In a rapidly evolving digital landscape, the intersection of cryptocurrency and traditional banking has become a focal point for industry leaders and regulators alike. Recently, Bank of America CEO, Brian Moynihan, emphasized the urgent need for regulatory clarity around cryptocurrency payments. As digital currencies gain traction, their integration into mainstream financial systems poses unique challenges and opportunities. This article delves into Moynihan’s call for a systematic regulatory approach, exploring the implications for businesses and consumers in the crypto space. We will examine the current regulatory landscape, gather insights from industry reactions, and discuss the path forward for financial entities navigating these exciting yet complex waters. Explore the CEO’s call for action on regulatory clarity in crypto payments, current industry reactions, and insights into the future landscape of regulations.

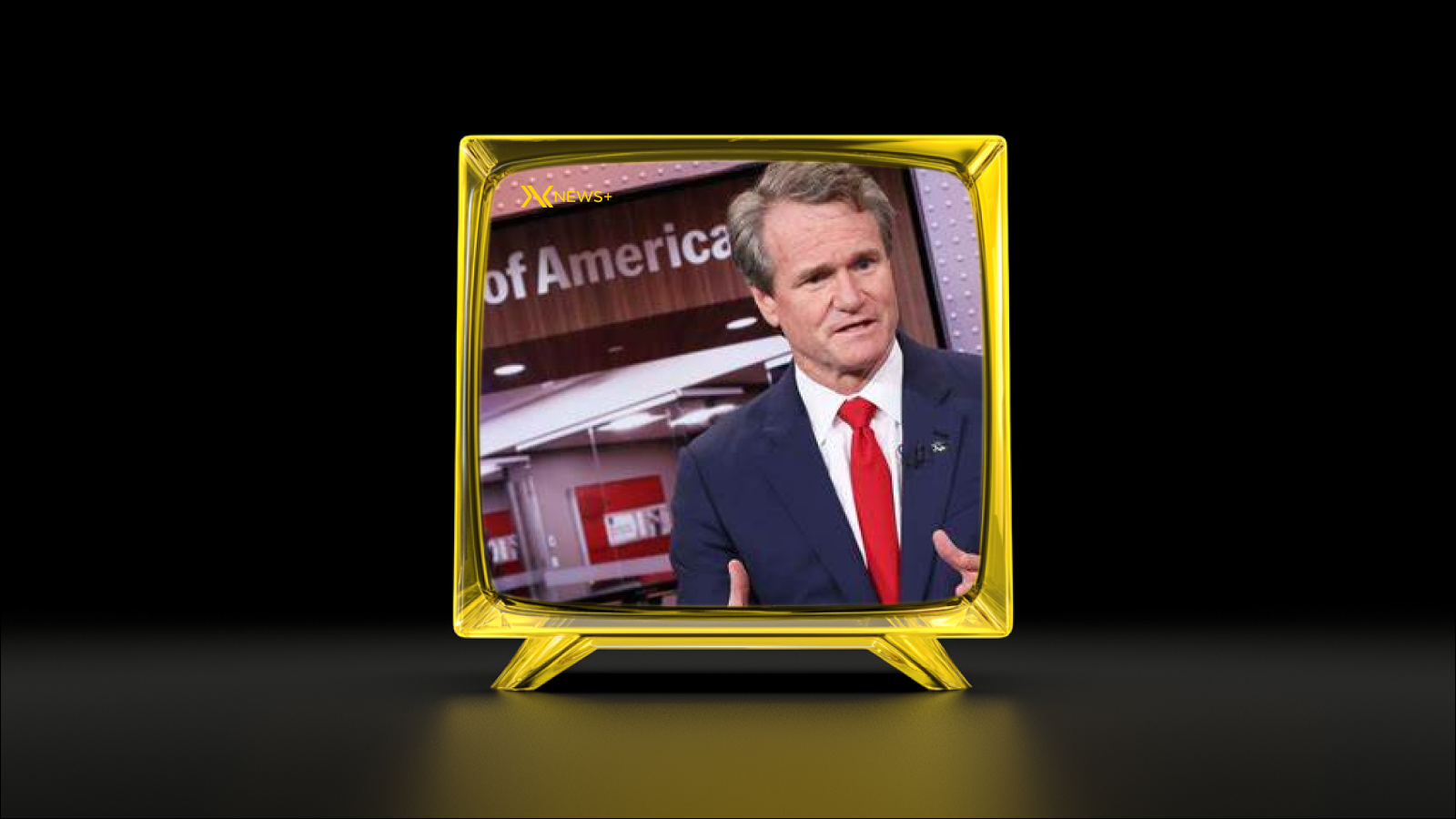

Brian Moynihan, CEO of Bank of America Call for Action

During a recent industry conference, the CEO of Bank of America emphasized the urgent need for regulatory clarity regarding Cryptocurrency Payments. According to him, a well-defined regulatory framework is crucial not only for fostering innovation in the financial sector but also for ensuring consumer protection. He argued that without clear guidelines, financial institutions and tech companies are left uncertain about how to integrate cryptocurrencies into their existing systems.

The CEO highlighted that the ambiguous regulations surrounding Cryptocurrency Payments could hinder the growth of a space that holds immense potential. He advocated for a collaborative approach, where both regulatory bodies and industry leaders work together to create a balanced environment that promotes growth while safeguarding financial stability.

Furthermore, he pointed out that clear regulations could enhance trust among users, making them more likely to engage in Cryptocurrency Payments. This trust is essential for the broader adoption of digital assets in everyday transactions, which could drive further investment into the cryptocurrency market.

The CEO’s call for action reflects a growing sentiment within the industry: the need for a cohesive strategy that promotes the use of Cryptocurrency Payments while addressing the inherent risks associated with this rapidly evolving sector.

Why Regulatory Clarity Matters for Crypto Payments

In the rapidly evolving world of Cryptocurrency Payments, regulatory clarity is essential for fostering innovation and protecting consumers. A well-defined regulatory framework helps to establish trust among users and businesses, encouraging wider adoption of digital currency solutions. Without clear rules, companies may hesitate to invest in cryptocurrency technologies for fear of sudden regulatory changes that could disrupt their operations.

Moreover, regulatory clarity can facilitate compliance, ensuring that businesses understand their legal obligations and can operate within a safe, transparent environment. This structure not only promotes current blockchain startups but also attracts traditional financial institutions that might otherwise remain on the sidelines. With an increase in regulatory guidance, businesses can develop and implement Cryptocurrency Payments systems with confidence, knowing they are adhering to the law.

Furthermore, a robust regulatory framework can mitigate the risk of fraud and scams in the cryptocurrency space, which continues to deter potential users. By providing a safe environment, regulatory bodies can help instill confidence in consumers, allowing for greater participation in the cryptocurrency economy.

Achieving regulatory clarity is vital for the long-term stability of the cryptocurrency market. It enables existing players to innovate while attracting new entrants, ensuring that the ecosystem continues to grow and evolve in a sustainable manner.

Current Regulatory Landscape

The regulatory landscape surrounding Cryptocurrency Payments is complex and rapidly evolving. Numerous countries have adopted varying degrees of regulation, spanning from stringent restrictions to more flexible frameworks aimed at fostering innovation. In the United States, the lack of a unified federal approach has led to confusion among businesses and consumers alike, complicating compliance and operational decisions for financial institutions.

Some states, like Wyoming, have taken the initiative to create favorable regulations that encourage the growth of the cryptocurrency market. In contrast, others have imposed strict rules, creating a patchwork of regulations that can be difficult to navigate. This inconsistency often leads to uncertainty, hindering investment and adoption within the industry.

Internationally, institutions like the Financial Action Task Force (FATF) have recommended frameworks for regulating Cryptocurrency Payments, emphasizing the need for anti-money laundering measures. Yet, the implementation of these recommendations varies significantly among jurisdictions, contributing to a chaotic regulatory environment.

As a result, financial institutions, such as Bank of America, are urging for clearer regulations that foster innovation while ensuring consumer protection. The call for regulatory clarity is crucial, as it will not only streamline compliance processes but also promote broader acceptance of Cryptocurrency Payments globally.

Industry Reactions

In response to the CEO’s call for regulatory clarity on cryptocurrency payments, various industry stakeholders have voiced their opinions. Many experts agree that clearer regulations could foster a more secure and innovative atmosphere for digital transactions. Cryptocurrency advocates assert that without clear guidelines, businesses and consumers alike face unnecessary risks when engaging in cryptocurrency payments.

Financial institutions, too, have chimed in, highlighting that regulatory ambiguity hinders their ability to create banking products that integrate cryptocurrency payments. In fact, a report from a leading fintech analyst emphasizes that banks are keen to explore this market but are often held back by fear of non-compliance.

Moreover, some regulators have shown signs of understanding the need for a balanced approach to regulation. They acknowledge that overly stringent rules could stifle innovation rather than protect consumers, paving the way for potentially beneficial changes in how cryptocurrency payments are handled commercially.

Overall, the consensus among industry players is clear: streamlined and precise regulatory frameworks could not only alleviate confusion but also bolster the growth of digital currency adoption, thereby enhancing the future landscape of cryptocurrency payments.

The Road Ahead

As the discourse surrounding Cryptocurrency Payments continues to evolve, it is imperative for stakeholders, including financial institutions and regulators, to collaboratively chart a path forward. This collaboration can foster a regulatory environment that both promotes innovation and ensures consumer protection.

Financial institutions like Bank of America are likely to play a crucial role in advocating for clear regulations, which can encourage greater adoption and confidence in digital currencies. Enhanced dialogue between banks and regulators can ultimately lead to frameworks that accommodate the unique aspects of Cryptocurrency Payments.

Moreover, addressing potential risks while fostering technological advancements will be vital. Developing a robust infrastructure that can smoothly integrate cryptocurrencies into existing payment systems can drive efficiency and broaden market access.

Moving forward, it is essential for the financial sector and regulatory bodies to work together to create a balanced approach that recognizes the benefits and challenges of Cryptocurrency Payments. Through transparent and thoughtful regulation, the future of digital currencies can be shaped to benefit all stakeholders involved.

Disclaimer

The information provided in this article is for informational purposes only and should not be construed as financial or investment advice. The Cryptocurrency Payments landscape is rapidly evolving, and regulatory frameworks are still developing around the world.

Bank of America’s position, as discussed by its CEO, reflects concerns and desires for clarity that are shared by many in the financial industry. However, individual results may vary based on specific circumstances, and readers are encouraged to consult with financial advisors or professionals when considering engagement in Cryptocurrency Payments.

Moreover, the views and opinions expressed in external quotes or industry reactions do not necessarily reflect those of Bank of America or its affiliates. It remains imperative for participants in the Cryptocurrency Payments sector to remain vigilant and informed about the risks involved.

As the regulatory environment continues to change, businesses and consumers are advised to stay updated on developments and seek appropriate guidance tailored to their specific situations.