MARKET SUMMARY

Latest Situation in Crypto Assets

| Assets | Last Price | Weekly Change (%) | Monthly Change (%) | YTD Change (%) | Market Cap |

|---|---|---|---|---|---|

| BTC | 96,657.99$ | 1.93% | 3.48% | 119.00% | 1,91 T |

| ETH | 3,419.26$ | 4.77% | 0.27% | 45.71% | 412,90 B |

| XRP | 2.214$ | 3.65% | 52.13% | 253.00% | 127,55 B |

| SOLANA | 192.95$ | 5.44% | -17.42% | 76.21% | 92,53 B |

| DOGE | 0.3219$ | 9.60% | -18.04% | 250.00% | 47,46 B |

| CARDANO | 0.9029$ | 9.86% | -8.84% | 44.83% | 31,70 B |

| TRX | 0.2587$ | 2.99% | 28.27% | 140.00% | 22,29 B |

| AVAX | 38.56$ | 7.69% | -12.02% | -7.86% | 15,81 B |

| LINK | 23.44$ | 10.82% | 28.44% | 50.89% | 14,96 B |

| SHIB | 0.00002224$ | 10.90% | -9.87% | 108.00% | 13,12 B |

| DOT | 7.244$ | 13.41% | -13.41% | -15.72% | 11,11 B |

*Table was prepared on 12.27.2024 at 11:30 (UTC). Weekly values are calculated for 7 days based on Sexta-feira.

Fear & Greed Index

Source: Alternative

Change in Fear and Greed Value: 0

Last Week’s Level: 74

This Week’s Level: 74

This week, the Fear and Greed Index remained stable at 74. The $1.3 billion crypto theft by North Korean hackers raised security concerns and negatively affected the risk perception in the markets. Russia’s decision to start using Bitcoin for international payments gave a positive signal in terms of adoption. MicroStrategy’s purchase of 5,262 Bitcoins boosted confidence in institutional demand, but its impact on the index was limited. The complex effects of these developments explain the stability in the index and show that investors maintain their cautious stance.

Fund Flow

| Ativo | Week Flows (US$m) | MTD Flows (US$m) | YTD Flows (US$m) | AUM (US$m) |

|---|---|---|---|---|

| Bitcoin | 375 | 5,040 | 38,963 | 128,624 |

| Ethereum | 51.3 | 2,301.3 | 4,500 | 17,435 |

| Multi-asset | -121.4 | -157.4 | 282 | 6,968 |

| Solana | -8.7 | -22.0 | 80 | 1,612 |

| XRP | 8.8 | 288.8 | 430 | 835 |

| Binance | - | 4.0 | 2 | 653 |

| Litecoin | 0.6 | 4.8 | 52 | 219 |

| Short Bitcoin | 0.4 | 21.2 | 142 | 137 |

| Cardano | 0.7 | 7.8 | 24 | 130 |

| Chainlink | 1.7 | 3.1 | 44 | 94 |

| Other | -0.0 | 19.0 | 279 | 562 |

| Total | 308 | 7,510 | 44,797 | 157,269 |

Overview: Digital asset investment products saw continued inflows totaling $308 million last week.

Fund Inputs;

- Bitcoin (BTC): $375 million in inflows.

- Ethereum (ETH): $51 million inflows were seen.

- XRP: $8 million inflows were seen

- Litecoin (LTC): $0.6 million

- Cardano (ADA): saw $0.7 million entries

Fund Outflows; $8 million funds were outflowed on Solana.

Assessment: Despite the weekday, Bitcoin saw net inflows totaling US$375 million for the week. This compensated for the largest daily outflows on Dezembro 19, which totaled 576 million$ . Bitcoin short positions, on the other hand, are still being held by traders.

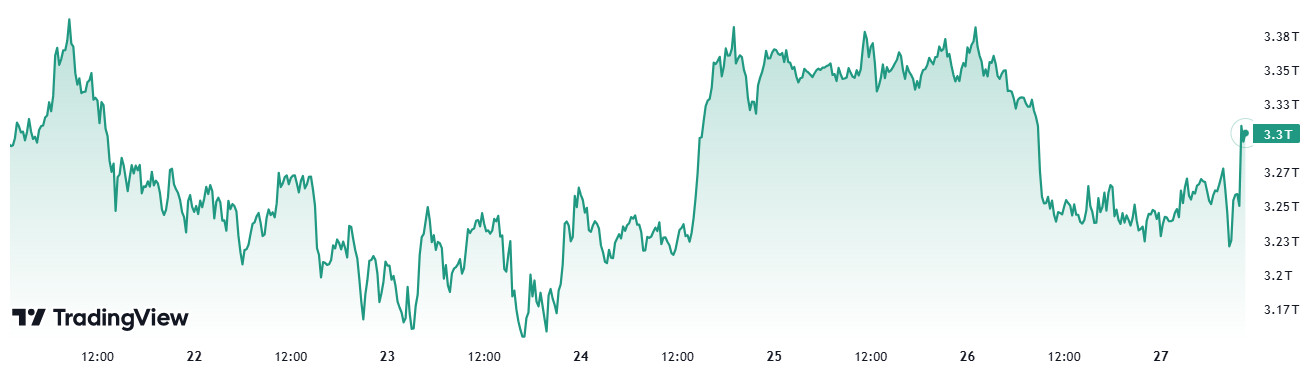

Total MarketCap

Source: Tradingview

Last Week Market Capitalization: $3.2 Trillion

Market Capitalization This Week: $3.3 Trillion

The total market capitalization in the cryptocurrency market is close to ending its 2-week losing streak this week. The total market, which recorded an increase of 3.20% compared to the previous week, draws a positive picture in the last week of the year. As the last week of the year approached its close, the net total entering the total market amounted to 102.77 billion dollars.

Total 2

When Total 2 is analyzed, there was an increase of 5.15% this week after a 15.05% decrease from the previous week. This net inflow of approximately $ 67.27 billion shows that the amount entering altcoins is more than the amount entering Bitcoin when compared to the total market, When this amount is decomposed proportionally, 65.45% of the total amount entering the market is evaluated by altcoins, while 34.54% seems to be evaluated specifically for Bitcoin.

Total 3

This week’s net inflow of approximately $49.96 billion brought a 5.43% rise on Total 3. While 25.73% of the net amount entering the altcoin market was evaluated on Ethereum, this shows that Ethereum is trying to regain its lost influence on altcoins.

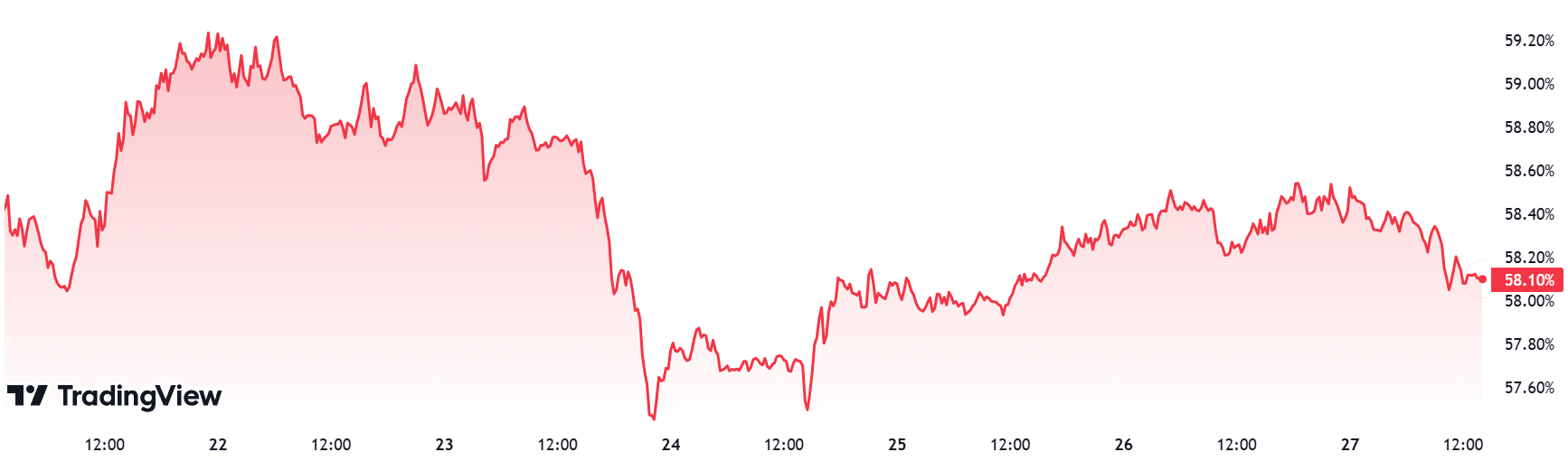

Domínio do Bitcoin

Source: Tradingview

Weekly Change:

- Last Week’s Level: 58.88%

- This Week’s Level: 58.10%

Bitcoin dominance reached a high of 59.92% with the positive momentum it captured in early Dezembro. However, as of the current week, it has seen some pressure from these levels and has displayed a negative trend.

In this context, Bitcoin dominance closed last week at 58.88% and is moving at 58.10% as of this week.

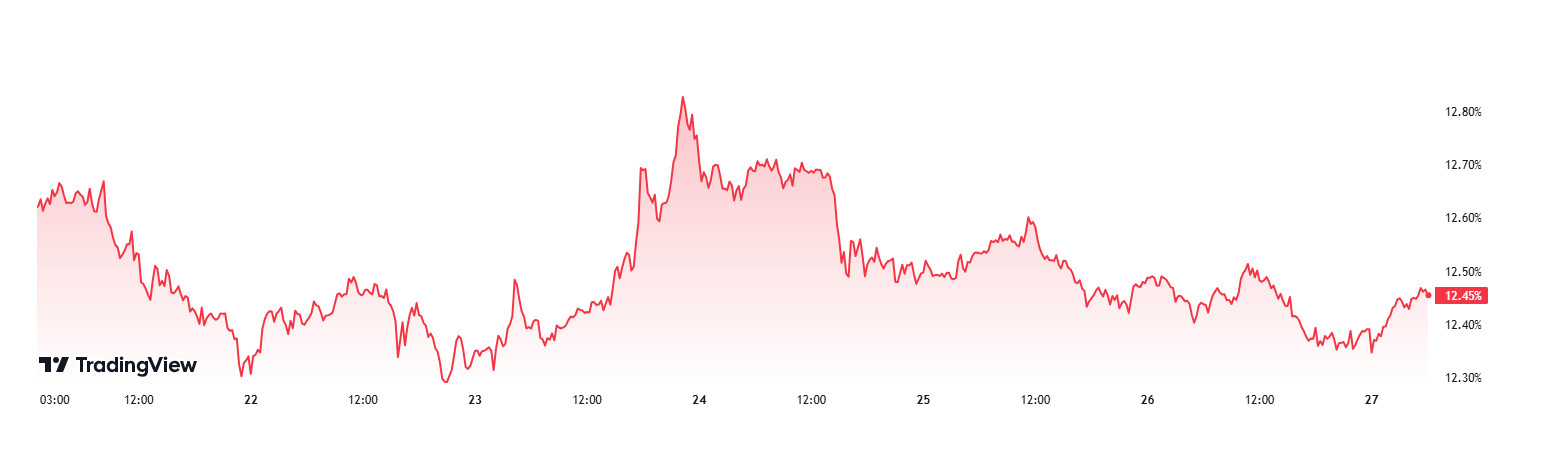

Domínio do Ethereum

Source: Tradingview

ETH dominance, which closed last week at 12.35%, rose slightly at the beginning of the new week, but then entered a downtrend. ETH Dominance is currently at 12.45%.

In the coming week, applications for unemployment benefits, manufacturing purchasing managers index and ISM manufacturing purchasing managers index data will be announced. With the positive evaluation of these data by the market, the possibility of an increase in ETH dominance will increase after possible decreases in BTC dominance. As a result of this situation, ETH dominance can be expected to rise to 13% – 13.50% levels for the next week.

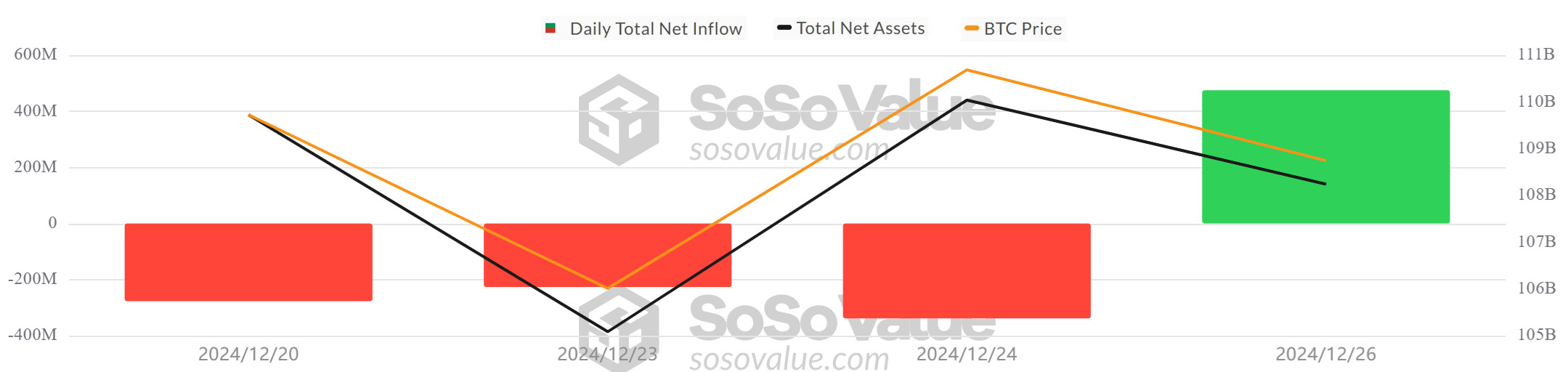

Bitcoin Spot ETF

Source: SosoValue

Featured Developments:

- Net Inflows: The 4-day negative streak between Dezembro 20-26, 2024 ended on Dezembro 26. While the 4-day negative outflow series saw a net outflow of over USD 1 billion, the negative series ended on Dezembro 26 with a net inflow of USD 475.2 million.

- BlackRock IBIT ETF Negative Net Inflows: As the 15-day positive net inflow streak in spot Bitcoin ETFs gave way to a 4-day negative net inflow streak, the net outflow in the BlackRock IBIT ETF came to the fore. On Novembro 6, 2024, the BlackRock IBIT ETF, which last saw net outflows, saw net outflows on Dezembro 20 and Dezembro 22.

- Cumulative Net Inflows: Cumulative net inflows into spot BTC ETFs exceeded $35.9 billion at the end of the 242nd trading day.

| DATE | COIN | PRICE | ETF Flow (mil$) | ||

| Open | Close | Change % | |||

| 20-Dec-24 | BTC | 97,434 | 97,764 | 0.34% | -277 |

| 23-Dec-24 | 95,153 | 94,861 | -0.31% | -226.5 | |

| 24-Dec-24 | 94,861 | 98,627 | 3.97% | -338.4 | |

| 25-Dec-24 | 98,627 | 99,379 | 0.76% | 0 | |

| 26-Dec-24 | 99,379 | 95,751 | -3.65% | 475.2 | |

| Total for 20-26 Dec 24 | -1.73% | -366.7 | |||

Conclusion and Analysis:

While there were fluctuations in Spot Bitcoin ETFs between Dezembro 20-26, 2024, there were signs of recovery with a net inflow of $475.2 million on Dezembro 26. Despite the 3.65% depreciation in Bitcoin price on Dezembro 26, strong investor interest in Spot Bitcoin ETFs was notable. With the inauguration of Donald Trump and his team in Janeiro 2025, the introduction of market-friendly policies and crypto-friendly regulations may increase investor interest in Spot ETFs. This could lead to continued inflows into Spot Bitcoin ETFs, boosting market confidence and creating a positive momentum in ETF performance. Positive momentum in Spot Bitcoin ETFs could also have a bullish effect on the Bitcoin price in the coming period.

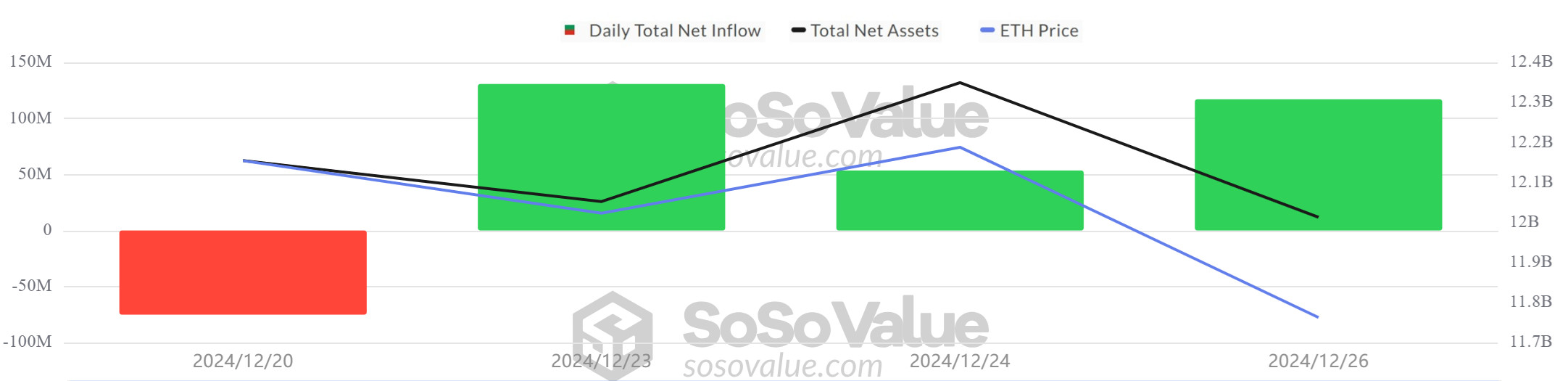

Ethereum spot ETF

Source: SosoValue

Ethereum price fell by a total of 2.43% between Dezembro 20 and 26. The price closed the day at $3,333 on Dezembro 26, down a remarkable 4.64%. US Spot ETH ETFs saw net inflows totaling $226.5 million during the Dezembro 20-26 period. Dezembro 23 and Dezembro 26 were particularly high inflows with $130.8 million and $117.2 million, respectively.

Between Dezembro 20-26, a total net inflow of $226.5 million was seen, while BlackRock ETHA attracted attention with an outflow of -$103.7 million on Dezembro 20 and a total net inflow of $57.9 million for the rest of the week. Fidelity FETH was the leading ETF of the week with a net inflow of $145.9 million. ETFs owned by Bitwise and GrayScale completed this period with positive net inflows in total. Spot ETH ETFs did not see any negative outflows in the Dezembro 20-26 date range. At the end of the 85th trading day, cumulative net inflows to US Spot ETH ETFs reached $2.65 billion.

Net inflows to Spot ETH ETFs in this period show that investor interest remains strong despite the price decline. In particular, the positive flows of ETFs of large firms such as BlackRock and Fidelity point to continued institutional demand. If the Donald Trump administration adopts market-friendly policies in Janeiro 2025, demand for Spot ETH ETFs can be expected to increase. This could trigger a rebound and upward movement in the Ethereum price. However, market uncertainty and price volatility are among the short-term risks.

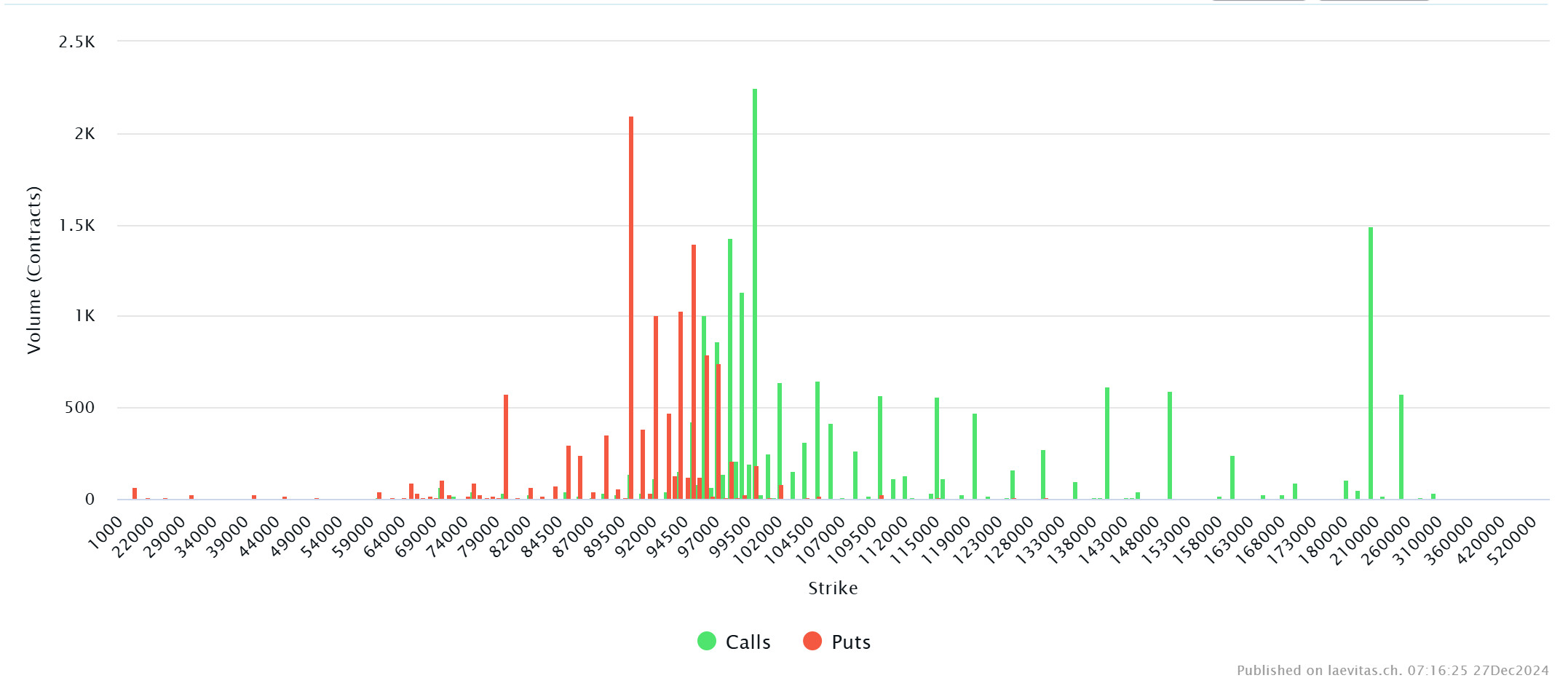

Bitcoin Options Breakdown

Source: Laevitas

Deribit Data: According to Deribit, the market is highly leveraged as a record 146,000 Bitcoin options contracts worth around $14 billion are set to expire. It points to uncertainty of direction ahead of expiry. This amount represents 44% of the total open interest for all BTC options of different maturities, marking the largest expiry event ever. While this is likely to be profitable for buyers, these positions could be closed or rolled over to the next expiration. This could potentially cause volatility in the market

When we examine the chart, if we look at it from a broad perspective, resistance has formed at around 110,000 dollars. On the other hand, it is seen that call options peaked at $ 105,000 and there is a general decline in volume after this level.

Maximum Pain Point: Bitcoin’s maximum pain point is set at $85,000. This shows us that Bitcoin is well below its strike price.

Option Expiration

Put/Call Ratio: The put/call ratio for these options is set at 0.69. A put/call ratio of 0.69 indicates that there is a strong preference for call options over put options among investors and that a possible uptrend in the markets is possible.

WHAT’S LEFT BEHIND

Trump Threatens EU with Tariffs: Trump urged the EU to buy energy from the US to close its trade deficit, saying he would impose tariffs otherwise.

First Crypto ETF Approval from the SEC: The SEC approved Hashdex and Franklin Templeton’s crypto index ETFs.

El Salvador Increased Bitcoin Reserves: El Salvador increased its reserves to 5,980.77 BTC with the purchase of 1 million dollars of Bitcoin.

Russia Bans Crypto Mining for 6 Years: Russia banned crypto mining in 10 regions and imposed restrictions in 3 regions to save energy.

Israel Approves Bitcoin FundsIsrael has approved the launch of six Bitcoin investment funds on Dezembro 31, 2024. The funds will track the Bitcoin price and offer a 0.25%-1.5% management fee.

Cautious Approach to Bitcoin Reserve from Japan: Due to the volatility of crypto assets and regulatory issues, it is distant from keeping Bitcoin as a national reserve.

New Bitcoin Move from MicroStrategy: MicroStrategy plans to increase the number of shares to buy more Bitcoin and will put the decision to a shareholder vote.

South Korea Delays Crypto Tax: South Korea is working on a regulation that aims to postpone the crypto taxation plan for two years.

Stablecoin Order is Changing in Europe: While USDT is delisted in the EU under MiCA regulations, euro-based stablecoins are becoming widespread.

New Appointments from Trump: Trump appointed Bo Hines as Executive Director of the Digital Asset Advisory Council and Sriram Krishnan as Senior Policy Advisor at the White House.

Jeff Bezos and Bitcoin Rumors: While Jeff Bezos denied rumors of a $600 million wedding, Michael Saylor and billionaires’ statements about Bitcoin’s rise in value drew attention.

Hut 8’s Bitcoin Reserve Strategy: Hut 8 aims to increase its Bitcoin reserves through low-cost production and strategic purchases to provide long-term returns to shareholders.

UAE’s Bitcoin Reserve is Under Discussion: While claims that the UAE has $40 billion in Bitcoin reserves have come to the agenda, Binance CEO CZ questioned the accuracy of these figures.

Fed Criticism from Musk: Elon Musk stated that the number of employees at the Fed is too high and said that there may be changes in Trump’s presidency.

Big ETH Transfer from Justin Sun to HTX: Justin Sun transferred 70,182 ETH worth $244.9 million to HTX. 42,905 of the ETH were withdrawn from Lido Finance and 27,277 from Etherfi.

HIGHLIGHTS OF THE WEEK

Having left the Christmas week behind, global markets are now preparing to start the New Year’s week. We witnessed a trading period in which data from the US failed to provide any new clues about the Federal Reserve’s interest rate cut path and the stimulus from major economies in Asia was mostly discussed. We witnessed a flat but volatile outlook in digital assets. Volumes traditionally fell, while depth in price action was often lost.

In the middle of next week, Quarta-feira will be the first day of the new year and all major traditional markets will be closed. We do not expect markets to return to their normal volume and course before the second trading week of Janeiro.

On the macro indicators side, Chinese manufacturing PMI data on Terça-feira, US Unemployment Claims and manufacturing PMI data on Quinta-feira will be monitored. However, we do not expect these data to be a decisive factor in the direction of the market unless we see figures that diverge too much from expectations.

For the short-term picture, we expect digital assets to remain flat, albeit with higher wavelengths, while the upward trend will continue in the long term. With large investors staying away from the market due to the New Year’s holiday, volumes will continue to remain low. In this parallel, it is important to keep in mind that we may see sharp rises and falls from time to time.

ESTUDOS ATUAIS DO DEPARTAMENTO DE PESQUISA DA DARKEX

Weekly Onchain Analysis – Dezembro 25

Donald Trump’s Digital Cabinet

What awaits the Crypto Sector after the European Union MiCA Regulations come into full force?

What Do Changes in Ethereum TVL and Stake Amount Mean for ETH Price?

Where Are Digital Assets in the Bull Season?

Market Activity and Investor Trends – BTC, ETH and XRP

Is MVRV’s Low Peak Signalling Selling Pressure in Bitcoin?

Net Unrealized Profit/Loss (NUPL) Analysis

Bitcoin: Puell Multiple Analysis

DADOS IMPORTANTES DO CALENDÁRIO ECONÔMICO

Clique aqui para ver o calendário semanal de criptografia e economia da Darkex.

INFORMATION

*The calendar is based on UTC (Coordinated Universal Time) time zone. The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

A Darkex não pode ser responsabilizada por possíveis mudanças decorrentes de situações semelhantes. Também é possível verificar a página do Calendário Darkex ou a seção do calendário econômico nos relatórios diários para possíveis alterações no conteúdo e no momento da divulgação dos dados.

AVISO LEGAL

As informações, comentários e recomendações sobre investimentos contidos neste documento não constituem serviços de consultoria de investimentos. Os serviços de consultoria de investimento são prestados por instituições autorizadas em caráter pessoal, levando em conta as preferências de risco e retorno dos indivíduos. Os comentários e recomendações contidos neste documento são de caráter geral. Essas recomendações podem não ser adequadas à sua situação financeira e às suas preferências de risco e retorno. Portanto, tomar uma decisão de investimento com base apenas nas informações contidas neste documento pode não resultar em resultados que estejam de acordo com suas expectativas.