Ethereum’s Recent Performance

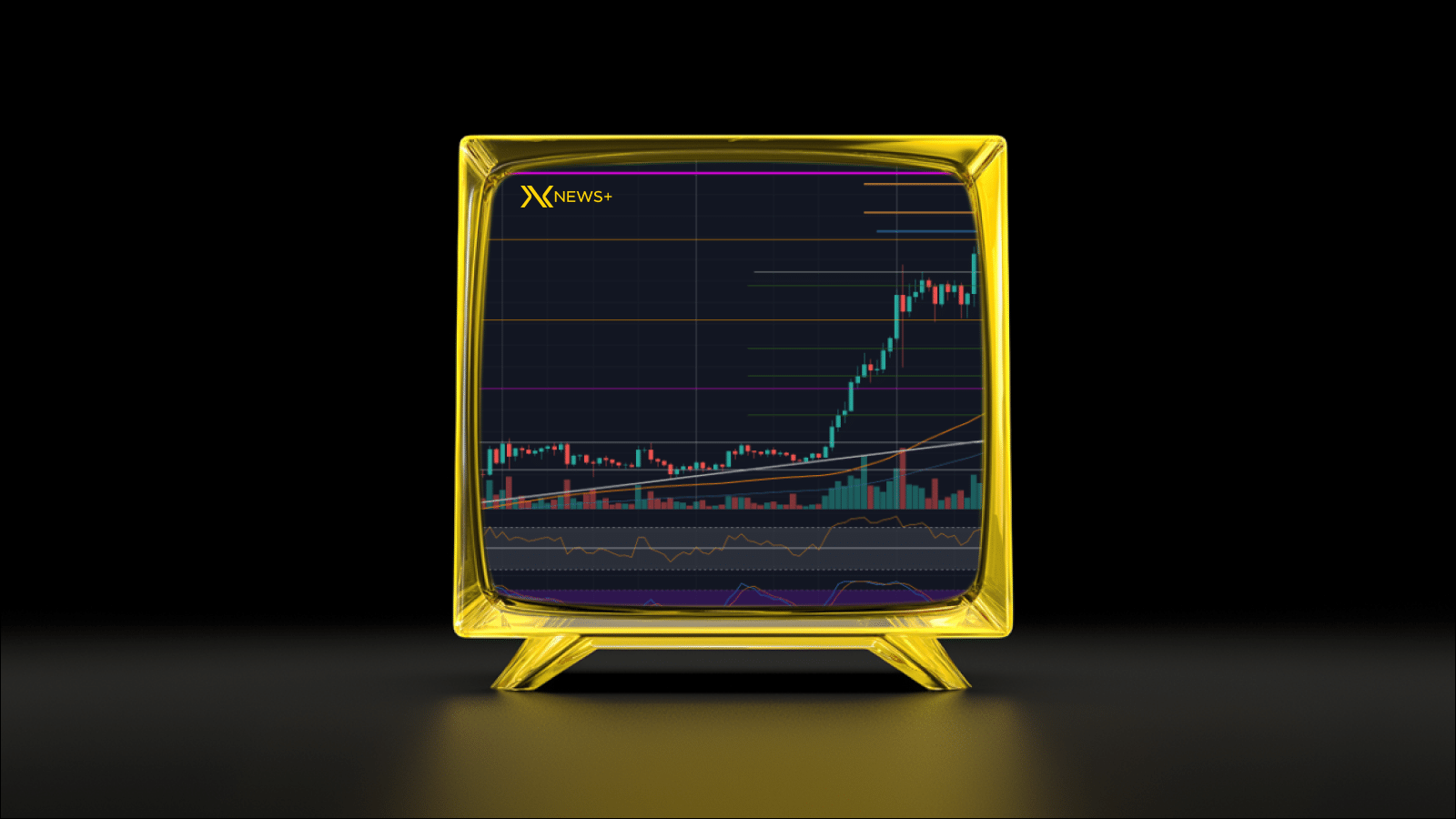

In recent weeks, Ethereum has shown remarkable resilience, pushing through various price resistance levels to reach the impressive milestone of Ethereum Hits $3,800. This surge reflects growing investor confidence and a renewed interest in the platform, driven by both technological advancements and market sentiment.

Historically, Ethereum has been known for its volatility; however, the latest upward trend indicates a more stable environment for potential investors. The price fluctuations have been significant, with Ethereum oscillating around the $3,500 to $3,800 range, signaling a strong potential for further gains.

Volume has also surged, with trading activity increasing on popular exchanges. This increased trading volume often correlates with bullish trends, which suggests that more investors are willing to enter the market at current prices. Additionally, the growing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs) has bolstered Ethereum’s value, as many of these platforms are built on the Ethereum blockchain.

As the month progresses, market analysts are closely monitoring Ethereum’s price action, anticipating whether this momentum will sustain past the $3,800 mark and potentially lead to new all-time highs.

The recent surge in Ethereum Hits $3,800 has been driven by several overarching market factors that collectively signal a growing enthusiasm among investors. The increasing adoption of decentralized finance (DeFi) projects and non-fungible tokens (NFTs) has brought new attention to Ethereum, showcasing its versatility beyond just a cryptocurrency. As institutions begin to invest more heavily in these sectors, we see a notable uptick in demand for Ethereum.

Furthermore, Ethereum 2.0’s phase implementation is contributing significantly to bullish sentiments. The transition to a proof-of-stake consensus mechanism aims to enhance scalability and reduce energy consumption, making Ethereum more appealing to eco-conscious investors. As the technical upgrades continue, confidence in the network’s long-term viability bolsters investment interest.

Another crucial contributor to the rally is the overall bullish trend in the cryptocurrency market. Increased participation from retail investors, compounded by promising economic indicators, has led to a risk-on sentiment that is advantageous for assets like Ethereum. Furthermore, strong performance from Bitcoin often correlates with rising altcoin values, including Ethereum.

Factors such as regulatory clarity and mainstream media coverage are essential to this rally. Improved regulatory frameworks can pave the way for more institutional investments, while favorable news stories can attract a new wave of investors seeking to capitalize on cryptocurrencies. Together, these drivers create a conducive environment for Ethereum to potentially reach even new heights.

Can Ethereum Hit New Highs?

As Ethereum Hits $3,800, the pressing question on many investors’ minds is whether this upward momentum can sustain itself and drive the cryptocurrency to new highs. Analysts are closely watching various indicators and market sentiments to gauge Ethereum’s potential trajectory in the coming weeks.

The current price level signifies a robust recovery from previous lows, suggesting strong buying interest. If the bullish sentiment continues, we could see Ethereum eclipse previous resistance levels, which may spawn further investor confidence and potentially push prices higher.

Several technical indicators can offer insights into this potential. The Relative Strength Index (RSI) is on the rise, indicating that Ethereum is not yet overbought, which often signals that the uptrend may continue. Additionally, support levels have formed, paving the way for price stability. Historical trends also support optimism; past surges have often been followed by significant price increases.

Moreover, external factors such as institutional adoption and network upgrades can propel Ethereum forward. Recent partnerships and developments within the Ethereum ecosystem could lead to enhanced utility and increased demand, further contributing to outlook positivity.

However, while the potential for Ethereum to hit new highs exists, it is crucial to consider the inherent volatility of the cryptocurrency markets. Investors should keep a close eye on external influences that may impact the broader market landscape. Ultimately, Ethereum’s journey toward new highs will depend on both market sentiment and fundamental underpinnings.

Risks to Consider

While the excitement around Ethereum hits $3,800 is palpable, potential investors should remain cautious and aware of several inherent risks associated with cryptocurrency investments.

1. Market Volatility

Cryptocurrency markets are known for their extreme volatility. Prices can soar rapidly, but they can also plummet just as quickly. This unpredictable nature can lead to substantial financial loss for investors who are not prepared for swift changes.

2. Regulatory Uncertainty

As governments around the world continue to develop regulations on cryptocurrencies, the landscape can shift unexpectedly. Ethereum hits $3,800 may be influenced by new regulations, which could either hamper or promote growth, depending on the nature of the rules implemented.

3. Technological Risks

Ethereum, like other cryptocurrencies, is reliant on technology and network stability. Issues like network congestion, smart contract vulnerabilities, or even potential forks could impact Ethereum’s price action and functionality, presenting ongoing risks to investors.

4. Market Sentiment

Public perception and sentiment play a significant role in the crypto space. Negative news, which may stem from anything ranging from hacks to unfavourable updates about Ethereum’s development, can significantly affect prices, including the recent milestone of Ethereum hits $3,800.

As always, potential investors should carefully assess their risk tolerance and conduct thorough research before entering the highly speculative world of cryptocurrency investment. Understanding these risks can help safeguard against substantial losses while navigating the exciting yet unpredictable waters of Ethereum.

Conclusion

As we wrap up our analysis, the recent surge in Ethereum’s value, with prices reaching Ethereum Hits $3,800, signals a potentially transformative time for the cryptocurrency. Investors and enthusiasts alike are keenly watching for new highs as the month nears its end, driven by robust market factors and a growing interest in blockchain technologies.

However, while the optimism in the market is palpable, it is crucial to remain vigilant about the inherent risks that can affect price trajectories. Understanding both the opportunities and the challenges will be key for anyone looking to navigate the evolving landscape of Ethereum investments.

The coming weeks will be telling for Ethereum. Will it surpass previous highs, or will it face unforeseen hurdles? Continuous monitoring of market trends and developments will be essential for making informed investment decisions as this narrative unfolds.

Disclaimer

The content provided in this article is for informational purposes only and should not be considered as financial advice. While we strive to present accurate and up-to-date information, the cryptocurrency market is highly volatile, and values can fluctuate dramatically. Ethereum Hits $3,800 may not be indicative of future performance.

Investors should conduct their own research and consider their individual financial situation before making any investment decisions. We do not warrant the accuracy, completeness, or usefulness of any information discussed in this article. Additionally, past performance is not necessarily indicative of future results. Always consult with a qualified financial advisor to understand the risks involved in trading cryptocurrencies.

Frequently Asked Questions

What factors contributed to Ethereum reaching $3,800?

The surge to $3,800 can be attributed to increasing institutional adoption, favorable market sentiment, and the growing popularity of decentralized finance (DeFi) applications.

How does Ethereum’s performance compare to Bitcoin’s since the start of the year?

Ethereum has outperformed Bitcoin in terms of percentage gains, driven by its unique use cases and the booming NFT market, although both cryptocurrencies have seen substantial growth.

What are some potential barriers to Ethereum reaching new highs?

Potential barriers include regulatory concerns, market volatility, and the impact of macroeconomic factors such as inflation and interest rates.

What technical indicators suggest Ethereum could reach new highs?

Bullish patterns on the charts, such as increased trading volume and higher highs in price action, along with strong support levels, suggest that Ethereum may continue its upward trend.

How do macroeconomic conditions affect cryptocurrency prices?

Macroeconomic conditions influence investor sentiment, liquidity in the market, and risk appetite, which can lead to heightened or subdued demand for cryptocurrencies.

Are there any upcoming events that might influence Ethereum’s price?

Yes, events such as Ethereum’s network upgrades, developments in the DeFi space, and announcements from major financial institutions can significantly impact Ethereum’s price.

What should investors keep in mind when considering investing in Ethereum now?

Investors should consider their risk tolerance, conduct thorough research, and stay updated on market trends and news that could affect Ethereum’s performance.

Follow Darkex daily analysis to get your analysis right.