The first quarter of 2025 saw significant shifts in the digital asset market as the euro appreciated against the dollar. In particular, among euro-backed stablecoins, EURC gained strong momentum, driven by both the European Central Bank’s (ECB) interest rate policies and the economic recovery in the Eurozone. During this period, regulatory developments, institutional adoption and increased investor interest played an important role behind the increased preference of EURC in the markets. In this analysis, the performance of EURC in the first half of 2025 will be evaluated in detail in light of macroeconomic factors and data on blockchain.

Macroeconomic Factors and the Strengthening of the Euro

Since early 2025, the euro has appreciated steadily against the dollar. While signs of economic recovery in the euro area and the ECB’s controlled interest rate cut process were effective in this trend, weakening growth data in the US and uncertain trade policies limited global demand for the dollar. The markets’ expectation that the FED would continue to keep interest rates unchanged strengthened, while the reorientation of capital flows towards Europe supported the euro.

Euro Area Budget Reforms and Fiscal Packages

To finance infrastructure and climate projects, the coalition government in Germany introduced a €500 billion special infrastructure and defense fund on March 21, 2025, with an article added to the Basic Law to finance railways, bridge repairs and logistics infrastructure. In the same period, on 11 February 2024, the Eurozone budget rule reform was adopted, allowing member states flexibility in public debt adjustments from four to seven years

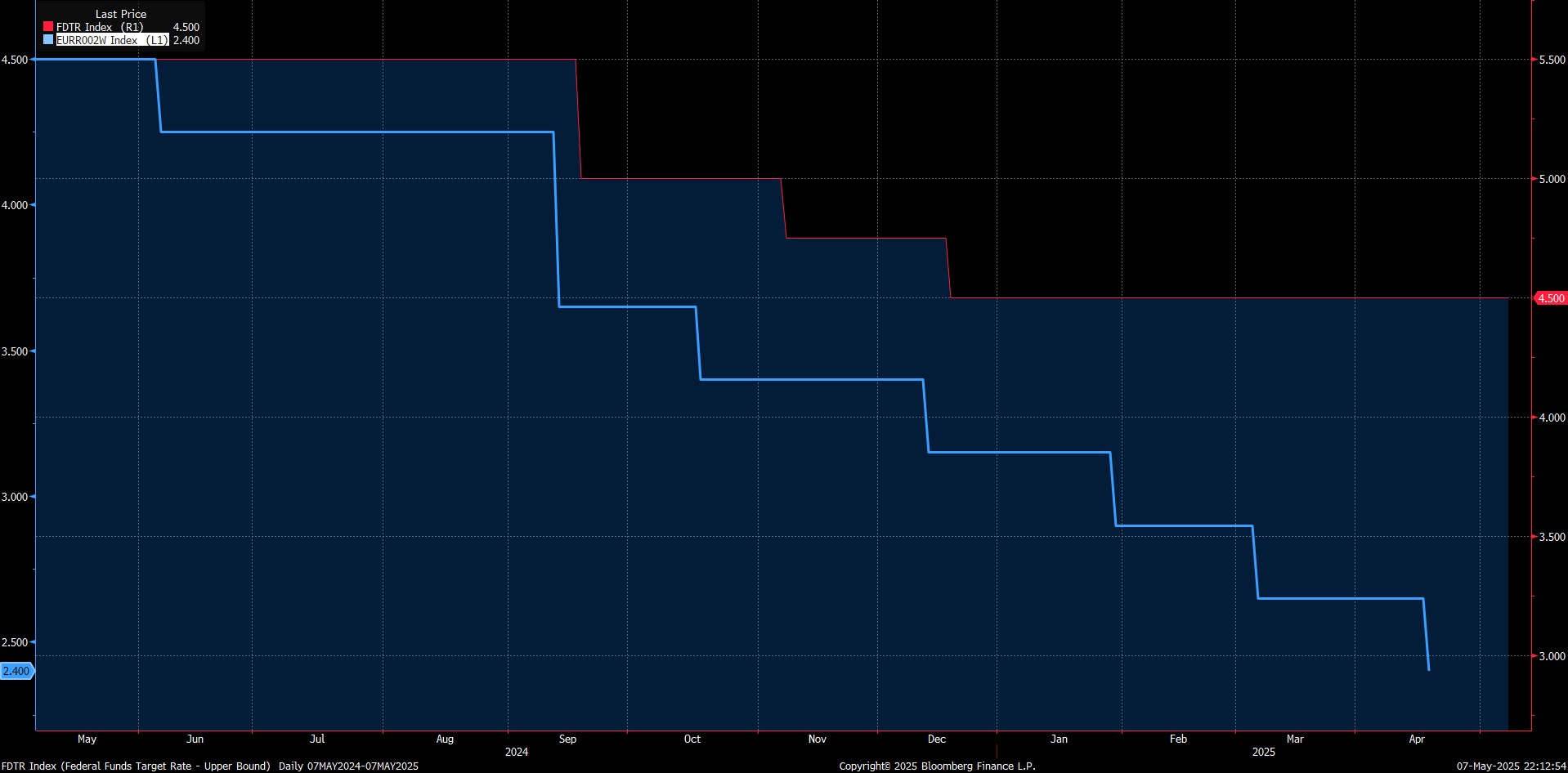

Central Bank Monetary Policy Decisions

ECB: On April 17, 2025, it cut its three main interest rates by 25 basis points, lowering the deposit rate to 2.25%, the MRO rate to 2.40% and the marginal lending rate to 2.65%. It also announced that it would maintain asset purchases at 50 billion euros per month. Vice-President Lagarde reiterated that “interest rates will remain at current or lower levels for a long time”.

Fed: kept the policy rate corridor unchanged at 4.25-4.50% on May 7, 2025. Markets expect a cut later in the year due to high inflation and slowing growth, which puts downward pressure on the dollar.

Circle’s Strategy and EURC’s Positioning

Circle has gained an important place globally with its dollar-backed stablecoin USDC and carried this success to the European market with its euro-backed stablecoin EURC. In 2024, with the electronic money institution (EMI) license it obtained from France, Circle fully complied with the European Union’s MiCA (Markets in Crypto-Assets) regulation and established its activities on a legal basis in the Eurozone. In this way, it is now able to offer EURC directly to institutional customers in Europe. EURC is traded on major blockchain networks such as Ethereum, Solana, Avalanche and Base, reaching a wide user base thanks to this multi-chain support. By 2025, Circle also launched the Circle Payments Network (CPN), an infrastructure initiative focused on corporate payments, aiming to make EURC available for real-time, cross-border payments in euros. CPN is intended to bridge the gap between the traditional banking system and blockchain-based stablecoin transactions. As part of Circle’s transparent reserve management policy, both USDC and EURC are regularly audited by independent audit firms and backed by 100% cash equivalent reserves.

Competition and Regulatory Landscape in the Stablecoin Market

As of 2025, the global stablecoin market is still largely dominated by dollar-backed tokens. Tether’s USDT has a market capitalization of around $143 billion, while Circle’s USDC has a market capitalization of around $58 billion. In contrast, euro-backed stablecoins have a total market capitalization of around $536 million as of April 2025. The largest share in this segment belongs to EURC, with around 80%. According to Circle’s transparency portal, the circulating supply of EURC stood at around 30 million euros at the end of 2024, reaching 217 million EURC tokens (around $246 million based on an average EUR/USD exchange rate of 1.13) as of April 2025. Daily trading volume varies periodically between $1 million and $50 million, with volumes increasing especially on decentralized exchanges and during periods of market volatility. Some issuers are withdrawing from the market after failing to comply with MiCA regulations. For example, Tether announced that it will cease issuing and supporting the EURT token in December 2024. In contrast, next-generation fintech startups such as Avian Labs have launched EURC-based euro payments via the Sling Money app, indicating that the use cases of MiCA-compliant stablecoins are diversifying. With the introduction of MiCA in Europe, EMI-licensed and regulatory-approved stablecoins have become a safe and legal choice for institutional investors. Industry-wide interest in euro-based digital assets is growing.

EURC’s 2025 Performance and Impacts on the Chain

EURC showed a steady and remarkable growth in the first quarter of 2025. The total supply increased by 43% on a monthly average between January and March 2025. The on-chain distribution of tokens shows that there are approximately 112 million EURC on Ethereum, 70 million on Solana and 30 million on the Base network. The number of active user addresses increased by 66% to 22,000 in the first quarter of the year, while the total monthly transfer volume exceeded $2.5 billion. The volume of EURC/USDC trading pairs on centralized exchanges and decentralized platforms increased.The appreciation of the euro against the dollar in the first half of 2025 caused short-term price fluctuations in EURC, which briefly rose as high as $1.13 in April 2025. However, EURC remained stable overall and arbitrage mechanisms worked effectively.

Conclusion

In the first half of 2025, macroeconomic factors such as the relative appreciation of the euro, increased geopolitical risks and regulatory clarity strengthened interest in EURC. Thanks to Circle’s strong technological infrastructure, transparent reserve management, MiCA compliance and multi-blockchain integration, EURC has become the clear leader among euro backed stablecoins. Although the global stablecoin market is still largely dominated by dollar-based tokens, EURC’s growth performance indicates that euro-denominated digital assets will find more institutional and cross-border use in the coming period.