Explore the reasons behind Litecoin’s recent drop, its current market position, and what lies ahead for this cryptocurrency.

The recent dip in Litecoin prices has raised eyebrows across the cryptocurrency community, especially as Litecoin declines 12% in the current market downturn. One of the primary factors contributing to this decline is the overall negativity prevailing in the crypto market, exacerbated by macroeconomic indicators that discourage investments in risk assets. With fears of rising interest rates and potential regulatory scrutiny, many investors are turning conservative, resulting in sales that significantly affect Litecoin’s value.

Furthermore, the recent revelations of less-than-ideal transaction volumes and network activity have cast a shadow over Litecoin. Investors often gauge the health of a cryptocurrency by its user engagement levels. As Litecoin sees a drop in adoption rates for transactions and other uses, the market reacts negatively, driving prices down even further.

Another critical aspect is the competitive landscape within which Litecoin operates. The emergence of new altcoins and innovations, including Layer 2 solutions, risks overshadowing Litecoin’s established brand. This reality has raised concerns among current and potential investors, as they reevaluate their holdings in light of the latest developments in more advanced blockchain technologies.

The combination of external market pressures, internal adoption metrics, and competitive challenges create a precarious environment for Litecoin. As it navigates through these turbulent times, the community will closely observe whether it can reclaim lost ground or if this downtrend will persist.

Litecoin’s Current Position in the Market

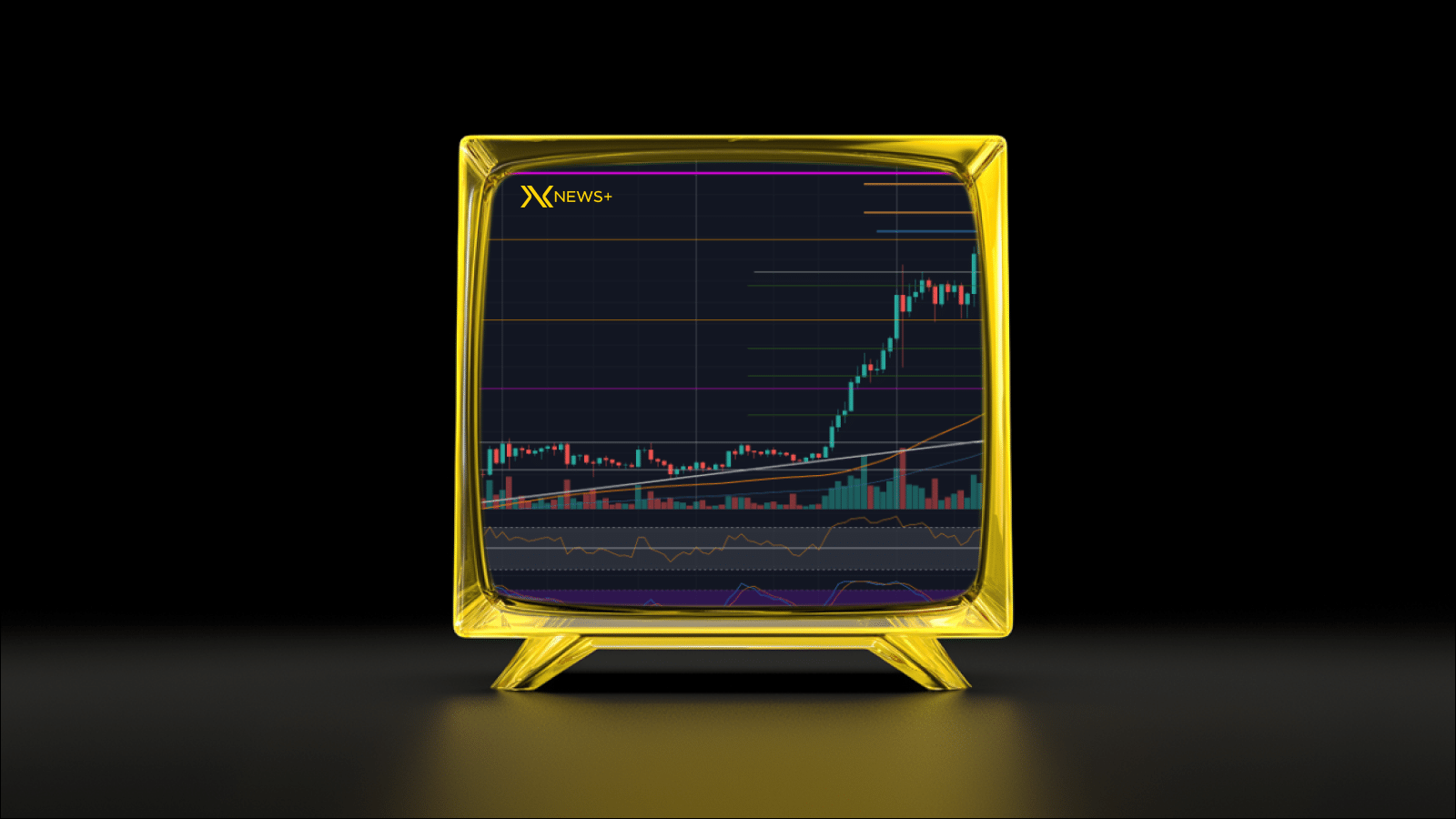

As of the latest market data, Litecoin is experiencing significant fluctuations amid the broader cryptocurrency market decline. Following the recent Litecoin Declines 12% trend, many investors are reassessing their positions in anticipation of a rebound or further downward momentum.

Currently, Litecoin’s trading volume has seen a noticeable drop, indicating decreased interest from both retail and institutional investors. This lack of engagement can often lead to heightened volatility, particularly as traders seek to mitigate risks in a challenging economic climate.

Moreover, Litecoin’s market capitalization has also been affected, placing it under pressure compared to its competitors. While it still holds a position among the top cryptocurrencies, its recent performance raises concerns regarding its capability to maintain this status in the current market state.

Despite the challenges, analysts remain cautiously optimistic about Litecoin’s long-term viability. The cryptocurrency’s continued development and community support offer potential for recovery as market conditions stabilize. However, investors are advised to monitor ongoing trends closely.

What’s Next for Litecoin?

Following the recent news where Litecoin Declines 12%, investors and market analysts are left pondering the cryptocurrency’s next move. With the current bearish sentiment affecting the broader market, Litecoin faces significant challenges that could influence its short-term performance and long-term viability.

One potential pathway for Litecoin is increased adoption and integration into decentralized applications and payment solutions. As more businesses look to embrace cryptocurrency, Litecoin’s speed and lower transaction fees may make it an attractive alternative for daily transactions.

Additionally, continued technological advancements in the Litecoin network could enhance its functionality. Upgrades or forks that improve scalability and security may reignite interest among both developers and investors, paving the way for renewed enthusiasm in the market.

Market sentiment plays a crucial role in the trajectory of Litecoin. If the overall cryptocurrency market experiences a rebound, Litecoin could benefit from a trend reversal, potentially recovering from its recent decline. Conversely, if market conditions remain unfavorable, Litecoin may struggle to maintain its position.

Investors are advised to monitor key price levels and market indicators closely. Understanding these trends and remaining vigilant will be vital in making informed decisions about trading or holding Litecoin in the upcoming months.

Conclusion

The recent market conditions have clearly affected Litecoin significantly, culminating in a notable Litecoin Declines 12% scenario. Investors and enthusiasts alike are left to ponder the implications of this downturn and how it will shape the future of Litecoin. As we have seen, market volatility can be influenced by various factors, including investor sentiment and macroeconomic trends, which could lead to further fluctuations.

However, it is essential for investors to maintain a long-term perspective. Litecoin has a history of resilience and innovation, suggesting that there may be potential for recovery. Staying informed and updated on market trends, alongside understanding Litecoin’s technical advancements, will be crucial for making sound investment decisions moving forward.

While the immediate outlook may seem discouraging due to the recent Litecoin Declines 12%, the cryptocurrency market is known for its unpredictable nature and potential for rebound. Careful analysis and strategic planning may provide opportunities for those willing to navigate these challenges.

As Litecoin adjusts to its new price levels, the coming weeks will be critical in determining its trajectory. Investors would do well to conduct thorough research and remain vigilant in the face of market shifts.

Disclaimer

The information provided in this article on Litecoin is for informational purposes only and should not be considered financial advice. Cryptocurrency markets are highly volatile, and investing in them involves a significant risk of loss. The phrase Litecoin Declines 12% refers specifically to past market conditions, and future performance may vary substantially.

Before making any investment decisions, it is essential to conduct your own research and consult with a financial advisor familiar with your circumstances. This article does not guarantee the success of any trading strategy or investment in Litecoin or any other cryptocurrency.

Readers should be aware that past performance is not indicative of future results. While the analysis may reflect certain trends in the Litecoin Declines 12% scenario, unforeseen events can lead to significant fluctuations in price and market sentiment.

The cryptocurrency landscape is continuously evolving, and staying informed is crucial. The authors and publishers of this article accept no liability for any losses or damages arising from your reliance on the information presented herein.

Frequently Asked Questions

What factors contributed to the 12% decline in Litecoin’s value?

The decline in Litecoin’s value can be attributed to a general market downturn, influenced by negative sentiment around cryptocurrencies, concerns over regulation, and broader economic factors affecting investor confidence.

How does Litecoin’s decline compare to other cryptocurrencies?

Litecoin’s 12% decline is significant but follows the trend of other major cryptocurrencies, which have also experienced declines ranging from 10% to 15% during this market downturn.

What are analysts predicting for Litecoin’s future performance?

Analysts are divided; some believe that Litecoin’s strong fundamentals could absorb the market shocks and lead to recovery, while others are cautious, citing ongoing volatility in the crypto space.

What should investors consider before buying Litecoin after this decline?

Investors should assess their risk tolerance, consider current market conditions, analyze Litecoin’s long-term potential, and stay updated on any regulatory news that could impact the cryptocurrency market.

How does Litecoin’s technology differ from Bitcoin’s?

Litecoin utilizes a Scrypt hashing algorithm, which allows for quicker block generation and increased transaction speed compared to Bitcoin, which uses the SHA-256 algorithm.

Are there any positive indicators in Litecoin’s recent performance despite the decline?

Yes, despite the decline, Litecoin has maintained a strong community support and development efforts, which could indicate that it has the potential for recovery and future growth.

What role does market sentiment play in cryptocurrency price fluctuations?

Market sentiment plays a crucial role in cryptocurrency price fluctuations, as it can drive buying or selling behaviors based on news, trends, and public perception, often resulting in rapid price changes.