Introduction

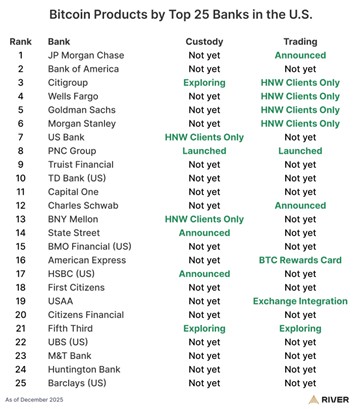

With the adoption of digital assets, their areas of use have rapidly expanded, initiating a process of integration that extends from traditional exchanges to investment funds and technology companies. In this rapidly growing ecosystem, ranging from stablecoins to tokenization projects, Bitcoin has become a strategic focus for both new investors and institutional actors thanks to its pioneering role and high market value. Parallel to these developments, major financial institutions in the US have also embraced crypto asset integration, with banks turning to develop Bitcoin-focused products and services to meet growing institutional interest. Recent industry research shows that many of the 25 largest banks in the US have developed Bitcoin-focused products or infrastructure. This reveals that Bitcoin integration is no longer a matter of doubt for major American banks, but rather a strategic priority.

U.S. Banks Partnering with Crypto Markets

| Bank | Developments and Partnerships |

|---|---|

| JP Morgan Chase | Crypto purchases with credit cards (Coinbase); JPM Coin infrastructure |

| US Bank | BTC custody |

| Citigroup | Crypto custody and payments |

| Wells Fargo | BTC-backed loans |

| PNC Bank | Coinbase Custody as a Service infrastructure |

| Goldman Sachs | Tokenized Bond Project |

As indicated in the table above, the products developed by these institutions generally cover custody, trading, lending, and payment infrastructure. Digital assets were initially used by institutions for spot Bitcoin trading and custody services. JPMorgan offered its customers the ability to purchase crypto assets through Coinbase via credit cards and use JPM Coin as a result of these transactions. Some banks provided infrastructure support for ETFs and investment funds, while working on crypto-collateralized financing opportunities and tokenized payment systems.

US Bank (U.S Bancorp) partnered with NYDIG (New York Digital Investment Group) and began using NYDIG’s infrastructure to offer Bitcoin and digital asset custody services to its corporate clients. This service includes both cold wallet storage and a secure transaction infrastructure under regulatory oversight. Citigroup and Anchorage Digital, on the other hand, enabled outsourcing through blockchain integration. These infrastructure partnerships allowed banks to provide secure custody and blockchain integration services through outsourcing, in compliance with existing regulations, rather than establishing a new crypto department within their own organizations.

What do these products cover, and what could they impact?

The regulatory approval of spot Bitcoin ETFs in the US and other countries is an important milestone in terms of digital assets becoming accessible to a wider range of investors. As a country with one of the world’s largest crypto asset reserves, the US continues to maintain its positive approach to the future of digital assets under President Trump. This situation, coupled with financial institutions responding to growing demand for digital asset services, demonstrated the rapid advancement of cryptocurrency integration into the traditional banking system. These products provided easy access not only to individual investors but also to institutional funds, insurance companies, and pension funds.

Today, the largest banks in the US are actively developing Bitcoin-focused products and services. Key products include Bitcoin custody services, trading and brokerage solutions, and integration with existing asset management platforms. Citigroup and JPMorgan, in particular, have tested their own digital transfer networks using the blockchain technology underlying Bitcoin to increase transaction speeds.

Conclusion and Evaluation

The United Kingdom announced that it will implement a stablecoin regime in 2026. Thanks to the integration of stablecoins into the financial system, banks and fintech institutions will be able to use these assets more effectively. As an example, Belarus announced that it has authorized crypto banks that combine traditional banking with token transactions. It is predicted that NFTs will be used more actively in digital asset integration under MiCA Phase II in 2026. A comprehensive crypto licensing framework is also expected to come into force in Australia that same year. Throughout 2026, many exchanges, custodial service providers, and broker-dealers may be required to obtain official licenses. Along with regulatory changes for tokenized funds and ETFs, the issuance of securities via blockchain infrastructure may become more widespread. As regulations become clearer, increased institutional participation could accelerate the financial integration process in the stablecoin and tokenization sectors.

Disclaimer

All information on this website is provided for general informational purposes only. We make no warranties regarding the accuracy, completeness, or reliability of the content.