About ZCASH

ZCASH (ZEC) was launched in 2016 as a privacy-focused cryptocurrency. It emerged when several scientists agreed to create a cryptocurrency that was similar to Bitcoin but could have additional features. It was developed as a fork of the Bitcoin blockchain with user security and anonymity features. Initially released as Zerocoin, ZEC was soon renamed Zcash. The founders’ primary focus was to verify coin and transaction ownership in a much more anonymous manner than Bitcoin, thereby providing greater security for users.

Zcash uses the zk-SNARK security protocol to enable verification between parties during a transaction without disclosing any information to each other or the network. This protocol protects the sender, recipient, and amount by fully encrypting them. This maximizes user security, a behavior style embraced by users in the crypto ecosystem.

Source: Coinmarketcap

Reasons for the Rally

It is quite difficult to pinpoint a single reason specifically for Zcash. Indeed, looking at market data, we see that the rise is not limited to Zcash, but privacy-focused cryptocurrencies in general have experienced an increase of over 80%. We see coins such as Monero (XMR), Firo, and Dash positively diverging from the market. While Dash has risen over 650%, Firo over 500%, and Monero has seen a more limited rise compared to the coins mentioned, it has still risen over 150%. Therefore, it is quite reasonable to conclude that interest in privacy-focused products in the cryptocurrency ecosystem is increasing and that the rise in Zcash should be evaluated in this context. Indeed, Alex Bornstein, Executive Director of the Zcash Foundation, said that the rise was “entirely organic.”

Regulation and government oversight, which are developing globally, can cause discomfort among certain user groups within the ecosystem. This accelerates the flow to privacy-focused projects in the ecosystem and creates positive pressure on pricing. Looking at the market narrative, we can assess the recent increase in interest in DEXs and the subsequent interest in ASTER, another decentralized exchange, in this context.

Price Analysis

- Spot Volume Bubble Map (On-Chain)

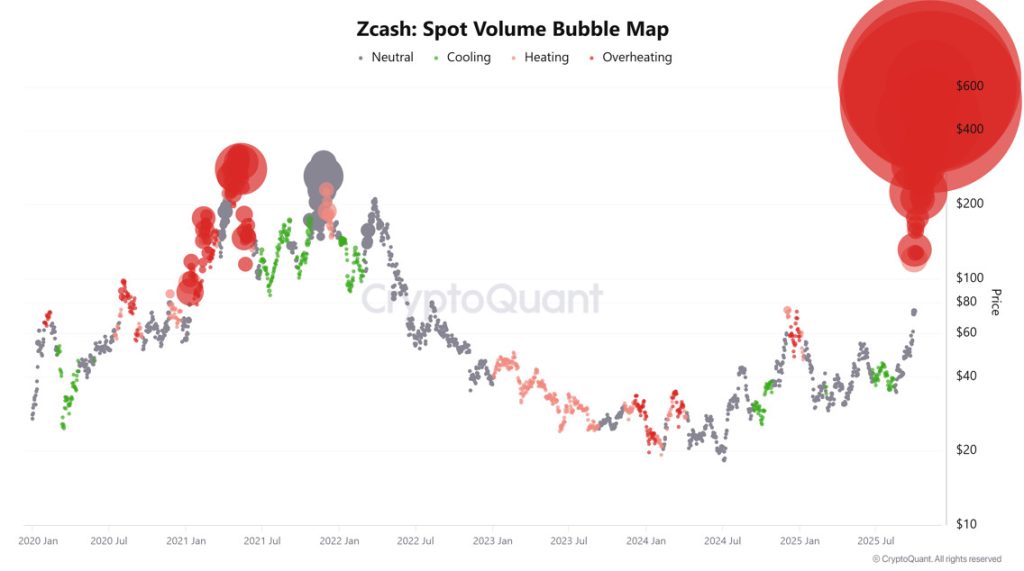

Looking at the Spot Volume Bubble Map, we obtained from CryptoQuant, we see Zcash’s (ZEC) volume concentrations in spot markets throughout the 2020–2025 period represented by color and bubble size. The red tones on the graph (heating/overheating) represent areas of excessive heating where spot volumes are rapidly increasing along with the price, while the green and gray areas (cooling/neutral) indicate phases of market stabilization or cooling, giving us some clues about pricing.

Source: CryptoQuant

The large clusters of red bubbles observed in 2021 correspond to the volume spikes in the final stage of the previous bull cycle. We see that the overheated market during this period underwent a sharp correction shortly thereafter, entering a “cooling” phase throughout 2022–2023. The resumption of volume growth in 2024 indicates that ZEC gained momentum after a long consolidation period.

In the second half of 2025, the massive red bubbles that become apparent on the right side of the chart indicate a record increase in spot trading volumes and that ZEC has entered a parabolic upward trend in terms of price, but also that saturation has set in due to excessive buying and speculative volume. Historically, similar overheated regions have encountered short-term price corrections. Therefore, we can say that momentum has peaked in ZEC, the trend is exhausted, and the risk of correction is quite high.

- Technical Analysis

After moving within a specific range for over three years, the price entered an uptrend on September 30th. Following three touches within this trend, it experienced an increase of over 1000%, rising from $60 to $750. Looking at the current structure on the 4-hour chart, we see a strong “bearish” formation called a double top. Initially, following the breakout of the double top, we can expect the price to pull back to the target zone around $340, confirming the downward move with a retest movement. Additionally, what makes the scenario even more pessimistic here is that the current target price level signifies a trend break, which could pull us back to the negative divergence zone formed on October 2. If the price pulls back to the divergence zone (150$ – 170$) again, it would mean a decline of approximately 65%. For this entire negative scenario to be eliminated, the formation structure must first break down, meaning the price must close above the blue shaded area (510$ – 540$) on a 4-hour chart.

Overall Assessment

While the high level of hype in the ecosystem supports price stability, the expectation that regulatory pressure will increase in the coming period means that both Zcash and all privacy-focused products may be subject to greater scrutiny in the long term. Anti-Money Laundering (AML) and Travel Rule applications, in particular, continue to tighten. Considering the restrictions imposed by European Union and US regulators on “privacy-enhancing” coins and the oversight they will impose on exchanges, liquidity shortages and delisting announcements may increase for these products. Therefore, if the projects in question enter a regulatory preparation phase, it could eliminate the source of the hype they generated and lead to sharp sell-offs.

Indeed, regional delistings have already occurred on some exchanges. Some have been removed from EU markets. Countries like South Korea and Japan have been implementing restrictions on this ecosystem for some time.

However, as we mentioned in the report, Zcash’s privacy is optional. It offers transparent and shielded modes. While this may not mean much in sectoral terms, it is a feature that somewhat softens Zcash’s position. However, it is inevitable that it will be affected by the liquidity crunch and regulatory pressure in the category. This could increase downside risks for the price.