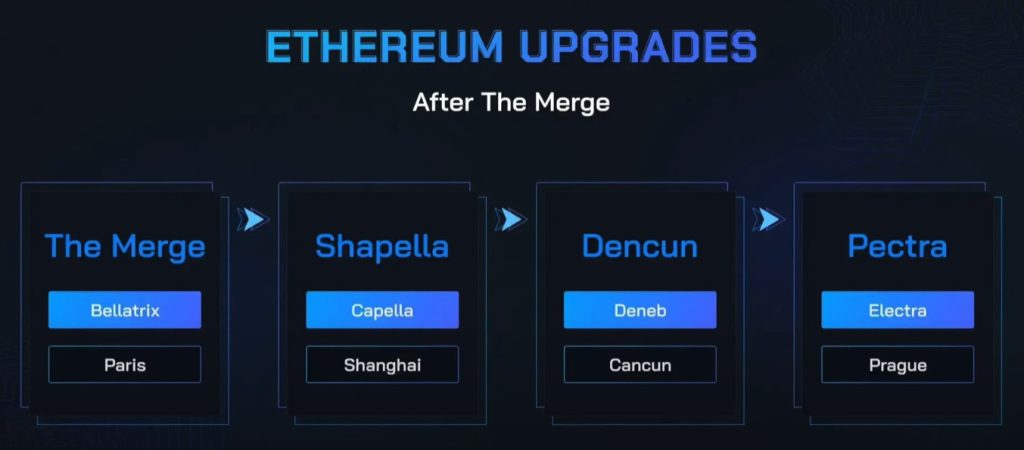

Pectra Overview

The Pectra update, which was expected to be active on March 2025, was postponed due to a number of bugs that developed on the Holesky and Sepolia testnet and became active on the mainnet on May 7 without any problems. With the Pectra update, it has been recorded as the largest update in its history, as it includes a total of 11 Ethereum enhancement proposals (EIPs). A number of technical changes that will take place in Ethereum with this update are as follows: EIP-7251 increased the maximum stake of validators from 32 ETH to 2048 ETH. With EIP-7702, factors such as the ability to pay gas fees with different tokens and multi-signature were activated. With EIP-7691 and EIP-7742, features such as reducing L2 transaction fees and reducing overall network congestion thanks to more blobs per block are among the most significant changes on the Ethereum side.

Impact on Ethereum

Although Pectra brings many innovations in itself, the “bullish” development among these innovations is the increase in the validator staking upper limit from 32 ETH to 2,048 ETH. We can say that the reduction of validator costs in this EIP, especially when combined with the staking option in Ethereum ETFs on the SEC’s desk in the US, can affect the institutional interest in Ethereum very much.

After the update became active on the mainnet on May 7, there was a significant increase in the ETH price. The price, which was around $ 1,800 before the update, realized consecutive positive daily closes on May 8-9 and 10. In this three-day period, it gained approximately 45% and more than 55% in total, approaching $ 2,800.

Impact on Layer 2 Solutions

With the update, we can talk about increased data capacity for L2. With EIP-7691, the number of temporary data blocks called “blobs” per block is doubled with this update. The number of blobs, which were 3 and 6 before the update, has increased to 6 and 9 after the update. This means more data processing capacity for L2 solutions. To clarify with an example table:

| Feature | Before EIP‑7691 | After EIP‑7691 |

|---|---|---|

| Target Blobs per Block | 3 | 6 |

| Maximum Blobs per Block | 6 | 9 |

| Total Rollup Transactions (Example) | 60,000 | 90,000 |

| Total Cost (Example) | 1 ETH | 1 ETH |

| Cost per Transaction | 0.0000167 ETH | 0.0000111 ETH |

Reduced transaction costs and increased data processing capacity will allow applications (dApps) on Ethereum to become more scalable. This in turn will increase total locked assets (TVL) in L2 solutions and make the network more economical to use.

In terms of price, Optimism (OP) and Arbitrum (ARB), two of the L2 projects, experienced a strong rise in parallel with the movement of Ethereum with the incoming update, and OP and ARB experienced a 60% and 69% appreciation, respectively.

Future Prospects

The fact that the network efficiency will increase with the low transaction fees that will be realized with the update was welcomed by the players in the market and this was reflected in the price. Especially when we look at the strong increase in the ETH / BTC parity, we see that it has started to compensate for the long-lasting loss of power. In addition, when we evaluate the Ethereum etf staking option, which is expected in the market in parallel with Ethereum’s technological developments, in the same perspective, there will be no doubt that institutional eyes will turn towards Ethereum. Institutional actors will want to turn the positive expectation in the market into earnings with the reduction of transaction costs and will try to make Ethereum familiar to traditional finance investors. This adoption could lead to a very strong and positive story for Ethereum.

Disclaimer

This content has been prepared by the Darkex Research Team for informational purposes only. It does not constitute investment advice. All risks and responsibilities arising from your investment decisions are solely your own.