What is WLD Worldcoin Token and Recent Developments

Introduction

Worldcoin WLD, which aims to create a digital identity and financial network, is a cryptocurrency project developed by OpenAI CEO Sam Altman and the Tools for Humanity team. WLD aims to verify the authenticity of people with a unique system called World ID. The WLD token itself is an ERC-20 token on Ethereum. In this privacy-focused system, users earn WLD tokens when they perform a biometric scan with a device called Orb and authenticate on the World App. The WLD token is also a utility token that provides the right to participate in protocol governance and voting. On the ecosystem side, the World App and World ID operations run on the OP Mainnet, while WLD is on the Ethereum chain of origin as ERC-20 and has representation on Optimism. The Worldcoin project, led by Sam Altman, is among the startups backed by major investors such as Andreessen Horowitz, Khosla Ventures, Blockchain Capital, Tiger Global.

Core Architecture and Privacy

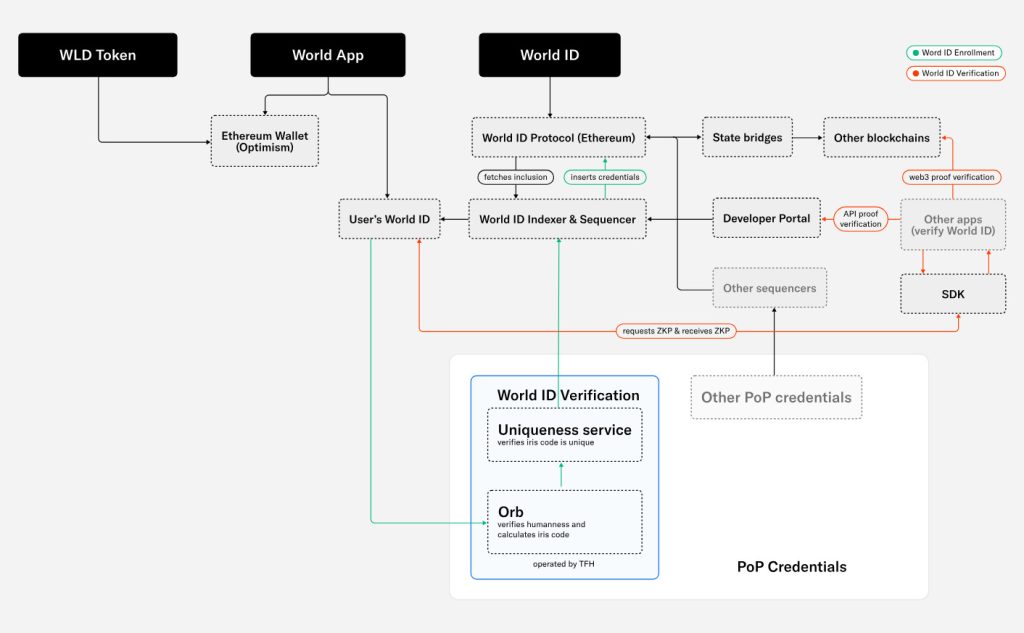

Source: Whitepaper.world.org

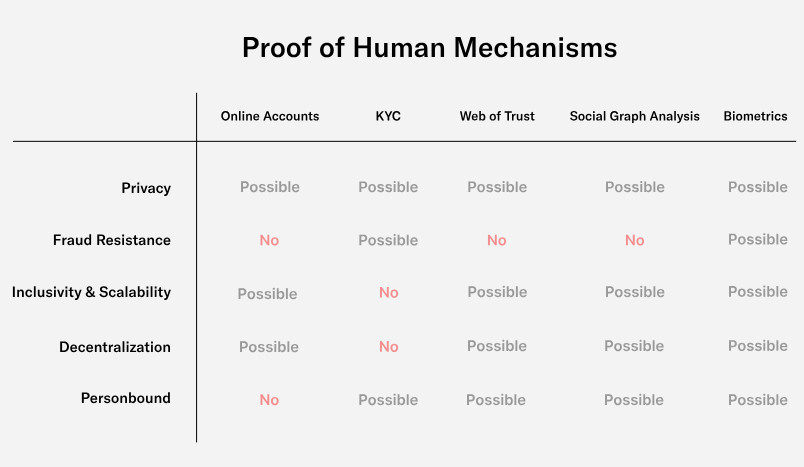

World ID provides the proof of human concept with zero-knowledge proofs (ZKP). The aim is to “prove that you are human and unique without revealing who you are”. In this framework, Worldcoin addresses the gaps in privacy, fraud resistance and inclusivity left by alternatives such as online account/KYC/social graph with a combination of biometrics + ZKP. The verification process is carried out with special hardware Orb; in default behavior the images are processed and deleted on the device, if the user gives explicit consent the storage mode is switched on and the data is encrypted in transit/storage; the user can delete them from the app at any time.

Source : Whitepaper.world.org

WLD is an ERC-20 token. The World Chain Mainnet, where user requests are processed, is positioned as an OP Stack-based layer-2 on Ethereum; if needed, assets can be bridged to Ethereum via the OP Stack Superbridge. This architecture aims to optimize scalability and cost by decoupling the authentication layer and the transaction/payments layer.

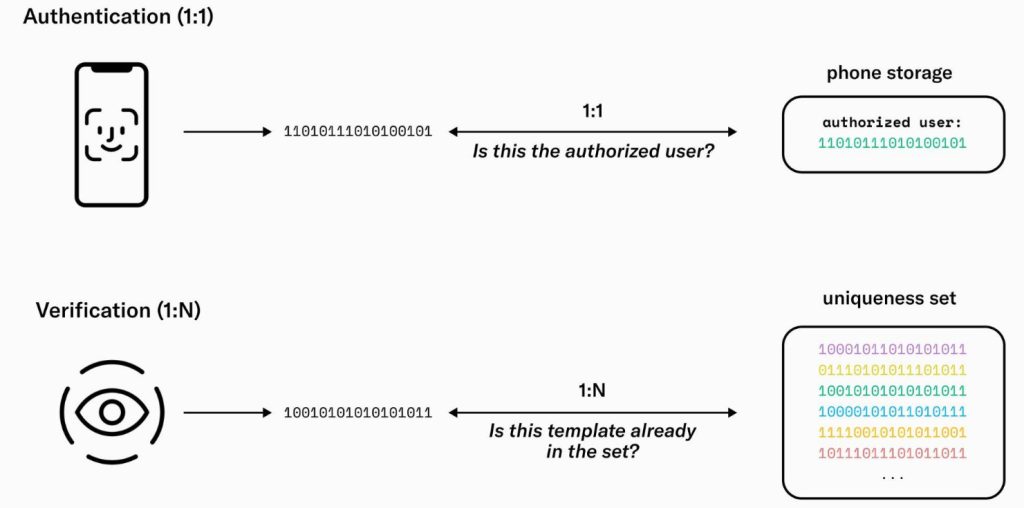

World ID’s approach to scalability centers on the singularity problem. There are two distinct flows: 1:1 authentication (e.g. “is this an authorized user?” against the template on the device) and 1:N uniqueness verification (whether the privacy-protected template produced by Orb already exists in the global uniqueness set).

Source : Whitepaper.world.org

The second flow applies the “one person = one identity” principle without learning the identity of the application and prevents multiple registrations. Deduplication, authentication, recovery, revocation and expiry form the core of the system, providing a secure foundation for scenarios such as bot/sybil protection on social platforms, fair distributions, voting and, in the long term, AI-powered UBI.

Tokenomics Framework

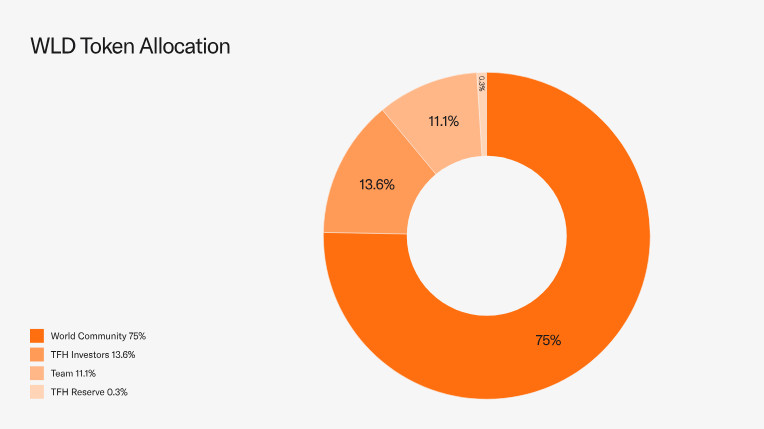

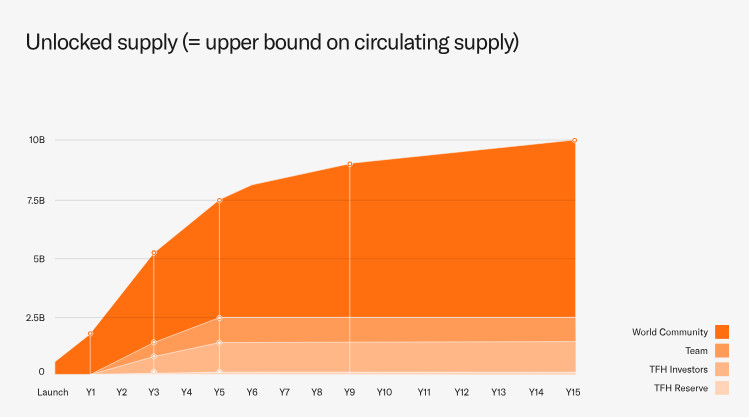

Source: Whitepaper.world.org

The total initial supply is 10 billion WLD. A maximum annual inflation rate of 1.5 percent may be applied by governance decision as of July 24, 2038, 15 years from the earliest, with a default rate of zero. The allocation structure is as follows at the senior level based on the April 28, 2025 outlook, 75% World Community, 11.1% Team, 13.6% TFH Investors, 0.3% TFH Reserve. The unlocking program is spread over 15 years.

Eightco and BitMine’s Investment Plan

In September 2025, the US-based technology company Eightco Holdings NASDAQ announced that it will raise approximately $250 million in private equity. It also announced an additional $20 million strategic investment from BitMine Immersion Technologies, which focuses on crypto assets. With this funding round, Eightco plans to use the cash to purchase the Worldcoin WLD token, a treasury strategy that will turn WLD into the company’s main reserve asset. Along with these announcements, the company appointed Dan Ives as chairman of the board of directors and announced its plan to change its Nasdaq symbol from OCTO to ORBS. In this context, the world’s first Worldcoin treasury strategy was emphasized.

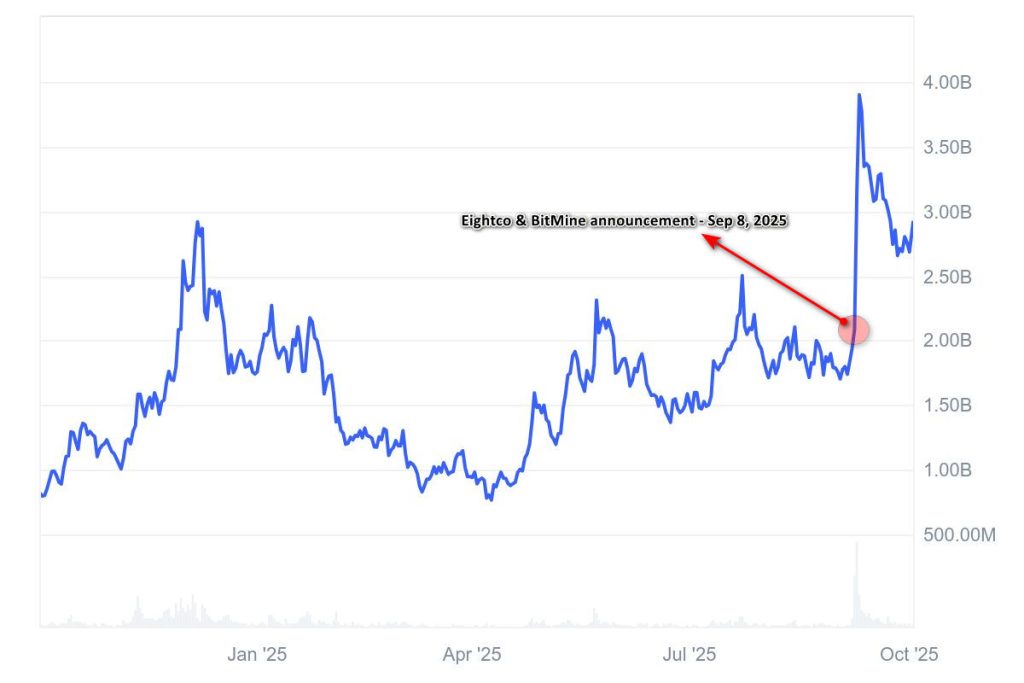

Immediately after this news flow, a significant reaction was seen in the WLD market. On September 8 and 9, 2025, an intraday increase of approximately 40 percent to 50 percent was recorded in the WLD price with the effect of the announcement. Since the figures may show small deviations in different sources, the term range is preferred.

Market Impact and Future of the Investment

The impact of Eightco and BitMine’s investment on WLD’s market dynamics is twofold. On the one hand, Eightco’s plan to raise $250 million in private equity capital and BitMine’s strategic investment of $20 million, along with the company’s announcement that it will use this resource for WLD purchases, increase the confidence in World ID technology and the WLD token. Reminiscent of MicroStrategy’s Bitcoin strategy, Eightco has created a different positioning among publicly traded companies by turning WLD into a reserve asset, and the short-term price reaction seen after the announcement can be read as a reflection of this confidence in the market.

Source: Coinmarketcap.com

On the other hand, this move is considered a high-risk speculative bet. WLD is still a highly volatile crypto asset and its authentication-focused nature leaves it vulnerable to regulatory uncertainty around privacy and data protection. In the medium to long term, the value proposition will be determined by the direction of the regulatory framework and the pace of widespread adoption of World ID. On the market cap side, following the announcement, there was a rapid jump from approximately $ 2 billion to 3 billion 800 million 4 billion band, followed by a balance in the range of 2 billion 800 million 3 billion.

ETF and ETP Status for WLD

There are no ETFs for WLD in the main markets. In Europe, Sweden-based Valour’s “Worldcoin WLD SEK” ETP started trading in December 2024. This product aims to track WLD one-to-one and is exchange-traded. In summary, the access channel today is through ETPs in Europe, with no ETFs in major markets, including the US. This partially focuses the scope of institutional access on Europe and creates a limiting framework for global fund flows unless news of an ETF for WLD breaks.

Institutional Investors and Stakeholders

Eightco’s funding round included participation from the World Foundation, Discovery Capital, GAMA, FalconX, Kraken, Pantera, GSR, CoinFund, Occam Crest, Diametric, and Brevan Howard. Since the early days of the Worldcoin project, the support of venture capital organizations such as Andreessen Horowitz, Khosla Ventures, Blockchain Capital and Tiger Global has also been a known background in the ecosystem.

Risks and Topics to Monitor

Source: Whitepaper.world.org

Regulation, data privacy and the compatibility of authentication with legal regimes are the defining risks in WLD’s value narrative. World ID’s technical architecture is privacy-focused with zero-knowledge proofs and an opt in data retention option, though country-specific authority decisions and controls may require additional adaptations. Liquidity depth and volatility are the key considerations for institutional treasuries in WLD. In addition, on the tokenomic side, the 15-year unlocking program and the inflation parameter after 2038 should be monitored.

Conclusion

Worldcoin aims to provide proof of humanity through World ID in a scalable, privacy-focused framework suitable for application integrations. WLD’s ERC-20 origin and architecture, powered by OP Stack on World Chain, promises new use cases at the intersection of identity and finance. While Eightco’s plan to position WLD as a treasury asset and the accompanying capital inflows indicate increased institutional interest, it should be noted that volatility and regulatory uncertainty remain. The absence of ETFs and the presence of intermediate products such as ETPs in Europe suggest that the market is diversifying its institutional access tools. In the medium to long term, the pace of adoption, regulatory direction and in-network usage metrics will determine the strength of the WLD narrative.