Introduction

World Liberty Financial (WLFI) was founded in 2024 as a global platform focused on decentralized finance (DeFi) solutions. The main goal of the platform is to enable users to make more efficient use of their digital assets and democratize access to financial services on a global scale. In line with this vision, WLFI is developing a comprehensive ecosystem that bridges traditional finance with Web3 infrastructure, offering staking, lending, liquidity management and governance mechanisms. The platform launched USD1, a stablecoin backed by US Treasury bonds, on multiple networks.

Source: https://worldlibertyfinancial.com/

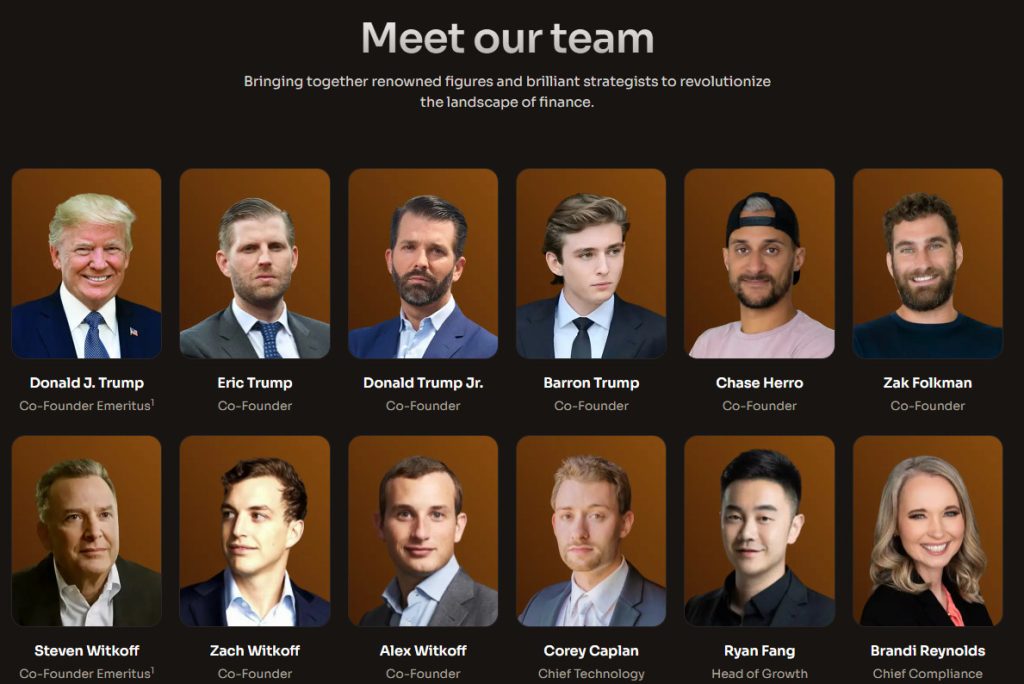

One of the most striking aspects of the WLFI project is the direct support of US President Donald Trump and his family. The Trump family’s name brought strong public interest to the project at its inception. Donald Trump Jr. and Eric Trump’s active roles in the ecosystem have had an unprecedented political impact on the DeFi space. With the launch event at Nasdaq in August 2025, WLFI has become not only a financial venture, but also a symbol at the intersection of politics and crypto.

Source: https://worldlibertyfinancial.com/

The WLFI token was initially offered only as a governance tool to a limited group of investors, raising approximately $550 million in the process. Designed to be non-transferable, the WLFI token allowed investors to participate in voting on the future of the platform. However, the official token launch on September 1, 2025 was the turning point for WLFI. After the launch, the WLFI token rose above the $0.30 level on the first day of trading. Thus, it became one of the most prominent developments of the year in the crypto markets.

The Trump family’s name contributed to the rapid listing of WLFI on global exchanges and attracted the attention of a wide range of investors. WLFI has been a big hit in the DeFi world, as well as in political and financial circles. In this report, we take a detailed look at the launch, initial circulation and future prospects of the WLFI Token.

Initial Circulation Details and Token Distribution

The total supply of WLFI Token is set at 100 billion. Approximately 25% of the total supply was circulated in the first phase. This ratio was intended to provide a strong start to the market while incentivizing early investors.

Looking at the breakdown of the initial circulating supply:

- 10 billion to World Liberty Financial, the founding company of the WLFI project

- Approximately 7.8 billion WLFI tokens are held in the treasury of Nasdaq-listed Alt5 Sigma

- 9 billion to WLFI liquidity and marketing activities

- 4 billion WLFI tokens were initially allocated to investors who participated in the public sale (at 20% of their vesting).

This distribution demonstrates that the project is aiming for a balanced start for ecosystem development and early backers.

The remaining 75% of the supply (approximately 75 billion WLFI) will be added to circulation at a later stage according to various lock and vesting schedules. The shares reserved for the team and founding members are tied to long-term lock-up plans, while the remaining 80% of the public sale will be gradually released on a timetable to be determined by governance votes.

Source: https://worldlibertyfinancial.com/governance

“WLFI Governance Image to be Added”

The portion reserved for advisors and strategic partnerships will be circulated with the approval of the community and in line with established timelines. This method ensures that the token supply is managed by the community while preventing sudden and uncontrolled supply entry into the market.

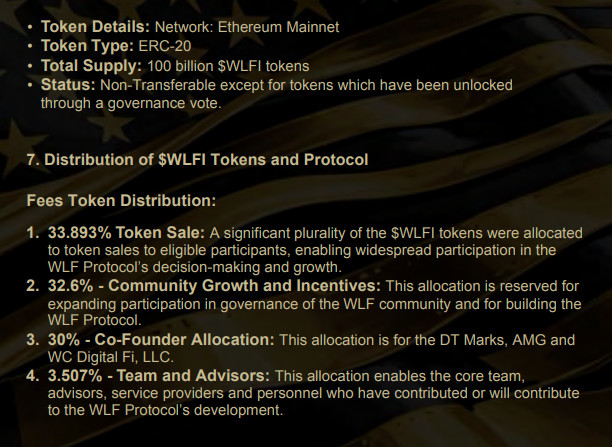

If we examine the official distribution of the WLFI token in the whitepaper:

- 893% – Token Sale

- 6% – Community Growth and Incentives

- 30% – Co-Founder Share (DT Marks, AMG and WC Digital FI, LLC)

- 507% – Team and Consultants

Source: https://static.worldlibertyfinancial.com/docs/intl/gold-paper.pdf (WLFI Whitepaper)

This tokenomic structure of WLFI aims to reward early investors (through the first 20% unlock) while maintaining long-term supply-demand balance and price stability. Thanks to its transparent distribution model and community-approved vesting programs, WLFI aims to be at the center of a sustainable DeFi ecosystem, rather than a project that only comes to the fore with political connections.

Stock Exchange Listings and Market Reactions

Immediately after its launch, the WLFI token was listed on many major cryptocurrency exchanges around the world, making it accessible to investors. Leading platforms in the cryptocurrency market announced WLFI listings as of September 1, 2025. In a short period of time, news of the WLFI listing attracted attention in the cryptocurrency market. This widespread listing significantly increased the token’s liquidity and trading volume. In fact, in the first 24 hours, the trading volume in the spot market exceeded 2.5 billion dollars, while the volume in the derivatives markets reached 4.6 billion dollars. This data showed that there was intense speculative interest and trading activity in WLFI before and after the launch.

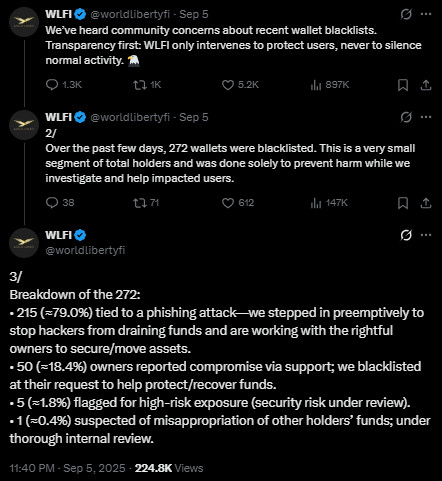

However, the initial market reaction was characterized by high volatility. The price of the WLFI token surged above around $0.30 on launch day, but quickly corrected as some early investors took profit realizations. According to on-chain data analysis, several large wallets that had received large amounts of tokens in the pre-sale phase transferred their WLFI tokens to exchanges immediately after the unlock. As a result of this selling pressure, the WLFI price fell as low as $0.16 on the 4th trading day. In this process, the WLFI team, which examined some wallet movements in particular, stated that it took measures regarding the manipulation made and provided confidence on the token again. After the WLFI team’s posts on their official accounts, the WLFI token recovered again. According to CoinMarketCap, the WLFI token, which is currently trading at $0.23, is ranked #25 in the global crypto assets rankings with a market cap of approximately $5.7 billion.

Source: https://x.com/worldlibertyfi

The high volume of transactions and sudden price fluctuations indicate that WLFI has been volatile in its early days. However, confidence in the project has not been completely shaken, with some large investors taking long-term positions. Such large-scale support demonstrates that the start-up community around WLFI is not just speculative players, but also serious stakeholders who believe in the vision of the project.

Overall Assessment

The WLFI token launch has been one of the biggest events in the crypto world in recent years, both in scale and interest. The fact that it reached a market capitalization of billions of dollars on the first day showed how quickly the support of political and financial figures for crypto projects can move the markets. However, this rapid rise with high liquidity also brought sharp fluctuations. While the project team tried to stabilize this volatility with burn and buyback plans, the decisions taken through community votes showed that the governance mechanism was functional.

Going forward, the future of WLFI will depend heavily on community governance and the ability to increase the platform’s real use cases. If the supply is managed in a controlled manner and the ecosystem continues to grow, WLFI can gain long-term and stable value. Otherwise, high valuation pressure early on could put a lasting pressure on the price. With its launch, WLFI is one of the clearest examples of both opportunities and risks in the crypto ecosystem.

Disclaimer

The information provided in this article is for educational and informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, and readers should conduct their own research or consult a licensed advisor before making investment decisions.