Introduction

The world’s view of crypto assets, popularized by the US and the European Union, has been sceptical of decentralized crypto assets, emphasizing that they have no intrinsic value, are irrelevant to the functioning of real economic sectors, and are vulnerable to manipulation and illicit use.

The US has argued that it is too early to formulate global competitive strategies on crypto assets. Risks such as the vulnerability of a reserve to cyber-attacks and speculative mass trading by rival countries are also raised.

Popularized after the 2008 Global Financial Crisis, the decentralized character of crypto-assets, especially Bitcoin, which are not produced by central monetary authorities of governments, is still seen as a risk for many national governments because the relations of industrializing state governments with crypto-assets that are not produced by central monetary authorities of governments, especially Bitcoin, have not yet established a solid and universal legal basis, and crypto-assets, which have started to be seen as a safe haven just like other precious metals and commodities during periods of increased turbulence in Capital Markets, increased security risks, or decreased interest yields, are still seen as a risk for many national governments.

The crypto-asset wars, which have the potential to create the next stage of global political economy competition, have formed opinions on the sustainability of the ‘Strategic Bitcoin Reserve’ project with rational steps.

The crypto-friendly rhetoric that Donald Trump, who took office as President of the United States of America (USA) on January 20, has insistently emphasized since his election campaign, the markets have started to price this to the point that this situation will change radically.

Trump’s Strategic Crypto Reserve Plan

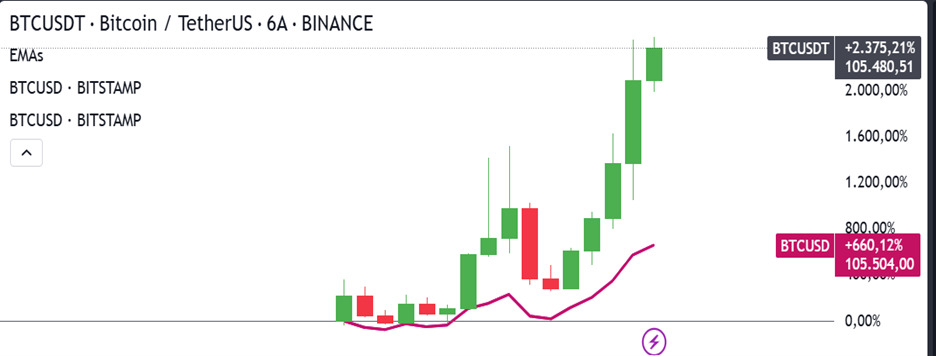

TRUMP said that as of January 20, the US will become the capital of artificial intelligence and crypto. Bitcoin started to rise to the $105,000 level after these statements. With TRUMP taking the presidency again, every statement he makes about bitcoin is carefully followed.

- Trump approves the US Bitcoin Reserve. Benefits for the US to create a BTC reserve

- The dollar is gradually losing its dominant position.

- The US national debt continues to grow

- Bitcoin could become a hedging tool like gold for the US and strengthen its role in the digital economy.

There were different opinions on the idea of ‘Strategic Bitcoin Reserve’ brought up by Trump.

Opinions

- It is argued that an amendment regulating the US Treasury’s ability to buy and sell crypto assets by Presidential Decree through the currently operational ‘Currency Stabilization Fund’ be sufficient for this.

- Another view is that the US Congress will approve a much more detailed special legal study for the strategic reserve to be established specifically for Bitcoin.

So far, Bills introduced to Congress, especially by crypto-friendly Republican Senators, call for the US Treasury to launch at least a 5-year program to buy 200,000 Bitcoins from the markets each year.

Considering that the total Bitcoin reserve in global capital markets is around 21 million, a reserve of 1 million Bitcoin, or 5%, would be sufficient for long-term national interest projections. It was also suggested that the $21 billion in crypto assets seized by the US Department of Justice on the grounds that they belonged to groups doing illegal business could be used to support this reserve. However, both the establishment of the Strategic Bitcoin Reserve and the use of such blocked resources within the scope of the reserve may require long and complex legal processes to be completed.

The Trump administration, which seems determined to pursue its agenda of global trade and financial wars against China, has identified crypto assets as a useful instrument to realize this agenda faster.

It is argued that crypto assets, which are expected to gain value in the medium term thanks to the official interest of the US Treasury, can play an important role in reducing budget deficits and keeping the dollar strong.

The Trump administration has aimed to make bitcoin mining a national priority, framing it as an opportunity to dominate the “block space”. Rachel Silverstein, Bitfarms’ US General Counsel, said on election day: “I think sanctions are a way to avoid war.” She added that it is important to leave sanctions as a tool for states to use.

Bitcoin blocks have a finite capacity, which limits the number of transactions that can be included in each block. Fred Thiel, CEO of Marathon Digital, commented in an X post: “Block space guarantees the ability to transact. Let’s ensure that the US remains the most dominant bitcoin mining nation in the world.” Advocates like Senator Cynthia Lummis tout SBR as a solution to US economic challenges, claiming it could “address a meaningful portion of its debt” and strengthen global positioning. MicroStrategy CEO Michael Saylor goes even further, suggesting that the US government should buy 20-25% of bitcoin so that it can “control the world reserve capital network.” Saylor’s Digital Assets Framework emphasizes the role of criminal liability in ensuring compliance and transparency, aiming to minimize fraud and misbehavior while ensuring that participants adhere to legal and ethical standards. Such frameworks can be used to strengthen decentralization, which could reinforce US influence over bitcoin and transform it from an open, neutral network into an instrument of state governance.

Donald Trump took office with plans to turn the US into the world’s bitcoin mining center. As a first step, he launched his own coin (TRUMP$) and MELANIA, named after his ex-wife. Many people are celebrating bitcoin’s designation as a Strategic Reserve Asset and are buying these coins in volume. Supporters such as Michael Saylor, Tether and other major institutional players consider this a historic achievement and argue that it cements bitcoin’s status as a legitimate store of value. This increasing institutionalization risks jeopardizing bitcoin’s original spirit as a “freedom currency”, as decentralization and resistance to censorship could weaken under the influence of regulatory and economic controls.

Bitcoin, which has the most widespread use among crypto assets, has risen from 60 thousand US dollars to 100 thousand US dollars in a period of about 6 months since the possibility of Trump’s election as President has emerged, which is one of the most concrete data reflecting this excitement.

Trump’s assurance of a second term as President after a first term of severe political and economic turmoil, his announcement that he will establish a national ‘Strategic Bitcoin Reserve’ after taking office, and the creation of a new official position for Elon Musk, such as the ‘Ministry of Productivity’, have revived expectations of long-term policy change regarding crypto assets. The concept of ‘Strategic Reserve’ is used in the context of storing raw materials, production inputs, or precious metals that are considered critical by national decision-makers, especially hydrocarbon resources such as oil and natural gas, against supply disruptions. In this way, supply disruptions that may occur during regional and global crises are intended to prevent negative effects on macro-economic balances.

The Trump administration, which seems determined to pursue its agenda of global trade and financial wars against China, has identified crypto assets as a useful instrument to realize this agenda faster

Arguments that direct channels of influence on crypto assets, especially Bitcoin, will strengthen the US dollar and create defence mechanisms against China and other emerging powers are confirming the current trend. The US Government could issue a presidential decree directing its agencies to prioritize interaction with the crypto sector.

Another development is that Trump has recently held meetings with different people from the crypto sector. These range from exchange CEOs to project founders. This shows that Trump and his team are really keen to develop the crypto sector. While there are many opinions, the general trend is that crypto can become a leading asset on the path to digitalization thanks to this reserve plan.

Trump said he would make America the world capital of crypto and artificial intelligence. Ethereum-based projects are sharing Ethereum support posts one by one.

On January 23, Trump took a big step forward on cryptocurrencies by signing a decree on his election promise of a “National Bitcoin Reserve” plan.

The decree emphasizes that the digital asset sector plays a critical role in US innovation, economic development and international leadership. The government is therefore committed to supporting the growth and use of digital assets, blockchain technology and related technologies. The right of citizens and private sector organizations to access and use public blockchain networks will be protected and encouraged. This includes software development, mining, transaction verification processes and self-custody of cryptocurrencies in personal wallets.

The decree also includes stablecoins. It is stated that steps will be taken to support the development and growth of dollar-backed stablecoins worldwide in order to protect and strengthen the sovereignty of the US dollar.

The decree prohibits the creation and launch of the Central Bank digital currency.

Central Bank digital currency has raised concerns that it could undermine individual privacy by giving governments excessive oversight and control over financial transactions.

On January 23, after this speech, Bitcoin soared.

In his speech on the same day, Trump also signed two decrees on artificial intelligence and a decree establishing a “Science and Technology Advisory Board”.

General Evaluation

On January 16, Trump’s “America-first” strategic reserve plan was announced for the first time. It could be designed to prioritize US Central crypto assets (such as USDC, Solana, XRP). In addition, the Trump administration’s crypto-friendly policies and World Liberty Financial’s addition of altcoins such as Ether, Aave, Link, Ena, Ondo to its portfolio is creating excitement in the markets. These steps are expected to accelerate the crypto ecosystem.

On November 21, Trump said: ” We will give them some Bitcoin and we will erase the US debt of 35 trillion dollars. If we are not the leader in crypto, someone else will be.

On January 23, US President Donald Trump fulfilled his campaign promise and signed an executive order to create a task force on cryptocurrencies.

Following the signing of the decree, eyes turned to Bitcoin and other cryptocurrencies held by the US. The decree stated that the option of creating this reserve from assets legally seized by law enforcement agencies will be evaluated.

The government holds about 200,000 BTC, worth $20 billion. This is followed by 54,753 units of Ether. These assets also include cryptocurrencies such as BNB, TRX. This could support the rise of Bitcoin, altcoins and the Ethereum network.