Understanding Central Bank Digital Currencies And Their Role In The Future

Central Bank Digital Currencies (CBDCs) represent a significant transformation in the way governments and their financial institutions interact with both national and global economies. Essentially, CBDCs are digital forms of a country’s fiat currency, issued and regulated by the central bank. Their primary purpose is to provide a secure and efficient means of payment, while also potentially revolutionizing monetary systems.

The emergence of CBDCs is driven by several factors, including the declining use of cash, the rise of cryptocurrencies, and the increasing demand for more efficient payment systems. As the world moves toward a more digital economy, it is essential for central banks to adapt by providing citizens with a state-backed digital alternative that can ensure financial stability and consumer protection.

In discussing the future of CBDCs, it is crucial to consider their potential impact on various areas. For instance:

- Efficiency: CBDCs can reduce transaction costs and enhance cross-border payments by streamlining the processes involved.

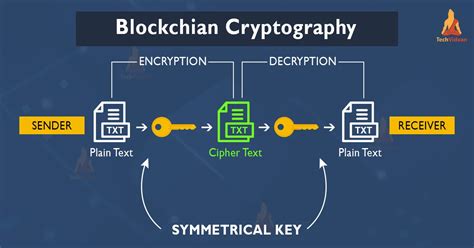

- Security: The use of advanced technologies such as blockchain can help prevent fraud and increase transaction transparency.

- Monetary Policy: CBDCs may provide central banks with new tools to manage economic stability and respond to financial crises more effectively.

Additionally, the role of CBDCs extends beyond serving as a mere digital currency. They have the potential to improve payment infrastructures, promote financial inclusion, and support economic growth. As the digital economy expands, CBDCs could play a pivotal role in fostering enhanced participation from various demographics, enabling easier access to financial services.

The future of CBDCs is poised to reshape the financial landscape significantly. As they evolve, continuous dialogue among governments, financial institutions, and the public will be essential to navigate the challenges and leverage the opportunities presented by this innovative monetary form.

How CBDCs Can Enhance Financial Inclusion For Various Demographics

Central Bank Digital Currencies (CBDCs) have the potential to significantly enhance financial inclusion across diverse demographics, particularly those currently underserved by traditional banking systems. They can do this in several meaningful ways:

- Greater Accessibility: CBDCs can be accessed via smartphones and digital devices, bridging the gap for individuals in remote and rural areas who may lack physical bank branches.

- Lower Transaction Costs: The use of CBDCs could reduce transaction fees, making financial services more affordable for those who rely on low-cost transactions for their daily needs.

- Expanded Financial Services: CBDCs can enable people without bank accounts to participate in the economy. This includes access to credit, savings, and insurance products, which are usually unavailable to unbanked populations.

- Increased Trust in Financial Systems: As CBDCs are issued by central banks, they could bolster trust in the financial system, encouraging more individuals to engage in financial activities.

- Enhanced Security and Privacy: CBDCs can offer secure transaction methods, protecting users from fraud and ensuring that their personal information remains confidential.

Overall, The Future of CBDCs looks bright when it comes to promoting financial inclusion. By leveraging technology and innovation, these digital currencies have the potential to integrate more individuals into the financial ecosystem, fostering greater economic equality and participation.

The Future Implications Of CBDCs On Monetary Policy And Economic Stability

The introduction of Central Bank Digital Currencies (CBDCs) has significant potential to reshape the landscape of monetary policy and economic stability. As central banks explore the future of currency management, CBDCs can provide new tools for policymakers, ultimately influencing how economies function on a macro level.

One of the primary implications for monetary policy is the enhanced ability to implement quantifiable monetary tightening or easing strategies. CBDCs could enable central banks to effectively transmit policy changes more swiftly through direct mechanisms, allowing them to influence interest rates and liquidity in the economy without the traditional constraints of the banking system.

Additionally, with real-time transaction monitoring capabilities, central banks could gain a more nuanced understanding of spending behaviors and economic trends. This transparency could foster data-driven decision-making, enabling them to respond proactively to economic shocks or downturns, thereby ensuring greater economic stability.

Furthermore, CBDCs offer the possibility of improved financial data collection, promoting features that can help in avoiding over-leverage and mitigating systemic risks within the banking sector. By allowing for better consumer and institutional risk assessments, central banks can enhance their regulatory frameworks, making the financial system more resilient against crises.

However, while the benefits are promising, the adoption of CBDCs is not without challenges. The balance between maintaining consumer privacy and the necessity of surveillance for financial stability must be managed carefully to avoid unwanted repercussions. Additionally, the potential for enhanced efficiency to lead to decreased demand for traditional banking services poses a risk to financial institutions that play crucial roles in today’s economy.

The implications of CBDCs on monetary policy and economic stability present a compelling future. As central banks continue to experiment and innovate with digital currencies, understanding these dynamics will be vital for their successful implementation, and ultimately, for shaping the future of global finance.

Challenges Facing The Future Adoption Of Central Bank Digital Currencies

The adoption of Central Bank Digital Currencies (CBDCs) presents several challenges that could impact The Future of financial systems around the globe. Here are some of the key obstacles that need to be addressed:

1. Technological Infrastructure: Implementing CBDCs requires significant advancements in technological infrastructure. Central banks must ensure that their systems are capable of handling high volumes of transactions securely and efficiently. This includes investing in cybersecurity measures to protect against potential hacking threats.

2. Regulatory Framework: The creation of a comprehensive regulatory framework is essential for the successful implementation of CBDCs. Governments and central banks need to establish clear guidelines to facilitate the operation of CBDCs while safeguarding users’ rights and privacy.

3. Public Trust and Adoption: For CBDCs to succeed, gaining the public’s trust is vital. People need to feel confident that these digital currencies are secure and that transactions will be protected. Building this trust requires extensive education and engagement strategies from central banks.

4. Impact on Existing Financial Institutions: The introduction of CBDCs might disrupt the traditional banking system. Financial institutions may face challenges regarding their operations and profitability, leading to resistance from established banks that may see CBDCs as a threat.

5. Economic Concerns: Central banks must consider the potential economic ramifications of launching CBDCs. For instance, an increase in digital currency holdings could lead to reduced deposits in traditional banks, affecting liquidity and interest rates.

6. Interoperability with Existing Systems: Ensuring that CBDCs can seamlessly integrate with existing financial systems is crucial. This interoperability would enable smooth transitions and adoption across different platforms and sectors.

7. Geopolitical Considerations: The introduction of CBDCs may intensify competition among nations, potentially leading to geopolitical tensions. Countries may leverage CBDCs for economic advantages, creating an uneven playing field globally.

8. Privacy and Surveillance Concerns: The digital nature of CBDCs raises concerns about privacy and surveillance. Users may fear that their transactions will be monitored, leading to pushback from those who value anonymity in financial transactions.

9. Digital Divide: While CBDCs have the potential to enhance financial inclusion, there is a risk that communities without internet access or digital literacy may be excluded. Addressing the digital divide is crucial to ensuring equitable access to these currencies.

10. Adoption Costs: The costs associated with transitioning to a CBDC system can be significant. Central banks and governments will need to assess the financial implications of implementing the infrastructure necessary for launching and maintaining CBDCs.

By tackling these challenges, stakeholders can pave the way for a successful implementation of CBDCs, ultimately shaping The Future of finance in a way that benefits all.