As the U.S. election nears, increased betting and hedging tied to the political event, is powering notable increases in trading volumes in the crypto market. The election will have far-reaching consequences for the crypto regulatory space in the world’s largest economy.

Early this week, the decentralized derivatives exchange Derive saw an institution take a multi-legged bitcoin (BTC) options strategy, betting on a continued move higher in BTC after the Nov. 5 election. The trade generated a notional trading volume of $25 million, the largest ever onchain options transaction bet tied to the U.S. election, Derive told CoinDesk in an email.

The institution acquired 100 call option contracts with a $70,000 strike price set to expire on Nov. 29 while simultaneously writing or selling 200 contracts of the $80,000 call and 100 contracts of the $50,000 put, both expiring on Nov. 29. The institution deposited eBTC, restaked bitcoin created via EtherFi, as collateral, ensuring it earns passive yields on the same.

The strategy, which looks like a ratio call spread funded by a short put position, will profit most if bitcoin rallies to $80,000 by Nov. 29. The positioning is consistent with options flows on centralized exchanges, which indicate expectations for a post-election rally to $80,000 and higher.

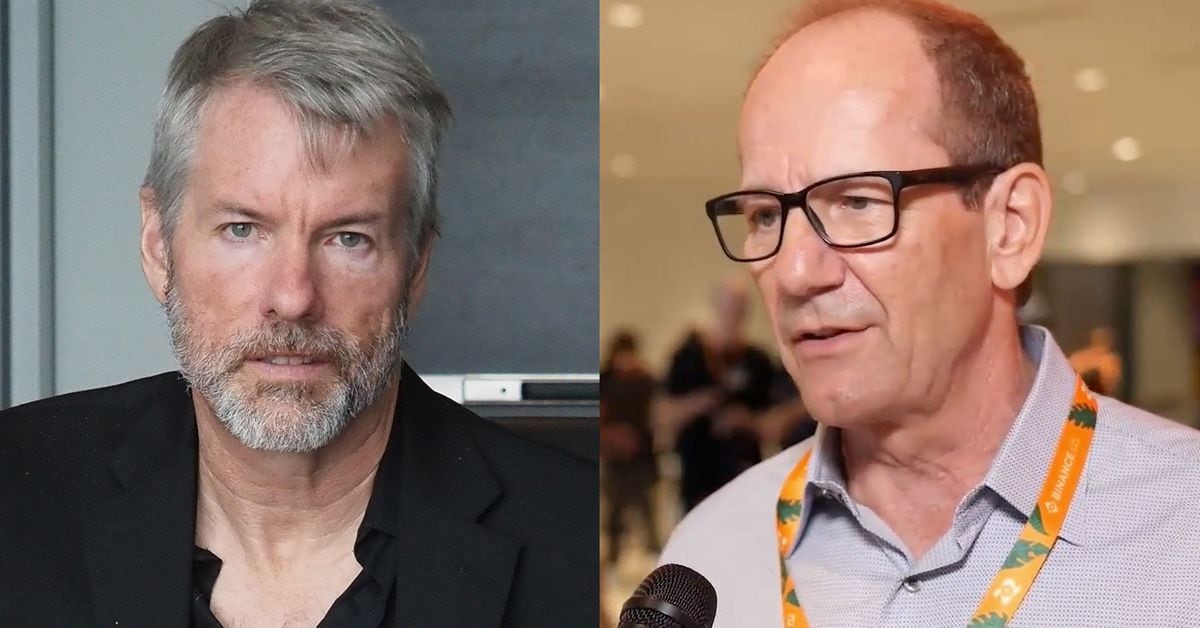

“This $25 million options trade marks a watershed moment for onchain options trading, and it’s one that could have significant implications post-election. The institution has strategically positioned a unique structure with sold puts, bought calls, and eBTC collateral, potentially standing to make $1,020,000 on the structure if BTC hits $80,000 by November 29 – excluding any gains from the eBTC collateral,” Nick Forster, co-founder of Derive told CoinDesk in an email.

“The trade is a prime example of how onchain options offer scalable, non-correlated yield for any onchain asset,” Forster added.

Derive is the largest onchain options platform, accounting for 32% of the total DEX options volume of $339 million in the past 24 hours, according to DeFiLlama. The onchain market, however, is still relatively small compared to Deribit and other centralized platforms, which boast a cumulative 24-hour volume of several billion dollars.