MARKET SUMMARY

Kripto Varlıklarda Son Durum

| Varlıklar | Son Fiyat | Change (%) – Weekly | Change (%) – Monthly | Change (%) – Since the beginning of the year | Market Cap. |

|---|---|---|---|---|---|

| BTC | 67,695.64$ | -0.32% | 6.03% | 53.10% | 1.34 T |

| ETH | 2,529.18$ | -4.05% | -3.73% | 7.32% | 303.94 B |

| SOLANA | 171.58$ | 11.54% | 14.00% | 56.88% | 80.76 B |

| XRP | 0.5255$ | -4.62% | -10.84% | -16.63% | 29.81 B |

| DOGE | 0.1379$ | 2.58% | 26.26% | 49.91% | 20.21 B |

| TRX | 0.1649$ | 3.65% | 9.54% | 53.05% | 14.27 B |

| CARDANO | 0.3411$ | -1.74% | -10.77% | -45.22% | 11.94 B |

| AVAX | 26.38$ | -4.52% | -4.85% | -36.97% | 10.74 B |

| SHIB | 0.00001766$ | -6.05% | 18.03% | 65.42% | 10.42 B |

| LINK | 11.81$ | 3.38% | -4.23% | -23.89% | 7.41 B |

| DOT | 4.154$ | -2.19% | -10.46% | -51.66% | 6.28 B |

*Table was prepared on 10.25.2024 at 14:30 (UTC). Weekly values are calculated for 7 days based on Cuma.

Fear & Greed Index

Source: Alternative

Market Summary

Fed member Logan’s statements on the possibility of gradual rate cuts suggest that the low interest rate environment may increase risk appetite and direct investors to risky assets. Logan’s emphasizing that liquidity is still abundant is considered as a factor that supports market confidence. However, the lack of clear information on the timing of the rate cut continues to create uncertainty.

The fact that open positions in Bitcoin futures reached an all-time high in this process reveals the vitality of the market and investors’ future price expectations. In addition, Tesla’s continued holding of Bitcoin assets in its third quarter financial report points to continued institutional support and long-term confidence in Bitcoin.

Korku ve Açgözlülük Endeksi

The slight decline in the index to 72 from 73 last week may indicate a partial increase in market uncertainty. This change suggests that investors’ cautious behavior continues and that they are raising questions about the market.

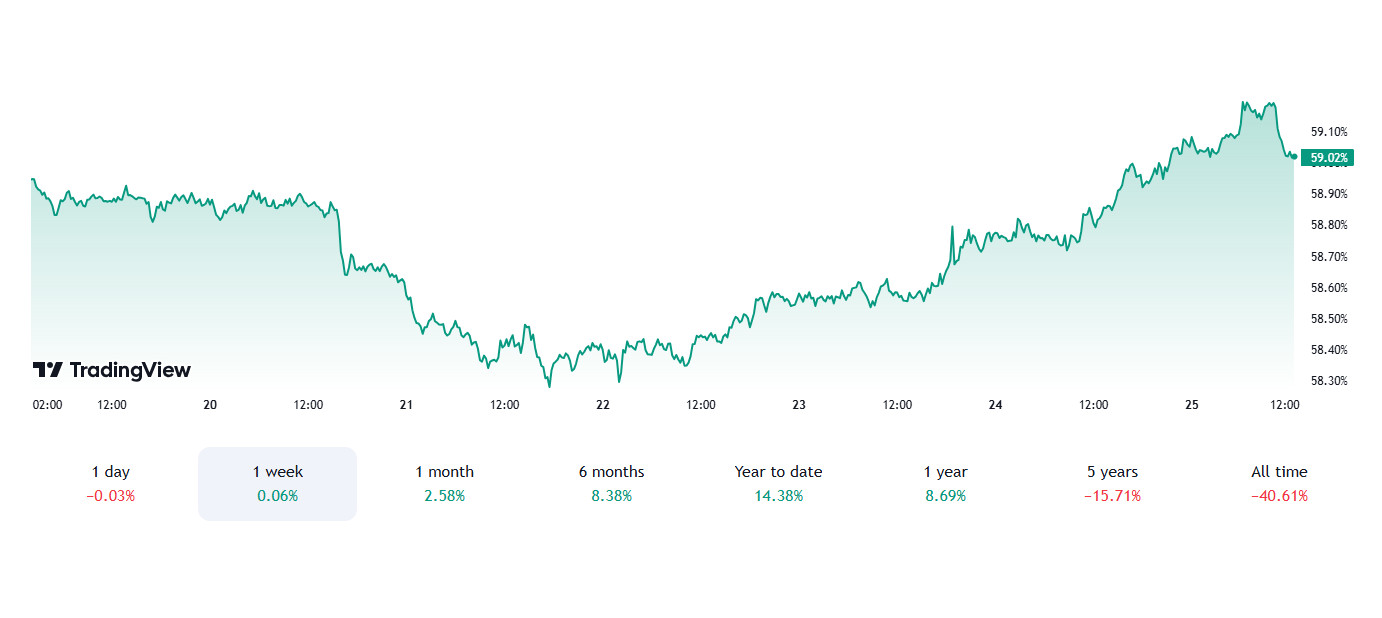

Bitcoin Hakimiyeti

Source: Tradingview

Bitcoin Hakimiyeti

Last week saw a record rise in dominance with the interest of institutional investors. When we look at this week, we see that the dominance rate has decreased slightly. As a matter of fact, bullish movements in the altcoin market attracted attention from time to time.

The Shift in Bitcoin Dominance

- Last Week’s Level: 59.20%

- This Week’s Level: 59.01%

Impact of Institutional Investors

Last Week’s Rally

Institutional investors’ interest in Bitcoin has led to an increase in dominance to 59.20%. This shows that confidence in Bitcoin is growing and that large investors are favoring Bitcoin more.

This Week’s Decline

The decline in dominance to 59.01% suggests that interest has waned somewhat, or that investors are starting to turn to alternatives other than Bitcoin.

Total MarketCap

Source: Tradingview

Last week, with the historical rise in Ekim, we saw an increase in risk appetite and with the approach of the US presidential elections, we saw an increase in the total marketcap value as presidential candidate D. Trump took the lead in the polls. When we look at this week with the correction movement in Bitcoin, the decline in total market capitalization gave back last week’s gains.

Change in Market Value

- Last Week’s Market Capitalization: $2.283 Trillion

- This Week’s Market Cap: $2.272 Trillion

Election Impact

Trump’s Lead in the Polls: The approach of the US presidential elections and Donald Trump’s lead in the polls created hope in the markets for a move away from uncertainty and possible new regulations. This, in turn, increased investors’ risk-taking tendencies.

Market Responsiveness

Investor Sentiment

A decline in market capitalization may indicate that investors have become more wary of uncertainty. Market volatility is common, especially during election periods. This may require investors to act more cautiously and strategically.

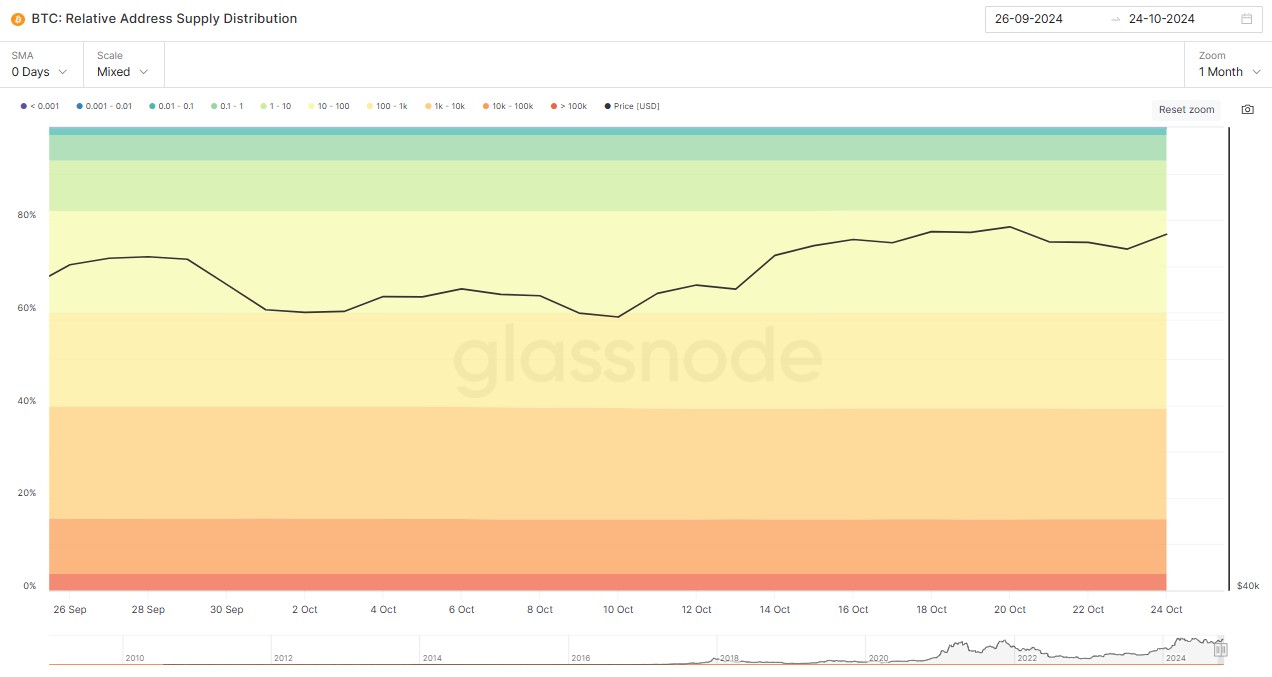

Bitcoin Supply Breakdown

Source: Glassnode

| Address Range | 17.10.2024 | 24.10.2024 | Change | Analiz |

|---|---|---|---|---|

| 0.001 – 0.01 BTC | 0.217% | 0.217% | Fixed | No change in the number of micro investors. |

| 0.01 – 0.1 BTC | 1.399% | 1.399% | Fixed | No change in the number of micro investors. |

| 0.1 – 1 BTC | 5.568% | 5.571% | Increase | There is an increase in demand from small investors. |

| 1 – 10 BTC | 10.813% | 10.812% | Decline | Mid-level investors accumulate more BTC. |

| 10 – 100 BTC | 22.000% | 21.993% | Decline | Large investors reduced their positions. |

| 100 – 1k BTC | 20.643% | 20.744% | Increase | The process of accumulation among the whales continues. |

| 1k – 10k BTC | 23.942% | 23.840% | Decline | Slight sales are observed in large accounts. |

| 10k – 100k BTC | 11.788% | 11.817% | Increase | The giant whales continue to increase their position. |

| > 100k BTC | 3.602% | 3.579% | Decline | The biggest players are selling. |

Genel Değerlendirme

In general, we are seeing large and giant investors enter a period of mild accumulation, while smaller accounts continue to buy. These movements support an uptrend in the Bitcoin price, which has risen from $67,316 to $68,170 during this period.

This shows that both individual and large investors are still active in the market and that there is a strong basis for continued price stability.

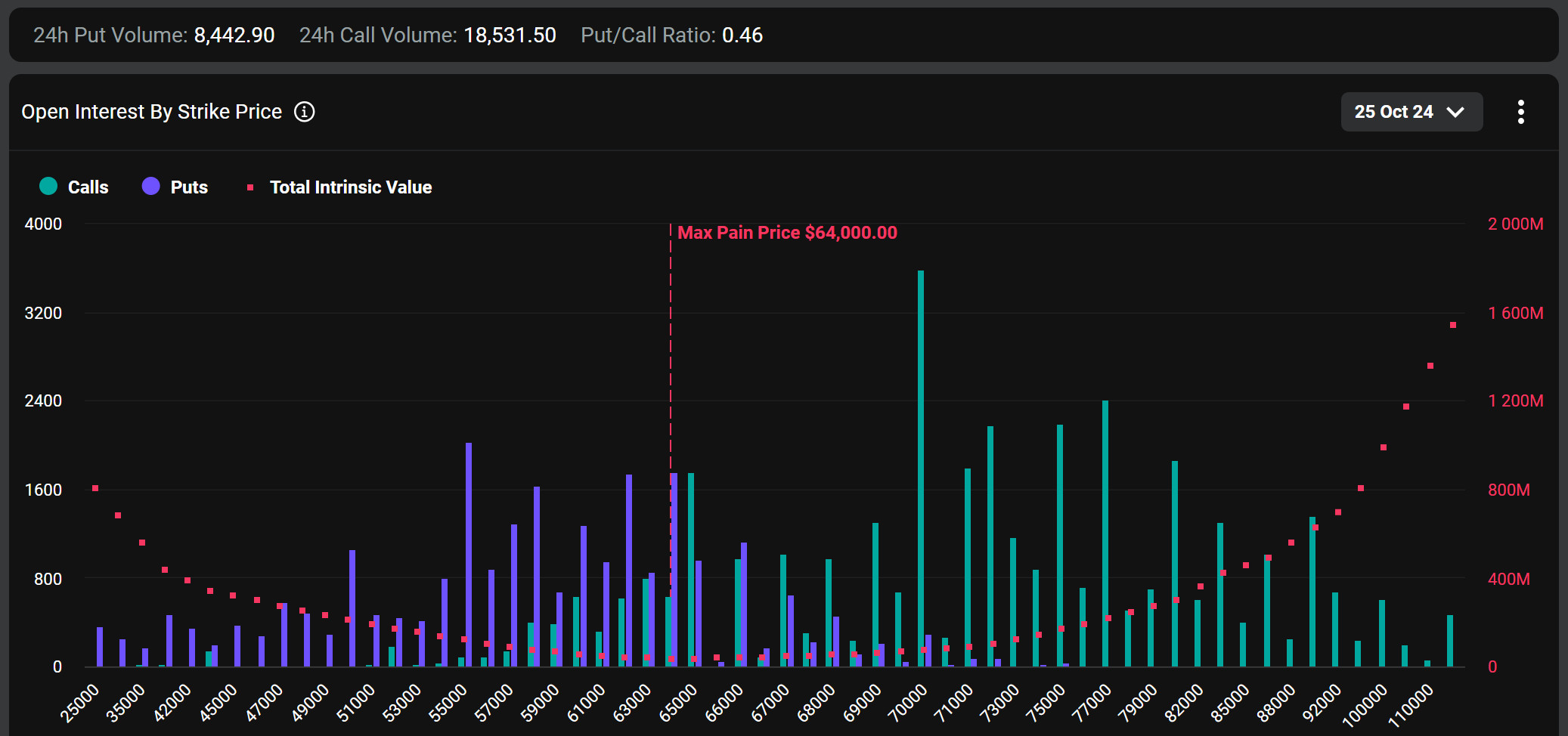

Bitcoin Options Breakdown

Source: Deribit

Market Expectations and US Election Impact

According to Bloomberg, options traders are taking positions that Bitcoin will reach $80,000 by the end of Kasım, regardless of the US election results. This indicates a general optimism about Bitcoin’s performance despite divergent political views on cryptocurrency regulation. At the same time, expectations of a rate cut by the Federal Reserve have also boosted traders’ market sentiment.

Deribit Options Data and Maximum Pain Point

According to Deribit data, BTC options with a notional value of approximately $4.26 billion expire today. About $682 million of this amount, or 16.3% of the total $4.2 billion, is in profit for contract holders as it is below the current market price.

Bitcoin’s maximum pain point is set at $64,000. The maximum pain point represents the price point at which the largest number of option holders will incur losses if the price approaches this level.

Call/Sell RatioThe call/put ratio of BTC options is calculated as 0.46. This ratio indicates that investors have a stronger preference for call options over put options and that there is a bullish expectation in the market.

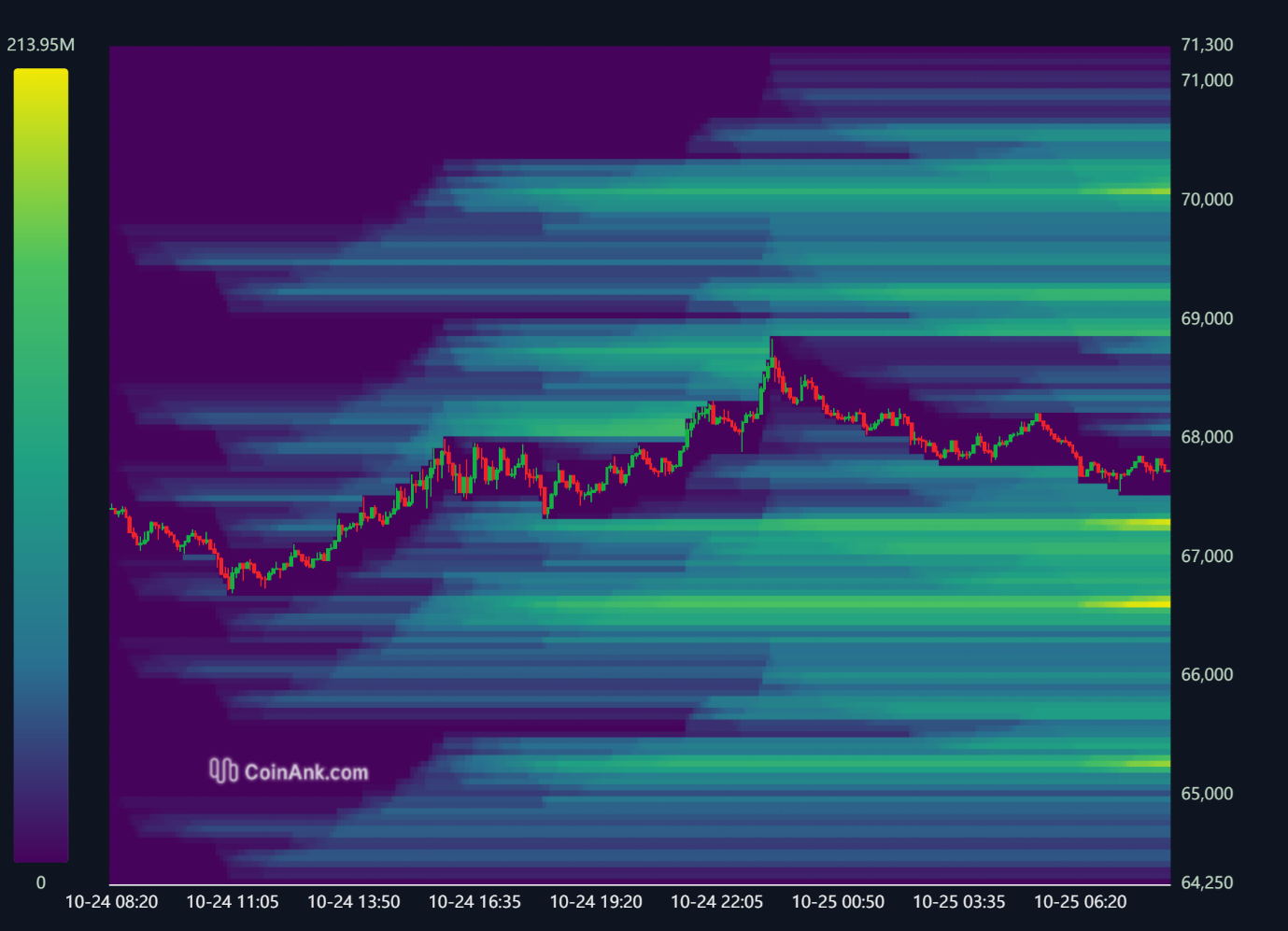

Bitcoin Liquidation Chart

Source: CoinAnk

Liquidation Levels

When Bitcoin’s weekly liquidation heatmap is analyzed, short positions in the 68,900 – 69,300 USD band were liquidated during the week, and with the subsequent price decline, long positions accumulated in the 67,000 – 64,000 and 65,800 – 66,000 ranges also reached liquidation levels. Currently, there is a significant liquidation area for short positions between 68,900 – 69,300 USD; this level may be cleared by price movements in the coming period.

In terms of long trades, liquidations have accumulated in the 67,200 – 67,400 and 66,500 – 66,700 USD ranges. In case of a downward movement of the price, these levels may be tested and long trades may be liquidated.

Weekly Liquidation Amounts

- Long Transactions: Between Ekim 21 and 25, a total of USD 93.37 million worth of long transactions were liquidated.

- Short Transactions: Between the same dates, liquidated short trades totaled USD 68.57 million.

This weekly liquidation data shows that liquidation movements concentrated at certain levels in the Bitcoin market offer clues about the direction of the market.

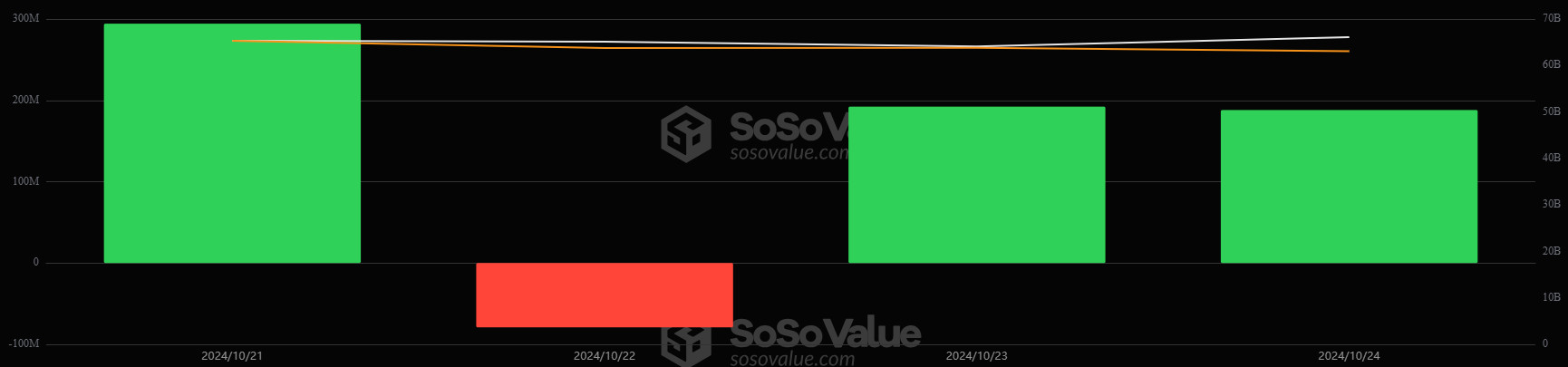

Bitcoin Spot ETF

Source: SosoValue

General Status

Positive Net Inflow Series

Positive net inflows in the Spot BTC ETF started on Ekim 11 and continued until Ekim 22. On Ekim 23, the positive inflow series was broken with a decrease of $79.09 million. On Ekim 24, it returned to positive with an increase of $ 188.11 million. This week’s net inflow was 595.62 million dollars. In weekly terms, there were 3 positive week series.

Blackrock IBIT ETF Net Inflows

Between Ekim 21-24, Blackrock IBIT Spot BTC ETF net total inflows increased by $855 million. With this increase, the Blackrock IBIT Spot BTC ETF value reached $23.69 billion.

Featured Situation

Market Impact

Despite the negative outlook for BTC this week, Spot BTC ETFs continued to see a surge in interest.

BTC Price Change

Bitcoin price decreased by 1.21% between Ekim 21-24.

Conclusion and Analysis

Total Net Inflows and Outflows

The net inflows in Spot BTC ETFs between Ekim 21-24 were noteworthy, with net inflows totaling $595.62 billion.

Price Impact

This week saw a 1.21% drop in BTC price, while Spot BTC ETFs saw increased interest from institutional investors. Between Ekim 21-24, the majority of Spot BTC ETFs saw net inflows. This suggests that Spot BTC ETF purchases increased even as the BTC price fell.

WHAT’S LEFT BEHIND

US Election Wind The

possibility of Donald Trump’s election in the US presidential elections has mobilized the cryptocurrency markets; In the Polymarket survey, Trump outperforms Kamala Harris with 63.9% and the election result is predicted to create a serious increase in cryptocurrencies.

Bitcoin Options Traders

Bitcoin options traders are taking a bullish position following the US elections and the Fed’s interest rate decision.

Russia to develop crypto mining and artificial intelligence projects in BRICS countries

Russia will develop artificial intelligence projects by establishing data centers in BRICS countries.

A New Era for Investors After SEC Approves Bitcoin Spot ETF Options The

U.S. Securities and Exchange Commission has approved Bitcoin Spot ETF options, marking a major milestone in the crypto market.

Elon Musk endorses crypto and XRP advocate senatorial candidate

Elon Musk endorsed John Deaton in the senatorial elections in the state of Massachusetts.

What’s the Target at Tesla?

While Tesla continues to hold 11,509 Bitcoins, it explained that the movements in its wallets are rotation. While Tesla’s third-quarter financial results surprised analysts, the company announced that it maintained its Bitcoin holdings.

Million Dollar Investment in Bitcoin from Metaplanet

Metaplanet increased Bitcoin purchases by raising 66 million dollars in funds with the support of individual investors.

Ripple-SEC Case Nears Deadline

As the Ripple-SEC case reaches a critical milestone, Ripple aims to lift the SEC’s sanctions.

Bernstein’s Ambitious Bitcoin Forecast for the End of 2025

Bernstein analysts predict that Bitcoin will reach six-digit prices by the end of 2025.

Ripple CEO Garlinghouse

Ripple CEO Brad Garlinghouse stated that the launch of a spot exchange-traded fund for XRP is only a matter of time.

Microsoft Bitcoin Investment

Microsoft is considering investing in Bitcoin and will put the issue to a vote at the shareholder meeting.

US Government Crypto Wallet

Arkham Intelligence reported that nearly $20 million worth of stablecoins and ETH were stolen from US government wallets.

US Applications for Unemployment Benefits Announced: 227K

Expectation: 243K

Previous: 241K

HIGHLIGHTS OF THE WEEK

We are on the eve of the most critical week in recent memory. Ahead of the US presidential election and the US Federal Reserve’s (FED) critical monetary policy statement, we are in for a five-day trading period of really important macro data releases. The macro dynamics that have been driving digital asset prices in recent months may gain momentum this week. In addition, investors will also be listening to news from Asia this week, with the exception of China.

Japonya

Japanese people living in the world’s third largest economy will vote for the lower house election this weekend (Pazar). Also, on Perşembe, the country’s Central Bank (BoJ) will announce its monetary policy decision. In recent weeks, news out of China has dominated the Asian agenda. This time Japan joins the journey.

The ruling party (the Liberal Democratic Party), which has been rocked by the scandal over the slush fund scandal, may have to come out of this election with some scars. Faced with the risk of losing its majority in the lower house for the first time since 2009, Ishiba’s party may be forced to form partnerships with more small parties, leading the Democrats to search for a new leader in the future.

The election results in Japan are important as they could also lead to changes in the country’s stance on digital assets. Going to the polls on Ekim 27, polls indicate that Japanese support for the ruling party is waning, and Yuichiro Tamaki, the leader of Japan’s Democratic Party for the People, is trying to take advantage of this situation by raising the need for tax cuts and regulatory reforms regarding cryptocurrencies. In a post on social media platform X, Tamaki invited those who think crypto assets should be taxed separately from the 20% rate to vote for his party and promised that “Crypto assets will not be taxed when exchanging crypto assets for other crypto assets”. On the other hand, the Constitutional Democratic Party of Japan, the country’s second largest party, announced that it will review the crypto tax system, which it sees as closely related to the development of web3 in the country.

Regulation and tax issues related to digital assets are also among the topics of the elections in Japan, the country with the third largest economy in the world, so the results are important for the crypto world. The BoJ’s interest rate decision is expected on the Perşembe after the elections and the bank is expected to leave interest rates unchanged. Although no surprises are expected from the BoJ front for now, the markets, which have experienced the impact of changes in the country’s currency on cryptocurrencies, will closely monitor the decisions and statements.

Important Macro Data in The US on The Eve of The Critical Week

The US presidential election on Kasım 5th and the Federal Open Market Committee (FOMC) announcements on Kasım 7th are of critical importance for all assets in global markets. In the week ahead, that is to say next week, we are awaiting a lot of highly important macro data and they will provide critical clues regarding the FED’s interest rate cut course.

On Çarşamba, we will see the US third quarter growth data (GDP). Also on the same day, the ADP private sector employment change will be on the agenda ahead of the crucial employment data on Cuma. On Perşembe, we will see the core PCE Price Index, which is the FED’s preferred measure to monitor changes in inflation. On Cuma, the last day of the first week of Kasım, non-farm payrolls and other labor market statistics await us.

ADP, GDP and PCE

We can say that volatility in the markets will increase in this busy calendar and we can see fluctuations in prices after each data. The world’s largest economy is expected to grow by 3% in the third quarter of the year compared to the previous quarter. On the other hand, we think that the PCE price index, which the FED prefers to monitor as an inflation indicator, is as important as the employment data.

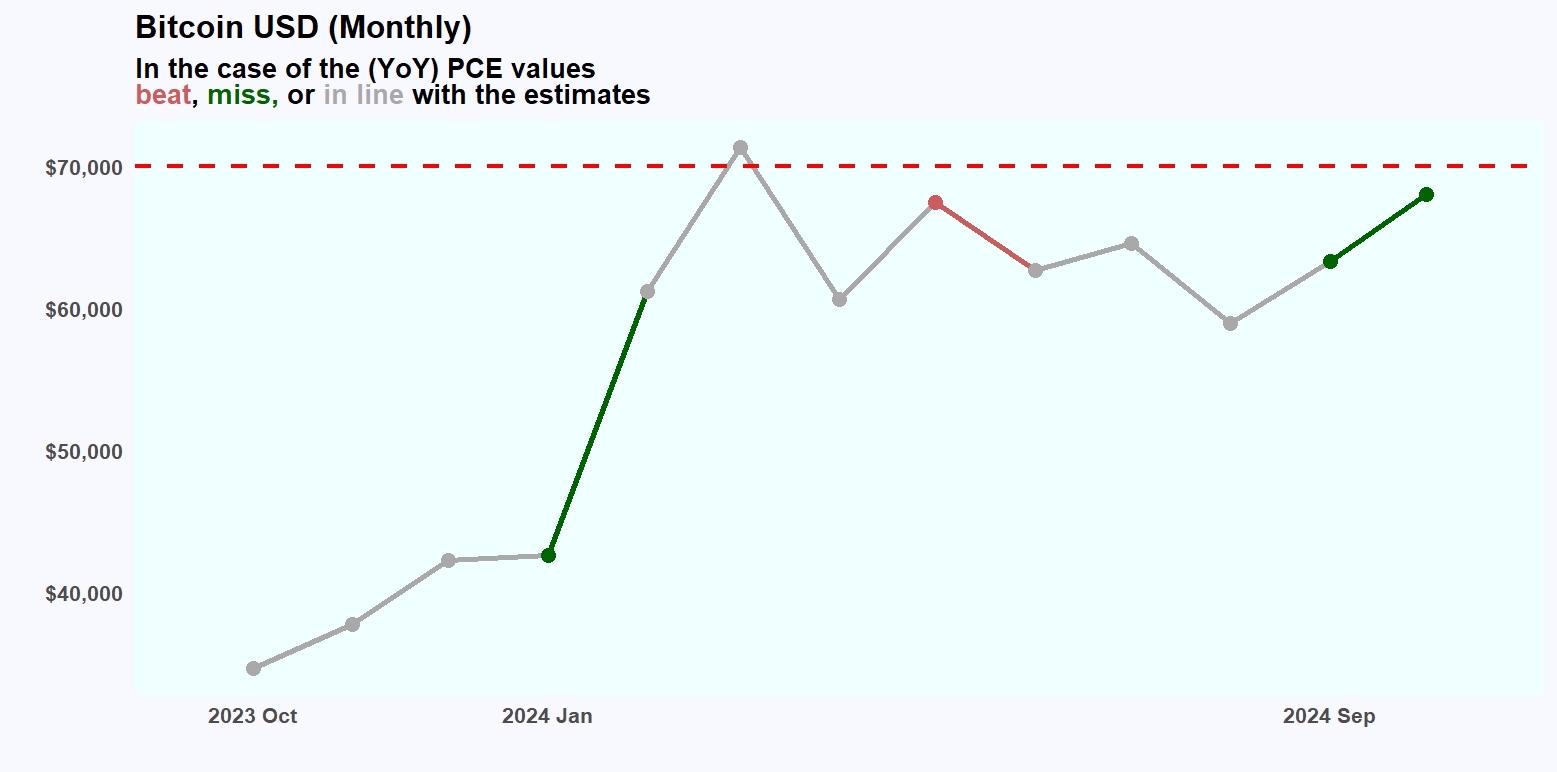

Source: Darkex Research Team, Data Geeek

According to a statistical study by Darkex Research Department, changes in PCE values (year-on-year) will positively affect Bitcoin prices, regardless of their distance from market expectations. In Eylül, the PCE price index is expected to have realized at 2.1% compared to the same month of the previous year (it is important to follow the daily bulletins for possible changes in the expectation figures).

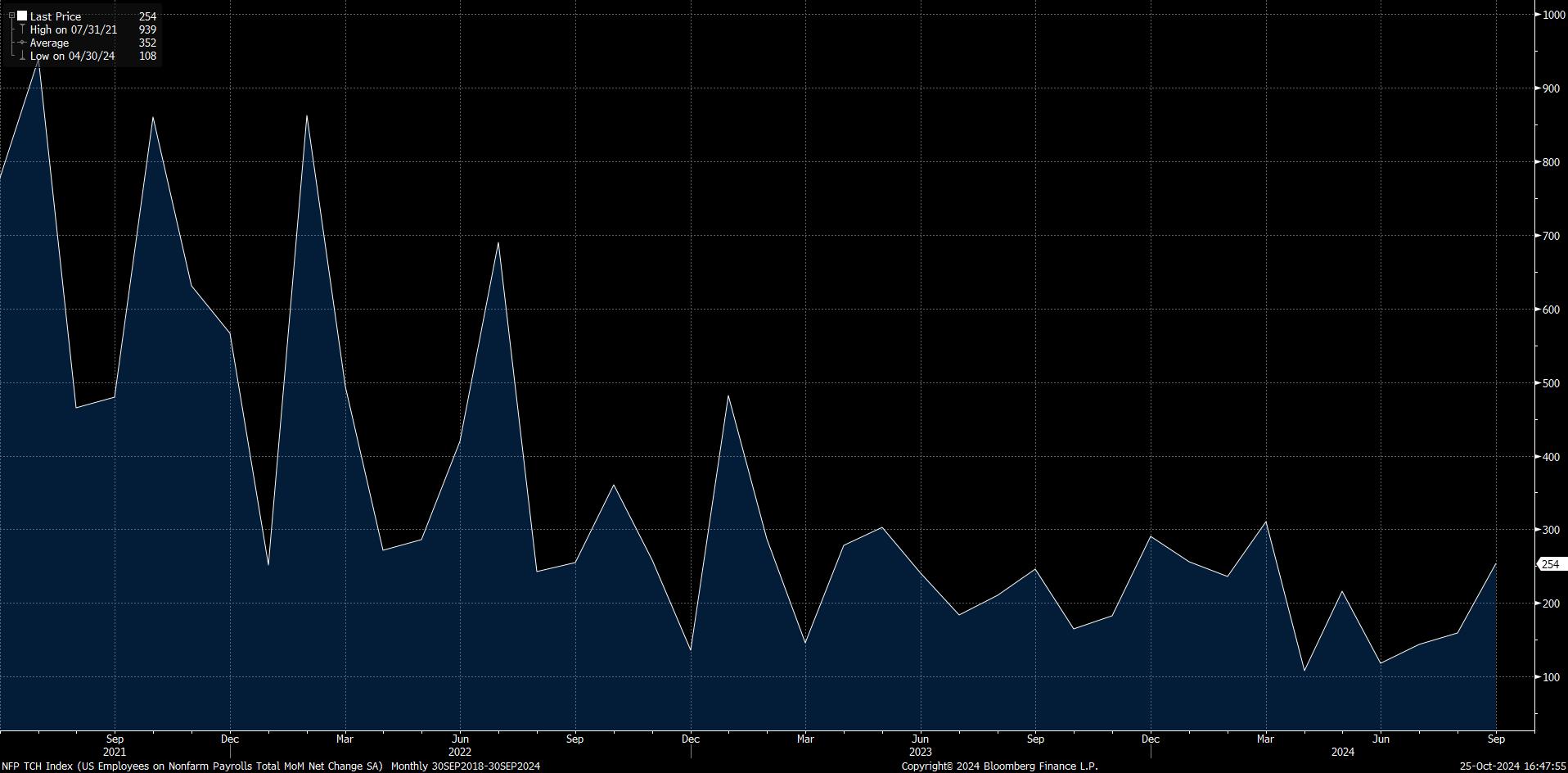

Labor Force Statistics

In the same first, last business day of the week, markets will focus on the US employment data. Among these, the non-farm payrolls change (NFP) data stands out.

Source: Bloomberg

In Eylül, we saw that the US economy added 254 thousand jobs in the non-farm sectors. This was much higher than the forecasts of 147 thousand. It is expected that we will see a more conservative increase in employment again. However, while the FED is so focused on the developments in the labor market, we can say that a surprise data may have harsh effects on the markets. It is difficult to predict the possible impact of the data on the markets ahead of the critical presidential election. Nevertheless, a higher-than-expected NFP data may have a negative impact on risky assets by increasing expectations that the FED will not act quickly on interest rate cuts. On the contrary, figures that create expectations of rapid interest rate cuts may pave the way for a moderate rise.

DARKEX ARAŞTIRMA DEPARTMANI GÜNCEL ÇALIŞMALAR

*In addition to the daily bulletins, special reports prepared by the Research Department will be shared in this section.

ÖNEMLİ EKONOMİK TAKVİM VERİLERİ

Click here to view the weekly Darkex Crypto and Economy Calendar.

BİLGİ

*Takvim UTC (Koordineli Evrensel Zaman) zaman dilimini temel alır.

The calendar content on the relevant page is obtained from reliable data providers. The news in the calendar content, the date and time of the announcement of the news, possible changes in the previous, expectations and announced figures are made by the data provider institutions.

Darkex cannot be held responsible for possible changes arising from similar situations. You can also check the Darkex Calendar page or the economic calendar section in the daily reports for possible changes in the content and timing of data releases.

YASAL BİLDİRİM

Bu dokümanda yer alan yatırım bilgi, yorum ve tavsiyeleri yatırım danışmanlığı hizmeti niteliği taşımamaktadır. Yatırım danışmanlığı hizmeti, yetkili kuruluşlar tarafından kişilerin risk ve getiri tercihleri dikkate alınarak kişiye özel olarak verilir. Bu dokümanda yer alan yorum ve tavsiyeler genel niteliktedir. Bu tavsiyeler mali durumunuz ile risk ve getiri tercihlerinize uygun olmayabilir. Bu nedenle, sadece bu dokümanda yer alan bilgilere dayanarak yatırım kararı vermeniz beklentilerinize uygun sonuçlar doğurmayabilir.