets as legitimate investment vehicles, increasing investor confidence.

- Accessibility for Individuals: ETFs have simplified access to crypto markets for individual investors, eliminating the need for technical expertise or wallet management.

How ETFs Affected Prices

The launch of crypto ETFs has had a significant and positive impact on the prices of leading cryptocurrencies, especially Bitcoin and Ethereum. US Spot Bitcoin ETFs have seen total net inflows exceed $39 billion after 258 trading days following their launch. Similarly, U.S. Spot Ethereum ETFs have seen net inflows totaling $2.83 billion after 126 trading days since their launch. These remarkable figures clearly demonstrate the magnitude of investor interest in crypto ETFs and their impact on market dynamics.

In particular, ETFs from industry leaders such as BlackRock and Fidelity have attracted a lot of interest among investors, which has directly led to increases in Bitcoin and Ethereum prices. These price increases have often been attributed to increased demand and improved market liquidity. Moreover, the launch of crypto ETFs as regulated financial products has accelerated the integration of crypto assets into the traditional financial world and reinforced investor confidence.

The effects of ETFs on prices can be summarized by the following key elements:

- Spot ETF Approvals and Price Spike: The launch of spot Bitcoin and Ethereum ETFs has driven the prices of these assets to record highs. In particular, institutional investors’ intense interest in these products triggered demand and price increases.

- Increased Liquidity: The introduction of ETFs has increased liquidity and partially reduced price volatility. A more liquid market provided a safer environment for both individual and institutional investors.

Demand Growth: ETFs have facilitated the access of crypto assets to a wider audience. Institutional and individual investors have had easier access to large assets such as Bitcoin and Ethereum through ETFs, which has increased demand and therefore prices.

Which Coins’ ETFs Could Be Next for the Emerging Sector?

With the evolving structure of crypto markets and the clarification of the regulatory framework, different cryptocurrencies are increasingly likely to be subject to Exchange Traded Funds (ETFs). In particular, if Donald Trump wins the US presidential elections and following the resignation of SEC Chairman Gary Gensler, it is anticipated that significant changes may occur in ETF processes.

Altcoin ETFs offer a new opportunity for investors to diversify their portfolios. The fact that popular altcoins such as Solana, XRP, Dogecoin, as well as assets such as HBAR and Litecoin are included in ETF application and approval processes can be considered as an indicator that the market has reached maturity. However, regulatory uncertainties and market demand are among the critical factors affecting the success of these products.

The year 2025 may mark the beginning of a new era in the financial markets as cryptocurrency ETFs are integrated into traditional investment instruments. According to Bloomberg ETF analysts Eric Balchunas and James Seyffart, 2025 will be a very active year in terms of ETF applications and approvals. Some of the posts of these ETF analysts are as follows:

Eric Balchunas 33 Crypto ETF Applications

Eric Balchunas emphasizes that the number of cryptocurrency ETF applications filed with the SEC as of 2025 is 33, and this list could grow rapidly in a short period of time. This shows the growing demand for the regulation of crypto markets and the interest of market players in new products.

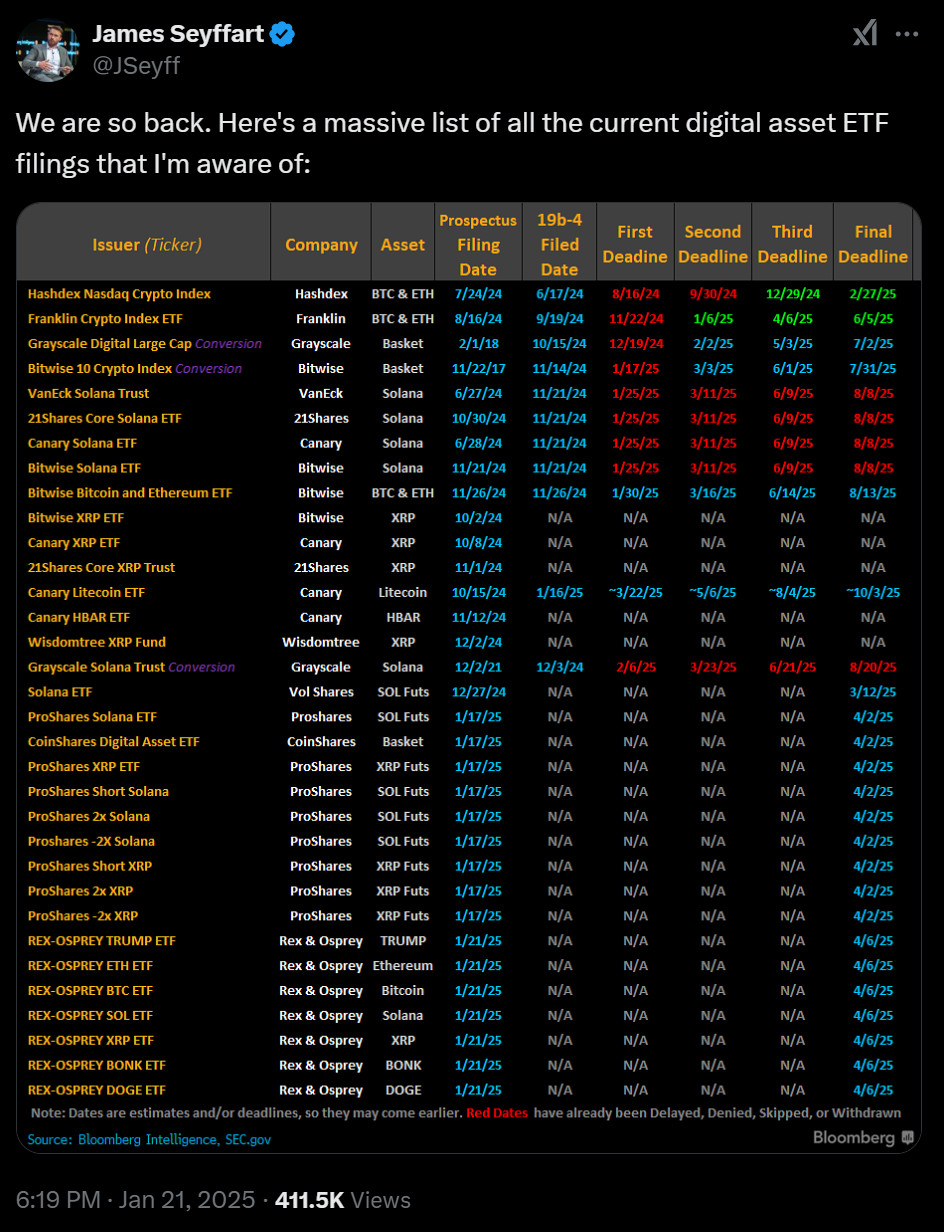

James Seyffart: Current List of Digital Asset ETF Applications

This list, shared by James Seyffart, details the current crypto ETF filings. The list includes ETF filings for major crypto assets such as XRP, Solana, Bitcoin, Ethereum, as well as some lesser-known altcoins. The stage of the applications and regulatory dates are detailed.

Eric Balchunas Solana Futures ETF Details

Information about the Solana Futures ETF (offered by Volatility Shares) shared by Eric Balchunas shows how quickly such products can be integrated into the market. With a potential launch as early as March 2025, this product could cement Solana’s place in the futures market.

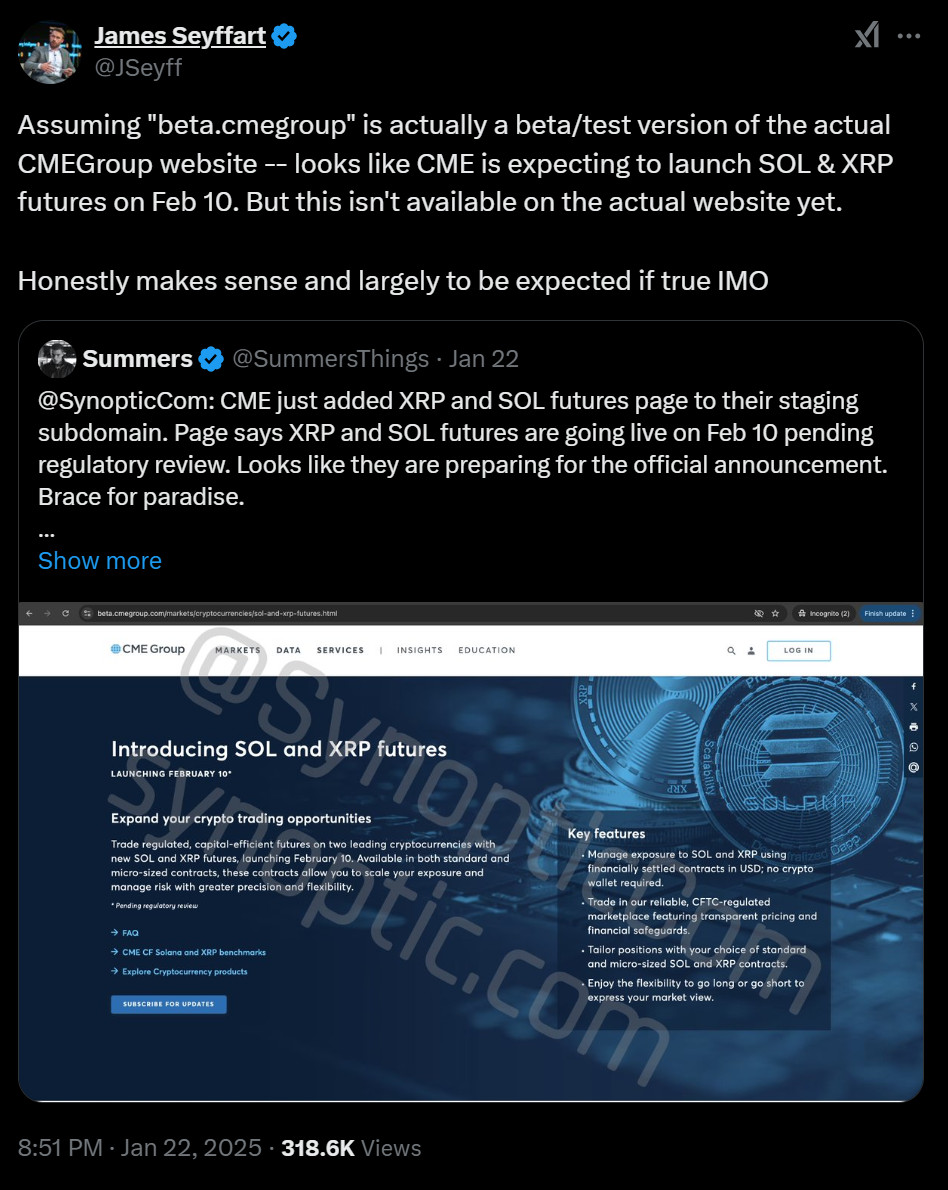

James Seyffart: CME Group Information on XRP and SOL Futures

CME Group’s preparations for XRP and Solana futures point to the expansion of derivatives markets for these assets. James Seyffart states that these futures could be launched by February 10, 2025. This development increases the importance of the derivatives market for institutional investors.

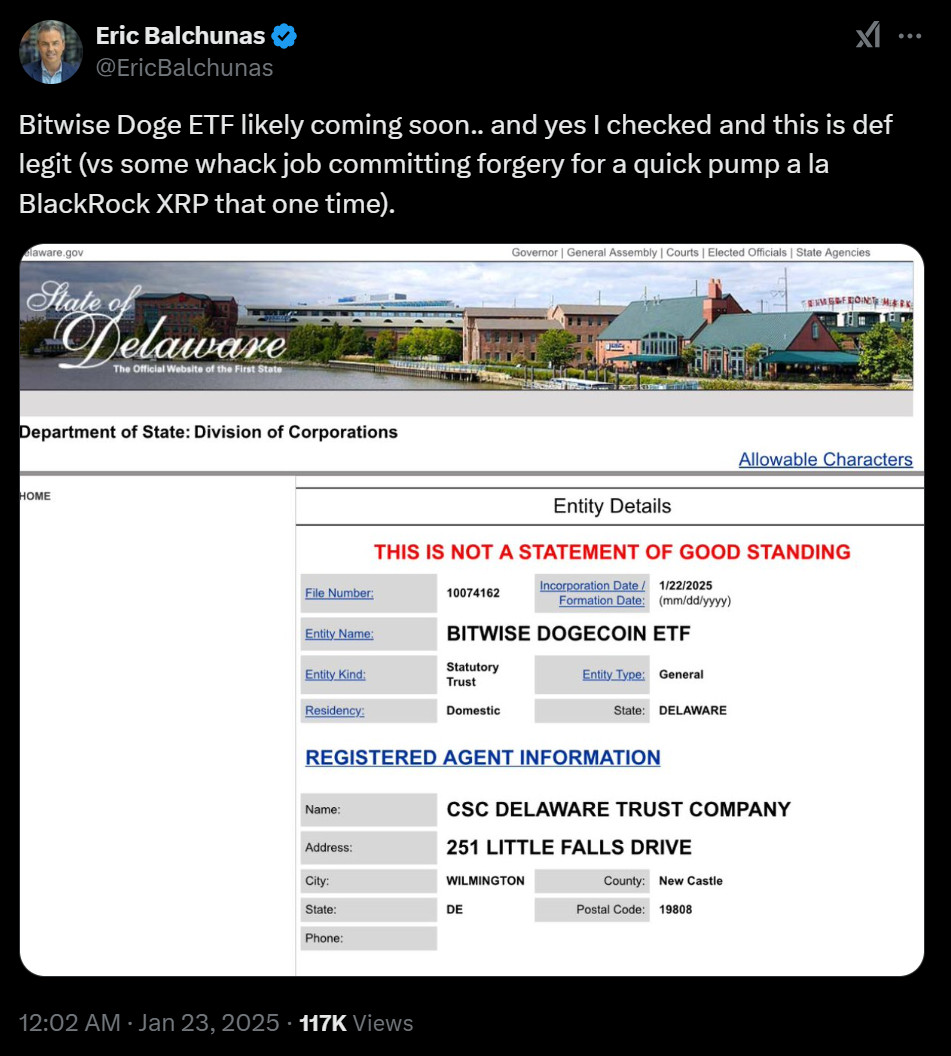

Eric Balchunas Bitwise Dogecoin ETF Application

The information shared by Eric Balchunas about the ETF application for Dogecoin shows that even meme coins are starting to find a place in regulated markets. This demonstrates the interest of a wide range of investors in such products and the growth potential of crypto markets.

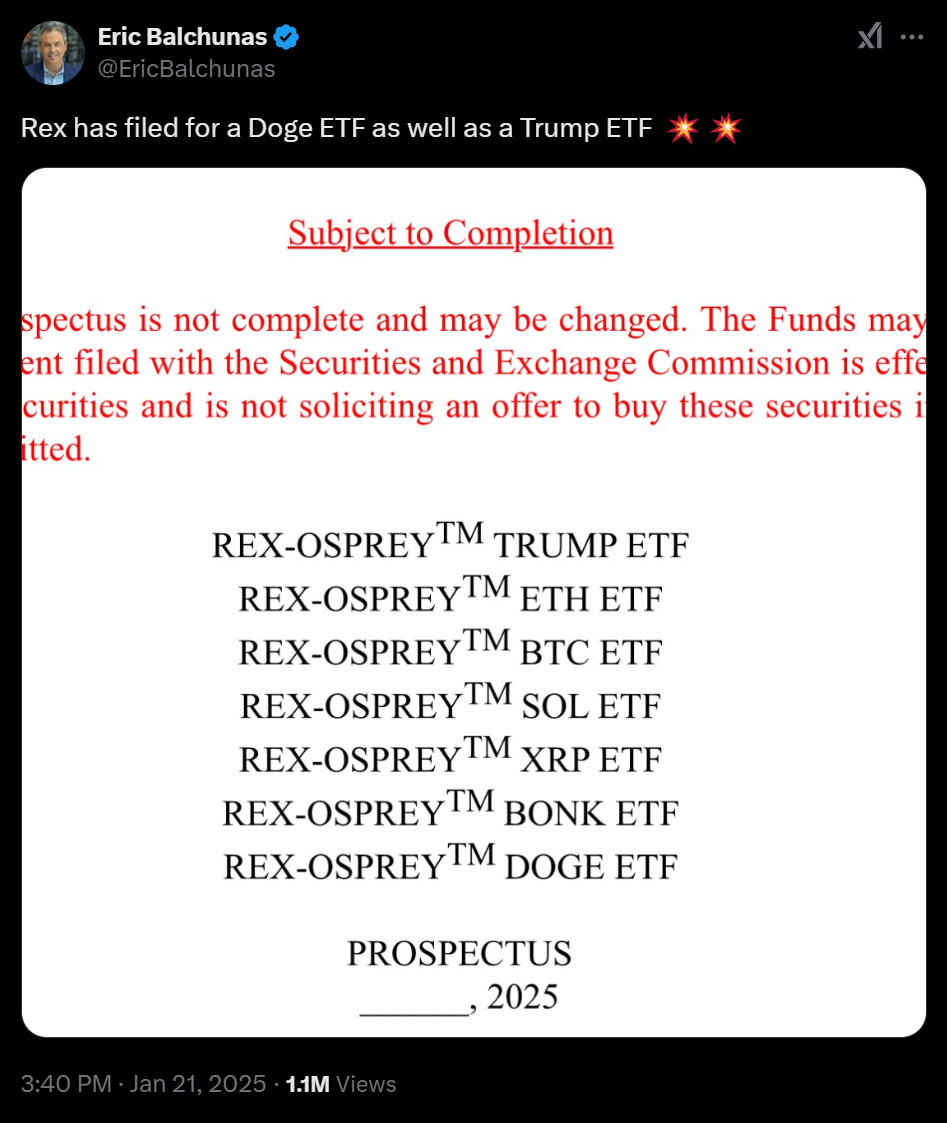

Eric Balchunas REX ETF Applications

Rex has come up with unusual products such as Dogecoin and even the Trump ETF. This shows how creative ETF filings have become and how they are shaped by market demand.

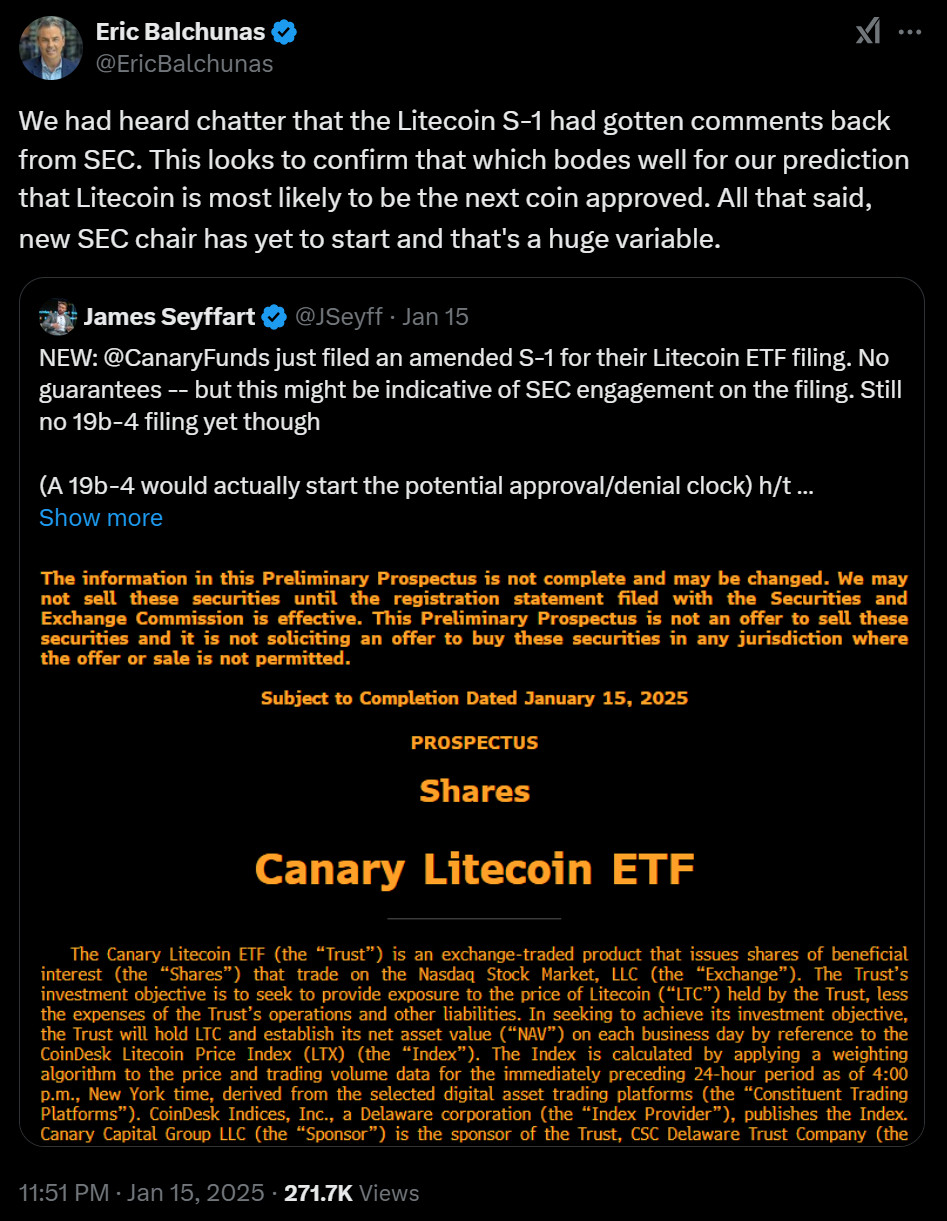

Eric Balchunas and James Seyffart: Canary Litecoin ETF application

It shows the SEC’s interest in Litecoin, and that the potential approval process could move forward. It is speculated that Litecoin could be the next asset to be approved in spot ETFs.

General Evaluation

Crypto ETFs have facilitated the seamless integration of digital assets into traditional financial markets, attracting a broader investor base. The resulting increase in liquidity and demand has strengthened the crypto ecosystem and contributed to the growth of crypto asset prices.

As we look toward 2025, the launch of ETFs for XRP, SOL, LTC, DOGE, and other cryptocurrencies could mark the beginning of a new era for the sector. The trajectory of crypto ETFs will ultimately depend on regulatory developments and investor appetite, setting the stage for further growth in this transformative space.