Introduction

FTX was a cryptocurrency exchange founded in 2019 by Sam Bankman-Fried, offering its users products such as crypto derivatives, options, futures and tokenized stocks. Initially headquartered in Hong Kong, FTX later moved to the Bahamas to comply with regulatory requirements. However, in November 2022, FTX’s collapse began. It came to light that FTX’s subsidiary Alameda Research had misappropriated client funds. These allegations shook investor confidence and led to massive withdrawal requests. The value of FTX’s own token FTT plummeted, and the liquidity crisis deepened. Following these developments, FTX filed for bankruptcy.

FTX filed for bankruptcy protection after a liquidity crisis in November 2022, filing for Chapter 11 bankruptcy protection in Delaware, USA. The company’s bankruptcy has gone down in history as one of the biggest collapses in the crypto industry. The process, which started with the resignation of FTX’s founder Sam Bankman-Fried, continued with serious accusations against executives, and 101 organizations affiliated with the company were also included in this process.

In the post-bankruptcy period, FTX initiated extensive legal proceedings to recover lost assets and pay off debts. The Delaware Court approved the company’s restructuring plan in October 2024. The first payments are scheduled to begin in January 2025, while the distribution is expected to last until the first quarter of 2026.

FTX Creditors’ Payment Process

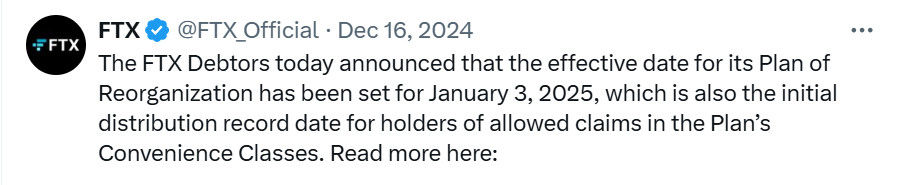

FTX announced that the first payments to creditors will begin within 60 days from January 3, 2025. This announcement marks a significant milestone in FTX’s two-year, multi-billion-dollar recovery efforts.

Source: X.com

John J. Ray III, CEO of FTX Debtors, said:

“Over the last two years, our team has worked diligently to recover billions of dollars and has succeeded in reaching this point. The entry into force of the Plan and the start of distributions in January 2025 reflects the extraordinary success of these recovery efforts. We are ready to begin the distribution of refunds for all customers and creditors, and we encourage our customers to complete the necessary steps to receive payments in a timely manner.”

FTX has taken an important step by partnering with two platforms to make the refund process more streamlined. Customers need to complete some mandatory procedures in order to receive a refund. These steps include,

- Know Your Customer (KYC) verification,

- filling out tax forms and

- There is registration on the announced platforms.

This process is crucial both to ensure compliance with financial regulations and to ensure that repayments are made properly and quickly.

Distributions for transferred claims will be made only to those transferred beneficiaries who have been processed and reflected in the official claims register as of the record date of January 3, 2025. This will take place after the completion of the 21-day notice period without objection.

In FTX’s payment process, creditors are classified according to the size of their claims. This classification aims to ensure that the payment process proceeds in an orderly and fair manner.

| Payment Category | Details |

|---|---|

| Total Distribution Amount | About 16 billion dollars. |

| Small Creditors | Creditors under $50,000 will be reimbursed 118%. |

| Major Creditors | Creditors over $50,000 will receive between 43% and 129%. |

| Payment Methods | Payment in cash and stablecoins is planned; no crypto payments will be made. |

| Start of Payments | As of January 3, 2025, payments will start within the first 60 days. |

General Evaluation

FTX’s payment process for creditors is an important step after the company’s crisis. Steps such as KYC verification and completion of tax forms will ensure that creditors’ rights are secured. In addition, the higher payment rate to small creditors will allow the process to work more fairly.

The fact that payments will be made in cash and stablecoins is a logical choice to eliminate the risks that may arise from the volatility of cryptocurrencies. This will make the payment process more stable.