Bizi Ne Bekliyor?

Fed Chair Powell’s Speech – Temmuz 1

Powell’s speech, interest rate and economic expectations will be closely monitored by the markets.

Non-Farm Payrolls (NFP) – Temmuz 3

This data, which shows the employment strength in the US economy, will play a key role in the FED’s assessment of the direction of the interest rate path.

Consumer Price Index (CPI) – Temmuz 15

Consumer inflation data for Haziran will shape the inflation expectations of the markets.

FED Interest Rate Decision Meeting (FOMC) – Temmuz 30

The Temmuz rate decision will be announced, together with Powell’s press conference, which could have immediate implications.

GDP (Final GDP) – Temmuz 31

US economic growth data for the second quarter will be released.

Personal Consumption Expenditures (PCE) – Temmuz 31

PCE data, which stands out as the FED’s inflation indicator, will be announced.

Ethereum Community Conference (EthCC) 30-3 Haziran-Temmuz

Ethereum developers and projects are coming together.

US Tariffs Update – Temmuz 9

It was announced that it postponed its decision to impose a 50 percent tariff directly on the European Union (EU) until Temmuz 9, 2025.

The Extent of Tensions after the Ceasefire between Israel and Iran

The developments between Iran and Israel will continue to be closely monitored by the market

Final preparations before the Stablecoin Act (GENIUS Act) comes into force – Temmuz

Companies complete reserve transparency and liquidity compliance before the Senate-passed law takes effect in Ağustos.

MiCA Implementation (EU) – Temmuz

All provisions of MiCA now apply in the EU. Crypto companies will operate under the supervision of the EU Banking Authority and ESMA.

XRP and Solana Spot ETF Filings (SEC) – Temmuz

Franklin Templeton and Ark Invest’s XRP and SOL ETF applications are under review. The SEC is expected to announce approval by the end of Temmuz.

Crypto Insight

| Pazara Genel Bakış | Güncel Değer | Değişim (30d) |

|---|---|---|

| Bitcoin Fiyatı | $107,450 | +2.65% 📈 |

| Ethereum Fiyat | $2,450 | -2.44% 📉 |

| Bitcoin Hakimiyeti | 65.70% | +2.10% 📈 |

| Ethereum Hakimiyeti | 9.09% | -0.69% 📉 |

| Tether Dominance | 4.83% | +11.62% 📈 |

| Toplam Piyasa Değeri | $3.25 T | -3.93% 📉 |

| Korku ve Açgözlülük Endeksi | Greed (74) | Greed (74) |

| Altcoin Season Index | 20/100 | 18/100 |

| Kripto ETF'leri Net Akış | $608.1 M | - |

| Açık Faiz - Perpetuals | $740.62 B | - |

| Açık Faiz - Vadeli İşlemler | $3.1 B | - |

*Prepared on 26.06.2025 at 13:13 pm. (UTC)

Metrics – Summarize of the Haziran

Fund Flow by Assets

| Varlıklar | 1st Week | 2nd Week | 3rd Week | 4th Week | Net (m$) |

|---|---|---|---|---|---|

| Bitcoin (BTC) | 152.0 | -56.0 | 151.0 | -1.3 | 245.0 |

| Ethereum (ETH) | 14.8 | 15.4 | 13.6 | 14.9 | 58.7 |

| XRP (XRP) | -28.2 | -4.0 | -4.0 | 11.8 | -32.1 |

| Solana (SOL) | 1.5 | -2.1 | -5.1 | 0.3 | -5.4 |

| Litecoin (LTC) | - | - | - | -0.1 | -0.1 |

| Cardano (ADA) | 0.1 | -0.4 | -0.4 | 0.4 | -0.3 |

| SUI (SUI) | 2.2 | -4.7 | 1.1 | 3.5 | 6.5 |

| Diğerleri | 2.7 | 1.2 | 1.2 | 1.9 | 34.5 |

*This data based on “Coinshares” reports

In Haziran, inflows into digital assets amounted to $272.3 million. In general, inflows were observed in the flow of funds. Bitcoin experienced a net inflow of 245 million dollars and Ethereum 58.7 million dollars. Ripple stood out with an outflow of $ 32.1 million. Litecoin continued to remain weak, while Solana output losses continued. Cardano experienced an outflow of -0.3 million dollars. Other coins saw an inflow of $34.5 million.

Toplam Piyasa Değeri

The total value of the cryptocurrency market started Haziran at $3.23 trillion. It rose by 0.70% during the month, totaling $14.37 billion. However, this increase was accompanied by high volatility rather than a stable trend. The first two weeks of the month saw sharp upward movements, with the market capitalization rising to $3.44 trillion. However, this level could not be maintained even on a weekly basis and the market fell below the levels at the beginning of the month. This sharp pullback was a reminder of how strong volatility can be in total market capitalization. This volatility, which intensified especially in the two-week period in the middle of the month, once again revealed the unstable nature of the market. While closes were bearish in the first three weeks of the month, it was only in the last week, with a bullish candle, that the total market capitalization tended to end the month in positive territory.

US Spot ETF Data

As of the end of Haziran, there was a total net inflow of 3.77 billion dollars to Bitcoin ETFs. After a strong performance of $6.21 billion in Mayısısısısısısısıs, institutional demand continued in Haziran. Although there were negative flows on some days in the first week of the month, the intense inflows between Haziran 9-18 kept the market perception positive. The inflows of $588.6 million and $547.7 million, especially on Haziran 24 and 25, showed that the market believed in the uptrend again. During this period, the Bitcoin price rose from $104,590 to $107,800. Overall, Haziran was a period of continued institutional buying despite market volatility.

Spot Ethereum ETFs saw strong net inflows totaling $1.08 billion by the end of Haziran. The increase in institutional demand, which started in mid-Mayısısısısısısısıs, continued in Haziran. Although there were outflows on some days, a positive flow prevailed throughout the month. These outflows can be attributed to profit realization or short-term fluctuations in the markets. The notable days of the month were Haziran 10, 11 and 12, when ETFs recorded net inflows totaling $477.6 million.

Options Data’s

In the Bitcoin options market, $15.12 billion worth of BTC contracts will expire tomorrow, the last week of this month, for a total of $24.67 billion. The number of Call options was concentrated in the $ 115,000 – 120,000 band with a total of 393.92 thousand expiry transactions, while Put options were in the range of $ 97,000 – 100,000 with 330.74 thousand expiry transactions. The put/call ratio was 0.85 and the maximum pain point will be realized at an average of $105,000.

In Ethereum options, approximately $ 2.33 billion worth of ETH contracts will expire in the last week of the month. When we look at the distribution of these contracts, there is a total of over 615 thousand contracts in call options, while there is a remarkable density especially in the range of 3,000 – 3,200 dollars. On the other hand, put options have a more limited open interest with about 319 thousand contracts. We see that the concentration on the put side is in the $ 1,800 – $ 2,200 band. This indicates that investors see these levels as risk limits. Overall, the put/call ratio is at 0.52.

Cytoside – Temmuz

Haziran: Uncertainties and Historical Trends

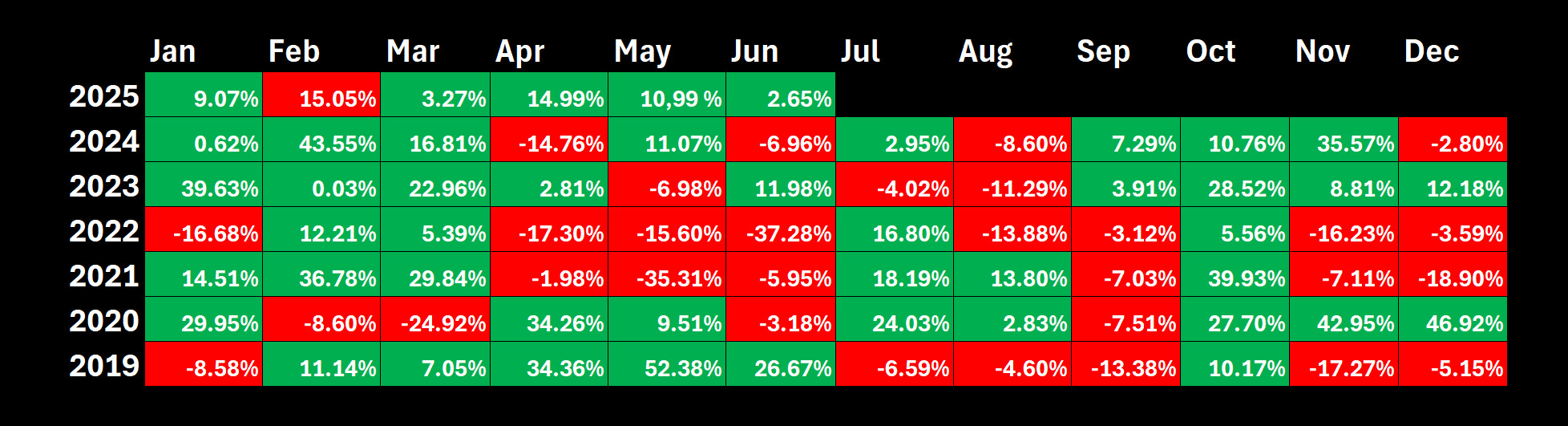

Bitcoin, which entered Haziran at $104,000, experienced a brief period of consolidation in the first week of the month, but then entered a downtrend. Especially by mid-month, the price dropped to the six-digit level of $101,000. Towards the end of the month, after a short period of consolidation, it dropped below $99,000. In previous years, a cautious optimism was observed in the markets in Haziran. In line with expectations this year, Bitcoin is set to end the month in positive territory with a 2.65% rise.

Temmuz Historical Data

Temmuz historically represents a mostly positive period for Bitcoin. Based on data since 2013, Bitcoin’s Temmuz performance has averaged a 7.56% increase. Especially in the last five years, there have been periods of double-digit gains, which supports investors’ optimistic expectations for Temmuz.

*Prepared on 26.06.2025 at 13:13 pm. (UTC)

Kaynak Darkex Araştırma Departmanı

However, although historical trends are positive, it should not be forgotten that the current period is highly sensitive to macroeconomic and geopolitical developments. Here are some important headlines that may have an impact on the market in Temmuz:

- Statements on tariffs in the context of US foreign trade policies,

- Developments on whether a ceasefire will ease Israeli-Iranian tensions,

- Voting of the “GENIUS Act” bill on stablecoin regulations in the House of Representatives,

- The process of integrating crypto platforms into the European market under the MiCA regulation,

- Economic indicators such as US macro data (inflation, unemployment, interest rate expectations).

Considering all these factors, although Temmuz carries an upward momentum for Bitcoin in line with historical data, it stands out as a period when investors should be careful against surprise developments.

Piyasa Nabzı

In the Shadow of the Middle East…

Global markets left behind an extremely challenging period. Although uncertainties over President Trump’s stance on tariffs eased to some extent, developments in the Middle East made it difficult for investors to see the way ahead. Moreover, changes in expectations regarding the monetary policy course of the US Federal Reserve (FED) continued to be a determining factor in asset prices. As the markets will start the second half of the year in Temmuz, the aforementioned dynamics are likely to remain important. Although a ceasefire has been reached between Israel and Iran, the fragile balances will keep the eyes on the Middle East. On the other hand, the ongoing process will be under scrutiny as President Trump managed to bring almost all of his trading partners to the table on tariffs. Meanwhile, attention will be shifting back to trade negotiations ahead of Trump’s Temmuz 9 deadline and his efforts to finalize a tax and spending package in Congress, which must be completed by the same dates. In the shadow of these uncertainties, we think that the Fed’s actions may be a bit more prominent next month. Following the news that Trump may announce his nominee to replace Fed Chairman Powell early, the decisions of the FOMC, which manages the monetary policy of the world’s largest economy, will be of critical importance. Therefore, we will open a separate parenthesis for these decisions and the variables that may affect them.

Temmuz 1 – FED Chair Powell’s Speech

Last month, US Federal Reserve Chairman Jerome Powell gave speeches both after the Federal Open Market Committee (FOMC) meeting and before the relevant committees of the Senate and the House of Representatives. We cannot state that there was a significant change in the Chairman’s stance. Powell, who wants to see more data in order to monitor the effects of the trade wars that started in the Trump era, continues to take refuge in the confidence of remaining in a wait-and-see mode. He will also want to take into account the impact of rising tensions in the Middle East on commodity prices. In addition, the game plan seems to have changed a bit in the last days of Temmuz with the news that US President Donald Trump may announce the next Fed Chair early, but we do not expect this to have a lasting impact on the markets.

Fed Chair Powell will participate in a panel titled “Policy Panel” at the European Central Bank’s ECB Central Banking Forum in Sintra. We do not think that the Chairman will take a different stance from his recent statements. However, volatility in the markets may increase if he comments on both tariffs and the timing of the next interest rate cut. According to the CME FedWatch Tool, markets are expecting three 25bps rate cuts from the Fed by the end of the year amid speculation of a change in the chair. Any announcements that could reshape this outlook could have a directional impact on asset prices. Statements that may strengthen expectations for further rate cuts may have a positive impact on digital assets, while assessments that may signal fewer rate cuts may put pressure.

Temmuz 3 – US Employment Data

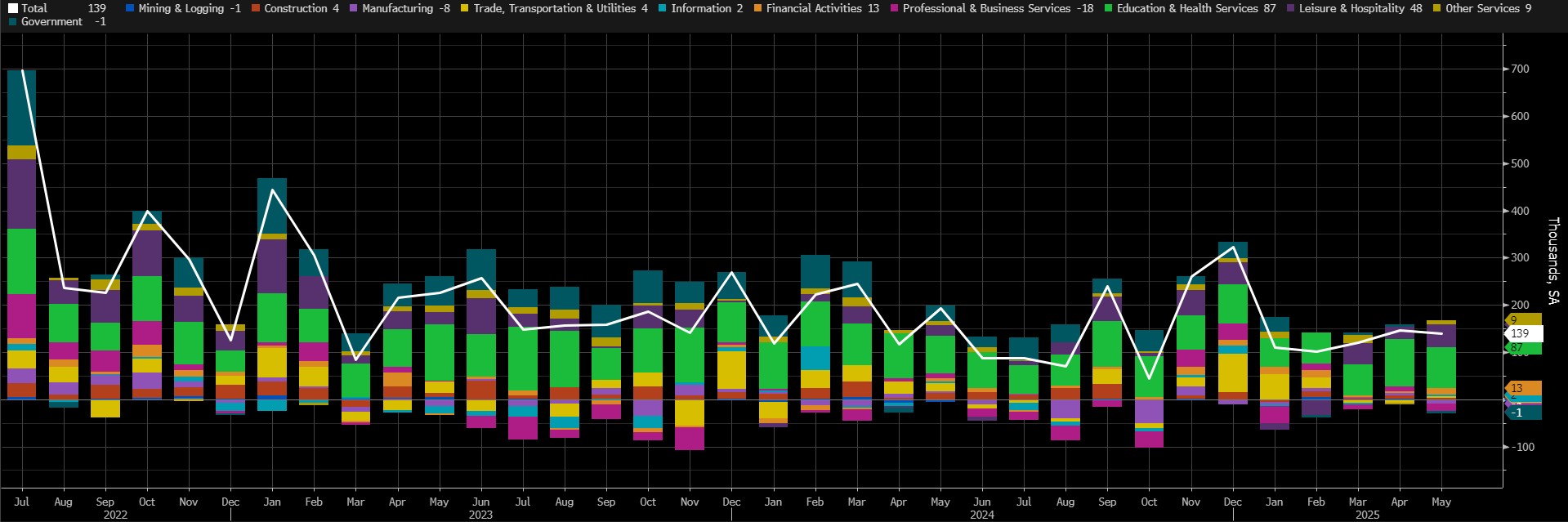

On Temmuz 3, markets will be receiving the Haziran Non-Farm Payrolls (NFP) data, which will provide clues about the tightness of the financial ecosystem in the coming period, which will provide information about the US Federal Reserve’s (FED) interest rate cut course. In addition, Mart figures such as average hourly earnings and unemployment rate will be followed.

In Mayısısısısısısısıs, the US economy added 139K jobs (Market Expectation: 126K).

Source: Bloomberg

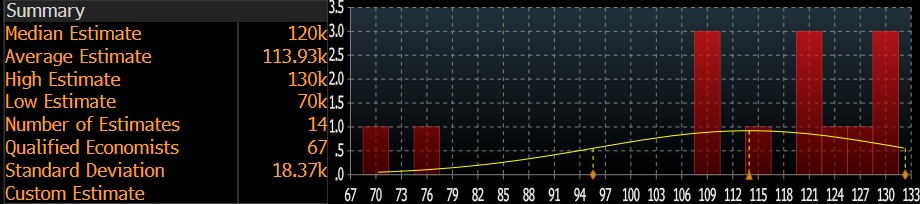

Our forecast for the NFP data, which is highly sensitive to the market, is that we may see data in the non-farm sectors of the US economy in Haziran, well above the general forecasts. At the time of writing, although the number of forecasts entered is small, we see that the consensus on the Bloomberg terminal is more pessimistic, around 120k (traders are advised to follow Darkex daily bulletins as this expectation figure may change later with the entry of new forecasts and surveys).

Source: Bloomberg

We believe that if the Haziran NFP data, which will be published in the shadow of Trump’s tariff-oriented foreign policy, the disruptions it may create domestically and the developments in the Middle East, is slightly below expectations, this will be priced as a potential metric that may create an expectation that the FED may act more boldly to lower the interest rate, thus increasing risk appetite and having a positive impact on financial instruments, including digital assets. We think that a slightly higher-than-expected data may have a similar but opposite effect. However, a much lower than expected NFP data could reignite concerns about stagflation with a commentary on the health of the US economy, which could put selling pressure on assets considered to be risky. It should be noted here that we also expect a much better-than-anticipated reading to have a positive impact. It is worth noting that we anticipate these effects taking into account the current state of market sentiment.

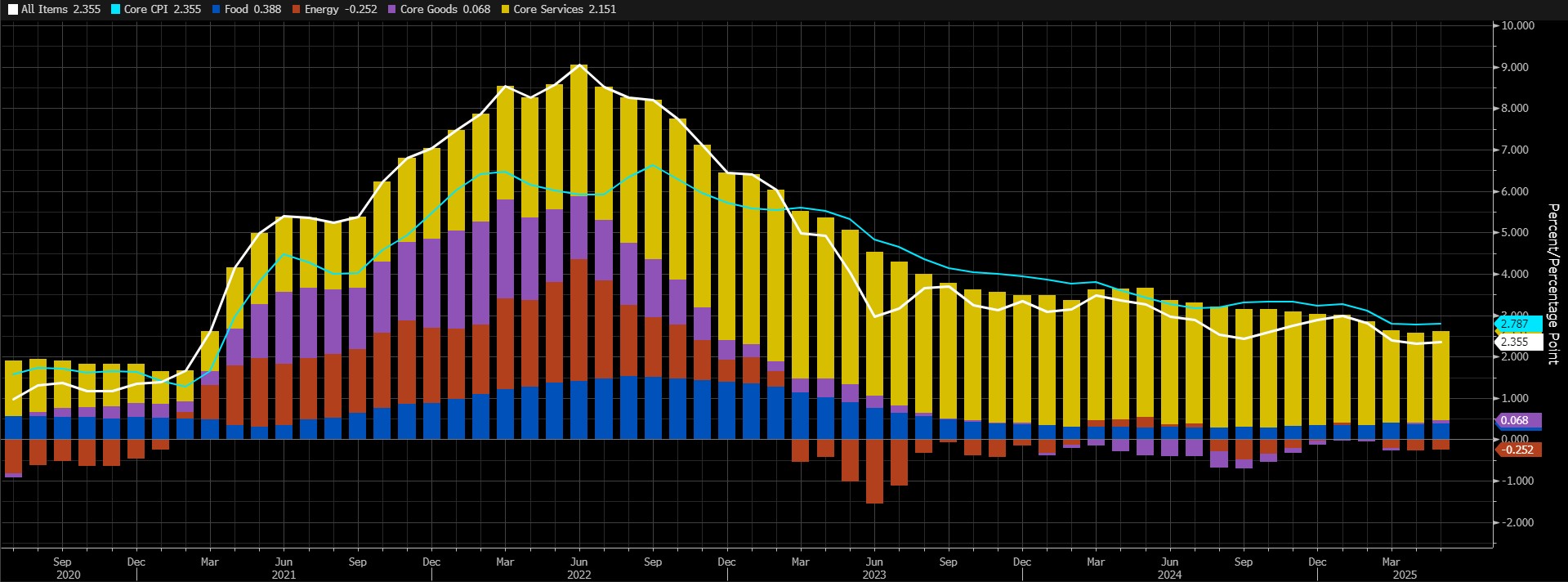

Temmuz 15 – US Consumer Price Index: CPI

One of the important macro indicators that may provide information on the timing of the US Federal Reserve’s (FED) interest rate cut will be the Haziran inflation, the Consumer Price Index (CPI) change. In the current difficult conjuncture, CPI data will be closely monitored as it may provide a signal for the course, as it may have an impact on pricing behavior.

The annual inflation rate in the US rose to 2.4% in Mayısısısısısısısıs 2025 from 2.3% in Nisan, the first increase in four months. On a monthly basis, CPI rose by 0.1%, below the previous month and the forecasts of 0.2%. Annual core inflation remained at 2.8%, the lowest level of 2021, while expectations pointed to an increase to 2.9%. Monthly core CPI also rose by 0.1%, below Nisan’s 0.2% and expectations of 0.3%.

Source: Bloomberg

As can be seen in the chart above, core services continue to have the largest share in the overall price level. Our expectation is for a monthly increase of 0.05% and an annualized CPI of around 2.15%. Nevertheless, let us remind that the market will react according to the consensus expectation.

A CPI data that will be below the market expectation may mean that the FED’s hand will be relaxed in terms of interest rate cuts and this may have a positive impact on digital assets. A figure that exceeds forecasts would reinforce expectations that the FED will not rush into another rate cut, potentially adding pressure.

Temmuz 30- FOMC Meeting

The US Federal Reserve’s (FED) fifth Federal Open Market Committee (FOMC) meeting of the year will be held on Temmuz 29-30 and the decisions will be announced on Temmuz 30. The FED is not expected to change its policy interest rate. However, what makes the Temmuz meeting important is that we may get clues about the timing of the rate cut.

On Temmuz 30, the markets will be looking for clues that could lead to a major change in market expectations. First, they will look to see whether the interest rate is left unchanged as expected. Half an hour after the publication of this decision and the text of the statement, Fed Chair Powell will step behind the lectern and hold a press conference.

1-Will the interest rate change?

As we mentioned, after the recent developments and the statements of the FOMC members, the Committee is not expected to decide on a rate cut. There may be a surprise decision to cut interest rates, which we see as a very low probability. We define an interest rate hike as unlikely.

2-Powell’s Press Conference

On Temmuz 30th, FED Chairman Jerome H. Powell will speak at a press conference, as he does after every FOMC meeting, half an hour after the decisions are published. Powell will first read the text of the decision and explain the reasons for the decisions taken. Then there will be a question and answer session where press members’ questions will be answered. Volatility in the markets may increase a little more in this part.

We do not expect a major change in the stance Powell has taken in his recent speeches. Last time, he maintained his stance that they need more data to get a clearer picture of the impact of the tariffs.

In the face of questions from the press, Powell’s more hawkish stance than before may reinforce expectations and pricing that the Fed will not be in a hurry to resume rate cuts. This may have some negative impact on digital assets. However, the fact that he mentioned the necessity of a new interest rate cut with evaluations regarding both economic growth and the labor market, and that he gave messages that more interest rate cuts could be made than the general expectations until the end of the year may increase the risk appetite and this may have positive effects on cryptocurrencies.

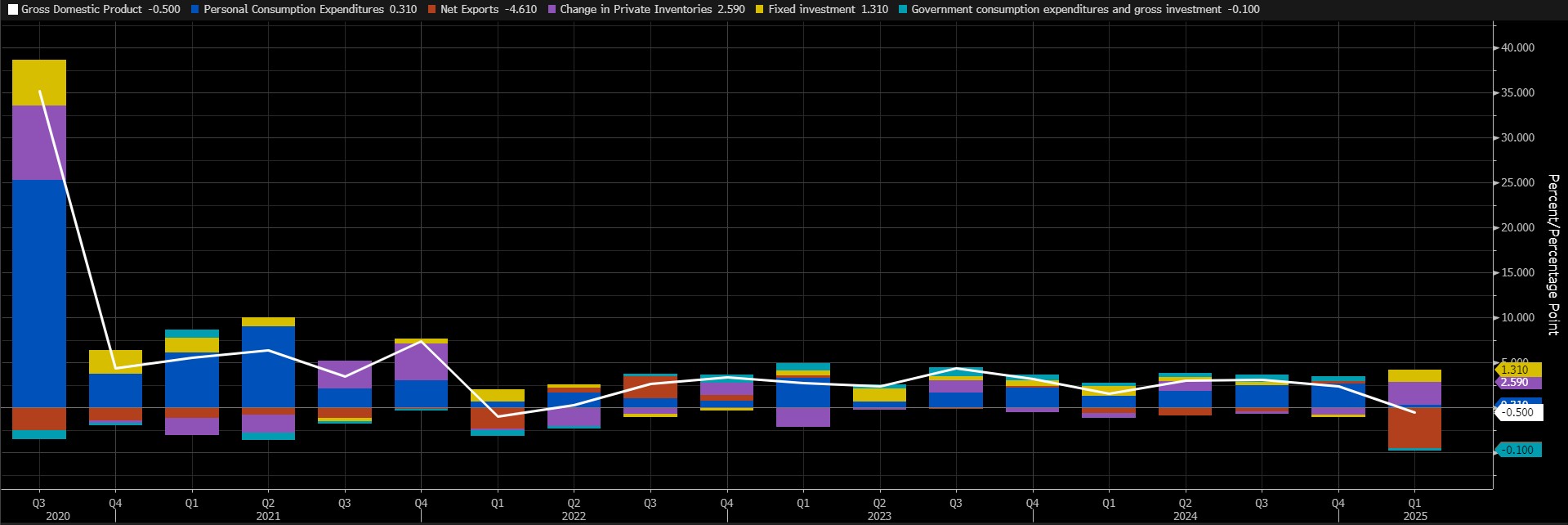

Temmuz 31- US GDP Change

Donald Trump’s unpredictable policy choices continue to be a challenging factor for the entire world. Economic actors are also facing the challenges of this highly uncertain environment as they formulate their expectations and plan for the future. This situation has some implications. The most important of these is the slowdown in economic activity… In this respect, it will be important to see how much the US economy grew in the second quarter of the year. According to the Bureau of Economic Analysis, which compiles this statistic, the US economy contracted by 0.5% in the first quarter of 2025 (previous estimate for the period was -0.2%), reflecting the consequences of Trump’s unpredictable policies. This was the first decline since the first quarter of 2022.

This weak figure was primarily driven by downward revisions in consumer spending and exports.

Source: Bloomberg

The new data will be the first forecast for the second quarter of the year and is therefore important. It is still difficult to quantify and measure the impact of Trump and the recent tensions in the Middle East on consumer behavior. The data will allow for healthier and longer-term projections on the direction of economic growth.

In terms of immediate market reaction, we believe that a higher-than-consensus expectation could increase risk appetite and have a positive impact on digital assets. A lower-than-expected GDP data may have a negative impact from this point of view.

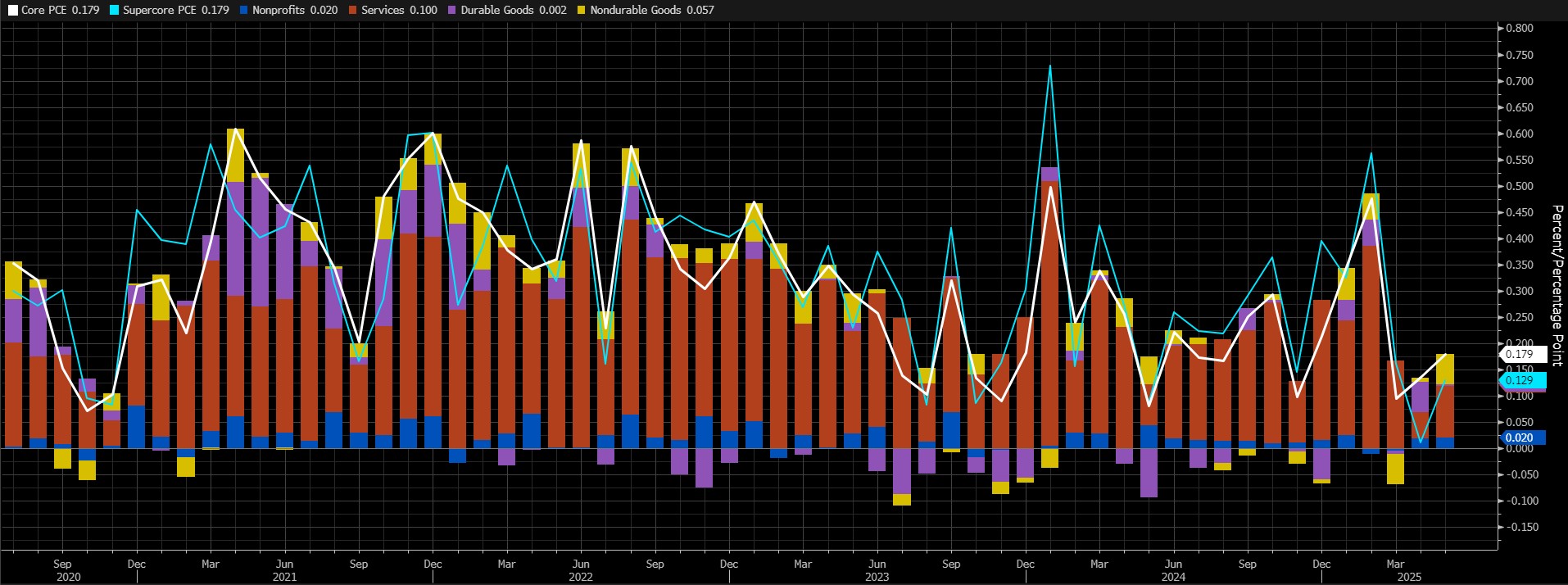

Temmuz 31 – FED’s Favorite Inflation Indicator PCE

At the Federal Open Market Committee (FOMC) meeting in Temmuz, markets will be watching the Personal Consumption Expenditures (PCE) data for Haziran closely for clues as to which of the following meetings will decide on a rate cut. This indicator is known as the preferred gauge for FOMC officials to monitor changes in inflation.

Source: Bloomberg

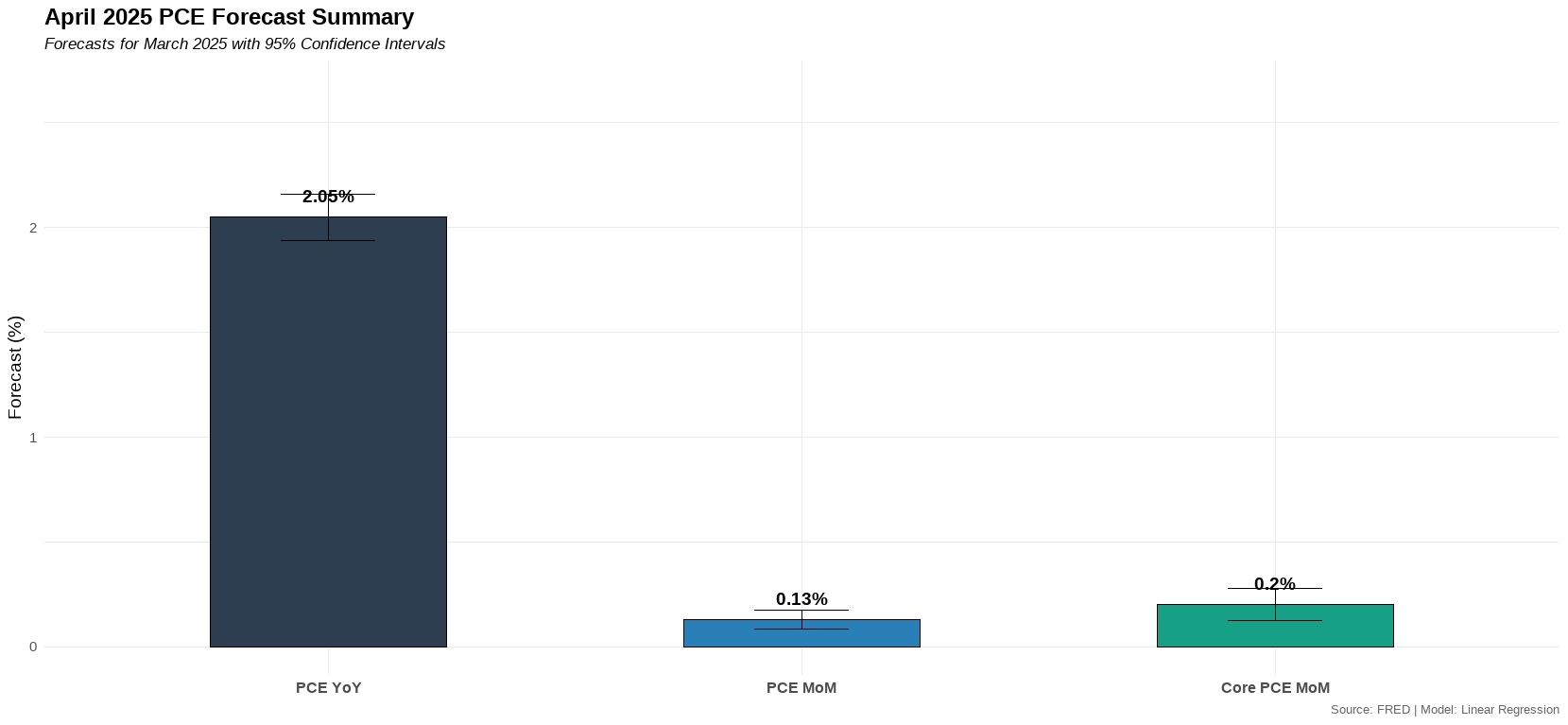

According to the latest data, core PCE increased by 0.2% in Mayısısısısısısısıs compared to the previous month. On an annual basis, core PCE increased by 2.7%. In addition, the annual core data , which was previously announced as 2.5%, was revised to 2.6%. We can say that we felt the Trump effect in this data as well. Our expectation is that core PCE data will increase by around 0.2% in Haziran.

Source: Darkex Research

A higher-than-expected data may support expectations that the FED will maintain its cautious stance on interest rate cuts, reducing risk appetite and putting pressure on digital assets. A lower-than-expected data may pave the way for value gains with the opposite effect.

*Tahminler Hakkında Genel Bilgiler

Bu raporda paylaşılan tahminler genel piyasa beklentilerinin yanı sıra araştırma departmanımız tarafından geliştirilen ekonometrik modelleme araçlarına dayanmaktadır. Her bir gösterge için farklı yapılar dikkate alınmış, veri sıklığı (aylık/çeyreklik), öncü ekonomik göstergeler ve veri geçmişi doğrultusunda uygun regresyon modelleri oluşturulmuştur.

The basic approach in all models is to interpret historical relationships based on data and to produce forecasts that have predictive power with current data. The performance of the models used is measured by standard metrics such as mean absolute error (MAE) and is regularly re-evaluated and improved. While the outputs of the models guide our economic analysis, they also aim to contribute to strategic decision-making processes for our investors and business partners. Data is sourced directly from the FRED (Federal Reserve Economic Data) platforming an up-to-date and automated manner, so that every forecast is based on the latest economic data. As the research department, we are also working on artificial intelligence-based modelling methods (e.g. Random Forest, Lasso/Ridge regressions, ensemble models) in order to improve forecast accuracy and react more sensitively to market dynamics. The macroeconomic context should be taken into account in the interpretation of model outputs, and it should be kept in mind that there may be deviations in forecast performance due to economic shocks, policy changes and unforeseen external factors. With this monthly updated working set, we aim to provide a more transparent, consistent and data-driven basis for monitoring the macroeconomic outlook and strengthening decision support processes.

Yasal Uyarı

Bu dokümanda yer alan yatırım bilgi, yorum ve tavsiyeleri yatırım danışmanlığı hizmeti niteliği taşımamaktadır. Yatırım danışmanlığı hizmeti, yetkili kuruluşlar tarafından kişilerin risk ve getiri tercihleri dikkate alınarak kişiye özel olarak verilir. Bu dokümanda yer alan yorum ve tavsiyeler genel niteliktedir. Bu tavsiyeler mali durumunuz ile risk ve getiri tercihlerinize uygun olmayabilir. Bu nedenle, sadece bu dokümanda yer alan bilgilere dayanarak yatırım kararı vermeniz beklentilerinize uygun sonuçlar doğurmayabilir.